We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Where To Stake ICP

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own inquiries.

TABLE OF CONTENTS

Internet computers are based on the Proof-of-Stake mechanism, and therefore, ICP can be staked to earn rewards. To do this, participants can either stake the tokens on the Network Nervous System App or deposit them onto a cryptocurrency staking platform. Normally, it's easier to stake on an exchange than otherwise. The rewards vary depending on the lock-in period, and naturally, the longer they choose to stake, the higher the rewards.

Best Places To Stake Internet Computer

1. Binance

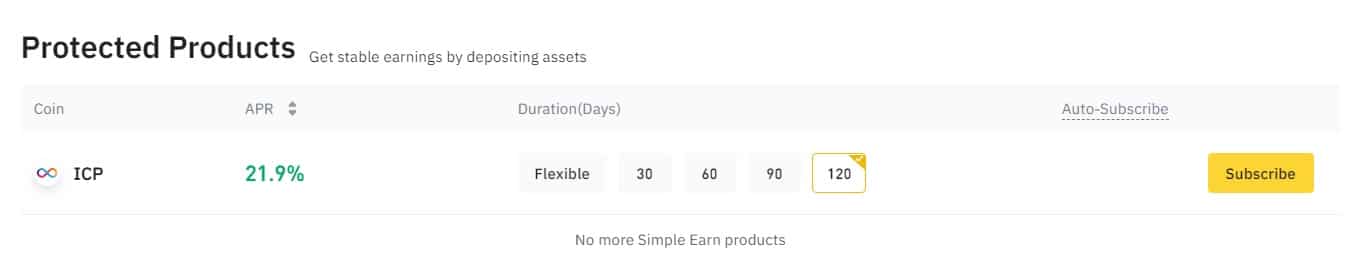

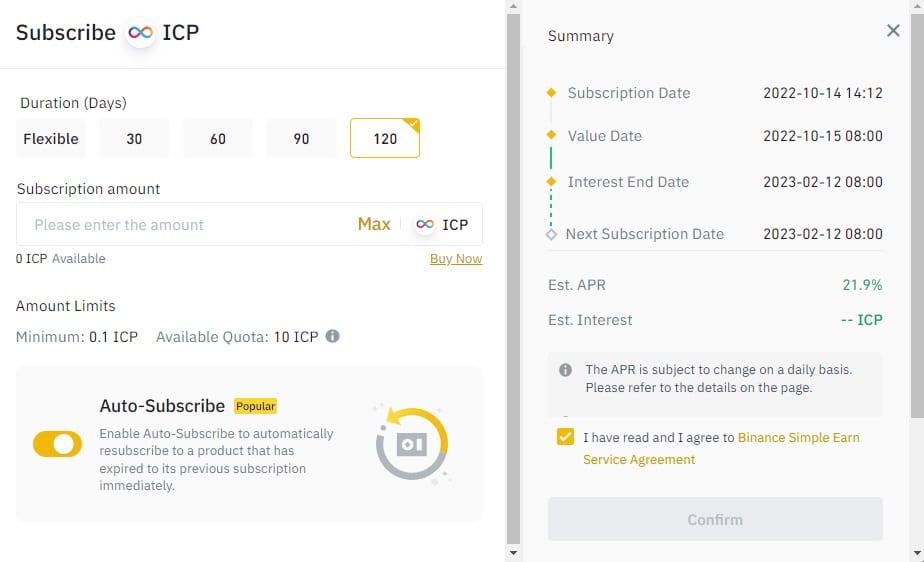

Binance introduced ICP staking in April 2022, with four locking periods of 30, 60, 90, and 120 days, respectively. A flexible option allows participants to choose the number of days to stake ICP. A minimum of 0.1 ICP is required to stake on Binance.

The 30-day option provides investors with an APR of 4.95%, which is below average when compared to other coins. However, investors may find the 120 days product quite lucrative as it offers returns of 21.90% APY at the time of writing. These are some of the highest returns offered compared to the best cryptocurrency staking coins in the market.

The flexible option enables users to choose the locking period according to their convenience, but the returns there are quite negligible, with a 0.50% APY return. However, this allows individuals to move ICP across to the Binance exchange, one of the few places for buying, trading, and selling ICP tokens. Moreover, it is a safe and secure exchange to leave ICP tokens with industry-leading security measures.

