We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Where To Stake Tezos

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Scalable, upgradeable, and secure, Tezos not only has great value as a tradable asset but as a cryptocurrency for staking due to its appealing returns. While the bear market has seen Tezos' total value locked (TVL) drop massively from above $200 million to only $34 million, it is still one of the best staking coins.

Here's a quick list of the best places to stake Tezos (XTZ):

- Binance (overall best place to stake Tezos)

- Coinbase (simple and safe way to stake Tezos)

- Kraken (reliable platform to stake Tezos)

- Ledger wallet (safest method for Tezos staking)

- Atomic Wallet (best-decentralized wallet to stake XTZ)

- Guarda wallet (good non-custodial wallet for staking)

Where To Stake Tezos For The Highest Rewards: Comparisons

This comparison guide provides an overview of where to stake Tezos (XTZ) to earn cryptocurrency rewards and a passive income. Our research is based on assessing the platform and wallets features, estimated annual yield, fees and security.

| Platform / Wallet | Estimated ROI |

|---|---|

| Binance | 2% to 11 % APY |

| Coinbase | 4.63% APY |

| Kraken | 5% to 7% APY |

| Ledger Wallet | 3% APY |

| Atomic Wallet | 5.8% |

| Guarda Wallet | 6% APY |

Top Platforms & Wallets To Stake Tezos Reviewed

1. Binance

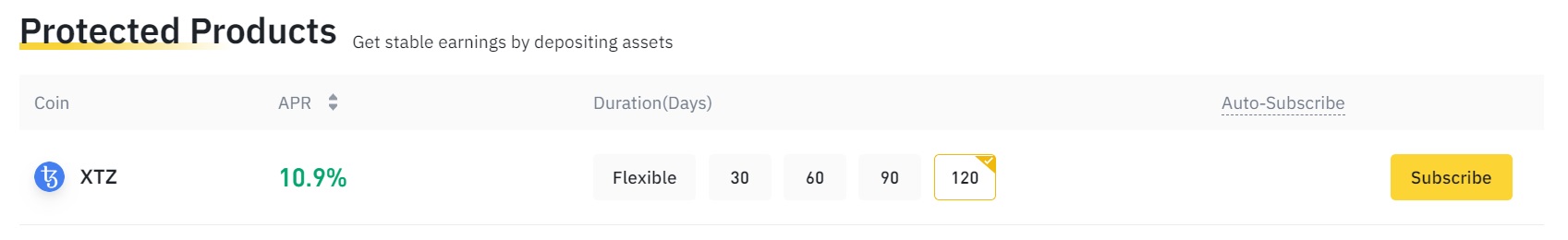

Binance is the right fit for those comfortable with a complex user interface to stake Tezos. On this platform, staking Tezos will yield users between 2% to 11.9% APY, depending on the chosen arrangement. There are no minimum amounts or staking commissions.

Binance has modified its staking program for most cryptocurrencies on the platform. While there was once a time when multiple staking mechanisms were presented that included the minimum and maximum restrictions, Binance removed them. Now, there is a simple program called Simple Earn through which users can earn rewards by staking their crypto assets. Under this new program, the estimated APY has been increased from 7% to 11% for Tezos.

There are two types of staking options that can be chosen. A locked-term or flexible arrangement. Those willing to lock their assets and are not worried about interacting with the market can use fixed-term staking. With flexible term deposits, however, the staking rewards are slightly lower – investors can only earn up to 2% APY for staking Tezos. However, considering Binance has not imposed any limits to staking, even a 2% return isn't a bad deal.

- Staking Tezos for 30 days will yield an APY of 5.1%

- Staking Tezos for 60 days will yield an APY of 7.50%

- Staking Tezo for 120 days will yield an APY of 11.9%

A benefit of Binance is there are zero fees for staking on its platform. All traders have to do is transfer their Tezos tokens to their Binance wallets, choose between Fixed or Flexible term deposits and jump into the Simple Earn program. However, investors will find their tokens being staked for flexible terms by default, which means they will receive the lower 2% staking reward without further action.

The only issue we found with Binance staking is that High-Yield staking is not available for any crypto pair involving Tezos. While advanced investors might find it an issue, it is just a minor gripe for ordinary-level traders. That said, interacting with Binance's ecosystem can be challenging. Another issue we found with Binance is that the original platform is banned for US traders. Investors based in the United States must use Binance.US, which, while it has a staking program, doesn't offer rewards for staking TXZ.

