We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Where To Stake MINA

Find out where to stake MINA tokens to obtain the best staking reward.

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Mina token (MINA) is the Mina Protocol's native cryptocurrency. The token powers the Mina ecosystem, facilitating transactions and fees among network users. Like other proof-of-stake (PoS) tokens, MINA can be staked on popular exchanges for periodic rewards.

Below is a brief overview of the best platforms for staking MINA tokens.

- Binance – Overall Best Mina Staking Rewards Platform

- Kraken – MINA Staking Platform with up to 20% APY

- OKX – Reputable Exchange with Simple Staking Features

- Uphold – Top MINA Staking Platform for US Residents

- Auro Wallet – Best MINA Staking Wallet

Where You Can Stake Mina Tokens

1. Binance

Binance is arguably one of the world's most popular staking exchanges for crypto assets. Investors can leverage Binance to earn passive income through its various earning features. These include decentralized finance (DeFi) lending and borrowing, yield farming, and more. However, crypto staking is the most common way investors earn crypto rewards on Binance.

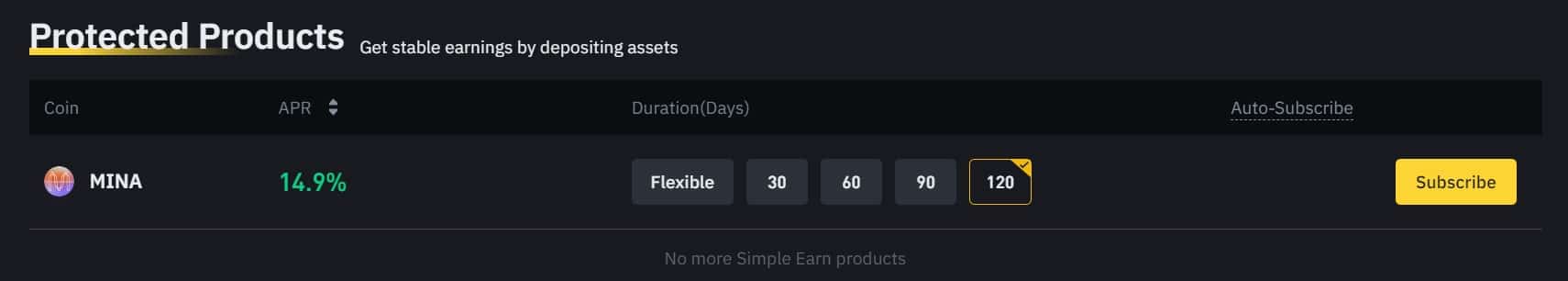

On Binance, users can stake MINA and 60+ other cryptocurrencies in the platform's DeFi staking pool. Binance launched MINA staking in 2022. Investors can transfer their coins to the exchange or buy MINA on Binance and stake it to receive rewards.

