We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Independent Reserve Review

Independent Reserve is one of Australia’s oldest crypto exchanges. The platform is well-secured, trustworthy and has quite competitive fees. That said, investors looking for a wide variety of coins to trade should consider alternative exchanges.

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own inquiries.

TABLE OF CONTENTS

Bottom line:

Independent Reserve is a high-quality Australian exchange with excellent security credentials and a solid user interface. Casual crypto traders can certainly use the platform, but It is largely aimed toward institutional and higher-net-worth investors. The tax solutions, low fees, SMSF support, and excellent customer support make it a logical choice for serious Aussie crypto traders. However, those wanting to trade altcoins or access DeFi features must consider alternative exchanges.

-

Trading Fees:

0.5% maximum, 0.02% minimum

-

Currency:

AUD, NZD, SGD, USD

-

Country:

Australia, New Zealand & Singapore

-

Promotion:

None available at this time

How We Rated Independent Reserve

| Review Criteria | Hedge With Crypto Rating |

|---|---|

| Features | 4.4 / 5 |

| Supported Fiat and Deposit Methods | 4 / 5 |

| Supported Crypto & Trading Pairs | 3.5 / 5 |

| Fees | 4.1 / 5 |

| Ease of Use | 5 / 5 |

| Customer support | 4 / 5 |

| Security Measures | 4.6 / 5 |

| Mobile App | 4 / 5 |

Pros Explained

- AUSTRAC-registered exchange. Independent Reserve abides by all financial regulations enforced by AUSTRAC, including AML, KYC and CTF requirements. This gives the exchange an extra layer of legitimacy compared to one that operates in a grey area.

- Excellent SMSF support. Independent Reserve has excellent infrastructure in place to support investors looking to add crypto to their retirement funds. Paired with their low fees and support for high net-worth individuals (HNWI).

- Competitive fees. Independent Reserve has some of the best fees on offer out of any Australian exchange. Their transaction fees drop as low as 0.02%, which is on par with some of the biggest international crypto trading platforms on the market.

- Tax support. Independent Reserve’s in-built tax support is a logical inclusion given their target of higher net-worth and institutional traders. This is both cheaper and much simpler than individuals having to integrate third-party tax solutions into their crypto exchange.

- ISO27001 Certification. ISO27001 Certification is the holy grail of security certifications and a massive plus for Independent Reserve users. Very few Australian exchanges have secured this prestigious certification (CoinSpot being another).

Cons Explained

- Limited list of supported coins. Every alternative crypto exchange in Australia has a larger list of altcoins on offer than Independent Reserve. This isn’t necessarily a huge deal, as many of the platform’s customers just want a simple way to invest in and trade the major currencies (Bitcoin, Ethereum, etc.). However, those more ingrained in crypto culture will want to look elsewhere to snap up more obscure coins.

- Not a huge range of features on offer. Independent Reserve lacks some advanced DeFi and crypto features that more and more exchanges are starting to host. This includes a lack of staking or earning services, crypto bundles and NFT support.

- Low liquidity. Those wanting to use Independent Reserve predominantly for trading may want to consider an alternate, international platform with superior liquidity and volume. This leads to high spreads—for example, at the time of writing, the buy/sell spread for Bitcoin is over $100 AUD. Conversely, Binance’s was only about AUD 35.

Independent Reserve Compared and Alternatives

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

Swyftx Swyftx

|

422 |

0.6% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.9 / 5 |

$20 Bitcoin for creating a verified account |

Visit Swyftx | Swyftx Review |

|

|

385 |

0.1% (spot) and 0.02% / 0.04% (Futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

Up to $100 welcome bonus |

Visit Binance | Binance Review |

|

|

380 |

1% (instant), 0.1% (spot) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

$20 Bitcoin for creating a verified account and depositing |

Visit CoinSpot | CoinSpot Review |

Independent Reserve At A Glance

Independent Reserve is a cryptocurrency exchange in Australia that provides a stable and secure platform for individuals to buy and sell 30 of the most popular digital currencies, including Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) at live prices. The exchange was founded in 2013 and has expanded its service offering to include crypto investors in New Zealand and Southeast Asian regions like Singapore.