Overall, Binance is a top staking platform for staking Tezos. It is one of the few platforms to have increased the APY for Tezos staking during the bear market. Furthermore, the Simple Earn program removes much of the leg-work people need to do for staking. The user interface for the desktop app, however, is not that easy to grasp for beginner-level traders. That said, the platform's mobile interface is much better and offers the same utilities as the desktop equivalent. For these reasons, Binance is the best platform for staking Tezos.

Read our extended review on Binance.

2. Kraken

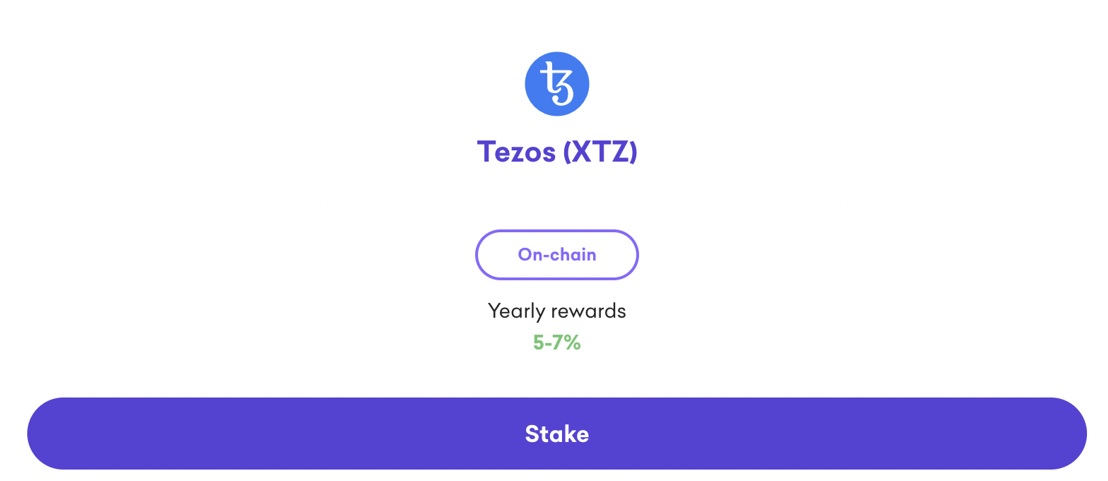

For those who want to earn interest on Kraken on their idle account, on-chain staking is a great option. Kraken is a good example of on-chain Tezos staking with staking rewards that range from 5 to 7% APY. Kraken distributes the rewards bi-weekly, meaning users will receive their XTZ tokens two times a week. With on-chain staking, a user's Kraken account is directly connected to the Tezos blockchain, and the rewards are distributed from there.

On the user interface front, Tezos takes a rather simple approach. The entire platform is simple to understand, and even beginner-level investors won't have any trouble interacting with the offerings of this platform. Furthermore, the mobile app by Kraken is also great – making it easy for mobile investors to invest, trade, or stake Tezos.

Overall, Kraken has a simple and rewarding staking interface. The staking rewards for Tezos are higher when compared to Coinbase. Moreover, similar to Coinbase, there is a staking fee for using Kraken. The standard commission is 15% which is deducted from the distributed rewards which are fairly high, and USA users are not eligible to stake XTZ due to recent SEC litigation.

Read our full Kraken review.

3. Coinbase

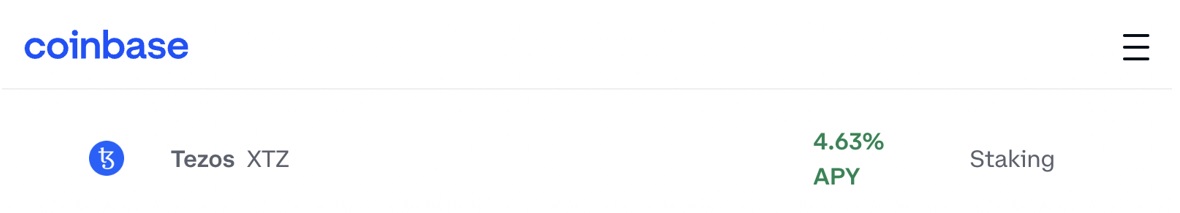

Coinbase is the biggest cryptocurrency exchange in the US that, along with standard trading services, also offers staking opportunities for multiple tokens. Staking Tezos on Coinbase is particularly lucrative since it offers up to 4.63% APY. Like Binance, getting started on Coinbase staking is also simple, and all it requires is for the user to have a verified account. However, since our last update, the staking rewards have been reduced on Coinbase from 5% in response to the bear market of 2022.

