We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Where & How To Stake CAKE

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

CAKE is one of the most staked cryptocurrencies and is unique as a DEX crypto asset. Investors interested in staking their CAKE tokens have three ways to do so. One is on the centralized exchange, where locking their CAKE tokens will yield them Annual Percentage Returns or APR, and the other is through providing liquidity to the Pancakeswap Liquidity Pools. The third way of staking is locking their tokens in specialized crypto wallets—hot wallets—and earning regular returns.

Here is the complete list of platforms that support CAKE staking:

- Binance (Overall the best platform to stake CAKE)

- Pancakeswap (The Official DEX that supports CAKE staking)

- Trust Wallet (Best Crypto wallet to stake CAKE)

Where to Stake CAKE – Best Platforms Reviewed

Unfortunately, investors looking to stake their CAKE holdings do not have many options. However, the places available to stake CAKE have been assessed by our experts and the general crypto community and found to be secure, easy to use, and provide high returns. With that in mind, here is the list of cryptocurrency exchanges that allow users to stake CAKE.

1. Binance

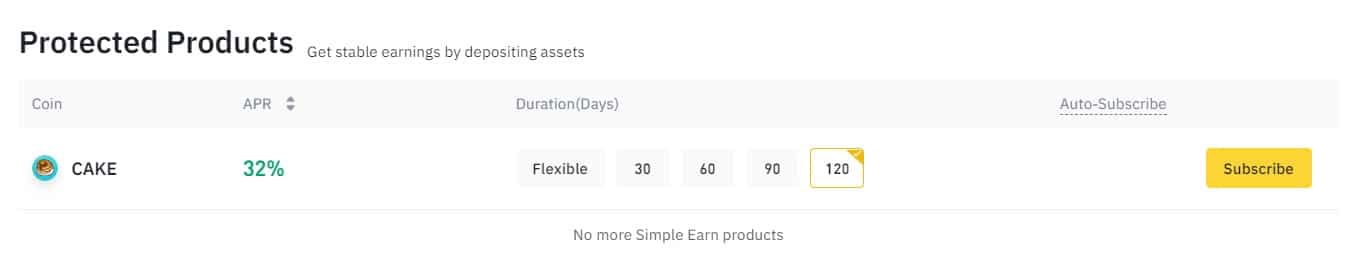

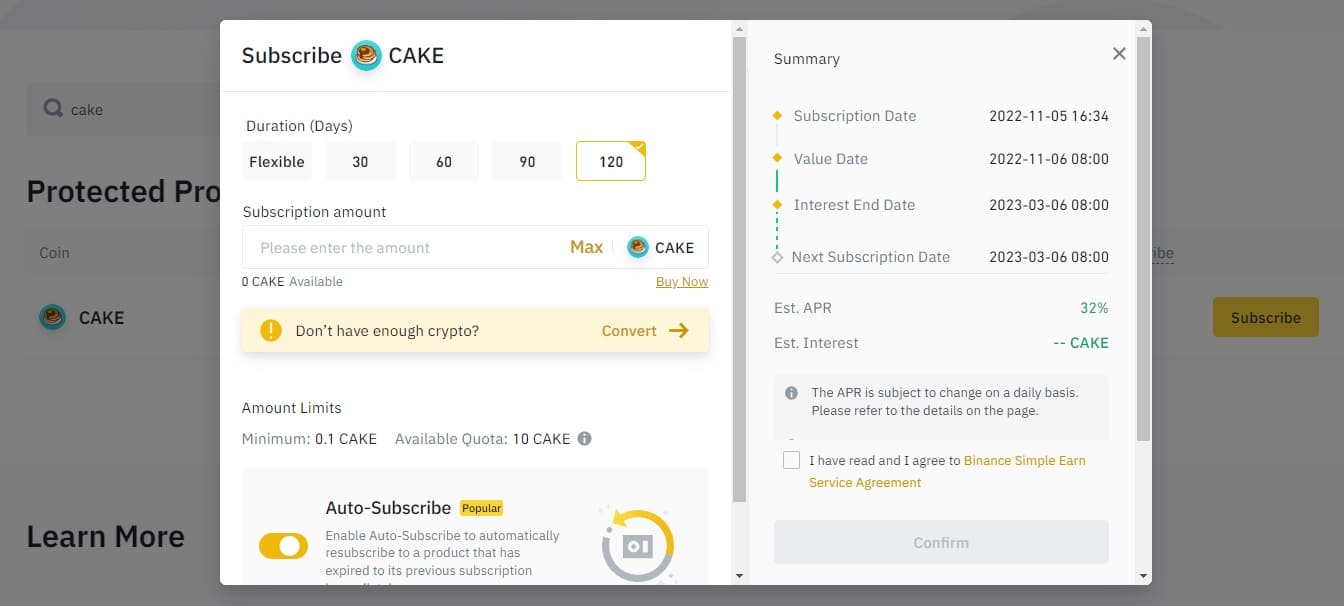

Binance is one of the few centralized exchanges that supports CAKE staking. Investors who want to take a simple approach to stake CAKE will find Binance the best staking platform. In addition to being the world's biggest cryptocurrency exchange, Binance also offers high staking returns for CAKE at as high as 49% APR (Annual Percentage Return) at the time of writing. Binance once had different savings and staking approaches that involved Flexible Savings, Locked Savings, and Locked Staking. However, in September 2022, Binance replaced it with the Simple Earn Program. CAKE stakers can engage in locked and flexible staking under this simple earn program, making it simpler to lock crypto assets.