Overall, when it comes to staking ICP on a crypto exchange, Binance is our top pick due to its numerous staking terms available and peace of mind the tokens will be safe. Learn more about Binance in our extended review on Binance.

2. Bitrue

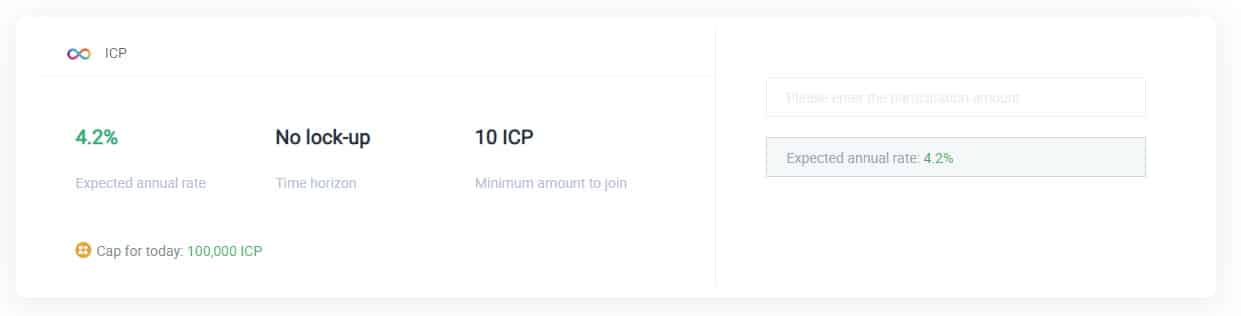

The most basic staking product for ICP on Bitrue offers a 4.2% expected annual interest rate, and there is no lock-in period for this staking option. Investors can stake their crypto with a minimum of 10 ICP tokens, while the limit for staking stands at 100,000 tokens. This product is a good alternative to Binance in terms of its flexible product type because the interest offered here is over eight times that of Binance. Therefore, investors who wish to stake their crypto without a locking period will receive much better returns with Bitrue.

Bitrue has three other ICP staking products that have a lock-in period of 14, 30, and 90 days and offer an APY of 13.66%, 9.11%, and 45.55% APY, respectively. These returns are significantly better than those of Binance, yet the exchange isn’t the first preference of investors because it has much less liquidity than Binance. For context, the exchange is not in the list of top 50 crypto exchanges by volume, while Binance stands at number one.

While true, investors can still go forward with the platform if high returns are the priority. Along with ICP, the platform has several other staking options, some offering APYs of over 200%. To learn more, read our full review on Bitrue.

3. Network Nervous System App

The Network Nervous System is software used to govern Internet Computers, and it does this by providing a place where participants can make community-based decisions for Internet Computers. The NNS also acts as a blockchain with a public key to validate all the transactions. The NNS proposes a vote, such as whether to add subnets to the network, and holders of the ICP token vote upon these proposals, and they receive rewards in the form of ICP tokens.

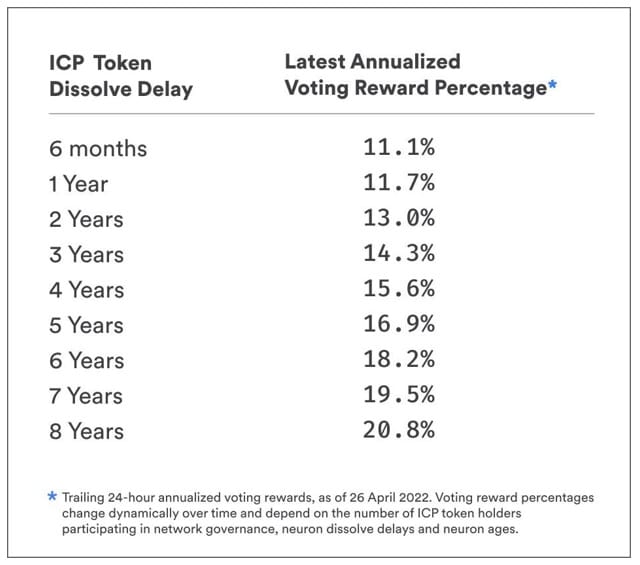

The annualized staking returns are time-based and start from 11.1% APY for a 6-month holding period. The next staking bonus is 11.7% APY for 1 year to 20.8% for staking over 8 years. These rates are estimates and subject to change with market volatility and the number of ICP tokens in the network governance.