With Coinbase, Staking is not only simple, but it is also secure and allows staking multiple assets at the same time. Furthermore, staking Tezos on Coinbase does not involve any fixed-term lockup. Investors are auto-induced into the staking utility by adding Tezos tokens to their Coinbase wallet and can opt out of it anytime. While the absence of fixed-term staking is definitely something that might worry some passive investors, active traders who want to react quickly to the current market changes would find the flexible terms to be a good deal.

However, staking rewards are not free of cost. There is a small commission fee involved in using the platform. Coinbase deducts a standard 25% commission fee. This is one of the highest in the industry based on our assessments and investors should be mindful of this.

Overall, Coinbase is a great platform to stake Tezos purely due to its simplicity and safety which are some of the reasons why more than 89 million users have trusted Coinbase. While its reward leaves a lot to be desired, the presence of flexible terms is commendable.

Read the full details in our Coinbase review.

4. Ledger Wallet

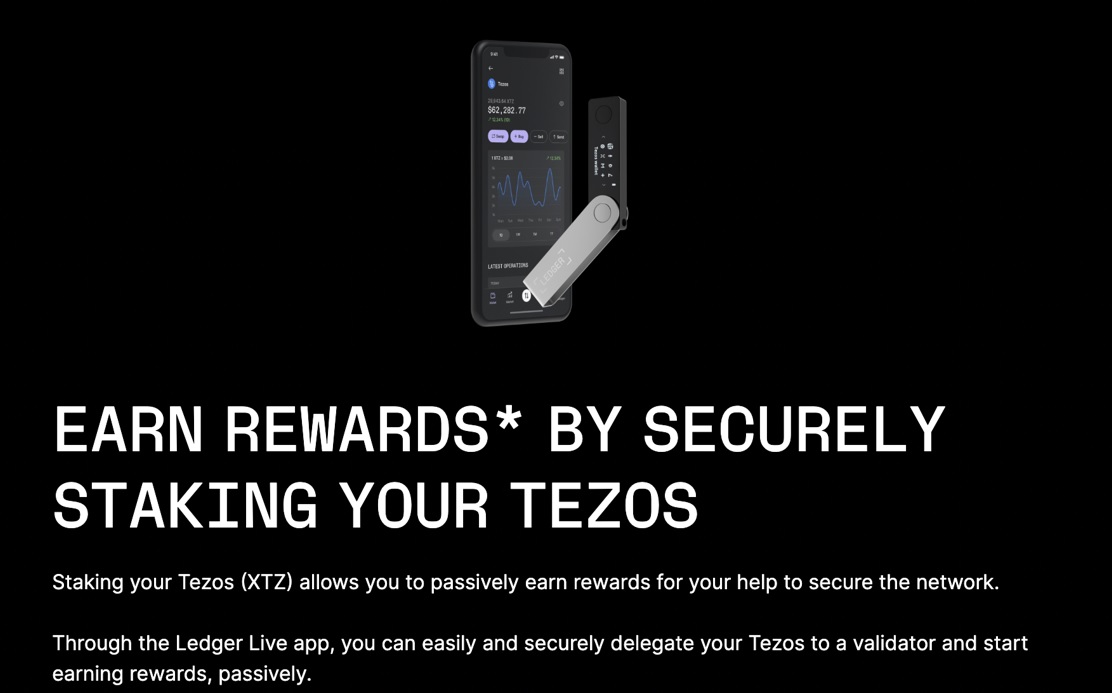

Staking at cryptocurrency exchanges always comes with a risk, and for those, hardware wallets like the Ledger wallet are the perfect way to store and stake cryptocurrencies like Tezos. The platform's flagship products, Nano S and Nano X offer robust security features and the ideal way to stake Tezos. Staking on Tezos through the Ledger wallet is easy. Through the wallet, users can connect to the Tezos network as a delegator or a validator. In return, they can earn rewards up to 3% APY.

