We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Where To Stake Cosmos

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Staking Cosmos (ATOM) is one of the top coins for staking using an exchange or wallet to earn passive rewards of up to 21.9% per year. Here is our list of the best places to stake Tezos for the highest returns which include crypto exchanges and wallets.

Based on our reviews, these are the top places to stake Cosmos to earn ATOM rewards:

- Binance (overall the best place to stake ATOM)

- Kraken (best platform to stake ATOM outside the USA)

- ByBit (good fixed and flexible terms)

- Coinbase (best way to stake ATOM for beginners)

- OKX (highest ATOM staking rewards)

- Ledger wallet (best ATOM staking wallet for security)

- Atomic Wallet (best for validators)

- Guarda wallet (runner-up wallet for staking)

Best Platforms To Stake ATOM Compared

This comparison guide provides an overview of where to stake Cosmos (ATOM) to earn rewards and a passive income.

| PLATFORM | NUMBER OF COINS | STAKING FEE | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

|

|

None |

None |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

Up to $100 welcome bonus |

Visit Binance | Binance Review |

ByBit ByBit

|

None |

None |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

0% trading fees for 30 days (spot only) |

Visit ByBit | ByBit Review |

|

|

None |

None |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

None available at this time |

Visit Kraken | Kraken Review |

|

|

None |

None |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

$5 BTC bonus (USA only) |

Visit Coinbase | Coinbase Review |

Ledger Wallet Ledger Wallet

|

None |

None |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

None available at this time |

Visit Ledger Wal… | |

OKX OKX

|

None |

None |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.4 / 5 |

None available at this time |

Visit OKX | OKX Review |

Guarda Wallet Guarda Wallet

|

None |

None |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.4 / 5 |

None available at this time |

Visit Guarda Wal… | |

Atomic Wallet Atomic Wallet

|

None |

None |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.1 / 5 |

None available at this time |

Visit Atomic Wal… | Atomic Wallet Re… |

Where To Stake Cosmos For The Best ATOM Rewards

This section gives a detailed look into the platforms that offer stalking facilities to ATOM token holders. Therefore, to give our readers the best choices, we have utilized the staking facility to assess the interest rate, withdrawal times, and slashing risks. Our experts have also considered UI a big factor when judging this facility since that is one attribute beginner-level investors would be most concerned about.

