We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Matrixport Review

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Bottom line:

Matrixport offers a lot of features in one platform, including lending to earn crypto interest, crypto-backed loans, crypto exchange, margin trading and derivative products. All of these features are available on their iOS and Android mobile apps. The downside of Matrixport is the lack of transparency on crypto loans, only supports 7 cryptocurrencies and does not have a desktop version.

-

Trading Fees:

0.5%

-

Currency:

USD, EUR, GBP, RUB, and 28 others

-

Country:

Global (USA not allowed)

-

Promotion:

Up to $50 for new users

How We Rated Matrixport

| Category | Hedge With Crypto Rating |

|---|---|

| Features | 4.5 / 5 |

| Supported Fiat and Deposit Methods | 4.3 / 5 |

| Supported Crypto & Trading Pairs | 3 / 5 |

| Fees | 4 / 5 |

| Ease of Use | 4.6 / 5 |

| Customer support | 4.5 / 5 |

| Security Measures | 4.5 / 5 |

| Mobile App | 4.2 / 5 |

Matrixport Overview

Matrixport was founded in 2019 by Jihan Wu, the former co-founder of Bitmain. The company is headquartered in Singapore and is available in most countries around the globe. Matrixport is a new crypto lending platform in the market that offers crypto loans and interest accounts. Matrixport also offers a full-featured crypto exchange to swap crypto-to-crypto. Investors can also access leveraged products, margin trading, and even DeFi apps and protocols to earn interest. While Matrixport only supports 7 cryptocurrencies and 9 trading pairs, the most used product is the lending and borrowing platform.

To summarize, the key features and products of Matrixport are:

- Apply for a loan against deposited crypto holdings

- Interest-free loans available (up to 7 days)

- Supports 9 cryptocurrency trading pairs

- Access to DeFi interest accounts

- Earn up to 30% interest on crypto deposits

- Advanced trading and leveraged products

| Platform Name | Matrixport |

| Supported Fiat Currency | 32 (USD, EUR, GBP, RUB, and 28 others) |

| Supported Cryptocurrency | 7 (BTC, ETH, BCH, SOL, USDC & 2 others) |

| Deposit Methods | Cryptocurrency, Wire Transfer |

| Trading Fees | None |

| Withdrawal Fees | $30 for fiat withdrawals, crypto withdrawal fees vary by currency |

| Mobile App | Yes |

What Features Does Matrixport Offer?