While the process of staking on the NNS app is pretty direct, it may not be the most convenient. Users have to purchase ICP tokens on an exchange like Binance and then transfer them back to the app to stake the tokens. Compared to the options above, this is a major disadvantage of staking with the Network Nervous System app. It is much simpler for individuals to stake ICP directly on a unified exchange where the tokens are bought or traded.

Ways to Stake Internet Computer

1. Staking ICP on the Network Nervous System App

The NNS constantly puts up proposals to vote on the app, which are voted upon by ICP holders who’ve staked their crypto & gained rewards for doing so.

Here is a step-by-step process explaining how to stake ICP on NNS:

- Buy ICP tokens. The first step is to obtain ICP on an exchange that supports the token. At the time of writing, the top crypto exchanges with the highest ICP trading volume are Binance and Coinbase. These exchanges have fiat onramps, or the tokens can be converted with another altcoin.

- Create an account with the app. In order to participate in the governance of the ICP token, you will have to create an account on the official app that enables ICP staking. An Internet identity is required to log in to the NNS app. This can be done using biometrics such as fingerprints or face IDs on a mobile device. Or by using a physical key to authenticate the device. There is also a third option, where users can connect their wallets to authenticate themselves.

- Transfer ICP tokens to the app. Transfer the ICP tokens from the exchange to the “Main” wallet address displayed on the app. This should be done in less than a few minutes.

- Begin staking. Once the ICP tokens have arrived in the Main wallet, stake it by clicking on New Transaction. The minimum ICP required for this transaction is 1 ICP. The user will also need to choose the staking option such as Dissolve Delay. This is a period of time before the tokens can be released. and can range from 6 months to 8 years. The rewards increase with the longer duration. Lastly, choose which neurons to follow for voting.

2. Staking ICP on an Exchange

There are a few staking exchanges that support ICP staking. Our best pick is Binance exchange, however, there are other options such as Bitrue that can be used.

To stake ICP on a crypto exchange, follow these steps:

- Choose a staking platform. Select a staking platform from our recommended list above. Open an account and log in with the registered credentials.

- Purchase ICP. Add funds to the wallet using either fiat or crypto. If depositing traditional money, there will be a Know-Your-Customer (KYC) process to complete first. Next, buy ICP tokens using the funds in the wallet. Existing ICP holders can transfer the pre-owned ICP tokens to the exchange.

- Navigate to the staking section. Go to the staking section of the exchange and navigate through the staking list. Select ICP from the options.

- Choose a staking term and enter the amount. Decide on a staking term from the list such as flexible or fixed staking. Enter the number of ICP coins to stake which should be more than the minimum staking amount.

- Review and start staking. Confirm the request by clicking on the “Stake Now” button.

How Does Staking Internet Computer Work?

Staking, as a mechanism, was introduced in cryptocurrencies that follow proof-of-stake consensus mechanism that selects random validators to confirm the transactions on the network. While the ICP network isn’t entirely based on proof-of-stake, it is powered by a four-layered consensus mechanism that is based around PoS, and therefore enables crypto staking.

A “neuron reward” is calculated daily, and neurons participating in votes receive a claim relative to their proportional stake, which is the number of ICP tokens earned. This means participants keep the network functional and are rewarded with ICP tokens for their contribution to its governance and security.