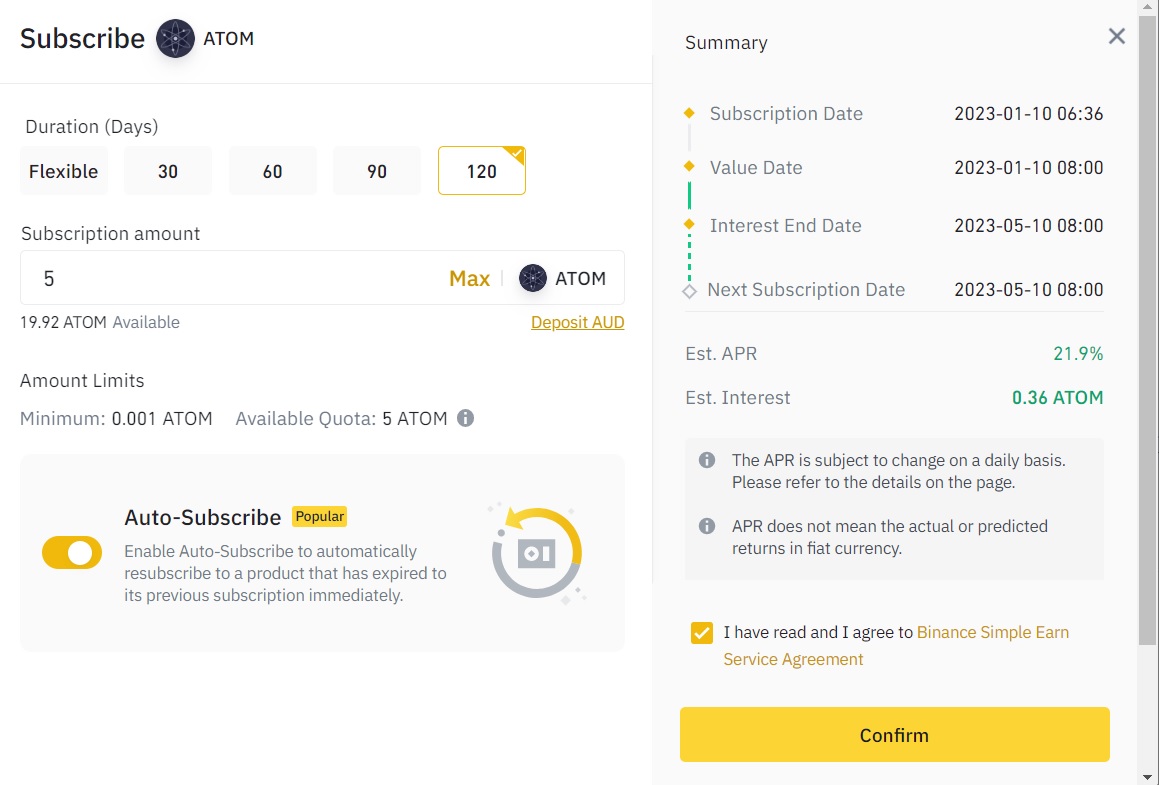

1. Binance

Binance is a cryptocurrency exchange that has gained renown for being the most liquid trading platform, with a 24-hour trading volume of over $38 billion. However, it is also preferred by stakers who want to hold their tokens and earn passive rewards. In addition to providing standard interest for holding crypto – a facility provided by most exchanges we have discussed – Binance also offers high-yield investment opportunities for those who stake ATOM.

Users who stake ATOM on Binance can earn APY from 3.5% to 21.9%, depending on the locking period and the staking terms. Speaking of terms, Binance offers two – flexible and fixed terms. Traders who want to make passive income on their ATOM holdings but want to fully access their tokens to react to the changing crypto market would find flexible staking a preferred option.

In addition, US-based investors can use Binance.US to stake ATOM to earn 14% APY.

However, advanced traders willing to delegate a portion of their crypto to the Simple Earn program and have no intention to use it for the staking period can opt for fixed-term staking. Binance investors must have at least 0.001 ATOM to qualify for staking rewards, which has been reduced from 1 ATOM last year. There are also zero staking fees and commissions. Listed below is the breakdown of how much APY users can earn by staking ATOM under the Simple Earn program on Binance.

- Flexible Staking: 3.5% APY

- Staking for 30 days: 10.11% APY

- Staking for 60 days: 12.99% APY

- Staking for 90 days: 15.99% APY

- Staking for 120 days: 21.9% APY

The issue, however, lies in the platform's UI – it is not exactly user-friendly. That said, those willing to learn will find that Binance provides many articles and blogs in its knowledge banks.

Overall, Binance is the best place to stake ATOM in our view. The simple earn program is a good starting point for those who want to earn cryptocurrencies while holding them, and with dual investment, the opportunity to earn massive income through higher double-digit APR is high. Users can also benefit from the staking rewards in addition to potential trade profits on the spot or margin exchange. There is no fixed plan and users can switch the staking funds to trade Cosmos on Binance. The only issue we found is that the DeFi-staking for ATOM is currently unavailable on Binance.

Read our full Binance review.

