This Is What Decentralized Finance Is & How It’s Changing Traditional Finance

- DeFi stands for a decentralized financial infrastructure that allows users to access crypto financial services and products without the need for a middleman like central banks or other institutions.

- Some of the crypto services that DeFi provides blockchain users include lending, borrowing, and trading digital currencies.

- Given the fast-paced growth of DeFi services and its permission-less nature, governments around the world have expressed concerns. In contrast to centralized financial services, users are wholly responsible for their assets since no intermediary body is required to provide oversight.

TABLE OF CONTENTS

Let's Explain What Is DEFI

DeFi stands for a decentralized financial system that uses the blockchain network for customers to access financial products and services without an intermediary such as central banks and institutions. DeFi services first launched on the Ethereum (ETH) blockchain, an open-source smart contract platform to facilitate decentralized applications. Ethereum provided a suitable platform for DeFi to succeed with developers widely adopting the protocol as a trustworthy platform to build financial services to disrupt the traditional sector.

DeFi Has Shifted Global Finance

The importance of DeFi is centered around using the blockchain network which provides a means for secure and verifiable transactions without a trusted party. Bitcoin kickstarted the first iteration of decentralized finance in 2008 which created a decentralized environment for peer-to-peer online transactions.

DeFi shapes as a better alternative to traditional finance without intermediaries to offer a trust-less, cheaper and safer system for transacting value. Secondly, DeFi offers the ability to expand beyond the financial transaction to build an innovative and dynamic world of real-world applications that include decentralized exchanges, stablecoins, lending and borrowing platforms, and yield farming.

Why is DeFi Popular?

DeFi applications allow individuals to exchange, lend, borrow, and trade while remaining in complete control of all digital assets. Thanks to smart contracts and the blockchain, all third parties are removed from the process. Applications are available to anyone with a cryptocurrency wallet and services are far cheaper than traditional finance. There are also multiple opportunities to earn yields that far outpace those offered by the traditional banking sector.

DeFi Is Being Used For Many Applications

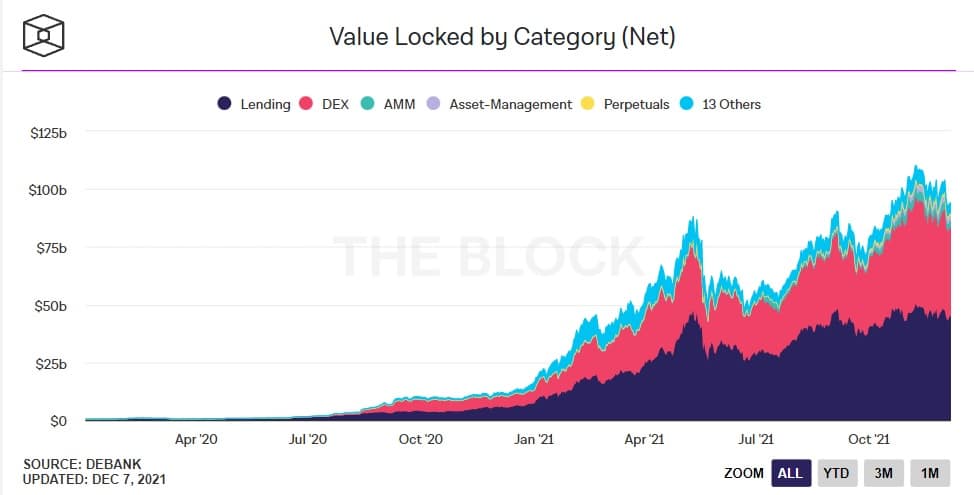

DeFi is used to access blockchain-based financial services, meaning cryptocurrency owners can borrow, lend, earn interest or perpetual trading without the need for a third party. The total value locked in DeFi products exceeds $100 billion across all DeFi-supported networks. While lending and borrowing are part of the decentralized finance functionality, individuals can transact tokens through leading decentralized exchanges or DEX platforms.

Decentralized exchanges differ from centralized crypto exchanges because they allow users to control their assets while disregarding broker and market maker fees. For example, on Uniswap, users can transact ERC-20 tokens without paying any exchange fees. The costs involved are limited to Ethereum network fees which are paid to miners on the network.

In short, DeFi is used for a new wave of services that incentivizes asset owners to provide liquidity, generate passive income and contribute to the growth of an emerging financial market.

The Pros and Cons of DEFI

The benefits of DeFi extend beyond an alternative to the existing financial systems. The pros of adopting and regulating DeFi will provide basic banking and financial services to all individuals using secure, transparent, and immutable transactions without a middleman. On the other hand, there are negatives, such as failed projects, poor scalability, and little consumer protection without Government regulations.

DeFi Pros:

- Permission-less system without reliance on corporations and institutions

- A positive shift in traditional finance that will encourage innovation

- Access to financial services for all individuals

- Secure, transparent and immutable transactions

- Faster transactions worldwide with lower fees

- Higher interest rates compared to traditional financial products

DeFi Cons:

- Regulatory concerns from Governments around the world

- Individuals are responsible and accountable for their assets without a central entity (e.g. bank)

- Learning for individuals who want to participate in the technology

- Fears and uncertainty over the protocol's security

- Lack of interoperability and scalability slows exmarket adoption

Explaining How DeFi Works

DeFi systems use a decentralized network where individuals can obtain access to financial products and services using ‘smart contracts'. A key distinction of how decentralized finance works is the absence of a middleman or central authority. Decentralized exchanges allow people to buy and sell with each other using immutable smart contracts.