Since the exchange's launch in 2013, Independent Reserve has gained the trust of over 250,000 individuals and thousands of SMSF accounts to buy cryptocurrency using Australian Dollars (AUD), New Zealand Dollars (NZD), United States Dollars (USD), and Singaporean Dollars (SGD). Independent Reserve is registered with national regulatory bodies such as AUSTRAC and has also received several prestigious awards for its services.

| Exchange Name | Independent Reserve |

| Features | Spot exchange, SMSF support, Auto-Buy (DCA), Advanced exchange, Tax reporting software |

| Supported Fiat Currency | AUD, NZD, SGD, USD |

| Supported Deposit Methods | Bank transfer, PayID/Osko, SWIFT and Cryptocurrency |

| Supported Cryptocurrencies | BTC, ETH, XRP, USDT, ADA and 25 more |

| Trading Fees | 0.5% maximum, 0.02% minimum |

| Customer Support | Knowledge base, FAQ, ticket system |

| Security Measures | 2FA, “Duress” password, ISO27001 Certification, Cold storage |

| Mobile App | Yes (Android and iOS) |

Independent Reserve Features Reviewed

Over The Counter SMSF Support

Independent Reserve has been around for over a decade and has been popular among SMSF and high-net-worth investors. This is largely due to the platform’s trustworthy nature, excellent SMSF support, and reliable over-the-counter (OTC) desk. Thousands—reportedly 80K+—of Australians use Independent Reserve as their platform of choice for adding crypto to their retirement funds. It also offers excellent tax reporting and generating tools, which are always important for active crypto traders and SMSF owners.

Additionally, the Independent Reserve customer service team provides 24/7 support to certain accounts and can assist with onboarding new SMSF customers. A particularly compelling feature is support for Auto-Buy (dollar-cost averaging) orders for accounts of all types – including OTC, SMSF and business accounts.