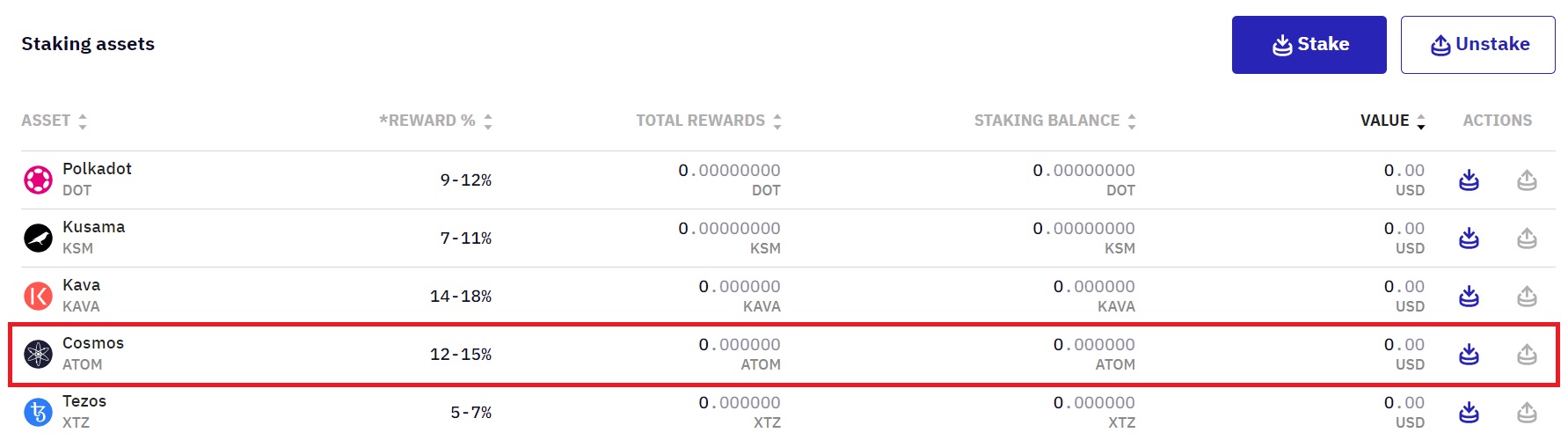

2. Kraken

Kraken is a cryptocurrency exchange and a hub of trading, selling, lending, and staking cryptocurrencies, including ATOM. Staking Cosmos (ATOM) will allow US-based traders to earn between 12 to 15% APY. The reward would depend upon the locking period, the number of assets staked, and the current market conditions.

All these factors combine to make Kraken a great place to stake ATOM. Since the platform offers on-chain staking, traders deal directly with the Cosmos network. Furthermore, unlike Coinbase, where users must wait for unstaking to occur, Kraken provides the benefit of instant unstake, allowing users to withdraw their assets at any time without any penalties. Also, the APY rewards are paid on a bi-weekly basis.

Overall, Kraken is a great platform for staking ATOM. It is available in the US; the user interface is intuitive – beginner-friendly and the staking rewards for ATOM tokens are competitive. Being a platform that offers on-chain staking also helps since it allows people to understand a bit more about the cryptocurrency market.

However, it is important to know that, like all the other platforms we have described in this list, staking rewards can increase and reduce based on the validators and the market conditions. There is also a 15% standard commission on all staking assets, which is cheaper than Coinbase, but still a negative. The other disadvantage is that USA residents are not allowed to stake ATOM due to recent SEC litigation, however, is still available for international users in supported countries.

Read our full Kraken review.

3. ByBit

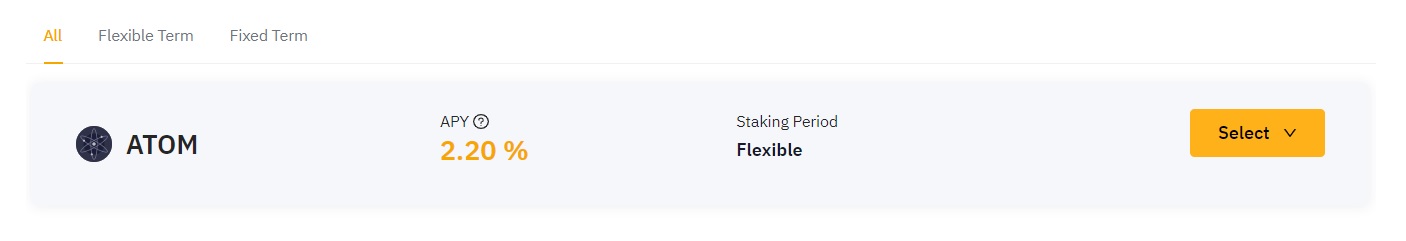

ByBit is our second pick and one of the few exchanges that have started to gain ground after the bear market because it has learned – and to this day, continues to provide more utilities to its user base. One of the biggest benefits it has introduced is staking – such as ATOM which can yield up to 2.20% APY. While staking ATOM on ByBit doesn't have the same high-level staking rewards as Binance, there are more ways to earn reward that makes it stand apart from its main competitor in this space.