Investors can stake their CAKE holdings in flexible or locked accounts. Flexible staking will net them as high as 8.00% APR, which has no maximum limit requirement. The APR will remain the same whether an investor stakes 1 CAKE token or 5 CAKE tokens. The same goes for locked staking. Binance's Simple Earn program has three locked durations: 120 days, 90 days, and 30 days. Staking CAKE for 30% will give investors an APR of 6.80%. Staking for 90 days and 120 days will net the holder 21% and 49% APR, respectively.

CAKE is one of the passive cryptocurrencies active on the platform. Binance has only offered CAKE rewards under the Simple Earn program. Unlike BNB staking, CAKE staking is impossible for dual investment or any other high-risk staking protocol, making Binance a suitable platform for those who want to make passive gains on their CAKE holdings.

Another reason investors might consider Binance to stake their CAKE tokens is that Binance charges no fees for holding the crypto asset. However, CAKE's lack of riskier and higher staking rewards can be seen as a minus for institutional investors.

The user interface is another attribute that users must be aware of – it is not beginner-friendly. Binance has provided tutorials on how to make staking CAKE suitable for all users. However, novice investors might have a hard time understanding the different mechanisms. On the plus side, the Simple Earn program has a simple approach. But once again, there is a flip side to this. The locked staking limit per user is up to 10 CAKE. At the time of writing, the CAKE price is only $4.3, which reduces the staking rewards to a large extent.

It is also worth noting that Binance has drastically reduced the standard annualized interest rate for CAKE. Back in March 2022, it was around 70.56%, but Binance has now reduced it to 21%. While we can attribute this decrease to the effects of the bear market, it is still worth noting. Whether or not Binance will increase the staking rewards remains to be seen.

Read more about the pros and cons in our full Binance review.

2. Pancakeswap

Pancakeswap is one of the world’s biggest decentralized cryptocurrency exchanges, known for providing a simple-to-use platform for veteran crypto investors. CAKE is the native crypto asset of Pancakeswap and is the platform's governance token and liquidity token. Investors can stake their CAKE tokens to provide liquidity to the listed liquidity pools and earn staking rewards on the platform.