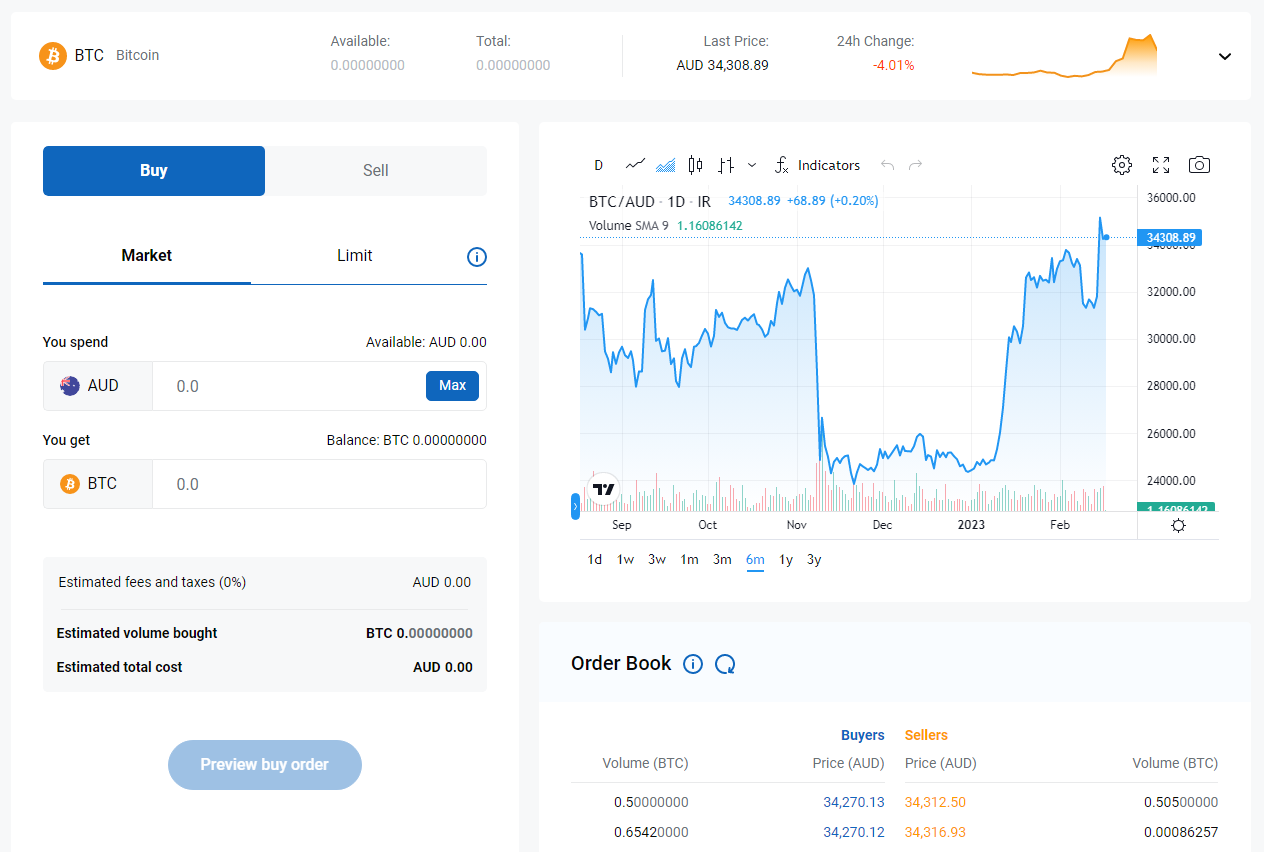

Advanced Trading Hub

Independent Reserve has streamlined its interface to be more beginner-friendly, but overall, the platform still leans toward accommodating advanced traders. In this vein, the exchange offers an advanced trading page for more experienced investors. Here, traders can access a customizable chart with hundreds of indicators and view the order book and price spread.

Traders can also adjust their order types between Market, Limit and Stop Limit. While this is an excellent addition for more advanced traders, the interface lacks a few features and order types that global competitors like ByBit and Binance offer.

Auto Trader

Independent Reserve has implemented an Auto Trader feature that can automatically execute orders on behalf of the investor. The basic principle underlying this option is known as dollar-cost averaging (DCA), which involves frequently buying a set amount of cryptocurrency regardless of price. There are three customizable strategies for customers to choose from:

- AutoBuy. Every time a user deposits AUD (or other fiat currency), Independent Reserve will automatically buy a pre-determined digital currency.

- AutoBasket. The same as AutoBuy, except instead of one coin, the exchange will buy a basket of pre-selected cryptocurrencies.

- AutoSchedule. This strategy will set an automatic deposit and/or purchase schedule for buying or selling specific crypto. It can be set to a daily, weekly, fortnightly, monthly, or last day of the month schedule.

Tax Reporting

Independent Reserve has integrated KPMG to provide tax solutions to casual, institutional, and SMSF investors. The platform charges a fee that varies depending on the number of trades the account has made.

The crypto tax software automatically generates reports based on an Independent Reserve’s account activity, making it a completely hands-off process. Trades made on other platforms can be submitted manually or uploaded via .CSV. Independent Reserve can also generate basic transaction history, holdings and order history reports.

| Trades Made | Fee (AUD) |

|---|---|

| Under 20 | $4.95 |

| Under 200 | $29.95 |

| Under 1,000 | $59.95 |

| Over 1,000 | $199.95 |

Account Creation & ID Verification

The process to register an Independent Reserve account is simple. To start, visit the website and click on the ‘Create Account' link at the top right-hand corner. This will bring up another page to decide on a username and password. The next stop will be to enter further personal information required to hold an account. In short, Independent Reserve’s verification process is relatively straightforward but a little time-consuming.

Supported Fiat & Deposit Methods

Users on Independent Reserve can deposit funds using AUD, USD, NZD and SGD fiat currencies. USD and NZD can only be deposited via SWIFT, which incurs a $15 deposit fee for transactions under $5,000. One of the best ways to fund an Australian account is using PayID/Osko, which has an initial maximum daily limit of $20,000 and takes less than 24 hours to arrive. All deposit limits can be increased via a request to the support team. On average, deposits above $20K will take one business day to arrive.

Customers can fund their Independent Reserve account to buy and sell Bitcoin and cryptocurrency assets using a bank transfer, PayID or SWIFT. Independent Reserve’s decent range of deposit methods, lack of fees, and high limits make it an excellent performer in this category.

| Deposit Method | Daily Limit | Speed | Fee |

|---|---|---|---|

| Bank transfer | $20,000 | 1-2 business days | Free |

| PayID/OSKO | $20,000 | Instant | Free for deposits above $100 |

| SWIFT | $20,000 | 2-3 business days | $15 for deposits under $5,000 |

Supported Cryptocurrencies & Trading Pairs

Independent Reserve provides 30+ digital assets that can be traded against fiat currencies such as AUD, USD, SGD, and NZD, including stablecoins, altcoins, and DeFi tokens. The available digital assets that can be purchased include Bitcoin, Ripple (XRP), Ether, EOS, Dogecoin (DOGE), and others. For a full list, visit their website.