The standard ByBit Savings option can be used to stake Cosmos by holding tokens in a ByBit wallet. Like Binance, Bybit also offers flexible and fixed-term staking. However, staking ATOM is only possible on flexible terms which is the part reason for the lower rewards. The yields are calculated daily and start a day after a trader adds ATOM tokens to their ByBit wallet.

Overall, Bybit is a suitable place to stake ATOM for active traders who prefer flexible terms. Although the lower APY is not as attractive as the Binance Earn program, the platform has a great UI, easy to understand, and is functional. Additionally, ByBit is still evolving, which means that a fixed-term staking utility may come for ATOM soon.

Read our full ByBit review.

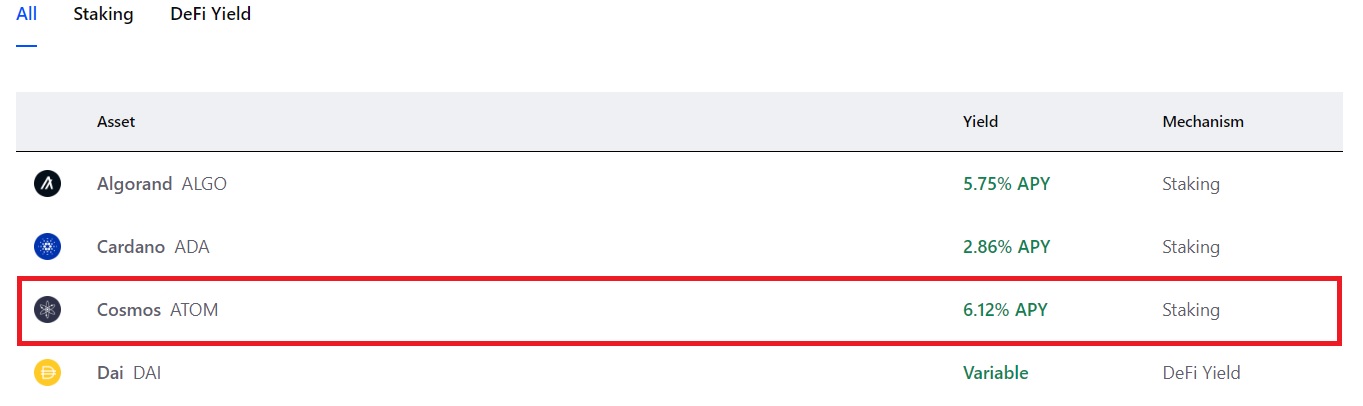

4. Coinbase

Coinbase is the second largest cryptocurrency exchange, right after Binance. It serves over 89 million crypto traders and is a preferred destination for crypto beginners that want to earn crypto by soft staking their ATOM tokens. By staking ATOM on Coinbase, users can start earning up to 5% APY which is paid directly to a Coinbase wallet after approximately 7-14 days. After the first payment, the ATOM staking rewards will be deposited approximately every 3 days. Furthermore, staking on Coinbase is inclusive, as users don't need more than $1 to start earning rewards on their cryptocurrency.

However, it is important to know that Coinbase is not infallible; it does change the rewards with time – sometimes for the worse and sometimes for the better. Special attention must be paid when staking ATOM because the rewards vary depending on the validator's performance to secure and support the Cosmos network. In other words, users are staking Cosmos through Coinbase as a “quasi” delegator – interacting with the Cosmos chain through their wallets and delegating tokens to the Coinbase-selected delegators. It also means that the simple process of staking ATOM through Coinbase comes at a cost. There is no option to choose a validator.