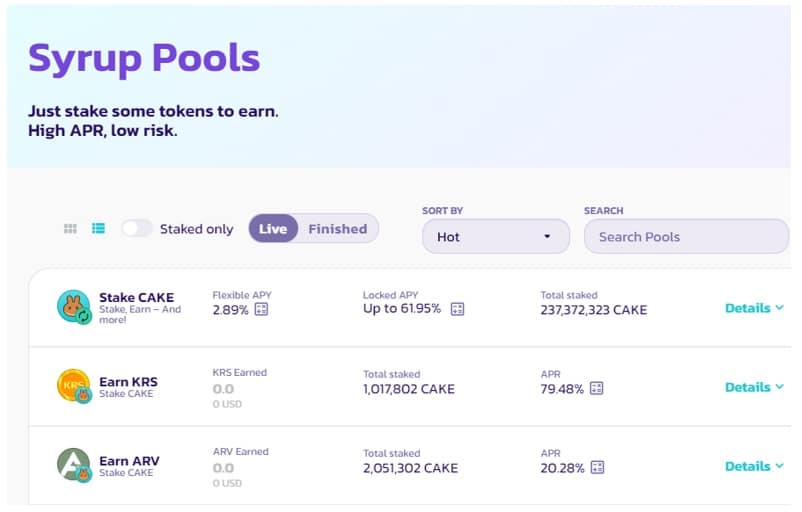

Staking CAKE on Pancakeswap provides the highest APY (Annual Percentage Yield) out of all the platforms listed in this guide. Staking CAKE under locked protocol will give the user up to 61.95% APY. Flexible staking rewards are low, and users can earn only up to 2.89% APY. At the time of writing, 237 million CAKE tokens have been staked on the “Stake CAKE” liquidity pool. There are many liquidity pools, each belonging to a different cryptocurrency. The liquidity pools that are active at the time of writing are:

- Earn KRS: Up to 80.68% APR

- Earn ARV: Up to 20.38% APR

- Earn CO: Up to 20.20% APR

- Earn HOOP: Up to 20.00% APR

- Earn MONI: Up to 20.83% APY

- Earn GQ: Up to 20.97% APR

- Earn WOM: Up to 19.81% APR

- Earn ANKR: Up to 19.24% APR

- Earn HAY: Up to 21.10% APR

- Earn SFUND: Up to 21.10%

It is important to note that liquidity pools have random APR. The staking reward varies depending on the amount of liquidity added to the pool. However, better liquidity translates to a higher APR.

Another way to stake CAKE on Pancakeswap is through “Farms”. Here, users can stake their LP tokens (liquidity pool tokens) – tokens given to users to loan their crypto to the liquidity pools – and earn CAKE-BNB, CAKE-BUSD, and CAKE-USDT pairs. Like the liquidity pool, APRs also vary here.

- CAKE-BNB: Up to 45.40% APR

- CAKE-BUSD: Up to 41.005 APR

- CAKE-USDT: Up to 42.86% APR.

Those who connect their wallets to the farms get a Yield Booster upgrade that doubles the APR. But it is subjective to the staking conditions on both fixed-term CAKE Syrup pools and Farms.

Pancakeswap is a decentralized exchange that allows only crypto-to-crypto exchange and not fiat trading. That is why It is more suitable for experienced crypto traders. Additionally, users must be aware of the impermanent loss when staking into the liquidity pools. Impermanent losses cause the price of crypto assets—including CAKE – to change once they are added to the pools. They can only be mitigated if the user selects a high-yield liquidity pool, which Pancakeswap doesn't lack.

Another aspect that crypto traders need to worry about is scams. While Pancakeswap is a secure platform, it is also a DEX, which means anyone can list their crypto assets. Many of these assets were found to be rug pools, costing investors millions.

On a positive note, Pancakeswap has not put any maximum or minimum staking requirements for staking CAKE. However, investors must note that more staked CAKE will lead to higher rewards. However, staking isn’t free on Pancakeswap. It charges a 2% fee on all the rewards generated on flexible staking pools. However, that fee changes based on the performance of the staking pool. On the other hand, Pancakeswap doesn't charge any performance fee for fixed-term staking. Users can also opt to extend their staking period while in fixed terms to gain access to higher rewards.