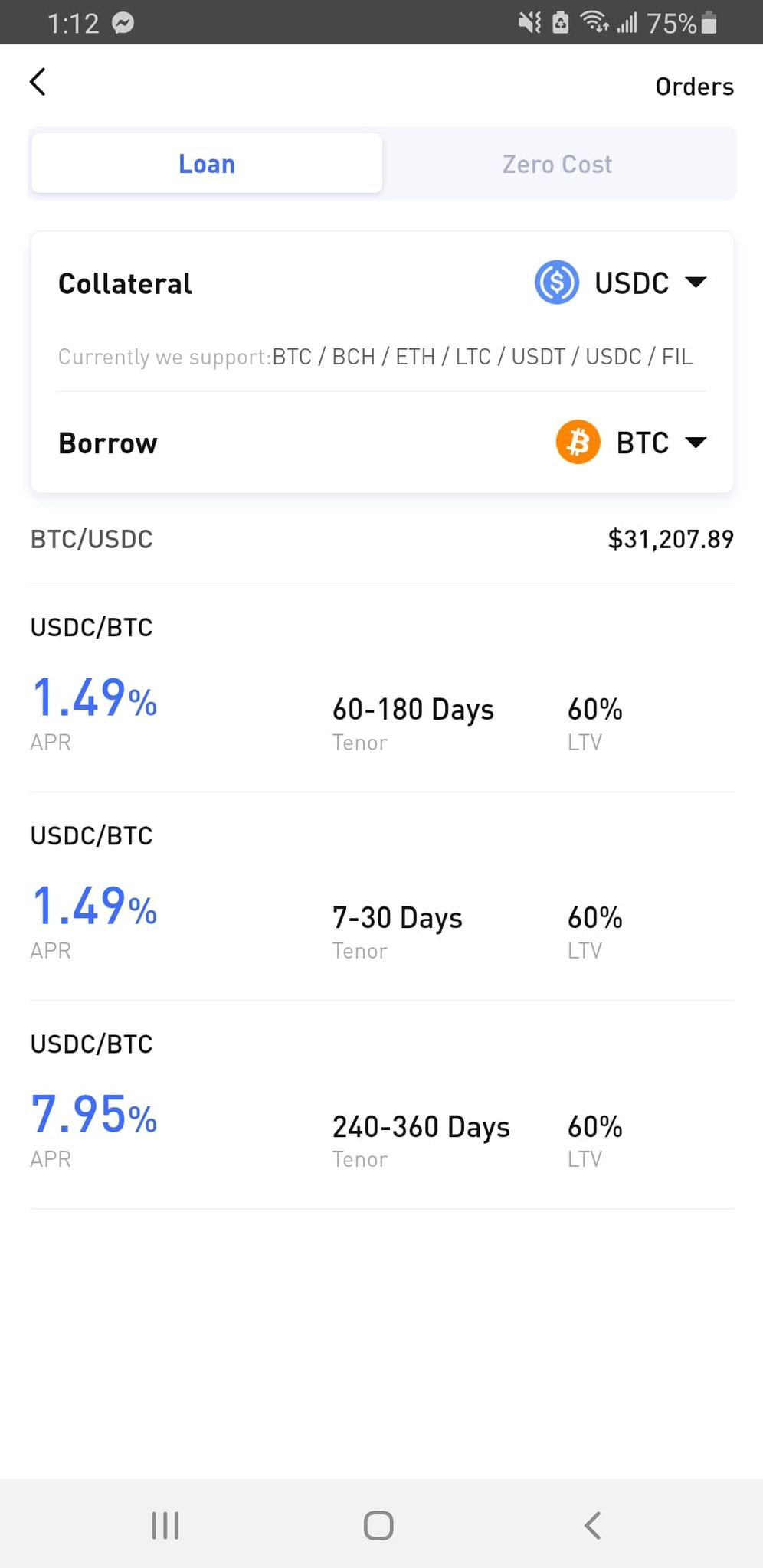

Crypto-Backed Loans

Matrixport offers crypto-backed loans at favorable interest rates, as well as 0% interest loans for certain borrowers. Users can deposit one of 7 different cryptocurrencies, and borrow cryptocurrency such as stablecoins or Bitcoin (BTC). Interest rates vary by collateral deposited, the currency borrowed, and the loan-to-value (LTV).

Here’s an example of a user depositing BTC and borrowing USDT:

| BTC/USDT Loan Interest Rates | Term Length (Days) | Loan to Value (LTV) |

|---|---|---|

| 1.38% | 30 – 180 | 20% |

| 5.51% | 30 – 180 | 30% |

| 7.19% | 30 – 180 | 40% |

| 8.28% | 30 – 180 | 50% |

These traditional crypto-backed loans carry the risk of liquidation if the value of collateral drops below the value of the loan terms and the LTV rises above the loan limits. Matrixport can liquidate part of the collateral to pay back the loan, or users can deposit more collateral to get back under the LTV limit.

The best feature is the 0% loans which are available. The structure of the loans functions a bit differently than traditional crypto loans we have reviewed from providers such as Hodlnaut. To obtain a zero-cost loan, only Bitcoin (BTC) is available for collateral. Moreover, users will need to borrow against the current value of BTC, choose a “take profit” price, and only borrow up to the assigned LTV (which varies by loan plan).

Once the loan is selected and BTC is deposited, there are no monthly payments and users pay zero interest throughout the loan. If BTC rises above the “take profit” price, the Bitcoin is sold and users are refunded their collateral and the profit made from selling Bitcoin at a higher price. If the price of Bitcoin drops below the “protection price”, then the loan will be closed and collateral will be lost. If the price of Bitcoin stays above the protection price and below the take-profit price, the loan will just need to be repaid by the end of the term.

The setup of the crypto loans on Matrixport is unique in the market with its low interest rates and the option of paying no interest at all. While 0% interest loans are appealing for retail investors, the loans can end prematurely given the volatile market conditions which may not be ideal for everyone.