Although the most popular coins are represented, Independent Reserve has one of the smallest list of supported digital currencies of any exchange. The platform offers trading pairs for all of its base fiat currency, but Australian customers will find the best liquidity and spreads on AUD pairs. NZD pairs have reportedly seen spreads of over $1,000 on BTC.

Independent Reserve Fees

Deposit and withdrawal fees

Deposits and withdrawals are free on Independent Reserve’s side. That said, Osko and SWIFT transactions may incur a fee on the provider’s side. Crypto deposits and withdrawals will incur a standard network fee.

Trading fees

Independent Reserve's fee is based on the past 30 days' trading volume, which starts at 0.5% per transaction. As the trading volume increases, the fees can be reduced to as low as 0.02% (recalculated every 4 hours).

The fee structure increments appear to suit high-net-worth individuals and SMSF investors with large sums of money to invest to obtain a lower crypto trading fee. For beginners, the 0.02% trading fee is probably not within reach. However, a base fee of 0.5% is an excellent price for the Australian market. However, International competitors offer cheaper alternatives, such as Binance and ByBit (both 0.1%).

| Volume (30 day) | Trading Fee |

|---|---|

| $0-49,999 | 0.5% |

| $50,000 | 0.48% |

| $100,000 | 0.46% |

| $200,000 | 0.44% |

| $400,000 | 0.4% |

| $1,000,000 | 0.32% |

Independent Reserve Ease Of Use

Independent Reserve has received some criticism from customers and reviews for its poor accessibility and clunky past. In our experience, this was not the case, and the team has clearly spent a lot of time trying to improve the platform’s design. The exchange is clean, has a simple color scheme, and all features are easy to find.

More advanced investors will appreciate the platform’s improvements to the “Advanced Trading” page. Originally, the charting feature on offer was not integrated with TradingView (TV) and was a bit clunky to manipulate. This has been amended, and customers can now use fully customizable TV charts flush with indicators and drawing tools. Even the normal spot trading page has integrated an Order Book and charting software into it, a massive upgrade since our last review.

Adjusting the slider and zooming to view the exact time frame to analyze the candlestick patterns can be problematic and frustrating. If you rely on technical analysis, you might want to use another cryptocurrency charting site in conjunction with Independent Reserve (to make the most of the low trading fees).

Overall, Independent Reserve's charting interface is disappointing for a major crypto exchange in Australia. The entire interface could undergo a complete overhaul to modernize the trading experience and keep it up to date. More and more crypto exchanges are integrating with TradingView by default which provides superior charting for serious investors and traders alike.

The simple instant/buy trade page has been developed further, too, and is now quite easy for beginners to navigate. The Independent Reserve exchange has clearly put a lot of effort into shedding its moniker as an expert-only platform, and it shows. We were impressed by the platform’s willingness to put the user’s experience first in its evolution over the past few years. Ultimately, Independent Reserve still isn’t the most aesthetic and easy-to-use exchange on the market, but it is making big strides in this area.

Mobile App

Independent Reserve has a simple mobile app for iOS and Android devices. The program offers investors the ability to buy, sell, and trade 30+ digital currencies while on the go. The app is quite stripped back and, although very easy to use, is missing some major features, like advanced charting. Overall, Independent Reserve’s mobile app is a solid, modern offering but lacks some of the bells and whistles we’d expect from a top-tier app.

Customer Support

Independent Reserve has developed a reputation for excellent customer support in its ten years in the Australian market. From thousands of reviews on the platform's customer support, they have decent TrustPilot (3.6) and ProductReview (3.6) ratings.

Independent Reserve is among the few Australian exchanges offering round-the-clock customer service. However, we are unsure how the business lives up to this claim, as they do not offer a live chatbot or phone support. However, customers can open a support ticket via the Support Messages page and expect a prompt response (depending on local business hours). Independent Reserve also has a knowledge base/FAQ that will answer most users' basic questions. Ultimately, the IR customer support team is fast, thorough, and helpful, but the lack of contact methods is a minor downside.

Security Measures

Independent Reserve has ISO 27001 certification, a big deal for Australian crypto exchanges. This certification is quite difficult to accomplish and demonstrates a strong commitment to customer safety and security.

The platform reportedly employs a dynamic cold wallet solution to store most digital assets. The cold wallets are secured by multi-layer encryption and stored on offline digital hardware. The hardware is stored in physical vaults in geographically diverse locations according to the website.