3. Trust Wallet

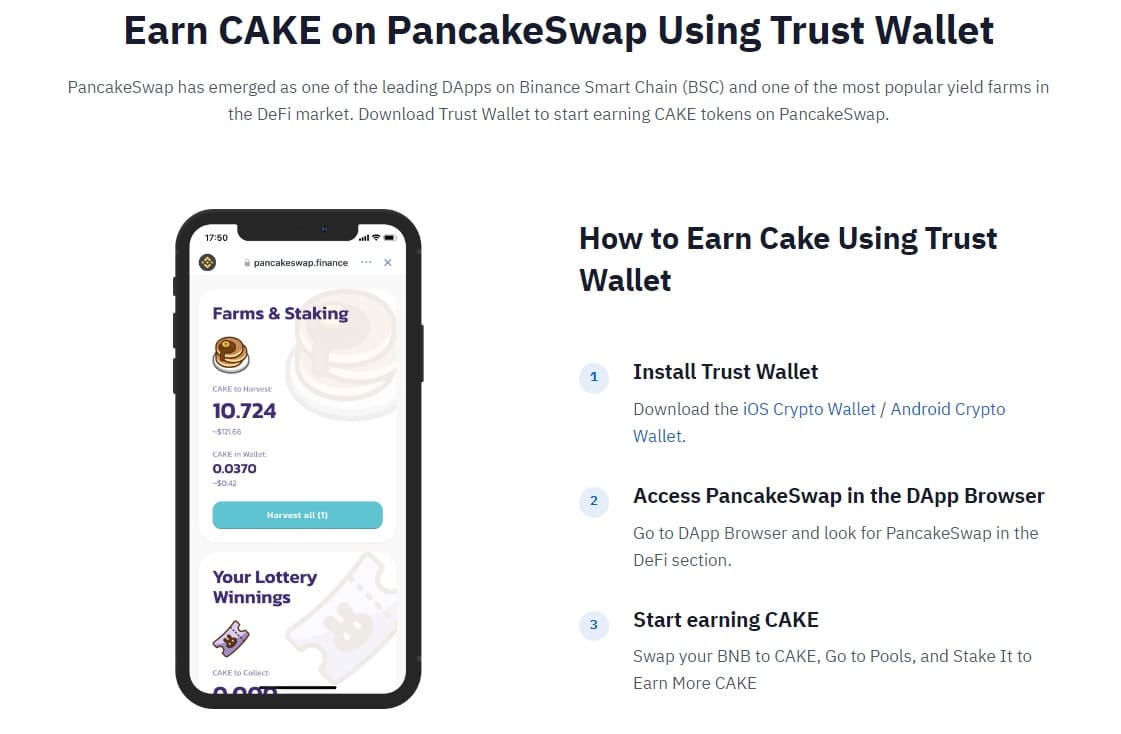

Investors interested in a software wallet to stake their CAKE tokens and earn high rewards can choose TrustWallet. It is a non-custodial wallet that supports over 1 million crypto assets from multiple blockchains. Investors can also use this wallet to buy a wide range of crypto assets, transfer tokens and buy or sell NFTs. Experts have noted TrustWallet as one of the most versatile crypto-holding wallets in the market – making it the perfect tool to stake CAKE.

However, the approach to staking cake through TrustWallet is different. For instance, all it does is connect the user to the Pancakeswap staking pools on which they can stake their CAKE holding and earn lucrative returns. This involves downloading the TrustWallet from the iOS or Android store, swapping their BNB for CAKE, going to Pancakeswap through the dApp browser, finding a liquidity pool and starting staking. Users can also convert their CAKE tokens into other BEP20 crypto assets on the platform.

That said, there are two factors that the critics of this wallet are not a fan of – security and accessibility. Being an open-source wallet, TrustWallet doesn’t have any security measures to secure the assets. There is no multi-factor authentication to secure the wallets, and many hacking attempts have occurred. On the flip side, TrustWallet is also decentralized, which is suitable for users who don't trust centralized exchanges. Anyone can create an ID on the platform; the details remain anonymous. Furthermore, the amount of information provided to TrustWallet is left up to the user. While giving the details is necessary when buying cryptos from partner exchanges, TrustWallet doesn't require them when buying cryptos from PancakeSwap.

Read our full review on Trust Wallet.

Best Methods to Stake CAKE – Comparison List

The table below lists the best staking platforms for CAKE and compares them based on their returns, fees, security, and other attributes. CAKE rewards are accurate only at the time of writing.

| Platform | Staking Fee | Estimated ROI |

|---|---|---|

| Binance | None | 6.80 to 49% |

| Pancakeswap | 2% for flexible-term staking None for fixed-term staking | APR differs based on the performance of the staking pools and Farms |

| Trust wallet | None | Directly connects the users to farms. APR varies depending on the chosen staking pool |

How To Stake CAKE on Pancakeswap

Active crypto traders looking to participate in the Pancakeswap ecosystem follow the steps below to stake their CAKE holdings through Pancakeswap.

- Get a crypto wallet. The first step for investors is to get a soft crypto wallet that supports the Binance Smart Chain. Many soft wallets provide this facility—our recommendation goes to TrustWallet and MetaMask. Both are extremely versatile and support multiple chains.

