We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Where & How To Stake Cronos (CRO) Tokens

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform, please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own inquiries.

TABLE OF CONTENTS

CRO is a niche cryptocurrency that can be staked on the Crypto.com platform only. Other cryptocurrency staking platforms do not support CRO staking. Individuals can stake CRO on different ecosystems within Crypto.com that offer different APY rewards and methods. The top places to stake CRO include:

- Crypto.com DeFi Wallet

- Crypto.com App

- Crypto.com Exchange

1. Crypto.com App

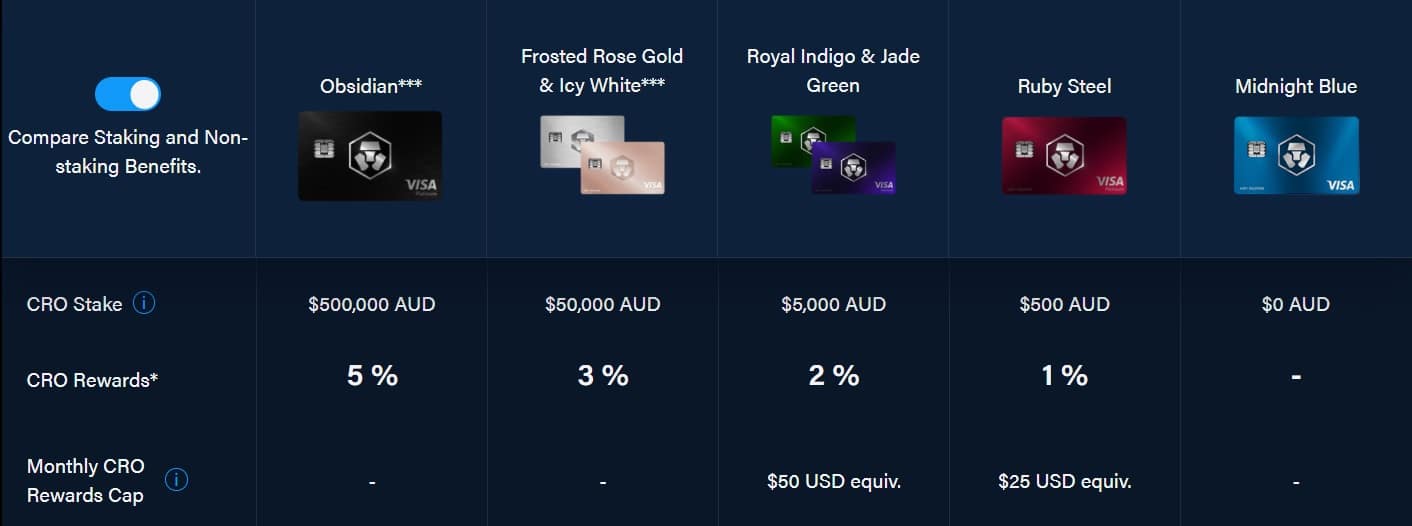

Crypto.com App is the most popular way to stake CRO, given its appeal to beginners through its innovative and modern application. Moreover, it allows the investors to reserve one of the premium metal Crypto.com Visa cards that offer various benefits, including cash back, purchase rebates, and access to better rewards on the Crypto. Earn programs. CRO stake rewards range from 4% APY to 8% APY using the Crypto.com App. Below is the breakdown of staking rewards for using the Crypto.com app:

- 5% APY: Reserved for Obsidian cardholders who have staked equal to or more than $400,000 worth of CRO tokens.

- 3% APY: Reserved for Frosted Rose Gold and Icy White Card holders with stakes of $40,000 worth of CRO tokens.

- 2% APY: Reserved for Royal Indigo and Jade green card holders with $4000 worth of staked CRO.

- 1% APY: Reserved for Ruby Steel indigo cardholders with $400 worth of staked CRO.

Investors must know that these are slashed rewards. Crypto.com did so during the crypto winter, reducing the APYs and removing rewards for investors with Midnight Blue Crypto.com visa cards. Overall, the Crypto.com app is a great way to earn rewards on CRO for those who are deeply involved with the Crypto.com ecosystem. Getting a Crypto.com Visa card is necessary, or investors can't earn the APYs. However, these rewards are prone to slashing, and there are none for low-tier Crypto.com visa cards.

Therefore, only people willing to make crypto payments part of their daily life should use the Crypto.com app to earn rewards. This may be a limitation for those wanting to stake and earn CRO rewards without the card. That said, Crypto.com has increased the rewards for registered app users on the Crypto Earn program. To learn more about the features, benefits, rewards, and fees, read our full Crypto.com review.