In a way, the programmed nature of each smart contract replaces the traditional financial institution. The digital contract is fully transparent and can be verified on an open public ledger, however, does not contain any personal information. For DeFi to be successful, smart contracts must operate on a decentralized blockchain infrastructure. The most popular DeFi networks are Ethereum, Solana, Cardano and Tron.

A real-world application of DeFi is lending and borrowing platforms which have a similar process to traditional finance. A person who wants to borrow crypto can obtain a loan by providing a small amount of collateral. The benefit is to access liquidity without selling their digital assets. On the other hand, a person that lends their assets to provide liquidity for the loan will earn interest on their crypto in return. Several providers facilitate DeFi loans and interest payments such as Crypto.com, Nexo and Binance Earn.

How Do I Make Money With DeFi?

Several applications and products can be leveraged by investors to make money with crypto and earn additional yield. These include staking, liquidity farming, yield farming, and lending through crypto savings accounts.

- Liquidity Farming: Swaps between tokens on a decentralized exchange like Uniswap use liquidity providers. In DeFi, liquidity providers are users who add their token pairings to the liquidity pool. As a result, users who add their tokens are rewarded with a percentage fee – 0.3% from all swaps based on the proportion of their total share in the pool.

- Yield Farming: Is is similar to the concept of staking. While tokens are added to the liquidity pool, the same tokens can be added to farms that create and distribute the farmed tokens. To keep things simple, Yield Farming is riskier than staking because protocol owners can obtain much easier access to the farms as DeFi farmers are always seeking farms with the best yields.

- Lending: Users can lock up their tokens in smart contracts and use them to allow other users to borrow them in exchange for added interest. The benefit is that tokens are locked into contracts, and the failure of borrowers to pay does not affect the lender's total assets.

- Cryptocurrency staking: Most DeFi platforms and protocols use PoS as their consensus mechanisms; therefore, the network rewards users who stake tokens for validation. In short, users have to lock up the protocol's native token for a certain period and receive interest that is paid out in the platform's native token. For example, staking Cardano has an estimated reward of 5.65% at the time of writing.

Are There Risks With DeFi?

Every investment presents both opportunities and risks that largely depend on the type of strategy investors choose, the protocol or platform invested in and the level of knowledge and expertise. Investing in DeFi involves a similar risk to traditional markets but there are additional considerations. These include technical issues, project failures, regulations and hackers.

- Technology issues. Decentralized finance protocols are a relatively new technology. The success of the DeFi protocol is 100% reliant on the software programmers and coders that have developed the smart contracts. Vulnerabilities in smart contracts can be exploited by bad actors and hackers. A relevant example is the DeFi platform BadgerDAO which was compromised resulting in a hack of $120 million in stolen crypto assets from investors' wallets.

- Project failure (rug pulls). DeFi platforms, services and products are reliant on individuals to develop the systems to facilitate ongoing operation. In a way, these platforms are not entirely 100% decentralized as a degree of trust is placed on the developers behind the project. There have been examples where the owner of a DeFi project has blind-sighted the community and sold his tokens. For example, in 2020 the creator of the SushiSwap network sold $13 million worth of SUSHI tokens which collapsed the price.

- Lack of regulatory oversight. DeFi products are not fully regulated in many jurisdictions at the time of writing. This presents an unknown for investors that can benefit the well-informed at the expense of smaller investors who lack expertise and knowledge. Furthermore, projects may not adhere to strict internal controls to protect investors from other risks.

DeFi Isn't Fully Regulated

DeFi is an innovative technology that is moving at a faster pace than laws and regulations. The various innovative products and services are technologically complex and may not be a perfect fit under current financial regulations in many countries. Within the United States, DeFi products are currently viewed under the lens of existing securities law. The SEC issued a statement that DeFi participants, activities and assets fall within the SEC’s jurisdiction.

However, as record hacks in the DeFi space continue to make headlines, the chances of regulators stepping in to protect users' investments appear likely. This could set a trend globally for Governments to regulate DeFi services that are gaining widespread popularity as an alternate system to traditional finance.

DeFi Tokens As An Investment

Reputable DeFi coins can potentially be a good investment for passive income as long as the underlying asset price does not depreciate more than the annual yield. The tokenomics of every project must be considered to evaluate if token inflation presents a risk in the future, leading to lower prices as more tokens are flooding the market.

Tokens and projects that provide essential operations such as price feeds, liquidity fees, or subgraph indexes are generally perceived to have more value than native tokens with no utility in the ecosystem.

Conclusion

As decentralized systems continue to evolve, there will be more incentives for individuals without access to traditional banking to use DeFi products and services. With over a 100 Billion market invested at the time of writing, it is a clear sign that DeFi is a way of the future. Therefore, ongoing dialogue between DeFi participants and Governments must encourage greater adoption of cryptocurrencies. This will also contribute to closing the gap between financial innovation and regulation.