What Is Solana & Is It A Good Investment?

Key Takeaways:

- Solana is an open-sourced blockchain network with smart contract capabilities. It is characterized by extremely fast transaction times.

- Due to its fast transaction speeds, Solana has a variety of real-world applications surrounding NFTs, DeFi marketplaces, and earning protocols.

- SOL tokens are deflationary assets where a burning mechanism helps to prevent the inflation that other crypto assets experience.

TABLE OF CONTENTS

Solana is a widely popular blockchain ecosystem and cryptocurrency that has surged in adoption since it was developed. But is it a good investment? This article will explain what Solana is, how it works, its pros and cons, where to buy Solana and whether it is a sound investment for the future.

The Basics of Solana (SOL)

Solana is an open-source blockchain network with smart contract capabilities and notably fast transaction speed to transfer. Since it was launched in 2017, Solana has soared in market cap and public interest, cementing itself as one of the most popular cryptocurrencies for investors. Much of this success has come on the back of decentralized app (dApp) development on the platform, as Solana hosts a broad range of NFT marketplaces and DeFi solutions.

The concept for Solana was birthed by Anatoly Yakovenko, who published a whitepaper outlining new blockchain technology that would allow transactions to become 10,000 times quicker than other blockchain protocols such as Ethereum.

This Is What Can Solana Be Used For

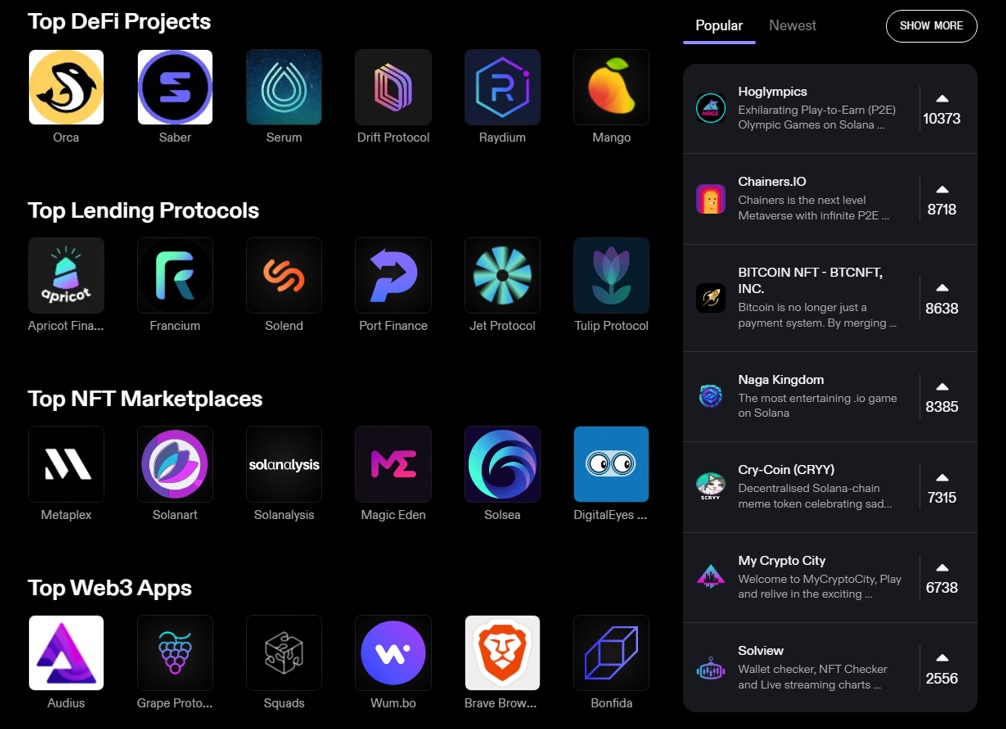

Solana offers lightning-fast dApps on an open-source blockchain that can be used by developers and the community for a variety of real-world use cases. The scope for dApps on Solana is enormous, with the vast majority of projects on the network focused on three main areas – NFTs, DeFi marketplaces, and earning protocols. However, this is far from Solana’s full potential and the network has already seen unique applications – such as Audius’ decentralized streaming platform – built on-chain.

