Over $700 Million in Crypto Liquidations as Bitcoin Crashes

Key Takeaways:

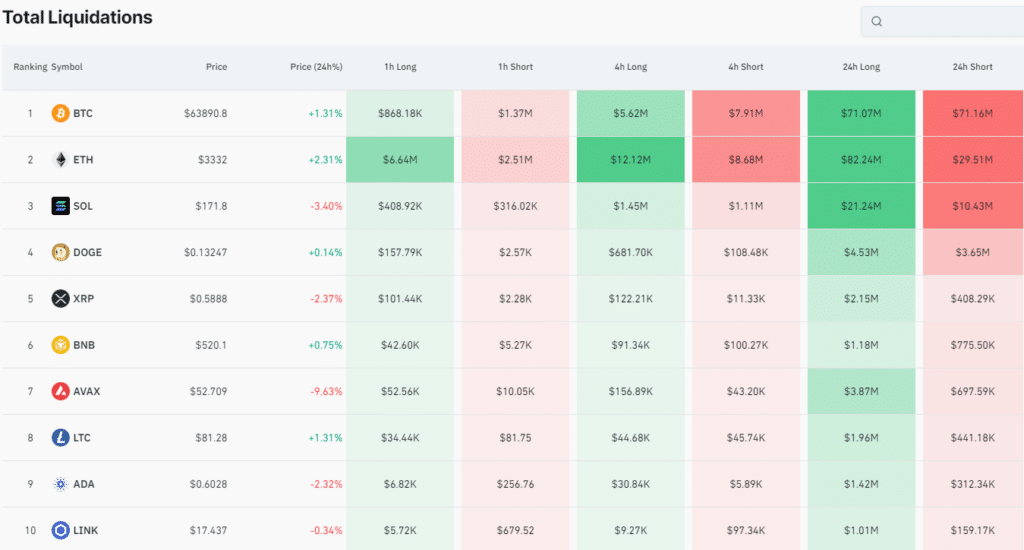

- While Bitcoin (BTC) continues to struggle, traders have suffered over $700 million in crypto liquidations.

- Since March 19th, around $588 million in longs and $148 million in shorts have been liquidated as BTC experienced volatility, dropping from approximately $68,000 to $61,700 and back up to $63,600.

What's Causing The Volatility?

Since creating a new All-Time High (ATH) of $73,794 on Thursday, 14th March, the price of BTC has been highly volatile. With the broader crypto market tied closely to Bitcoin's action, the volatility has been widespread. Assets like Ethereum or XRP have shed around 16.60% and 13.64% off their value, respectively.

According to data from Coinglass, over 110,000 traders have been liquidated over the past 24 hours, which raises questions about the state of the market and sends price predictions into disarray.

The cause for this volatility is up for debate. Some sources claim macroeconomic factors, while others attribute the movement to a healthy correction stemming from the substantial wealth the crypto market has recently enjoyed.

With volatility and crypto liquidations making it much more challenging for investors to track their holdings, people are looking toward crypto portfolio trackers for assistance.

$443 Million Flows Out From Grayscale GBTC ETF

Amidst the crypto market's volatility, over $440 million has flowed out of the Grayscale Bitcoin Trust (GBTC). GBTC became the largest Bitcoin Exchange Traded Fund (ETF) after officially launching as an ETF in January.

GBTC has experienced outflows of more than $12 billion since the beginning of the year. However, Grayscale CEO Michael Sonnenshein stated that the company expected significant outflows as investors seek to bank profits.

Bitcoin Halving

Market conditions are currently hazy. However, many crypto enthusiasts expect substantial moves over the coming weeks as the Bitcoin halving draws near. The event will see BTC rewards earned from validating a block drop by 50%. It also marks a significant reduction in the number of Bitcoins left to mine.

Historically, every Bitcoin halving has taken place toward the start of a bull cycle. As such, many investors and traders are speculating that Bitcoin could experience a massive price surge within the next 12 months.

With hundreds of millions worth of crypto liquidations and outflows, only time can tell how Bitcoin will perform over the coming year. That said, with BTC setting a new ATH a month before the halving, things are looking promising.