Crypto Interest Accounts

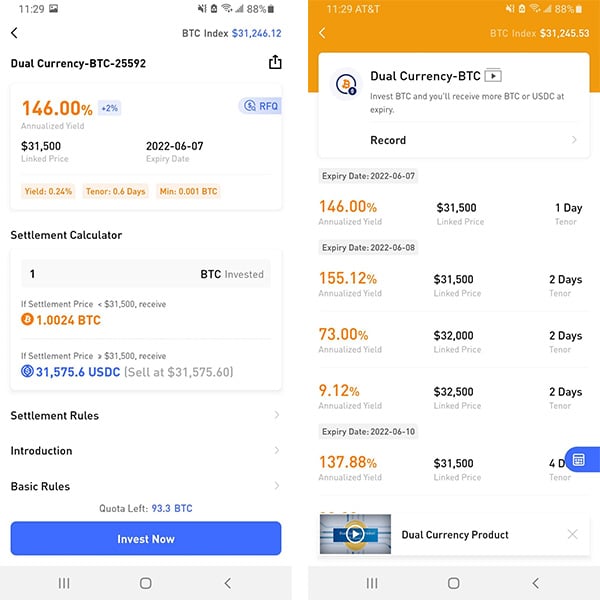

Matrixport offers multiple ways to earn interest on cryptocurrency. The most prominent method on the app is the “Dual Currency” offering. Essentially, this is a savings account that links two cryptocurrencies together to invest over a short period.

For example, a user can deposit a base currency (such as BTC) which is paired with a stablecoin (typically USDC). If the price of BTC falls, users are paid back in BTC, thus earning more BTC. If the price of BTC rises, users are paid out in USDC and also can earn more interest. Currently, only Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), and Solana (SOL) are available for Dual Currency investing.

The amount of interest earned will depend on the currency and term length selected. The shorter the term length, the higher the yield possibility (sometimes over 100% APY). But this requires more active involvement to continue investing and the payout is smaller. The longer the term length, the lower the annualized yield. Although, this may be a more desirable passive interest-earning strategy for certain individuals.

Like a traditional crypto savings account, there are also fixed-interest accounts earning up to 30% APY. For instance, users can earn interest on Bitcoin deposits in a fixed savings account at 3% APY. Some stablecoins are paying over 7% interest when depositing for up to 240 days. The deposits are locked in for the term length and cannot be withdrawn early. In short, the savings account interest rates are competitive but are lower when compared to its competitors like Crypto.com and Nexo which offer up to 12% APY on stablecoins.

DeFi Pools

Matrixport has a decentralized finance section to earn compound interest on the top DeFi ecosystems. Users can deposit funds into DeFi pools to earn interest between 5% and 30% APY. Due to the decentralized nature of the pool, individuals remain in full control of their funds at all times which can be withdrawn at any time. For example, Matrixport provides an on-ramp to popular lending protocols such as Curve, Swerve, and Compound. Users on the platform can borrow or lend their assets to the ecosystem to earn interest.

Crypto Trading Platform

For a “mobile-only” platform, Matrixport offers a fairly comprehensive trading platform with simple crypto swaps available for 8 crypto assets. These include Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Tether, USD Coin, Chainlink, and Polkadot. Users can trade between cryptocurrencies with zero fees. Although, there is a small spread of about 0.5% (based on our initial testing).