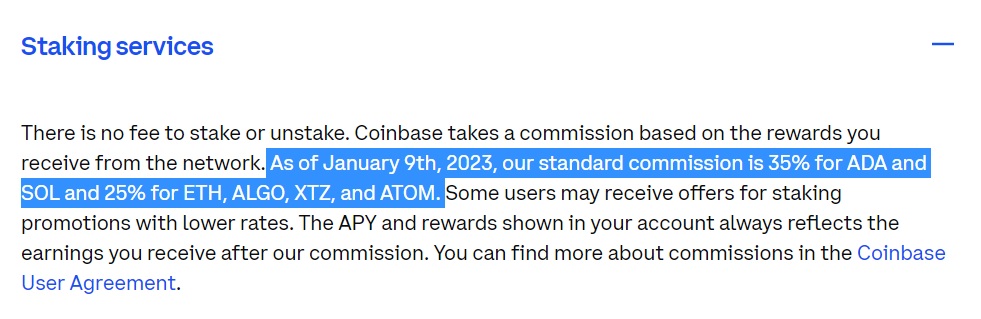

The other major disadvantage of ATOM staking on Coinbase is the commission. As of January 9th, 2023, the standard commission is 25% for ATOM according to the Coinbase website. Another point to note is that staking ATOM on Coinbase means no locking period. While it would ideally mean that users can't withdraw their earnings at any time – it is not the case. To get the full extent of their rewards, users must wait for Coinbase to unstake their tokens from the Cosmos network. Only then can the traders withdraw their earnings from their Coinbase account.

This is a massive negative for those who choose a flexible term to interact with market changes quickly to make the most out of short-term trades. Regardless of how the Coinbase wallet is tuned to the Cosmos blockchain and takes time to withdraw – everything about this platform is great. The mobile-friendly interface is easy to interact with, the trading module is easy to understand, and the soft staking program also allows users to stake other assets, like Tezos.

Read our full Coinbase review.

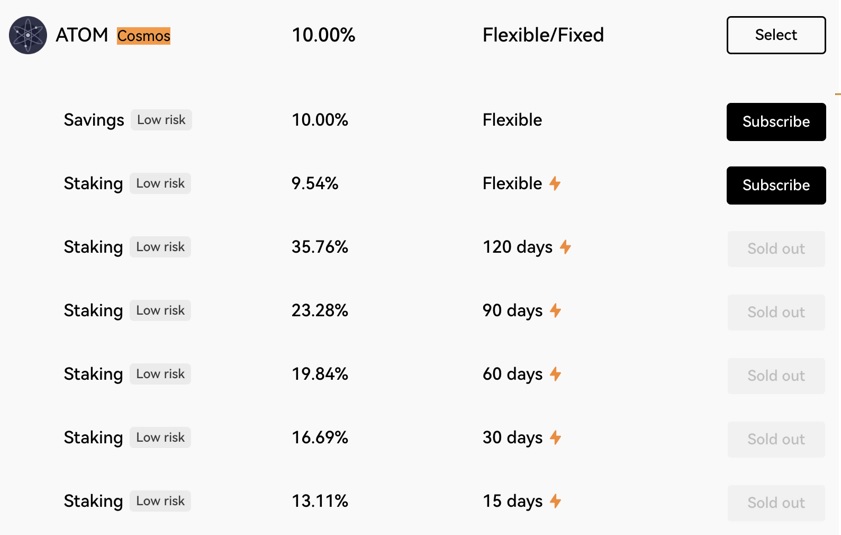

5. OKX

Investors looking for multiple beginner-friendly ways to stake ATOM will find that there is a lot to love about OKX. This exchange is the seventh largest in the world by market capitalization and hosts staking facilities for multiple cryptocurrencies with multiple options.

Staking ATOM on OKX will enable users to earn anywhere from 9.54% to 16.69% APY at the moment. However, it all depends on which validator is active right now. At the time of writing, only two forms of staking exist, and both are low-risk flexible staking – one is on-chain, and the other is off-chain.

