How To Short on ByBit

ByBit has several products to short crypto including margin, derivatives, and options. This guide explains the exact steps and shorting fees involved.TABLE OF CONTENTS

Shorting Bitcoin and other cryptocurrencies is one of the many ways to earn potential profits from the crypto market. Crypto trading platform ByBit offers spot and derivatives trading for its traders to short crypto. This article will explain how to short on ByBit using the various products available.

Can You Short on ByBit?

Yes, ByBit enables traders to short Bitcoin when they expect the coin’s value to fall. However, there are other methods aside from direct selling the asset that allows traders to short cryptos. These include:

- Direct Short Selling. As the name implies, direct short selling involves selling an asset from ByBit at a specific price on the spot exchange after the price has gone down. This is the most common shorting method on the cryptocurrency exchange.

- Margin Trading. This product is an extension of the spot market which enables traders to borrow funds from ByBit to amplify their capital and short-sell at a current market price. Once the trade is completed, the trader will need to repay the interest accrued on the borrowed funds. ByBit's margin trading exchange has up to 5X margin on BTC, USDT, USDC, and DAI.

- Futures Markets. ByBit has a derivatives market with USDT and USDC perpetual contracts to short cryptocurrencies available in the futures market, such as Bitcoin, Ethereum, and Cardano. Traders can deposit USDT or USDC to use as collateral using leverage up to 100X.

- Crypto Put Options. ByBit has a full-featured crypto options trading platform to open crypto put options to short-sell on ByBit without risking their assets. In other words, instead of trading a coin that an investor is betting on to reduce in price immediately, they can opt for crypto put options and sell them at a predetermined date. With this method, investors make profits when the underlying asset’s price reduces. They also don’t lose their asset (but will lose the option premium) if liquidation occurs.

Read our full review on ByBit to learn more about each product.

How to Short on ByBit with Margin

1. Login or create a new ByBit Account

The first step is to sign up on ByBit via the website or mobile app. From the homepage, click the “Sign Up” button. Then, enter the required information in the dialogue box, including a valid email, a new password, and a referral code (if any). Check the consent box and click “Create Account.” Alternatively, create a ByBit trading account using a mobile number.

2. Deposit funds

Complete the ByBit identity verification process and add funds to the ByBit account using the “Deposit” button at the bottom-right corner of the margin market screen. ByBit offers various payment methods, including cryptocurrencies and fiat deposits using debit cards and credit cards via “ByBit Express” and “One-click Buy”. There are no deposit fees on ByBit, and the funds will be credited into the ByBit wallet within minutes.

