We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Where & How To Stake Tron

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform, please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own inquiries.

TABLE OF CONTENTS

Investors are constantly on the lookout for earning a passive income, and recently, many investors have directed their attention to staking. Tron is among the major staking cryptocurrencies, delivering amazing returns to investors so far, and is a top coin in terms of its overall staking market cap. Here's a quick list of the best platforms and wallets to stake Tron:

- Binance – Overall Best Tron Staking Reward Platform

- Kucoin – Good TRX Staking Platform For Frequent Traders

- Ledger Wallet – Best Hardware Wallet To Stake Tron

- Trust Wallet – Runner-Up Software Wallet For Staking TRX

Featured Partner

Binance

Rated #1 Crypto Exchange Worldwide

4.8 out of 5.0

Binance is undoubtedly one of the most trusted exchanges with a feature-rich ecosystem for beginner and experienced investors. Rated #1 worldwide for customer service and users. Sign up and claim up to $300 USD in bonuses.

385+

USD, EUR, GBP, AUD, CAD, +22 Others

Bank transfer, SWIFT, SEPA, debit and credit card

0.1% (spot) and 0.02% / 0.04% (Futures)

How to Stake Tron (TRX) – Full Guide

Staking is a really easy process. Although the exact process may differ slightly from platform to platform, it’s pretty much the same, and users shouldn’t have much of a problem navigating it.

Step 1: Compare staking platforms

The first step is to find a cryptocurrency staking platform or wallet that supports the Tron network. Important aspects to consider are the ease of use, staking options (fixed and/or flexible), lock-up terms and commission fees. For this tutorial that demonstrates the staking process for Tron, we will use Binance as a platform for reference. Those who do not have an account should sign up with Binance and complete ID verification.

Step 2: Hold the minimum amount of Tron (TRX)

Each platform and token has a minimum number of coins you need to have before you can stake them. Depending on the platform you’re using, make sure you have enough crypto in your wallet before you check out the staking options. With Binance, the minimum amount of TRX tokens to begin the process is 0.1 TRX. Purchase or transfer the tokens and hold them in the Binance wallet.