Firstly, OKX's off-chain staking is essentially a savings account. The advantage of OKX compared to other platforms is there are six methods to stake ATOM tokens with fixed and flexible terms available as follows:

- 15 days: 13.11% APY

- 30 days: 16.69% APY

- 60 days: 19.84% APY

- 90 days: 23.28% APY

- 120 days: 35.76% APY

- Flexible staking: 9.54% APY

Investors must note that many of these options have been sold out due to popularity. Depending on the time frame and market conditions, most of them will return. However, that would also mean that the yields provided will be different.

Overall, OKX is a great cryptocurrency exchange with good staking utilities. While certain ATOM staking options have been sold out, we can expect them to return in the future. Also, in many ways, OKX does provide a higher APY than Binance. However, since OKX has recently gotten more traction in the market, we considered it better to place it at rank 5th for now.

Read our full OKX review.

6. Ledger Wallet

Cold wallets are cryptocurrency wallets that allow users to store their cryptocurrencies in a Pendrive-like apparatus and away from the reach of hackers. While Ledger wallet offers this facility, it also goes beyond the title of the best hardware wallets in the industry and offers investors a way to stake ATOM directly on the Cosmos hub.

Unlike standard exchanges, where the on-chain staking doesn't allow investors to select validators, the ledger wallet has a validator selection utility. Traders can use the Ledger companion app and stake ATOM by delegating to a validator of choice. Staking ATOM through Ledger gets investors an APY of 20% minus the validator fees. Furthermore, the ledger wallet doesn't impose any locking period on ATOM holdings. Users can stake their tokens and withdraw them anytime. However, once a trader has stopped delegating their tokens, they must wait for 21 days to get their assets.

Furthermore, staking ATOM through a ledger is easy. Users only need to connect their hardware wallet to Ledger live, set up their device by setting their accounts, populate the wallet with ATOM and use a conveniently placed Earn Rewards button to start staking. As mentioned, Ledger also has a list of validators from which an investor can choose. According to Ledger, all of them have been thoroughly vetted and offer high yields to all types of traders.

Overall, the Ledger wallet is a great option to stake ATOM for the more security-conscious investors. The cold storage provides an additional layer of security to the assets, and the fact that investors can choose between the validators handpicked by Ledger is a great benefit. The only issue is the 21-day waiting period to get the assets. However, considering it offers 20% APY, the waiting period is not a big issue.

7. Guarda Wallet

Guarda wallet is not just a standard cryptocurrency wallet; it is also a trading platform with close to 50 crypto assets listed. Users can not only buy and store the assets, but they also can stake them on this non-custodial wallet. Interested parties can download it on their mobile phones, but a desktop app is also an option for the more hands-on traders.

The platform supports 50 blockchains and over 400k cryptocurrencies. However, the platform only supports ten cryptocurrencies at a time. That said, it does offer ~10% APY for staking Cosmos which is lower than the Ledger wallet above. Like all wallets in this list, Guarda also acts as a medium through which users can delegate tokens to a validator of the Cosmos network. The process of staking is also simple. However, unlike Ledger, investors can't choose from a list of validators.

Overall, Guarda wallet is a great option to stake ATOM for those who prefer to use a decentralized cryptocurrency wallet rather than a centralized exchange. However, for those looking for the option to choose between flexible and fixed staking methods, Guarda wallet is not a suitable option.

8. Atomic Wallet

Our final pick for where to stake ATOM for the best rewards is Atomic wallet. This software free-to-use wallet offers 10% APY for staking Cosmos. Like the Ledger Wallet, Atomic Wallet also allows users to choose their validators. However, in order to get staking rewards, investors must wait for three weeks which is a major disadvantage. Another caveat when it comes to the staking rewards is that investors must put at least 1 ATOM in their atomic wallets.

Atomic wallet is decentralized and has no centralized authority. Since the wallet is non-custodial, the onus of security falls on investors. For that reason, we recommend only advanced users try this platform when wanting to stake their ATOM tokens.

Overall, Atomic wallet is also a good option for those wanting to stake ATOM. However, since the wallet is decentralized and does not have a companion hardware wallet, it is better for investors to look for alternatives – because decentralized wallets haven't had the best history when it comes to security.