How Much Can You Earn Staking Internet Computer

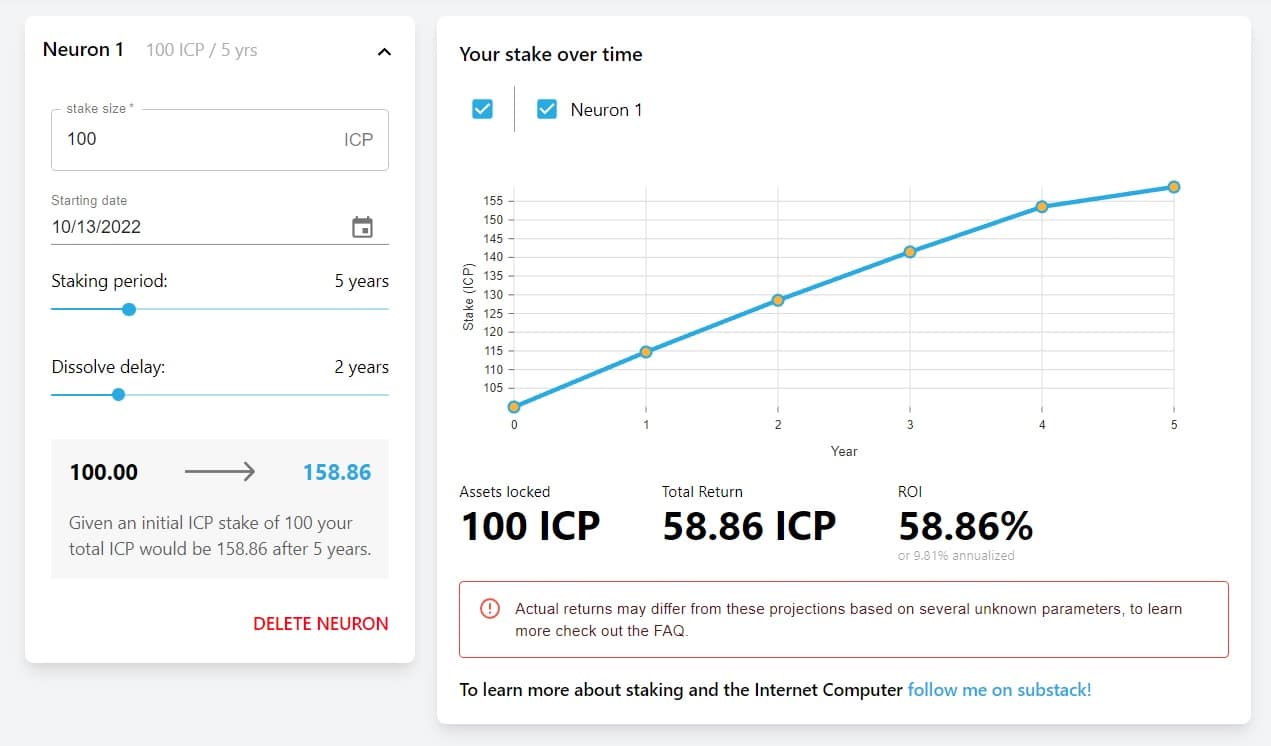

The average ICP staking reward using an exchange is between 4.5%-11% APY in a fixed or locked term. Longer terms are available, such as 120 days for a 21.90% and 45.55% APY return on Binance and Bitrue, respectively. Although, several factors besides the lock-in period can affect the reward. These include the dissolve delay, amount staked, age of the neuron (relating to the NNS), number of voting proposals and neurons participating in each vote, and the average age of all neurons. To work out the estimated rewards for staking ICP, the ICP Neuron calculator can be used as shown below.

Pros And Cons Of Staking Internet Computer

Here are a few pros and cons you should be informed about before choosing to stake ICP.

Staking Internet Computer Pros:

- High potential for growth. The Internet Computer project is quite visionary and shows a lot of potential for future growth

- The ICP token offers impressive APYs, and is, therefore, an optimal choice of the coin to stake for investors

- What enforces the credibility of a project more than the number of people who support it. ICP was 5 years in the making, and was launched only a year before, but has gained a lot of popularity in such a short time.

- Users can stake their ICP tokens either on the exchange of their choice or on the Network Nervous System App. Both of these are quite convenient, although the former is a more preferred option.

Staking Internet Computer Cons:

- Although the token price is expected to increase over time, it’s important to know that the crypto market is quite volatile, and therefore, the token price and the APYs are prone to change.

- Locking period to obtain the highest staking rewards

- Valuation of ICP tokens has significantly declined in the bear market

The Risks Involved

It is widely accepted that staking cryptocurrencies carry risks that are common to ICP as well. Here are a few things you should know about.

- APYs prone to change: APYs on most cryptocurrencies are bound to change. On Binance, for example, ICP offered an APY of more than 25% for 120 days when it was launched, while today it offers an APY of 21.90% for the same locking period. These changes can hamper investment strategies if the market conditions witness rapid changes.

- Vulnerability to Attacks: Crypto wallets aren’t unfamiliar with cyber attacks and scams. Investors who aren’t aware of such happening may become a target of such attacks and lose their money.

- Volatile Value: Even though the ICP tokens are staked, the value of the staked tokens still changes depending on the market conditions. Because of this, in the case of a bear market, the person may lose all of their money when staking.