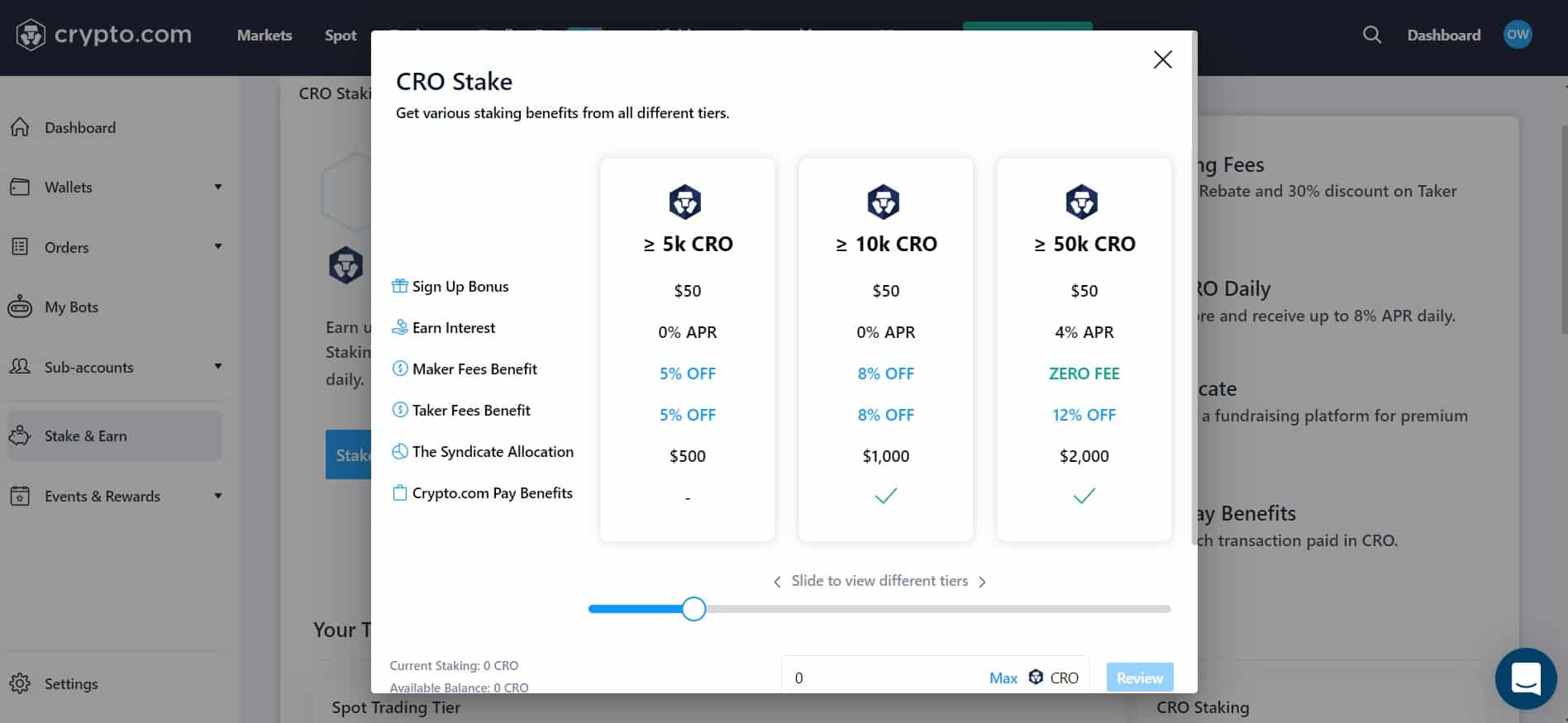

2. Crypto.com Exchange

Crypto.com Exchange is a great place for passive investors looking to earn CRO by simply staking their idle CRO tokens. It is a digital asset service and a world-leading crypto trading platform where users can buy, sell, and earn cryptocurrency assets. It is a mobile-friendly platform where users can make as high as 6% APY on CRO.

However, to earn higher rewards for native CROs, users must stake a high quantity of ERC-20 CROs on Crypto.com. With that said, the following is the breakdown of CRO APY:

- 0.65% to 4% APY for staking CRO for one month

- 0.97% to 6% APY for staking CRO for three months

- 2% APY for staking APY on flexible terms.