Now therein lies the issue. The rewards have been cut in half, and by its own admission, Ledger Wallet says that “rewards are not guaranteed”. Users have the flexibility to select from the group of validators and pick one with the highest staking rewards (unlike a staking exchange). However, the 3% staking payout is not 100% distributed as validators take a portion, and the amount would depend upon the chosen validator. Another downside is the staking rewards are only distributed roughly after five weeks then every 3 days afterward.

The biggest benefit of staking Tezos using the ledger wallet is control over the private keys. Users will have complete control over the security of their keys. This level of self-accountability gives a higher level of security to a blockchain network. As such, the Ledger wallet does offer one of the most secure ways to stake Tezos.

Overall, the Ledger wallet is one of the best hardware wallets to stake Tezos. However, the low APY might be an issue for some. That said, investors must consider that even if the APY is lower, the security they get by holding their assets inside a hardware wallet is higher. Furthermore, since the staking rewards are based on Tezos blockchain's performance, we can see an uptick in the yields next year sees an uptick in the Tezo price.

That being said, the five-week waiting period for getting the first rewards is something that impatient investors must note. It means that to get any type of major reward, investors must make a deliberate effort not to withdraw their tokens and use them for trading on the open market.

5. Atomic Wallet

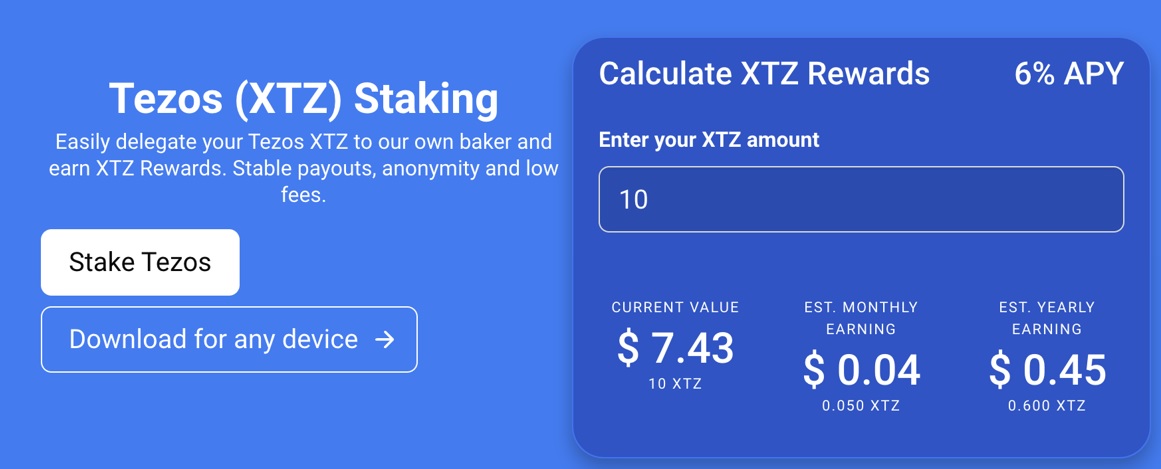

Investors looking for a decentralized way to stake Tezos can consider the Atomic wallet. Investors can gain up to 5.8% staking returns APY, which is slightly more than they would get by staking on Coinbase and other wallets like the Ledger. Staking has a minimum requirement on this platform – users need to stake at least 1 XTZ token to start earning rewards. Another big plus in favor of this wallet is that a staking rewards calculator will show exactly how much an investor can potentially earn depending on their Tezos holding in the Atomic wallet.

When using the Atomic wallet, there are no fees to stake Tezos since their accounts are directly connected to the baker. It means that the rewards will reach the baker to the user's account without any intermediary. However, depending on the number of Tezos tokens staked, the XTZ staking rewards can change.

While staking XTZ on the Atomic wallet is a great option for those with an existing wallet, it must be kept in mind that this free-to-use wallet does come with some security issues in a recent audit and the Ledger wallet is a safer bet for storing Tezos despite the lower returns.

Read our full Atomic Wallet review.