Read our full Atomic wallet review.

What Is Cosmos (ATOM) Staking?

Staking Cosmos is the way to delegate ATOM and involves storing coins in a cryptocurrency wallet or exchange to support the operation of the blockchain network – the native crypto of Cosmos blockchain and secure the Cosmos hub (a name given to the Cosmos network). Staking on Cosmos has two benefits.

- It allows users to earn APY for their contribution to the operation of the network.

- Users can take part in Cosmos Hub and the governance of the network. This is meant for validators who are directly contributing to the blockchain.

How Does ATOM Staking Work?

Validators and delegators stake their tokens on the Cosmos blockchain and earn regular APY. At the time of writing, this APY stands at 9.7%. Cosmos generate the rewards as soon as the staking transaction is complete. That allows users to claim their accumulated rewards quickly using their cryptocurrency wallets.

There are two ways through which staking rewards are generated on Cosmos.

- Transaction fees. Fees of all the transactions conducted on Cosmos are distributed among the validators.

- Creation of new ATOM tokens. To reward the stakers, the ATOM supply is inflated. It means that ATOM holders can't get any rewards. In other words, staking the rewards on the Cosmos chain is necessary.

Despite these benefits, Cosmos is aware of the risks. In fact, the official website recommends that delegators delegate their tokens to multiple validators in order to make guaranteed gains. Experts hint that cryptocurrency exchanges that offer ATOM staking stake the holder's ATOM tokens to a particular group of diverse validators to provide investors with regular rewards.

Another factor to keep in mind is that there is a commission element involved for delegators. Validators take a 10.28% commission from the generated rewards before passing them to delegators.

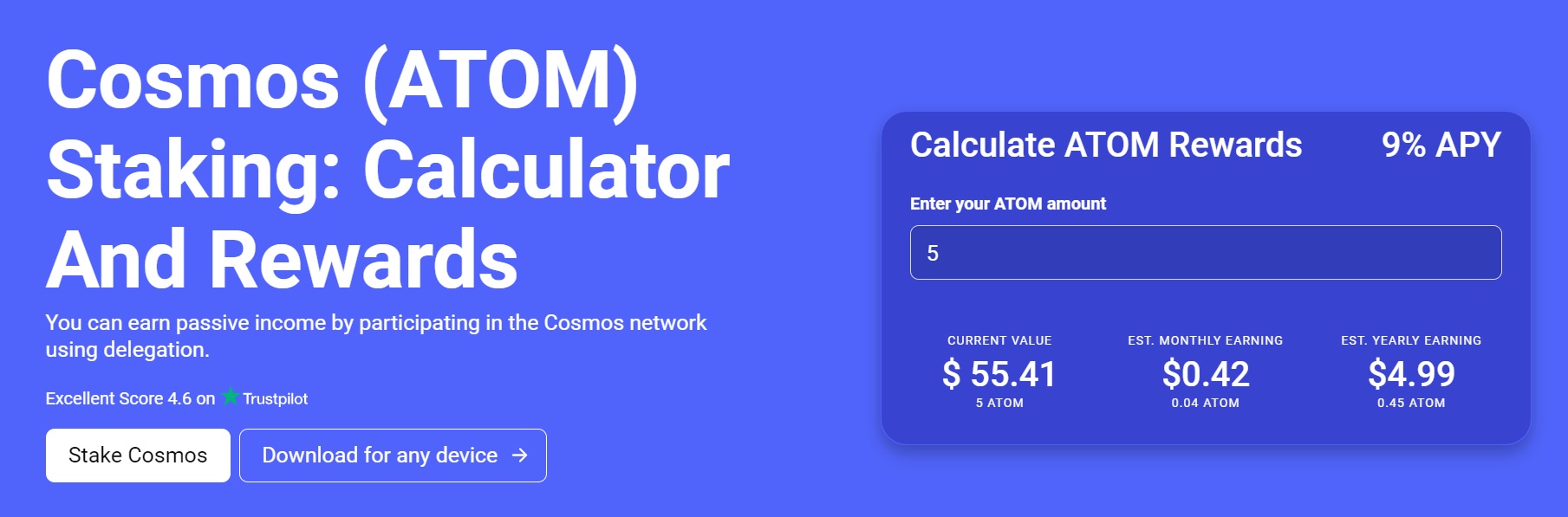

How Much Can You Earn Staking ATOM?