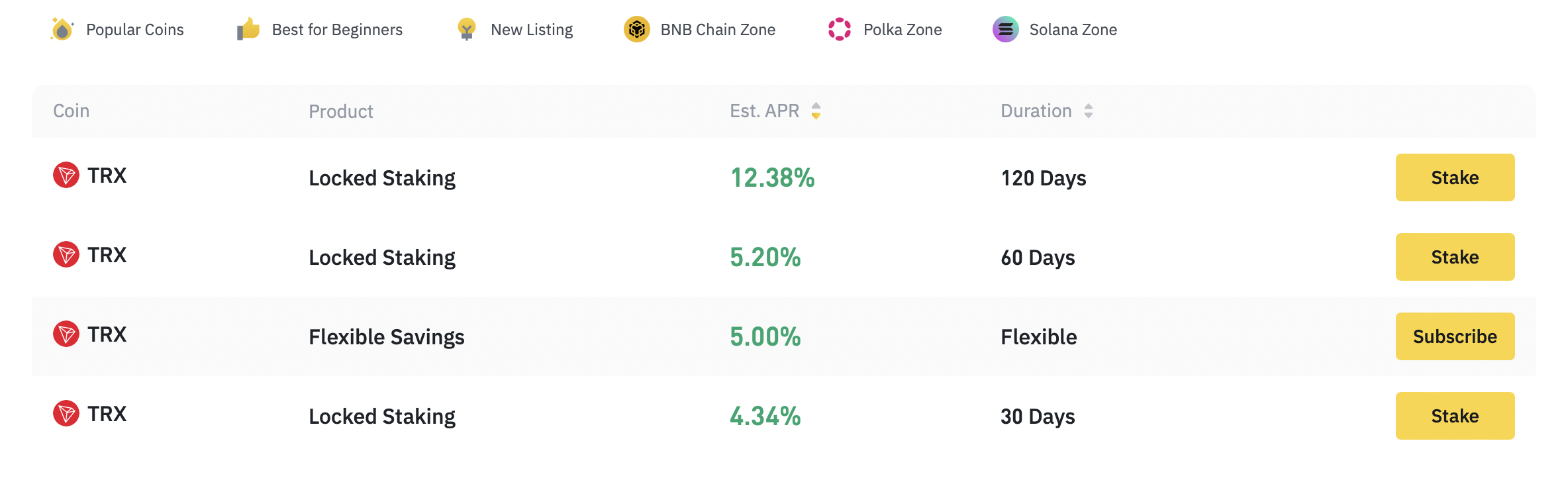

Step 3: Search & Filter through the staking options

The next obvious step is to review the staking options available on the platform. Binance, for example, has four Tron products. Each of these falls into a different category—locked and flexible. Further, all of these options have different APYs, wherein the product with the longest locking period delivers the most returns. Depending on what APY and locking duration you’re comfortable with, you can choose a product that best suits you.

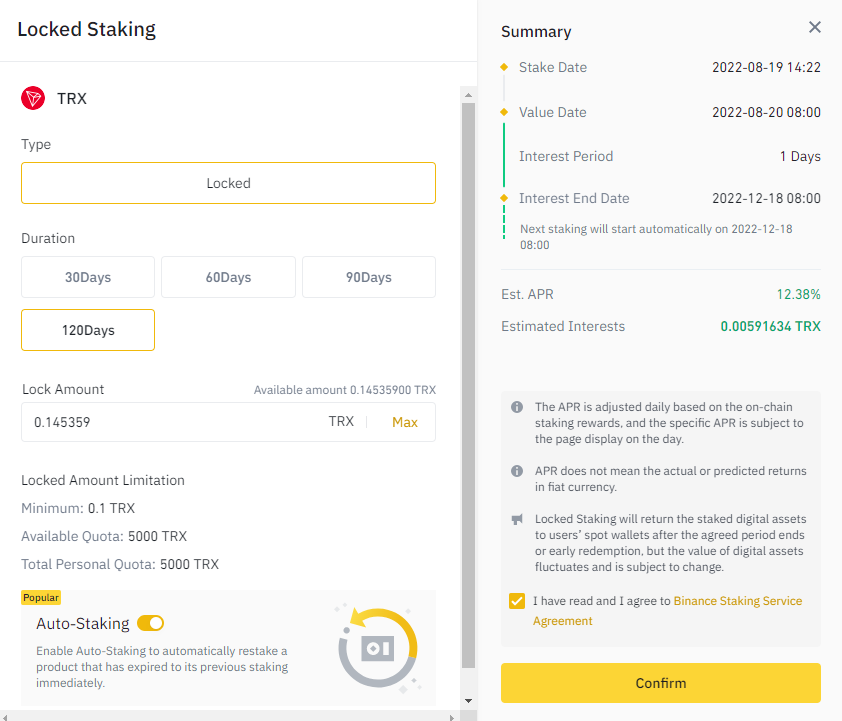

Step 4: Stake your Tron

After you’re done reviewing all the options, choose “stake,” and you will be directed to the next step. Enter the amount of Tron you want to lock in, and you’re good to go.

Staking Tron & Earning Potential

Tron follows a Proof-of-Stake consensus mechanism, where validators are chosen -in proportion to their token holdings- to validate the transactions on the network, for which they’re rewarded with Tron tokens. But becoming a validator requires technical expertise, which isn’t accessible to everyone. However, users can contribute their crypto into staking pools as delegators and earn interest on their staked crypto for their contribution to the network. Staking can be done through multiple exchanges and wallets.

The APY for staking depends on multiple factors, such as the duration of staking and the type of staking offered by every platform. While the highest staking APY is 12.38% on Binance, it’s fair to expect an average staking APY of 5% across platforms. Generally, the more the staking duration the better the APY appears to be.

Where You Can Stake Tron Today

1. Binance

Binance is the number one crypto exchange in the world, mainly due to the numerous services it offers to investors. In terms of volume, Binance has the most trading activity, more than eight times that of its next competitor. It’s no wonder, therefore, that Binance is the first choice of investors for any crypto-related services.

Along with being a crypto exchange, Binance also has an NFT marketplace featuring in-game assets, virtual land, and digital art. It ranks number one in the list of the best-centralized NFT marketplaces. Additionally, Binance also has an education platform, Binance Academy, where blockchain and cryptocurrency-related articles and videos are available across 15 languages. This is especially beneficial for newcomers having trouble navigating the crypto space.