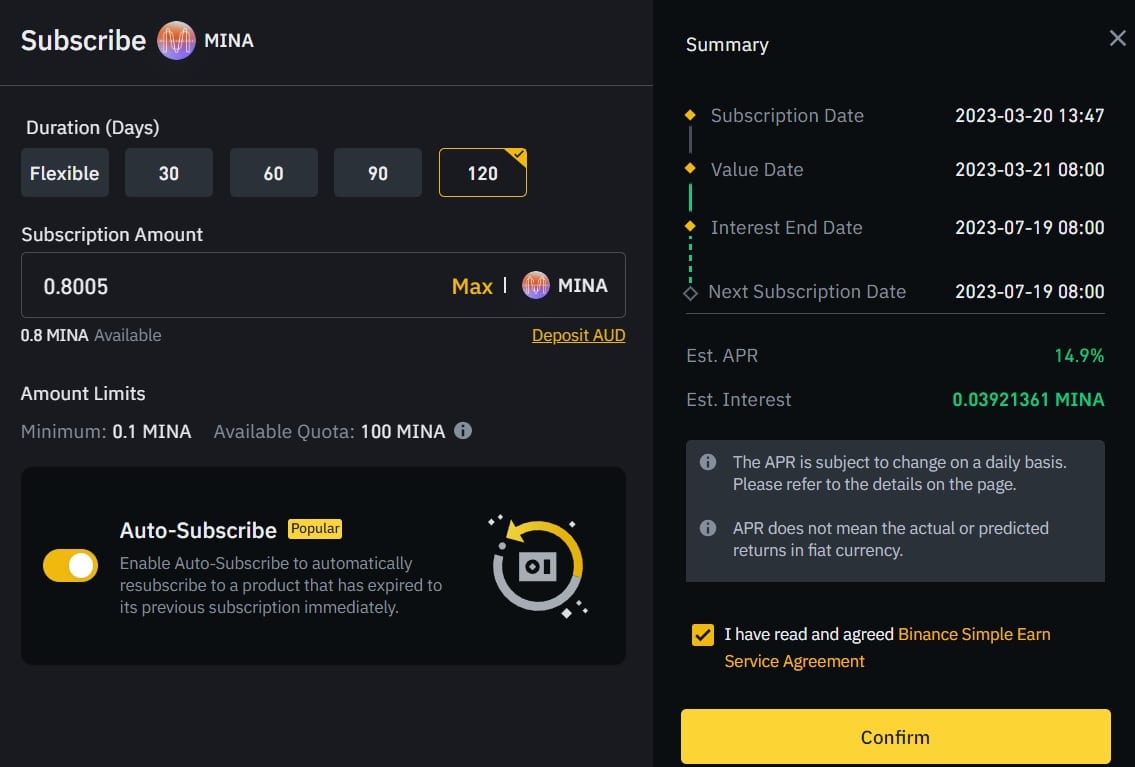

However, the only MINA staking option on Binance is via Locked Staking. This means traders must lock in their tokens for fixed periods ranging from 30 to 90 days. Annual staking interests range from 8.95% to 12.29% – depending on the period. The minimum staking amount is 0.05 MINA regardless of the staking period. The maximum staking limit ranges from 60 MINA to 15,000 MINA. More information is provided below:

| Lockup Period | Maximum Staking Amount | APY | Minimum Staking Amount |

|---|---|---|---|

| 30 Days | 15,000 MINA | 8.95% | 0.05 MINA |

| 60 Days | 600 MINA | 11.39% | 0.05 MINA |

| 90 Days | 60 MINA | 12.29% | 0.05 MINA |

There are no fees for staking on Binance. The APY offered by the exchange is also competitive, making it a top choice for all kinds of investors. However, savvy investors can stake MINA on competitor exchanges like Kraken for 20% APY. It's important to note that staking on Binance is offered on a first-come, first-served basis. This means the staking window may be closed at any time. Moreover, Binance is unavailable in the United States and Binance.US does not have Mina staking at the time of writing.

Read our full review on Binance.

2. Kraken

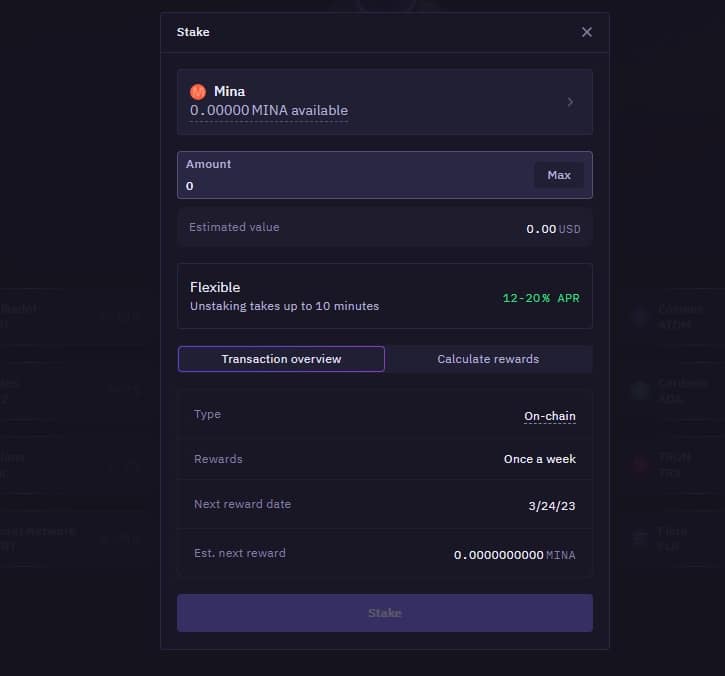

Kraken is another reputable staking exchange that supports the on-chain staking of 16 cryptocurrencies, including Mina (MINA). Non-holders can buy MINA directly from the exchange and transfer their coins to the staking pool. The coin is tradeable against EUR, USD, GBP, and BTC on Kraken and Kraken Pro.