- Connect the crypto wallet to PancakeSwap. The second step is to connect the crypto wallet to Pancakeswap. To do so, the users must first enable the Binance Smart chain in their wallets. Pancakeswap is a platform built on BSC. Therefore, it is a critical and fundamental step that investors must take before the next step.

- Have at least 0.1 BNB in the wallet. The crypto wallet must have at least 0.1BNB for it to stake the token.

- Swap BNB for Cake. Investors can then swap their BNB tokens for CAKE on Pancakeswap. Or, they can go to other crypto exchanges, buy CAKE and transfer it into the crypto wallet.

- Access the PancakeSwap Network. Users must then access the Pancakeswap network and find a liquidity pool that suits their requirements. Once they have selected the pool, it must be enabled.

- Stake CAKE tokens. After selecting a liquidity pool, users must enter the amount of CAKE they want to stake and press the “Confirm” button. When choosing liquidity pools, users must select between fixed-term and flexible-term staking.

How To Stake CAKE on a Crypto Exchange

The only cryptocurrency exchange that offers CAKE staking at the time of writing is Binance. Users can enter the “Simple Earn” program on Binance and lock their crypto assets to earn regular rewards. Here are the steps to follow:

- Create an account on Binance. The account creation process on Binance is simple. The process involves clicking on the sign-up button, providing user details, and creating an account. However, users must also fulfill the KYC requirements to trade on the platform and get staking benefits of the “Simple Earn” program.

- Buy CAKE or transfer it to the Binance wallet. Users can buy CAKE on Binance or transfer their tokens to the Binance Wallet.

- Choose between flexible or locked staking. Investors must then select between flexible or locked staking to stake their cryptos in the Binance Earn program.

- Start staking CAKE. Once the asset is part of the Simple Earn program, it will generate APRs for the user.

Note: Staking CAKE on Binance is another term for earning interest through a savings account. That is why it doesn’t take a lot of effort and is a good way for passive investors to earn interest on CAKE.

How To Stake CAKE Using a Wallet

Users can also stake their crypto assets through Trust Wallet. TrustWallet will give users access to Yield Farms to earn high APYs. The process of Yield Farming on PancakeSwap through TrustWallet is below, which, according to the software wallet, is the easiest way to earn CAKE.

- Download and install TrustWallet

- Add BNB to the wallet

- Swap a portion of BNB for CAKE

- Find a staking pool with good liquidity

- Deposit BNB and CAKE to access LP tokens

- Deposit the LP tokens into the yield farm

Note: TrustWallet is merely a pathway to stake on PancakeSwap. It doesn't provide any additional benefit besides a simple-to-use dApp that makes searching for liquidity pools easier.

How Does CAKE Staking Work?

CAKE staking on Pancakeswap works in the following manner:

- The holders decide to earn additional CAKE tokens through staking.

- When these holders stake their tokens, they provide liquidity to the PancakeSwap network.

- In return for their support for the network, they get staking rewards in the form of CAKE or other cryptos listed on the platform.

When staking CAKE tokens, users must consider the following:

- Impermanent loss: The negative change in the token's value when it is added to the liquidity pool.

- Gas fees: Network congestion can lead to gas fees and loss of earnings.

- Emission Rate: Creation of new CAKE tokens.

- Minimum withdrawal amount: The withdrawal amount dictates crypto withdrawal fees.