6. Guarda Wallet

The final wallet on our list is Guarda wallet. It is a secure online cryptocurrency wallet that supports over 50 blockchains and 400k cryptocurrencies. It is a non-custodial wallet that allows people to access their funds without divulging personal details. Getting access to this wallet is simple, as it is free to download.

Like the atomic wallet and the ledger wallet, the Guarda wallet also allows investors to connect with the Tezos network as delegators and earn crypto. At the time of writing, the reward for delegating cryptocurrencies is up to 6% per annum.

Overall, we found Guarda to be a great cryptocurrency wallet to stake Tezos. The wallet offers many facilities to all types of users., including buying, trading, lending, unstoppable domains, and AML services. Being non-custodial, Guarda leaves the responsibility to secure the assets in the user's hand – which is one of its greatest strengths. The only downside is that users must delegate at least 10 Tezos to get access to staking rewards which is a higher entry barrier compared to other places to stake Tezos in this list.

What Is Tezos Staking?

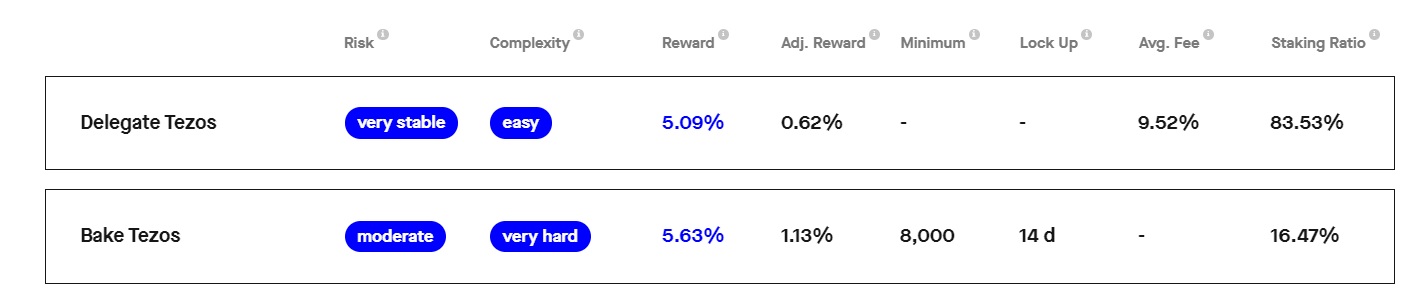

Tezos (XTZ) is a popular cryptocurrency that uses a Proof-of-Stake protocol to secure its network. Staking on Tezos works in two ways. One as a validator and the other as a delegator. Staking Tezos as a delegator allows investors to earn a passive income of up to 11% APY by indirectly participating in the validating of transactions on the network. Holders of Tezos who stake coins will receive XTZ tokens as a reward.

The other way to stake Tezos is as a validator which involves setting up a node to the Tezos blockchain as a staking pool for others to contribute their tokens. Similar to a delegator, the validator node verifies transactions and can also receive proportional staking rewards for a higher contribution to the security of the network.

Should You Stake Tezor Using An Exchange or Wallet?

- Staking Tezos using a staking exchange. The best method for staking Tezos for beginners is using a centralized exchange such as Binance, Coinbase, or Kraken. They are a simple method of staking Tezos or any other cryptocurrency, and it doesn't involve anything other than holding the cryptos in the exchange wallet. The only drawback of using this method is that users are not given a chance to select their validators and there can be staking fees.