The Pros & Cons of Solana

Solana is a particularly solid and reputable project with many obvious pros. However, this has not prevented the platform from receiving criticism, and Solana’s cons should be considered before assessing its value.

Solana Pros:

- SOL tokens are deflationary. Solana developers have introduced a burning mechanism where transaction fees are paid in SOL, and then burnt. This will help prevent the inflation that other cryptocurrencies experience

- Solana employs a hybrid Proof-of-Stake/Proof-of-History consensus mechanism which allows for a theoretical throughput of 65,000 transactions per second, dwarfing many others in the industry

- Solana is open-source and public, meaning transactions can be easily accessed and are immutable

- Solana is one of the most popular cryptocurrencies out there and doesn’t have issues with liquidity or accessibility

Solana Cons:

- Being a smart contract-focused network, there is potential for bugs and malfunctions in smart contract deployment

- The blockchain is yet to realize its potential for 60k+ transactions per second (TPS) with current rates averaging approx. 1,755 TPS

- A large number of top-performing dApps are hosted on rival networks, particularly Ethereum

- Even though Solana is public and open-source, it has received negative feedback for not being fully decentralized

- Solana’s focus on speed may have reduced its focus on security. An example is the Solana bridge ‘The Wormhole’ which was attacked and lost about $324 million

This Is How Solana Works

To understand how Solana works, the first step is to understand a smart contract. In simple terms, a smart contract is essentially a code stored on the blockchain that automatically executes when certain conditions are met. This technology has formed the core of decentralized finance applications. It’s because of smart contracts that Solana users are able to provide liquidity in an automated market maker (AMM), stake Solana, or mint NFTs.

Next, we have to look at Solana’s consensus mechanism to comprehend how it executes transactions, secures its economic backbone, and supports such impressive throughput. There are two prongs to the technology: proof-of-stake and proof-of-history.

- Proof-of-stake. With the proof-of-stake protocol, there are validators instead of miners. Validators essentially lock up a portion of SOL on a ‘node’, or a copy of the blockchain on their own computer. Instead of solving a complex mathematical puzzle like miners, validators are algorithmically chosen to execute smart contracts depending on criteria like stake size, server uptime, and so on. Validators are rewarded for their services via an annual percentage yield (APY) which operates exactly like an interest rate. Staking rewards are typically paid out in SOL.

- Proof-of-history. It is a relatively new concept in the cryptocurrency world, and not many networks have employed this technology. It’s a little more complex than proof-of-stake, but in simple terms it’s exactly what it sounds like – a proof of history. Validators running a node each have their own internal clock and are able to validate transactions without having to verify it with other validators. Each transaction, past and future, has its own timestamp that is immediately verifiable. This means that each node knows when it has to deploy a contract without relying on intel from other nodes. The advantage of PoH is a much faster transaction time than proof-of-stake can offer on its own.

SOL Tokens Can Be Used For…

SOL is the native utility token of the Solana network. It forms the economic foundation of the entire ecosystem for developing and participating in Solana-based dApps. Other uses include earning rewards from staking and paying transaction fees on the network.

- Staking Solana to earn SOL rewards. Proof-of-stake is an integral function of the Solana blockchain. Without SOL tokens locked up in the network, transactions would not only not be decentralized, but wouldn’t work at all. Validators don’t actually have a minimum requirement for the amount of SOL they must stake, however, it’s estimated that approximately 5,000 SOL must be staked to break even. This is because validators must pay to vote every epoch, which equates to about 3 SOL every couple of days. Delegators are able to commit their SOL to a validator and reap the rewards without needing the technological and computational power to run a node. In exchange, validators will charge a commission rate (essentially a fee), usually around 10%.

- Form of currency for dApps. SOL is typically used as the native currency for Dapps that are developed on the Solana network. This gives SOL a huge range of functions as a medium of exchange, including participating in DeFi protocols, buying in-game NFT items, and much more. dApp creators will also need to use SOL to launch their applications within the Solana ecosystem.