Staking rewards on Cosmos vary depending on the activity on the Cosmos blockchain. At the time of writing, delegators can get 20.95% APY by staking on the Cosmos platform. For running a validator node, the reward is 22.38%. There is a 21-day lockup period when staking directly on the Cosmos network. However, the adjusted reward is 6.88% APY for the delegator and 8.31% APY for the delegator when token inflation is taken into consideration.

What Are The Advantages of Staking ATOM?

Listed below are the advantages of staking ATOM.

- The value of ATOM is increasing. Cosmos is one of the few cryptocurrencies that have started to get back on track after retracing due to the FTX-triggered crash. The current trends on Coinmarketcap suggest that most are bullish about this asset. It is a sign that interest rewards might increase in the coming days.

- Direct Staking Allows governance participation. Professional stakers or validators who stake on Cosmos get a chance to participate in the governance and vote on the future development of the platform.

- Staking rewards have increased. The staking rewards for ATOM have increased, which means that people are focusing on the Cosmos ecosystem. In the long term, this interest can lead to higher APYs.

What Are The Risks of Staking ATOM?

Staking ATOM carries the same risks as staking any other cryptocurrency. They are as follows:

- Market risks are always present. Cryptocurrency is a volatile asset whose volatility has increased in response to the bear market. Investors are unsure whether to support a crypto asset or exit, which is creating erratic market conditions. That can have a negative impact on APY.

- Slashing is common. Staking through cryptocurrency exchanges leaves the rewards vulnerable through slashing. While in ATOM's case, Binance has increased the rewards, there is always a chance for the rewards to decrease in the near future. On the other hand, exchanges like Coinbase state on their website that they will do their best to avoid slashing, but cannot remove this risk.

- 21-Day Lockup. Staking through wallets, lock up ATOM for 21 days. Considering the current market conditions, not having access to the tokens for 21 days can be a detriment. For instance, the ATOM price oscillated between $8.5 to $10 within a span of a month – a ripe market for short-term traders. However, if the lockup is in place, traders won't be able to react to the market conditions quickly.

How To Stake Cosmos (ATOM) – Complete Tutorial

Below is the complete guide to staking ATOM through Binance, our number one pick to generate passive staking rewards from ATOM tokens.

1. Create an account on Binance

The first step is to create an account on Binance. The process is fairly simple and doesn't take more than a couple of minutes. However, the verification process can take up to a week. Read our Binance review to learn more about this platform.

2. Buy or Transfer ATOM to the Binance wallet

Either buy ATOM on Binance or transfer their tokens from their personal wallet to Binance. Advanced traders who want to dedicate a portion of their ATOM holdings for staking must choose the transfer route since all the ATOM holdings in their Binance account will be staked once inducted into the Simple Earn program.

3. Select between Fixed or Flexible Term

One of the most interesting aspects of Binance is that it automatically inducts users into the earning program. It means that as long as they are holding their assets in their Binance wallets, the assets are going to be staked under flexible terms. That said, investors do have the option to opt for Fixed-term. All they must do is go to their portfolio, select the token, choose the simple earn program and select the fixed or flexible term from the drop-down menu

4. Begin earning ATOM staking rewards

Once the staking method has been selected and the number of tokens to delegate, click on ‘Confirm'. Binance will begin staking the assets.

Frequently Asked Questions

Where should I stake ATOM?

While there are multiple ways to stake ATOM, our top pick is using Binance. It offers a safe way to stake ATOM and offers regular rewards. But those who want to participate directly and want to select their validators can choose the Ledger Wallet as an alternative.

Is ATOM good for staking?

Yes, staking ATOM is a great option for investors who want to earn passively from their ATOM holdings while staying away from the volatility of the cryptocurrency market.