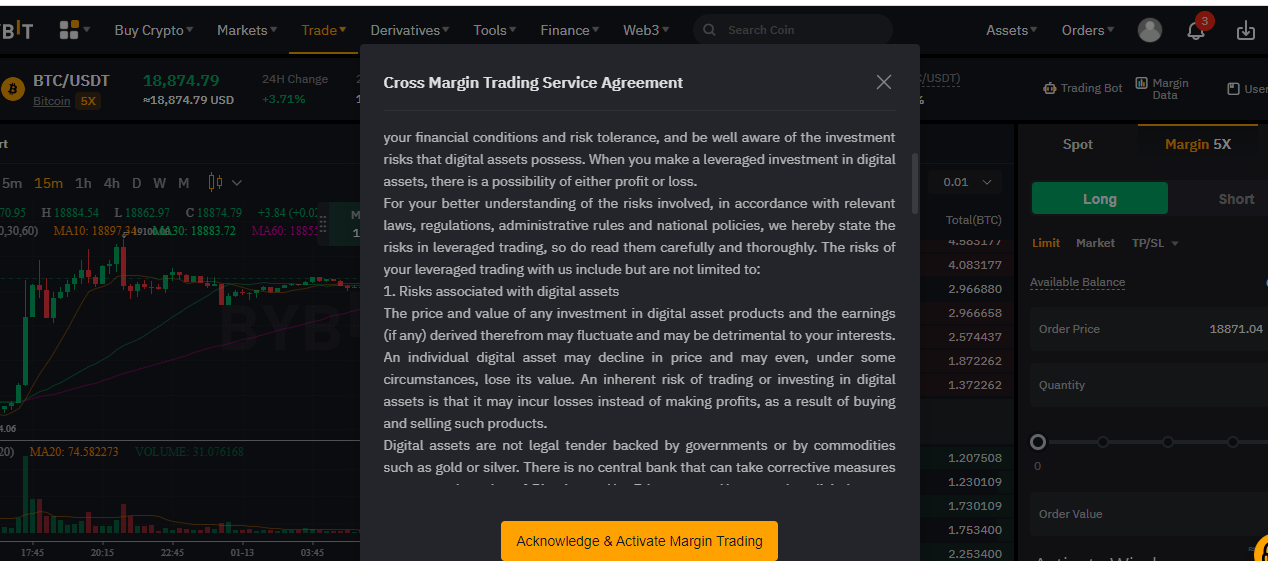

3. Activate margin account

ByBit requires new users to activate margin trading before entering the market. Therefore, traders are required to read information related to shorting on ByBit to understand the risks associated with the crypto trading strategy. Consent to the terms and conditions to gain access to the margin account.

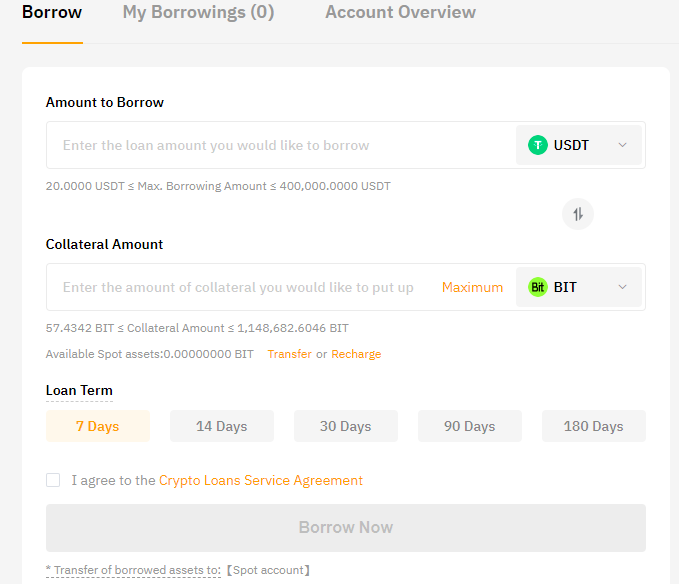

4. Borrow funds

The next step is to borrow funds to execute the trade. To get a loan, ByBit traders apply using the Crypto Loans feature on the platform. This can be accessed by clicking the “Finance” icon at the top of the screen and selecting “Crypto Loans” from the dropdown menu.

Enter the amount to borrow, the collateral amount, and the loan term from 7 days to 180 days, and click “Borrow Now.”

5. Transfer borrowed funds to margin account

The borrowed funds are usually deposited into the ByBit spot account automatically. Move the funds to the margin wallet using the “Transfer” feature beside the “Deposit” button at the base of the margin trading screen.