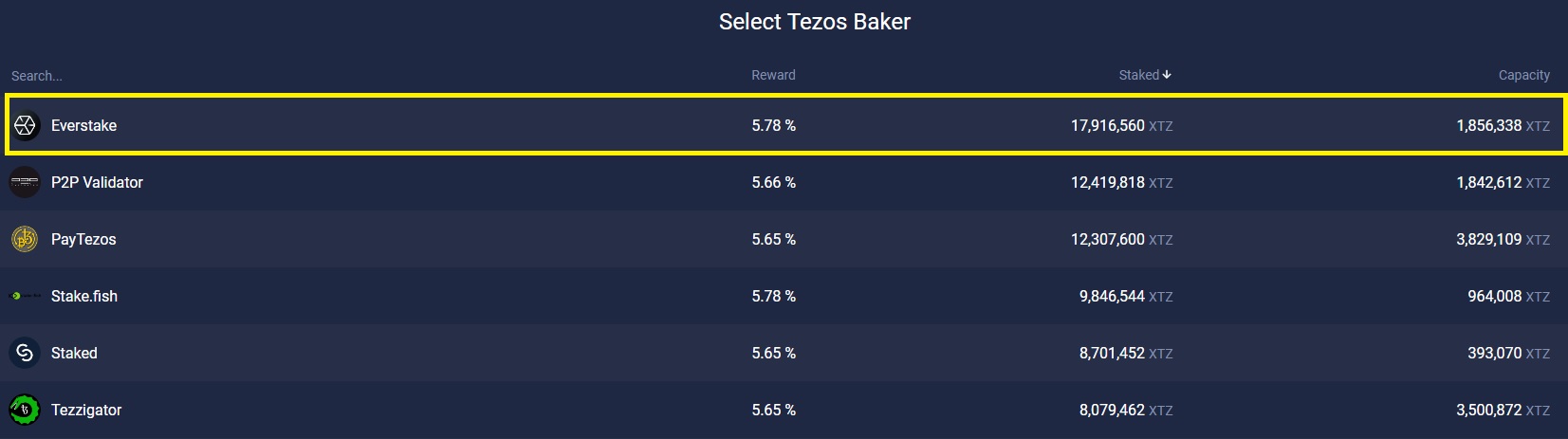

- Staking Tezos using a staking wallet. Wallets give users a chance to select their own validators. In return, the baker on the Tezos network gives these users returns after cutting a portion of the returns as Validator fees. The only downside to this method is that the XTZ staking yields are generally lower.

How Much Can You Earn By Staking Tezos?

Investors can earn up to 11.9% APY for staking Tezos on cryptocurrency exchanges such as Binance. However, flexible-term staking terms can offer rewards as low as 2% APY. On the other hand, staking Tezos using a cryptocurrency wallet has up to 5.63% APY for validators and 5.09% APY for delegators.

That said, the XTZ rewards earned will vary depending on the following points.

- The number of tokens staked as a baker-validator

- The number of tokens staked as a delegator.

- Network conditions

- The performance of the validator

- The market sentiments concerning Tezos. The returns provided can go up and down depending on the market moments of a particular asset.

How to Stake Tezos (XTZ) – Full Tutorial

1. Create an account on Binance

The first step is to create an account on Binance. It is a simple process that doesn't take more than a few minutes. However, US-based traders can't directly connect with Binance and Binance.US does not support Tezos staking at the time of writing. Therefore, Kraken is an alternative option to use. After the account is created on Binance, complete the ID verification process to gain access to the Simple Earn program.

2. Buy Tezos or Transfer to the Binance wallet

The first option is to buy Tezos directly on the exchange with fiat currency or another crypto. To do this, go to the “Buy Crypto” option in the navigation menu. Select a “Pay with” option and change it to the preferred fiat currency. Proceed to select the method to buy Tezos. Or, if they want to swap their crypto for Tezos, they can use Binance Converter.

As soon as the Tezos tokens are transferred to Binance, the staking begins. However, Binance chooses flexible staking by default. With Flexible staking, users can earn up to 2% APY. The minimum or maximum requirements are not present for the Simple Earn program. Binance has likely removed the minimum and maximum restrictions to draw more investors to load their assets on Binance in the current bearish market conditions.

3. Select between fixed or flexible term staking

Those who want to opt for a higher-yield “Fixed-term” staking must have manually done so by going to their Binance portfolios and switching to “Fixed Investment” under the Earn section. The Simple Earn program is best for novice investors who want to make passive gains without dealing with the complexity of this volatile cryptocurrency market. With a locked-staking option, investors can earn up to 11.9% APY.

4. Begin staking Tezos

Once the Binance account has been populated with Tezos tokens and a staking option has been subscribed to, it will start generating returns automatically.

Frequently Asked Questions

What is the best place to stake Tezos?

According to our research, the best place to stake Tezos is Binance. The platform offers up to 11% APY and is best for beginner-level traders.

How much can you make staking Tezos?

Staking rewards for Tezos depends on multiple factors, such as the staking period, the number of tokens staked, and the cryptocurrency exchange used. According to staking rewards, delegators can earn around 5.03% APY and validators around 5.62% APY.