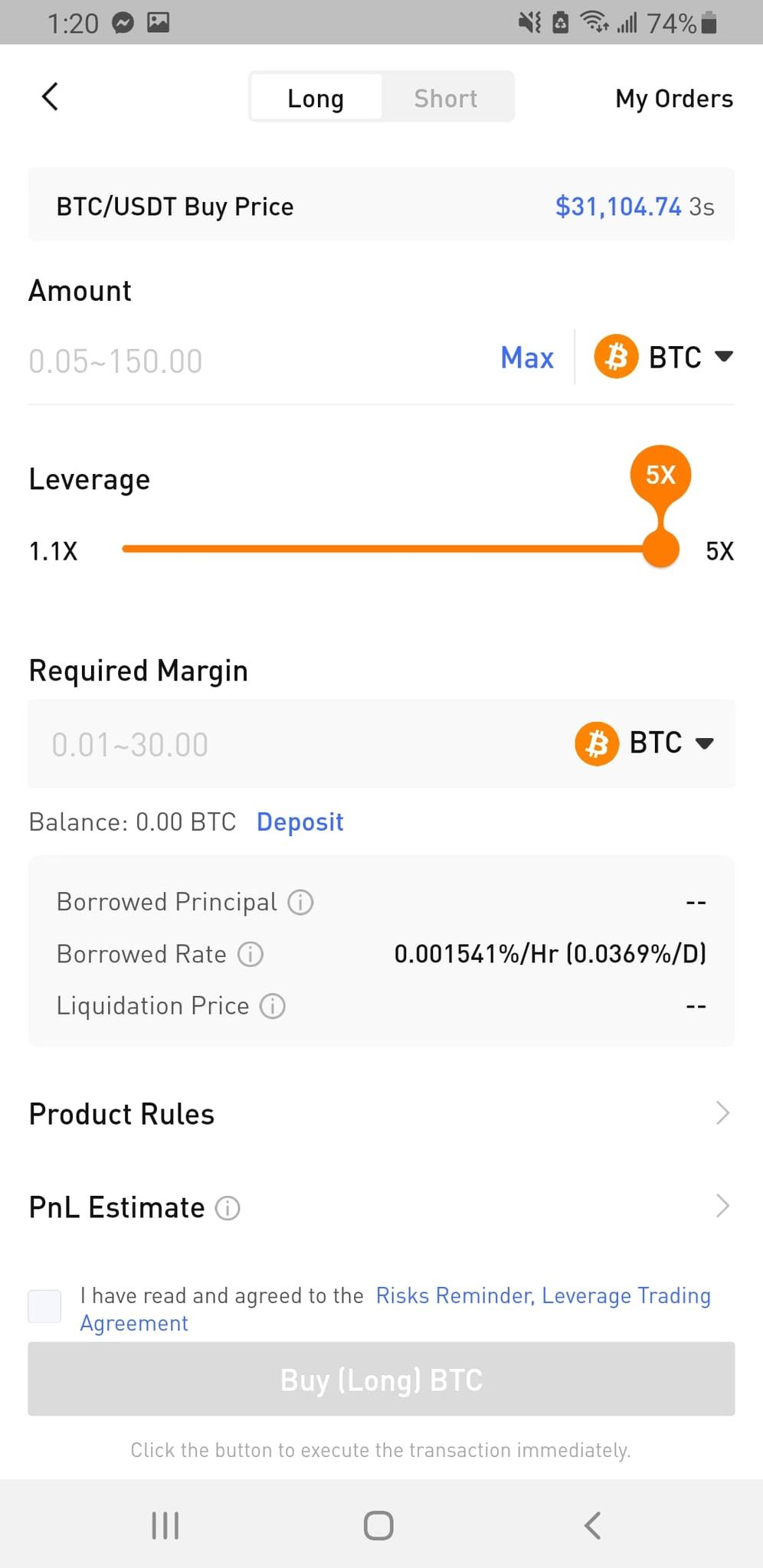

Trades can be placed using limit orders, trading bots, and the option to speculate using leverage BULL and BEAR contracts with up to 5x leverage. The standard swap interface allows simple market orders on crypto trading pairs, such as BTC-USDC.

There are also trading bots available, allowing users to program a bot to automatically buy and sell within specific price ranges. These bots offer a more advanced trading strategy to users and can help capture profit depending on the price movement of a selected cryptocurrency. Users can also set up auto-investing to buy at specific intervals of time. To see how Matrixport's bots stack up against its competitors, read our list of the best crypto bots for traders.

Matrixport Comparisons & Alternatives

Matrixport is an all-in-one crypto app that offers 0% interest loans, crypto interest accounts, and a full-featured crypto exchange all within a mobile app. Some other highly-rated lending and borrowing platforms that are similar to Matrixport are Crypto.com, Nexo, and Juno. Read the reviews below for a detailed overview of each provider for more information.

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

|

|

72 |

0.99% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

Get $25 in Bitcoin when you top-up or buy >$100 |

Visit Nexo | Nexo Review |

|

|

288 |

0.075% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.2 / 5 |

None available at this time |

Visit Crypto.com | Crypto.com Revie… |

|

|

8 |

None |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.5 / 5 |

Get up to $100 free on the first deposit |

Visit Juno | Juno Review |

Is Matrixport Safe?

Matrixport is a secure platform that employs crypto exchange security best practices. These include offline cold storage, SSL data encryption, and two-factor authentication (2FA) for all accounts. There have been no reported hacks since the platform was established. Moreover, crypto-assets are stored with Cactus Custody, which is a reputable cryptocurrency custodian.