- Paying for transaction fees. SOL is used to pay transaction fees on the network, commonly referred to as ‘gas’. Many will be aware of gas due to Ethereum, where transaction fees can easily climb into the triple digits due to network congestion. By contrast, Solana does not experience the same scalability issues and thus charges extremely low transaction fees. Though the specific price varies, gas on Solana is often less than a cent per transaction.

Investing In Solana

Solana has become one of the most sought-after cryptocurrencies for blockchain enthusiasts. Its thriving community, paired with a strong historical performance, places it in the upper echelon of potential crypto assets. The blockchain consistently has a high level of demand, both for its impressive transaction speeds and its cheap, efficient dApp framework for developers.

Over the past 12 months, the price of SOL has exploded from $19 to currently sitting at over $120, reaching a peak of $258.93 in November 2021. This is equivalent to a 531% increase in value. In the same time period, Solana has vastly outperformed popular, smart-contract capable competitors such as Ethereum, Cardano and Polkadot. While Solana is one of the best crypto investments on paper, there are a few factors that could stagnate what seems like an unstoppable ascent.

- Competition: Solana is competing in a fairly dense sector of the crypto market – DeFi. Decentralized applications, NFTs, and the metaverse have come into vogue of late and comprise a large portion of new blockchain projects. Smart contract networks like Avalanche (AVAX) and Terra (Luna) have experienced similar growth to Solana, and will likely be key rivals in the battle for DeFi ascendancy. Then, let’s not forget the big dog Ethereum. Though Ether hasn’t grown as rapidly as other smart contract platforms, it still maintains the highest market cap of any DeFi blockchain and has a throne that will be hard to usurp.

- dApp development: Though Solana is catching up, Ethereum still reigns supreme when it comes to decentralized applications. The majority of popular apps/NFTs right now – Axie Infinity, Bored Ape Yacht Club and The Sandbox, for example – still utilize the Ethereum network. Investors should be aware of what dApps are coming to the Solana blockchain and their potential for growth before purchasing any SOL.

Does Solana Have A Wallet?

Interacting with the Solana ecosystem requires the use of a supported Solana wallet. This can take the form of hardware (a physical device), a browser extension, or a desktop/mobile application. The wallet will generate a keypair – a public key for interacting with the Solana network and receiving transactions. In addition, the wallet will have a private key which is used to sign any transactions to and from the owner's wallet. The public key can be shared with anyone and works like an account number at a traditional bank. Conversely, the private key is like a bank account password and must be kept hidden and secure at all times.

Storing Wallet Safely

All cryptocurrencies, including SOL, are stored within a supported wallet. There are a few different types of wallets, although they can be broken down into two main categories: hot wallets and cold wallets.

Generally, for larger sums of cryptocurrencies, it is recommended to distribute Solana between both cold and hot wallets to maximize security and ease of use for trading. However, this may not be realistic for most investors. The easiest option is to store your funds on a centralized exchange wallet like Binance, Coinbase, Crypto.com, or FTX.

- Hot wallets. These are essentially any wallets that are connected to the internet. This includes software, browser extensions, or mobile applications. Any cryptocurrency you keep ‘on an exchange’ is actually also being stored in a hot wallet. Hot wallets provide extreme convenience for users, as they allow instant access to your crypto assets on various platforms. However, because they are connected to the internet they are substantially more vulnerable to hacks and exploits than alternatives.

- Cold wallets are defined as any crypto wallet—hardware or software—that is not connected to the Internet. This category of wallets trades inconvenience for enhanced security. They usually take the form of a physical USB device that must be attached to a computer or laptop to be utilized.

In addition, there are a number of popular wallets that are designed specifically for use with the Solana network. These include:

- Sollet wallet

- Phantom wallet

- Solflare wallet

- Ledger Nano X (used with Solflare or Phantom)

- Math wallet

- Exodus wallet

- Atomic wallet

A full list of supported wallets can be found on the Solana ecosystem page. Alternatively, For a list of wallets to store Solana, read our article on the best cryptocurrency wallets.