There is no minimum on-chain staking period. Instead, users’ rewards are pro-rated in line with how long they stake. In other words, investors will still be rewarded if they stake for only a few minutes. Moreso, there are no fees for staking and unstaking on Kraken.

At the time of writing, Kraken's staking rates are between 12% and 20% APY, which is relatively higher than Binance's. It's also one of the highest interest rates offered on Kraken staking. However, Kraken has disadvantages, such as its 15% staking commission and not being allowed in the US. The exchange suspended its staking services in the US following a settlement with the SEC last month.

Read our full Kraken review.

3. OKX

OKX is third on our list of best platforms for staking MINA. The Seychelles-based cryptocurrency exchange is one of the largest in the world in terms of trading volume. One of the standout features of OKX is its ease of use and its various Earn features, which allow investors to generate passive income via staking. MINA is one of the latest additions to the free OKX staking pool. Moreover, users can lock up and withdraw the MINA staked without worrying about gas fees or other charges.

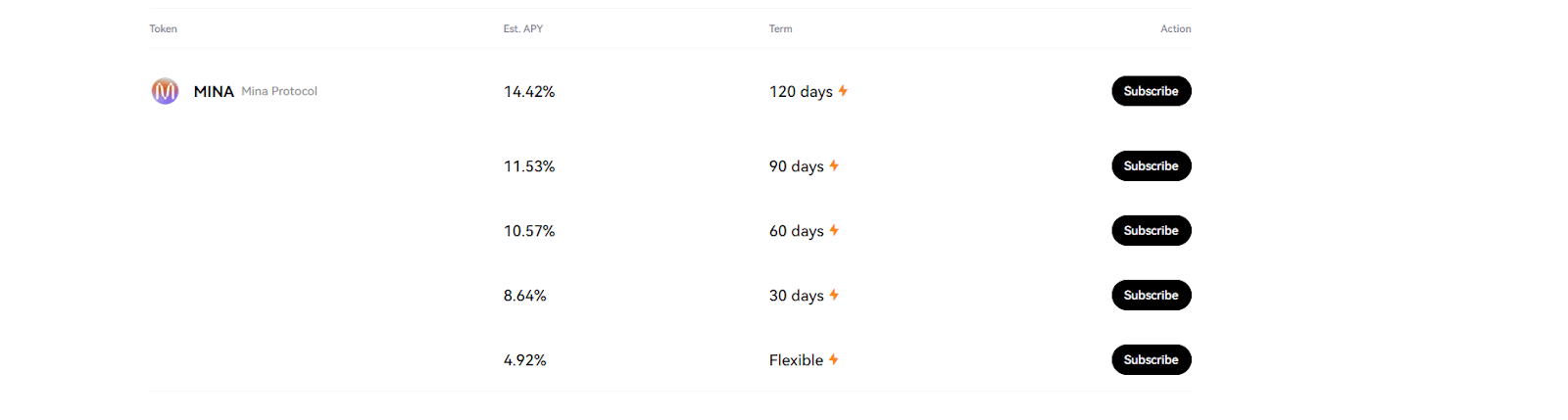

Regarding the staking tenor, the exchange offers flexible and fixed staking periods. However, unlike other platforms, the fixed periods range from 30 to 120 days. Meanwhile, staking rewards range from 4.92% APY to 14.42% APY – depending on the staking period (at the time of writing). A breakdown of the staking periods and interests is done below:

| OKX Staking Term | Estimated APY |

|---|---|

| Flexible | 4.92% |

| 30 Days | 8.64% |

| 60 Days | 10.57% |

| 90 Days | 11.53% |

| 120 Days | 14.42% |

A disadvantage of staking MINA with OKX is a lack of fiat or altcoin pairings. It can only be bought with USDT or USDC on OKX.

Read our full OKX review.

4. Uphold

Uphold is a New York-based cryptocurrency exchange offering crypto services to residents of the country and 150 others. The crypto trading platform is one of the most popular in the US. However, it’s among the lowest in market cap and trading volume. The platform allows users to buy MINA directly. They can store it in their wallets, trade it in the crypto market, or lock it for additional staking rewards.