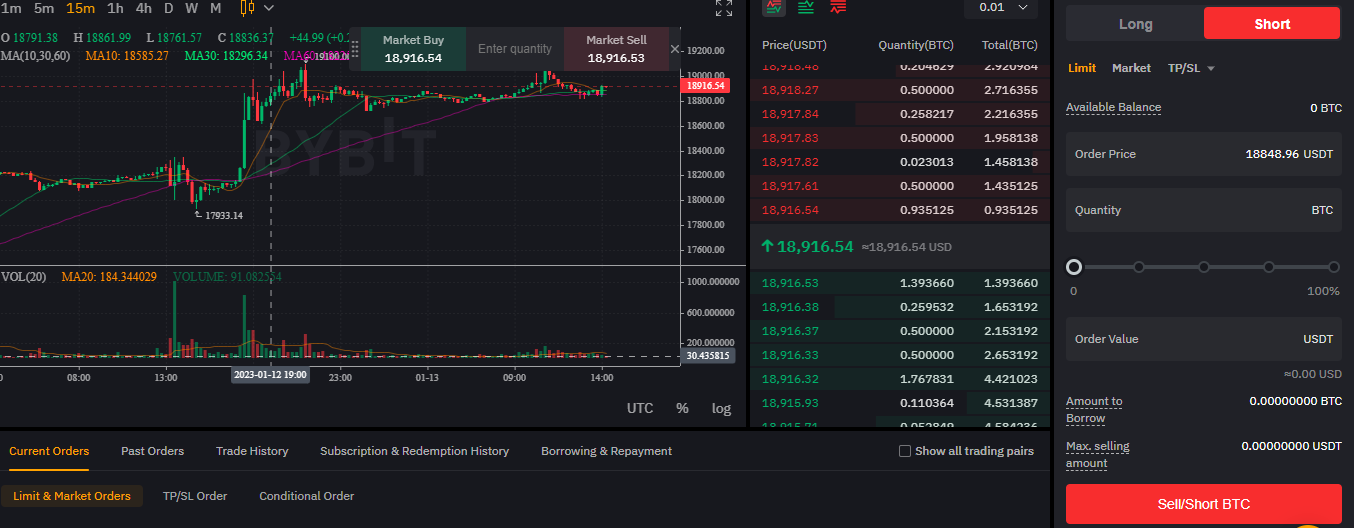

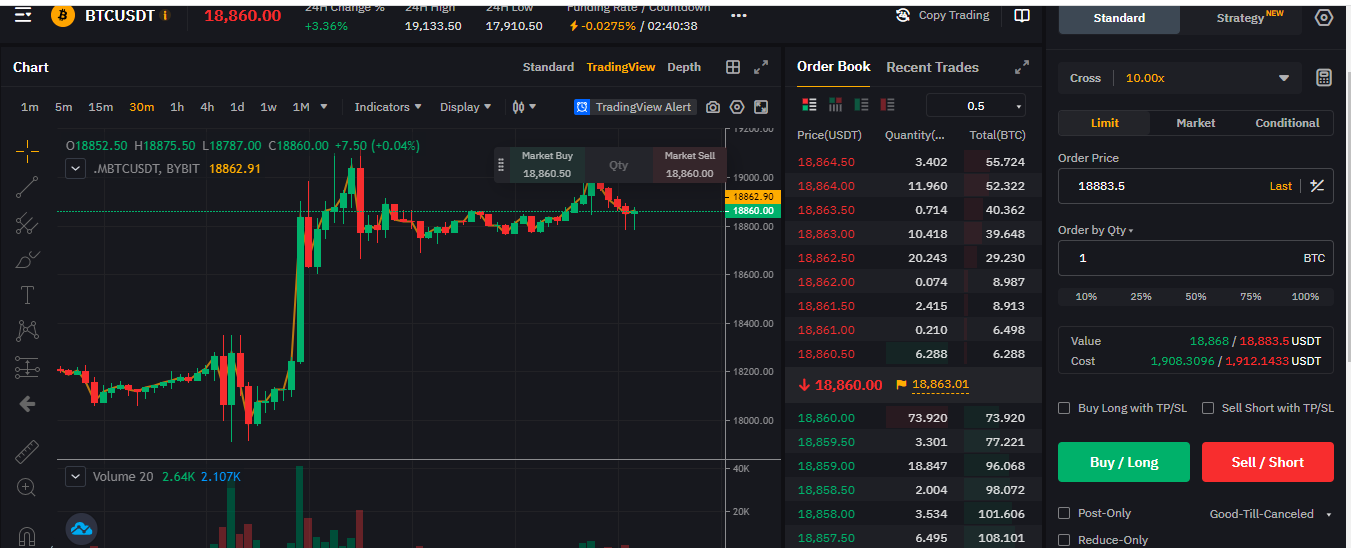

6. Enter a short position

Go short on Bitcoin or the chosen crypto asset by entering the order details in the dialogue box on the right side of the screen. Select “Margin” required, with up to 5x leverage, or short sell using “Spot” without leverage. There are three order types in the ByBit Margin market. Choose the method to short using a limit & market order, conditional order. There is also the option to set a take profit/stop loss order (TP/SL Order) before executing the short position.

Click “Short”, enter the order price and quantity, then tap “Sell/Short.”