Of all the services offered by Binance, crypto staking has garnered a lot of attention. More than 100 cryptocurrencies are available under the locked staking program on the platform, and 15 Defi Staking cryptos, including Eth & BNB, are available with 60 other staking products. Binance launched staking of Tron on 20 Oct 2020, where users earned an annualized percentage yield of up to 20.58%. At its launch, Binance had three staking products featuring Tron. Today, however, there are five products available for investors.

Binance allows investors to stake their crypto for 30, 60, 90, and 120 days, with APYs of 4.34%, 5.20%, 6.59%, and 12.38%, respectively. All four products mentioned are of the locked staking type, where investors must lock their crypto for the number of days mentioned. Additionally, there is one other product with flexible duration, where users can subscribe and redeem their assets any time they want.

One important thing to note is that users who redeem their coins before the completion of the locking duration will have to forgo all the rewards they’ve earned to date. If, as an investor, you’re unsure of your commitment to the mentioned duration, the flexible savings option would be a suggestible choice. Read our Binance review for more information on the exchange.

2. Kucoin

Kucoin is a popular crypto exchange known for its wide offerings. The platform offers over 600 cryptocurrencies to trade, and it is present in over 200 countries, catering to a user base of more than 8 million investors. KuCoin first introduced staking on its platform in 2019 and soon attracted over 300,000 users to this service. As of today, the platform has over 50 coins available to stake, including Tron.

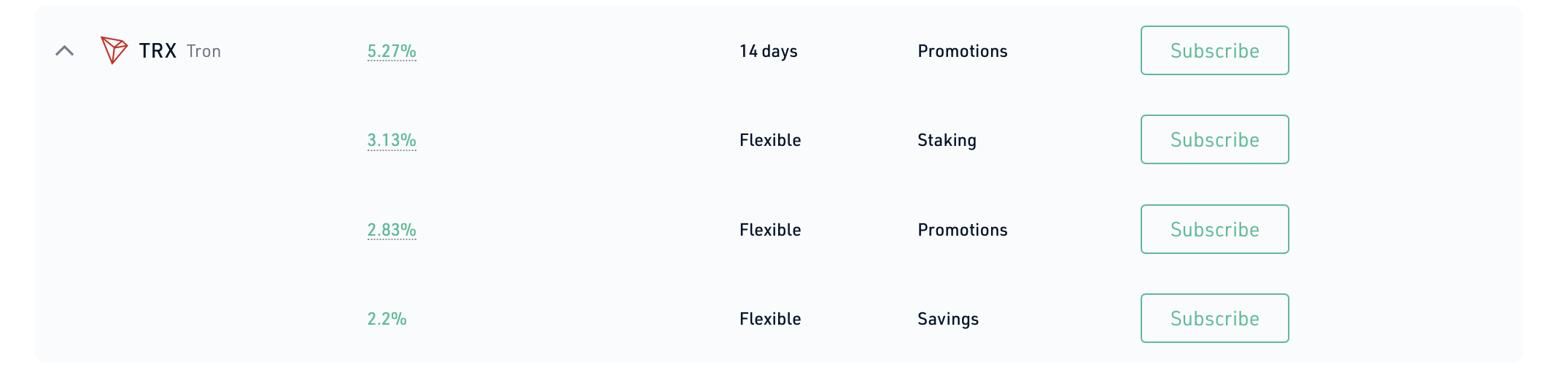

Unlike most other exchanges, KuCoin has something called soft staking. Users aren’t required to lock their crypto for any particular duration but can use their coins whenever they want. Considering the volatility of crypto, this is a great way to stake. Not only will you be able to withdraw your funds when the markets are underperforming, but you can even participate when cryptocurrencies are following an uptrend.

Regarding the options available to stake, KuCoin provides an APY of 2.2% and 3.13% on two crypto products that don’t require users to lock in their funds. There’s also an option to lock funds, where users can receive an APY of 5.27% by locking their funds for 14 days. It’s quite evident that KuCoin isn’t the exchange offering the best yield, but it can be a preference for users who don’t wish to lock their crypto and prefer having control over it.