Creating An Account With Matrixport

Creating an account with Matrixport is free of charge, and requires submitting a username and password to the platform. After verifying your email address, you will need to verify your identity with an official government ID, your residential address, and a selfie picture.

Note: To trade crypto without identity verification, a better option would be to use a top crypto swap platform that does not require account creation or KYC.

ID Verification Requirements

While users can deposit funds onto the Matrixport platform without verification, users cannot apply for loans, trade crypto, or withdraw funds from Matrixport without passing KYC. Identity verification helps protect users and prevent fraud on the platform, as well as complies with local jurisdictions.

Matrixport requires submitting verification documentation to be able to withdraw from the platform. The daily withdrawal limits start at $1,000,000. To increase withdrawal limits, users will need to submit proof of address, which usually means sending in a current utility bill with their name and address on it. This increases the limit to $5,000,000 per day.

Funding & Limits

Matrixport allows users to deposit crypto and fiat currency with no limits and no fees. The platform supports USD for deposits via wire transfer. Other fiat currencies can be purchased through a third-party partner Banxa, however, will incur high fees. The lack of support for depositing other fiat currencies is a limitation.

As for withdrawals, they are limited to $1,000,000 per day for KYC 2 verified accounts and up to $5,000,000 per day for KYC 3 accounts. There are withdrawal minimums for each crypto individually, and these are listed here. Fiat currency can be withdrawn via wire transfer and will incur a $30 fee (per transfer).

Supported Coins

Matrixport supports 7 cryptocurrencies which are BTC, ETH, BCH, SOL, and USDC. Users can access far more crypto when using the “Swap” function, which is provided by Banxa.

Only certain crypto is available for specific products on Matrixport, such as crypto loans, dual currency, and leveraged trading. Overall, the selection is very limited compared to the top lending and savings platforms. Those who are looking for a larger selection of crypto to trade or borrow against should consider Binance Earn and Nexo.

Applying For Loans on Matrixport

Matrixport offers crypto-backed loans, allowing users to deposit crypto and borrow against the balance. Users can borrow stablecoins or Bitcoin (BTC), and there are various LTV and loan term length options available.

To apply for a loan, users will need to select the loan they wish to apply for, deposit the cryptocurrency to be used as collateral, and set the term length for the loan (between 30 days and 360 days). Loans can be applied for directly on the mobile app, and offer instant approval and funding after depositing the collateral onto the platform.

There are also zero-cost loans that don’t require interest payments and don’t have the risk of liquidation. Users can deposit crypto onto the platform, select a take-profit price, and borrow up to 50% LTV on the collateral value. If the take profit price is hit, the loan does not have to be repaid, and the collateral is sold, with users receiving back their collateral plus some earnings.

Trading on Matrixport

Crypto can be traded on the Matrixport exchange, from simple crypto swaps to advanced limit orders and leveraged trading. Users can deposit USD or cryptocurrency, and select which crypto they want to trade.

For swaps, prices are adjusted every 5 seconds, locking in the price that you will pay each time. There is a spread charge which will vary per transaction, but based on our testing, equals about 0.5% of the total transaction.

For limit orders, users can trade for a low 0.1% fee, offering 9 different crypto trading pairs. Users can deposit crypto and place trades with instant execution once the limit price is hit. Leveraged trading is also available with up to 5x leverage available. Users can borrow margin and pay interest at an hourly rate, and there are several cryptos to select from.

Matrixport Fees

Matrixport does not have deposit fees for crypto or fiat currency (some banks may charge for wire transfers). Fiat withdrawals are only available in USD and via wire transfer which costs $30 per transfer. Trading fees are about 0.50% for swaps and 0.1% for limit orders which is fairly competitive in the industry.

As for the loans, Matrixport loan repayments are from 0% to about 8% depending on the crypto being borrowed and loan LTV. There are no loan origination fees.

Mobile App

Matrixport is only available on a mobile app and is supported on iOS and Android devices. Users can sign up for an account, deposit funds, place trades, apply for a crypto-backed loan, and earn interest all from the intuitive mobile app. This may be suitable for everyone.

The Matrixport app has an overall 4.2/5 star rating on the Android marketplace based on more than 1,000 reviews at the time of writing. There are a few user complaints about authenticating accounts, but overall users have positive things to say about the app. Overall, the Matrixport mobile app is intuitive and offers more features than most crypto apps.