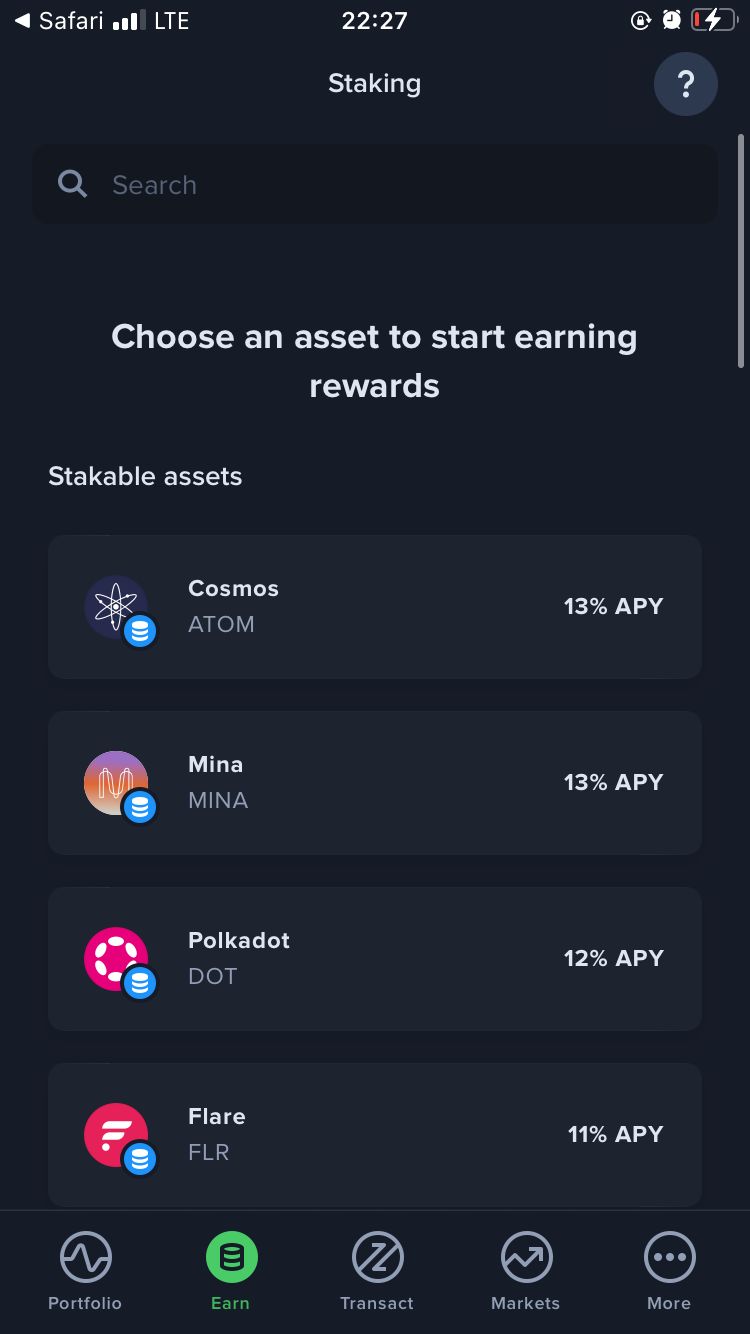

Uphold's earn program is limited to crypto staking only. Other DeFi earning possibilities, like yield farming and lending/borrowing, are unavailable. Regardless, staking MINA and other cryptocurrencies on Uphold is straightforward. Investors can stake MINA for fixed periods to earn about 13% APY. The rate offered by Uphold is quite low compared to some of the other exchanges in this comparison list. Moreover, the rewards depend on customers’ preferences and staking periods, which Uphold states start from 30 days.

Uphold charges a commission between 3% and 34%, depending on the staked asset and network condition. This makes Uphold an expensive choice for those who want to find a low-cost crypto platform to stake Mina. In addition, Uphold's staking feature is only available on its mobile app—that is, MINA can't be staked on the desktop version.

Read our full OKX review.