Higher CRO tokens diminish APY returns, which is common for all crypto assets. This breakdown of CRO rewards can be considered too complex in most crypto circles. However, to earn these rewards, users only need to buy and hold CRO on the Crypto.com Exchange.

These interest rates mentioned above are paid daily. In addition to APYs, staking CRO on Crypto.com has other benefits, including a rebate in trading fees, access to the Syndicate, a referral program bonus, and other pay benefits.

Overall, staking CRO on the Crypto.com Exchange is suitable for traders who want to safely hold their CRO tokens on the trading platform and earn rewards. The APYs are lucrative, and the additional rewards, such as cashback, are also valuable. That being said, staking CRO tokens on the Crypto.com Exchange is still dependent on those who are bullish about being a part of the Crypto.com ecosystem.

3. Crypto.com DeFi Wallet

The Crypto.com DeFi wallet is one of the safest places to stake CRO. Seasoned crypto investors who prefer non-custodial options can store and stake their Cronos tokens. The non-custodial wallet gives them access to all the DeFi services they need in one place with higher security. The wallet allows them to earn rebates on trading, not just CRO but also TONIC, ATOM, VVS, and other cryptocurrencies.

Investors may also prefer the DeFi wallet app to the Crypto.com Exchange because they can earn higher returns with flexible terms, which are absent on the Crypto.com Exchange. Those interested in staking CRO can stake the native CRO – existing on the Crypto.org chain – on the DeFi wallet. Staking CRO tokens on the DeFi wallet is easy. Users only need to store their tokens and click the “start earning” button to stake their CRO holdings.

The benefit of CRO staking on the Crypto.com DeFi Wallet is access to several dApps from the DeFi wallet. Through these apps, users can engage with different DeFi protocols, including MM Finance, Tectonic, Uniswap, OpenSea, and more. Even though it is a non-custodial wallet, the Crypto.com DeFi wallet has security measures similar to those of other elements of the Crypto.com ecosystem. This includes 12—to 24-phrase passwords and two-factor authentication.

Overall, the Crypto.com DeFi wallet app is a great option for experienced crypto investors only. This platform has a simple UI flow, allowing users to interact with functions such as the DeFi Earn, claiming rewards, stake claims, unstacking, and redelegation to new validators. It is a more robust option for staking CRO, allowing users to select a unique collection of validators to earn higher rewards. However, beginners may find the Crypto.com DeFi Wallet too complicated compared to the options above.

What's Involved With Staking CRO?

Staking CRO means locking up tokens for a certain period inside a Crypto.com DeFi wallet app, Crypto.com exchange, or Crypto.com app. It is a passive way to earn CRO for those who don't want to interact directly with the Crypto.com ecosystem. Generally, those who stake CRO earn APY, which is compounded weekly or daily. However, in CRO's case, users can access cashback, discounts, additional benefits, and annual percentage returns.

There are three ways to stake CRO through Crypto.com.

- Standard staking through the app

- Soft staking through the Crypto Earn program

- DeFi Staking through the DeFi wallet

The first two are centralized staking options, which are easy but offer minimal control to the investors. DeFi staking is the most popular way for seasoned investors to stake CRO. It is a decentralized option. Here, they choose a validator to stake their local CRO tokens. Validators are entities that operate nodes on the Crypto.org chain network, generating CRO by verifying transactions. Investors earn CRO from validators after subtracting the validator charge from the yield.

How To Stake CRO Using The Crypto.Com App

Staking CRO through the Crypto.com App makes investors eligible for many benefits, including higher cash back, purchase rebates, and better APY. The staking rewards are calculated daily but paid weekly. To stake CRO through the application, investors must have a significant amount of CRO and stake for at least 180 days.

Here are the steps to stake CRO tokens on the Crypto.com App:

- Log in to Crypto.com on a mobile device

- Tap on the ‘Trade' Button

- Select ‘Buy' and choose Select ‘CRO' from the list of assets

- Choose a fiat currency, enter the amount of CRO to buy

- Review and confirm the CRO purchase

- Navigate to the ‘Card' page and choose a Crypto.com VISA card

- Tap on ‘Stake CRO' to begin staking

How To Stake CRO on Crypto.com Exchange

Here are the steps to stake CRO through the Crypto.com exchange:

- Visit the Crypto.com Exchange website and log in using the registered credentials

- Select the “Stake and Earn” program along the sidebar menu

- Browse the CRO staking packages and enter the number of tokens to stake

- Review the order and confirm to begin staking CRO on the Exchange

How To Stake CRO Using the Crypto.com DeFi wallet

Staking CRO through the DeFi wallet is the most complex method. Therefore, investors should read this guide closely and enter all the details correctly.