The Estimated Rewards You Can Earn

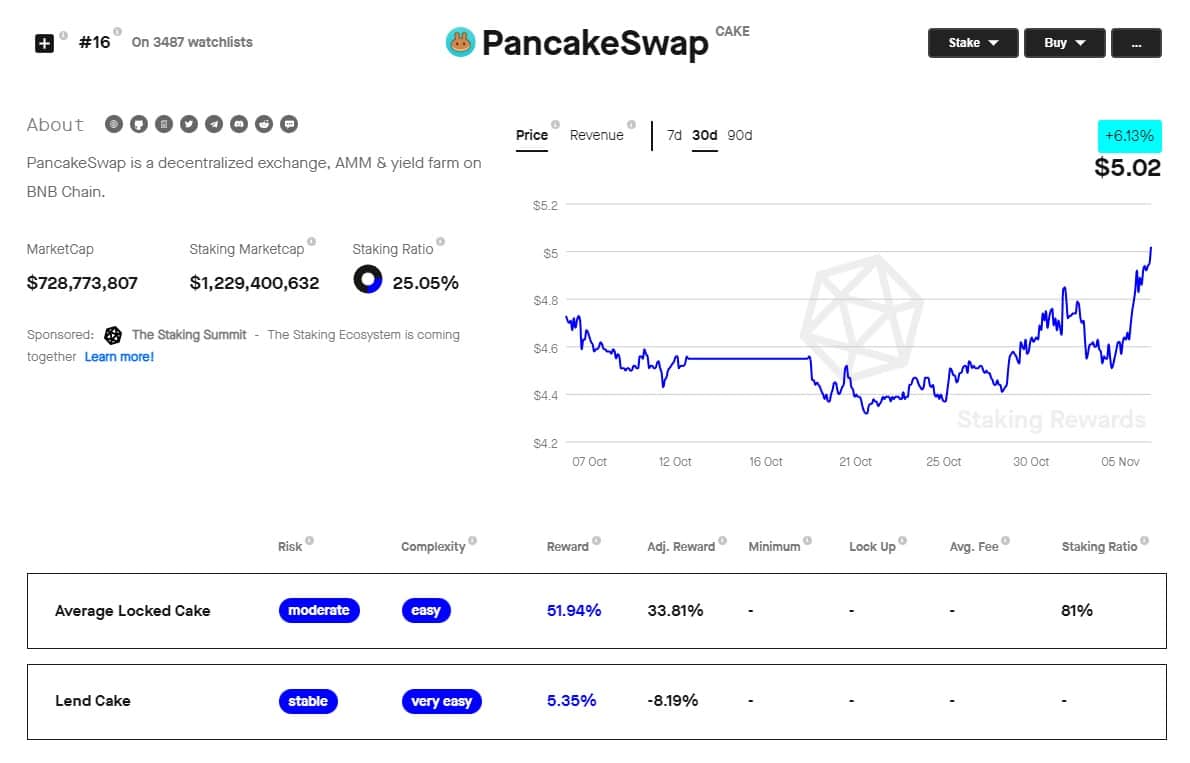

Staking CAKE can earn over 50% APY, but it would change depending on the liquidity pools. According to stakingrewards.com, the average locked staking reward is around 52.76% at the time of writing. But those who choose to lend CAKE on Pancakeswap will earn a lower 13.98% APY.

The Benefits of CAKE Staking

More than $1 billion worth of CAKE is locked on Pancakeswap for staking alone, making it one of the best staking cryptos on the market. At the time of writing, CAKE ranks #62 regarding market capitalization. While the CAKE price has plunged by a large margin since the beginning of 2022, many continue to remain bullish about this niche crypto asset. Here are the benefits of staking CAKE.

- Multiple Pools are available on Pancakeswap. Active crypto traders who want to interact with the DeFi ecosystem have a wide array of staking pools. The APY rewards are extremely high depending upon the type of staking pools users choose.

- A Higher Interest Rate on Binance. Binance is the only cryptocurrency exchange that offers staking benefits for CAKE. The APR it provides goes up to 49% based on the locking period. It is great for passive CAKE holders who don't want to engage directly with the DeFi ecosystem.

- iCAKE rewards. In July 2022, Pancakeswap introduced iCAKE rewards, a numerical metric to reward long-term CAKE holders. In addition to higher staking APRs, these holders will also have IFO benefits. IFO refers to Income from Operations. That is, those locking their CAKE in the liquidity pools for more time will gain a portion of the fees from the operations.

The Downsides

Following are the downsides of staking CAKE.

- Lack of CEX support. In our research, we found that Binance is the only centralized cryptocurrency exchange that supports staking for CAKE. As a niche cryptocurrency, CAKE hasn't generated much interest on crypto-staking platforms such as Kucoin or NEXO.

- Not-Beginner Friendly. Staking CAKE on Pancakeswap is not for novice crypto traders. Investors who possess prior knowledge of impermanent loss, alternating liquidity pools, and other critical matters are the only ones who would find cake staking suitable. Novice investors must be content with locking their CAKE on Binance.

- Reward Slashing. Staking rewards on Pancakeswap are subject to the number of participants in the pools and other major factors. Also, the cryptocurrency market is volatile, and slashing rewards is a common occurrence. For instance, Binance interest rates for CAKE were reduced by more than half in response to the bear market.