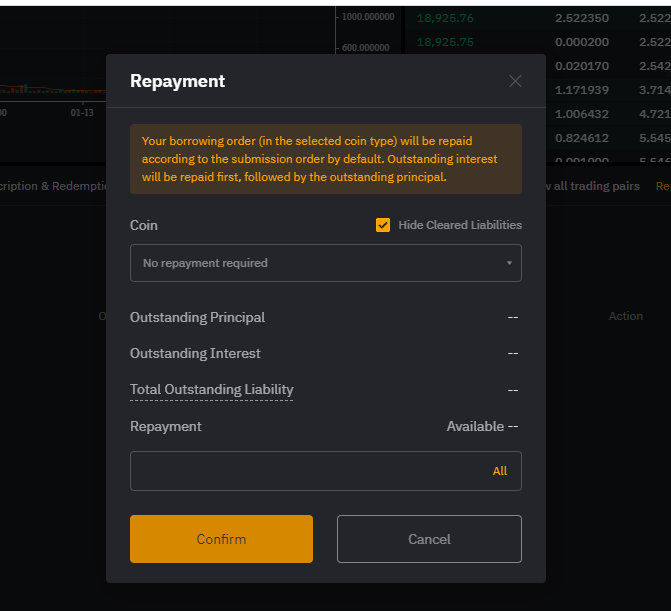

7. Repay debt

Once the trade is completed and trading positions are closed, repay the borrowed fund with interest accrued by clicking the “Borrowing & Repayment” button at the bottom of the screen. Click repay and enter the amount to be repaid to complete the transaction.

How to Short on ByBit with Futures

To short crypto on ByBit using futures, follow the steps below.

1. Create a ByBit account

Create a ByBit account on the website or mobile app using the same steps above. This involves clicking on the “Sign Up” button or “Create Account.”

2. Deposit funds to ByBit

ByBit does not require KYC and therefore persons can deposit crypto to their ByBit derivatives wallet using BTC, USDT, or USDC. To do this, navigate the ByBit derivatives trading page and click “Deposit.”

3. Choose the preferred derivatives contract

There are three shorting contract types on ByBit which are inverse perpetual, USDT and USDT perpetual, and inverse Futures (or Coin-Margined Futures).

- Inverse Perpetual contract offers margin trading, quoted in USD and settled in an underlying asset. As such, investors must own the underlying asset. The inverse perpetual options on ByBit are BTC-USD, EOS-USD, XRP-USD, and ETH-USD. Inverse Perpetual contracts have no expiration dates.

- USDT/USDC Perpetual futures contract offers margin trades quoted in a base asset, like BTC or ETH, and settled in USDT or USDC. However, for this contract type, investors don’t need to hold the base asset; they only need USDT or USDC.

- Inverse Futures or coin-margined futures contract is also settled in an underlying asset as in the Inverse Perpetual contract. However, coin-margined futures have an expiration or settlement date for their contracts.

Choose the preferred contract type and then select the margin choice between “cross margin and isolated margin”. When using the Cross Margin mode, collateral is shared by all positions under an account, while collateral under the Isolated Margin mode is available for a single position only. Cross and Isolated margins on ByBit offer up to 100x leverage, but this may vary depending on the crypto that is shorted.

4. Place sell order

Choose an order type as mentioned above which are market orders, limit orders, and conditional orders. Take a short position by entering the order price and quantity in the order input field on the right-hand side of the trading screen, and click “Sell or Short.”

Can You Profit From Short Selling on ByBit?

Short-selling crypto on ByBit or other crypto trading platforms can potentially be very profitable. However, it is best suited for experienced traders who can carry out solid research to make informed predictions. At the same time, shorting is suitable for active traders looking for short-term rewards with a high-risk appetite. Long-term investors may opt for safer crypto investment options available on ByBit.

Fees for Short Selling on ByBit

Shorting cryptocurrencies on ByBit attracts fees. The exchange uses a maker-taker fee model. The ByBit shorting fees are below:

- Flat 0.1% maker-taker fee for non-VIP members

- USDT & inverse contracts trading fee of 0.01% (maker) and 0.06% (taker)

- USDC perpetual trading fee of 0.01% (maker) and 0.06% (taker)

- A flat USDC Options trading fee of 0.03%

- Daily interest rate of 0.02%

- Hourly interest rate of 0.02% per 24 hours

Frequently Asked Questions

Can you long and short at the same time on ByBit?

Yes, ByBit traders can open long and short positions and trade simultaneously using any of the margin or derivatives products.

What does buy long and sell short mean in ByBit?

Going long on ByBit refers to borrowing a coin at a lower price from the exchange and selling at a higher price for profit in the bull market. Selling short is the opposite of buying long.