- Download the DeFi wallet app. Users must first download the DeFi wallet application. It is available on the official website. Investors must set up this wallet to buy or transfer CRO from other crypto wallets.

- Navigate to the Earn program. Once users have downloaded the wallets, they must enter the Earn program by clicking on the “Earn” button. Investors who still need to implement this option to stake CRO would see $0 in the resources section. They must click on the “Start Earning” button from here.

- Select and CRO from the staking list. Investors will then see a list of crypto assets under this program. They must CRO and click on “Stake CRO” to initiate staking. They must also provide the number of resources they want to stake. There is a minimum CRO staking amount of at least 5000 CROs to become part of the earning program. Once selected, a validator list will emerge.

- Choose a validator. Validators mostly run their own nodes to support the Crypto.com ecosystem. Investors must be careful about choosing a validator.

- Begin CRO staking. After selecting a suitable validator, click on “Confirm Stake” to finalize staking.

Finding A Good CRO Validator

Getting a high APY through DeFi staking CRO falls upon the quality of validators. Here are a few tips to help investors find the right validators:

- 0% commissions. Crypto.com deducts validator charges automatically from validators before rewarding APY to delegators. Some validators also ask for an additional commission for the upkeep of the equipment and other reasons. However, choosing a validator that doesn't charge additional commission is suitable.

- Zero missed blocks. Investors must choose validators that have maximum uptime and haven't missed any blocks.

- Fewer delegators to prevent further division of APYs. Fewer participants in the staking pool will increase the rewards between stakers.

The Pros and Cons of Staking CRO

The following are the benefits and disadvantages of staking Cronos:

Staking CRO Pros:

- Can earn high yields of up to 6% APY at the time of writing

- Investors who want to stake CRO on Crypto.com on flexible terms get up to 2% APR. It is quite a high return for a flexible-term return

- Staking CRO gives investors discounts on trading fees and rebates when trading other crypto assets on the Crypto.com platform

- By staking CRO, investors can get access to low-interest loans via its crypto lending platform

- Investors who have staked CRO tokens can apply for a Crypto.com visa debit card that comes with its own set of cashback rewards

Staking CRO Cons:

- Cronos is a relatively new rebrand of the Crypto.com coin. The developers are still working on adding more use cases to this token. However, in its current state, the use cases are restricted outside the Crypto.com ecosystem

- CRO rewards were upwards of 10% to 12% at the beginning of 2022. However, APYs have since been reduced between 4% to 8%

- Must have at least 5000 CRO tokens to stake in the DeFi wallet. That creates a high ceiling for investors who have just started.

- A fifth of the total supply of Cronos is in use. It is a major source of discontent among those who aren't sure about the direction of the project.

- CRO can only be staked on Crypto.com. Even the world's best cryptocurrency exchange, Binance, hasn't listed CRO in

Risks With Staking CRO Tokens

CRO is a speculative crypto asset, and like staking other speculative assets, it has many risks. Here are some of the most common staking risks associated with CRO.

- The roadmap does not clearly define its use case. CRO is associated with the Crypto.com ecosystem. So far, only a fifth of the supply has been released to the public. Crypto skeptics state that this project's roadmap needs to be clarified. Furthermore, CRO has not been in the news recently, signaling that not much progress has been made for this cryptocurrency.

- The value of CRO has been declining. CRO entered 2022 at $0.56 and has been on a decline since then. While investors can blame the crypto bear market for this drop, it is important to note that Cronos' biggest drop of 75% happened in the middle of April 2022, before the bear market. At the time of writing, CRO is accumulating around $0.10 and has shown no signs of changing trajectory.

- Crypto.com is susceptible to hacking attacks. Crypto.com admitted to losing $35 million from a large crypto exchange hack in January 2022 because of a two-factor authentication exploit. While the crypto trading platform has introduced new measures to protect the assets, there is no guarantee that it might not happen again. Loss of funds due to hacking can harm those who stake on Crypto.com.

- Slashing Rewards. Crypto.com has a history of severely slashing rewards. As mentioned earlier, APY for staking Cronos was in double digits. However, the token rewards have since been significantly reduced.

- Losing access to funds. When investors stake their CRO, they lose access to it till the end of the locking period. While flexible locking is an option, withdrawing still takes time, and investors can miss the opportunity to react positively to a market change. Furthermore, if CRO's value drops while it is locked, the profits earned by the investor are negated.