Compared to other exchanges, KuCoin has much lesser trading fees, normally ranging between 0.0125% to 0.10%. The only issue with KuCoin is that it isn’t licensed in the US. So, users in the US may have to consider other exchanges for their crypto-related needs.

3. Ledger Wallet

There are multiple ways to stake Tron, or any cryptocurrency for that matter, and while exchanges are some of the most popular ways of staking your crypto, they aren’t necessarily the most secure. Ledger Wallet is a trusted name when it comes to cold wallets as the wallet allows stakers to store more than 1000 cryptocurrencies without any hassle. The Ledger Live software can perform many crypto-related tasks, including staking Tron while safely holding the tokens in cold storage.

Staking Tron on a Ledger device is identical to the process on most exchanges, where the user must choose the locking period, enter the amount of Tron you want to stake and confirm the transaction. The staking reward at the time of return is approximately 5% but does vary on the network conditions. Using the software, holders of the tokens can choose the best delegator pool to join. The delegator fees will be taken from the yield.

For crypto enthusiasts who value the security of their investment over staking rewards, using the Ledger wallet to earn a yield on TRX is a great option.

4. Trust Wallet

Trust wallet is a crypto wallet offered by Binance, where you can store all your cryptocurrencies. It is available on both iOS and Android devices and opening your own wallet doesn't take more than a few minutes. In the Discover section of the app, several staking features can be accessed effortlessly. A full list of tokens is viewable with their respective staking APYs. Trust Wallet also has a staking reward calculator on its official website, showing the estimated earnings according to the current APYs, per day, month, or yearly.

Every cryptocurrency has a minimum amount you need in a wallet to be able to stake; in Tron's case, it is $1. Additionally, they need to have the required transaction fees in their wallet, which can be 1 TRX at minimum. After entering the amount of TRX to stake, users will be required to choose a validator. Select one from the options presented.

Users should be aware that the tokens will be frozen for three days when they cannot move or transfer them anywhere. After this period, the fund owners can unfreeze the TRX tokens or leave them there to earn staking rewards. Overall, Trust Wallet is a convenient way to stake Tron; however, regarding security, it is not as robust as using the Ledger wallet.

Read our full review of the Trust Wallet.

Benefits of Staking Tron

- Promising returns: We know that crypto is very volatile and although speculations give you a fair idea of where a coin is heading, there’s no surety when it comes to accurately estimating the profits. Staking, therefore, comes out to be a better option wherein, under the worst market conditions, the interest earned through staking can cover the unrealized loss due to a drop in the Tron price.

- Easy to stake: While it may take a while to wrap your head around how staking works, the actual process of stalking is really easy. Just as easy as purchasing a coin on an exchange. Even if you are a beginner, you can navigate the process pretty easily. If you’re having any trouble, refer to the guide above for a run-through.

- Not limited by the Internet: Users can stake their cryptocurrency in an offline wallet and earn rewards for the same. A cold wallet isn’t connected to the internet reducing any attacks, although uncommon, on your staked crypto.

- Environmentally beneficial: The PoW consensus mechanism followed by Bitcoin has received a lot of skepticism, and almost everyone is aware of why. The energy consumption to keep the network operational is concerning. Conversely, the PoS mechanism is said to be better. By playing your part in keeping the network functional and by staking your crypto, you’re lending a hand in saving the environment.

Risks of Staking Tron

- Volatility: A common risk with staking, and across crypto in general, is the market volatility. Not only are you holding a risky asset, but the interest you earn may not amount to anything if you’re locked in for a specific time, within which the asset drops in price, leading to an effective loss.

- Locked Period: Staking on most platforms has either a locking period or a freeze period, during which your assets are locked for months on end or a few days, respectively. During this period, you won’t be able to make any changes or respond to market action.

- Delays in Payments: While most platforms promise everyday payouts, delays in payments aren’t uncommon. This may not be a serious issue for many as staking in crypto is thought to be long-term, and the delays usually don’t occur for more than a couple of days.

- Developmental Changes: Developmental changes and votes can influence the way the network functions, causing a potential negative price trend if any news raises a negative sentiment. This can possibly lower your estimated APY on your staked Tron.