5. Auro Wallet

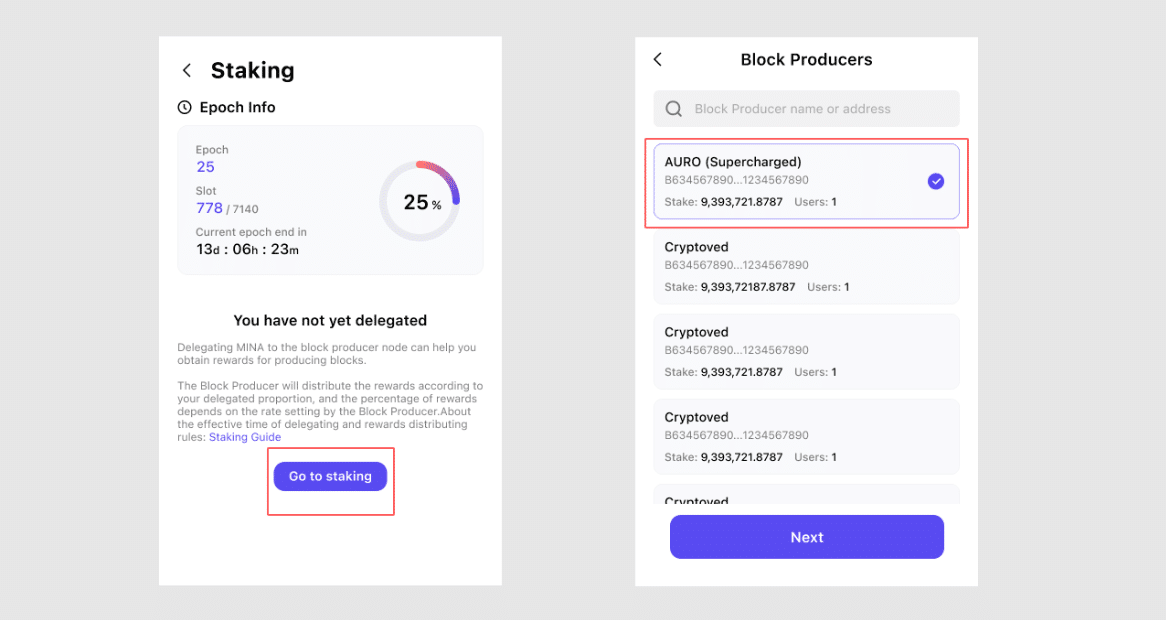

Auro Wallet isn't an exchange like the other MINA staking platforms reviewed in this guide. Instead, it's a DeFi staking and interest-earning wallet built for the Mina Protocol. Auro Wallet is an open-source crypto wallet that allows users to easily send, receive, store, and stake MINA tokens and access their transaction records on the network. In other words, the wallet was created to support Mina. For security, it generates multiple addresses and backup mnemonic phrases known only by wallet owners.

To stake MINA on Auro Wallet, the wallet's browser extension or iOS App must be installed. The downside is that the wallet doesn't support direct crypto purchases. This means investors will need to purchase the tokens elsewhere and transfer them to the Auro Wallet for holding (and staking), which will be problematic for casual crypto investors who hold Mina.

A benefit of using the Auro Wallet is the versatility of choosing between flexible and locked staking options. The rates for locked and flexible staking are 24% APY and 12% APY, respectively. However, Mina states that these are the standard percentages, which may vary slightly from epoch to epoch. Staking with Auro does incur a one-time fee of 1 MINA after creating a wallet.

The MINA Protocol

Mina (MINA) is a cryptocurrency token that powers the Mina protocol. The platform is a blockchain network that describes itself as the world's lightest because of its low transaction size and one of the fastest transaction speeds.

With the constant scalability, security, and decentralization issues plaguing proof-of-work blockchains, Mina Protocol creates a blockchain controlled by the network participants. The protocol combines Zero Knowledge Succinct Non-interactive Argument of Knowledge (zk-SNARKs) with the proof-of-stake consensus mechanism. Hence, combined technology minimizes the computing power required by nodes to validate transactions.

How to Stake Mina

This Mina staking tutorial will use our top-rated platform, Binance. The overall staking process via Binance Earn is straightforward and has competitive reward rates.

Step 1. Log in to Binance

Log in to the Binance account on the website or mobile app. To do this, click “Log In” at the top corner of the screen. Enter the login credentials and verification codes sent to the registered email and phone number. Then click “Submit” to continue.

Step 2. Buy Mina Tokens

Binance doesn't offer MINA a direct fiat-to-crypto conversion. This means users must convert a stablecoin like USDT or BUSD into MINA tokens via the “Binance Convert” feature or P2P platform. Enter the amount of USD or other fiat currency to spend in the “Spend” box. Choose MINA in the “Receive” box. Enter the payment details and follow the prompt to complete the transaction.

Step 3. Stake MINA

To add MINA to the Binance staking pool, click “Earn” at the top of the screen. Select “DeFi Staking” from the dropdown menu. Find the MINA ticker and click “Stake Now”. Choose the preferred staking period. Enter the quantity of MINA to be staked in the dialogue box, and complete the transaction.

It's important to note that Binance staking is on a first-come, first-serve basis. That means the exchange reserves the right to end the staking of any coin (including MINA) when the limit is reached.