We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Where & How To Buy Solana

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Solana is part of the high market-cap suite of tokens dubbed the ‘Ethereum killers’. While Ethereum still holds a huge portion of the blockchain market share among investors, buying altcoins with lower transaction costs and faster block times is slowly gaining traction for long-term growth.

The quickest and safest way to purchase Solana is to follow these steps:

- Compare and select a crypto exchange. Find and compare cryptocurrency exchanges that are available within the specific country and support the fiat currency that is to be converted into SOL tokens. Each exchange will have different deposit options to fund an account with money. Other important considerations to finding the right exchange are the deposit, trading and withdrawal fees, account and wallet security and customer support.

- Register an account with the exchange. Create an account with a crypto exchange using a valid email address or mobile number. Before making a deposit in fiat currency, exchanges have a mandatory Know Your Customer (KYC) process that will need to be completed. This is to meet the international Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) requirements. It is also recommended to activate 2 Factor Authentication (2FA) for additional account security.

- Deposit funds to a wallet. Choose a payment option that offers the best fees and reasonable speed for the funds to arrive in the exchange wallet. The most common payment methods include a bank transfer, wire transfer, debit card, credit card and PayPal. Existing crypto investors can also deposit Bitcoin, other altcoins or stablecoins (e.g. USD, USDT or BUSD) which can be converted into Solana on the exchange.

- Buy Solana. Browse the supported assets and choose Solana. Use the funded account to choose an amount to spend. Finalize the transaction by clicking on ‘Buy'. The amount of Solana will be determined at the selected price and transferred to the user's SOL wallet.

Where To Purchase Solana

Solana is one of the most popular cryptocurrencies and is available on a wide range of exchanges and trading platforms. Before getting started, it is wise to research and compare the best exchanges for crypto before landing on a specific provider. Prioritizing a specific feature – such as the lowest fees, best trust rating, best mobile application – will make this process much less stressful. Examples of where to buy Solana based on Hedge With Crypto's reviews are listed below.

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

|

|

385 |

0.1% (spot) and 0.02% / 0.04% (Futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

Up to $100 welcome bonus |

Visit Binance | Binance Review |

|

|

222 |

0.16% (maker) and 0.26% (taker) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

None available at this time |

Visit Kraken | Kraken Review |

|

|

806 |

0.1% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.6 / 5 |

Up to 500 USDT in bonuses |

Visit KuCoin | KuCoin Review |

|

|

79 |

1% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

None available at this time |

Visit eToro Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB. | eToro Review |

Is Solana Worth Investing In?

Like all cryptocurrencies, Solana is a highly volatile asset that can easily swing by more than 10% in just a 24-hour timeframe. Even with the promising long-term potential of the Solana ecosystem, investors must be prepared for the inevitable peaks and troughs that come with owning cryptocurrency.

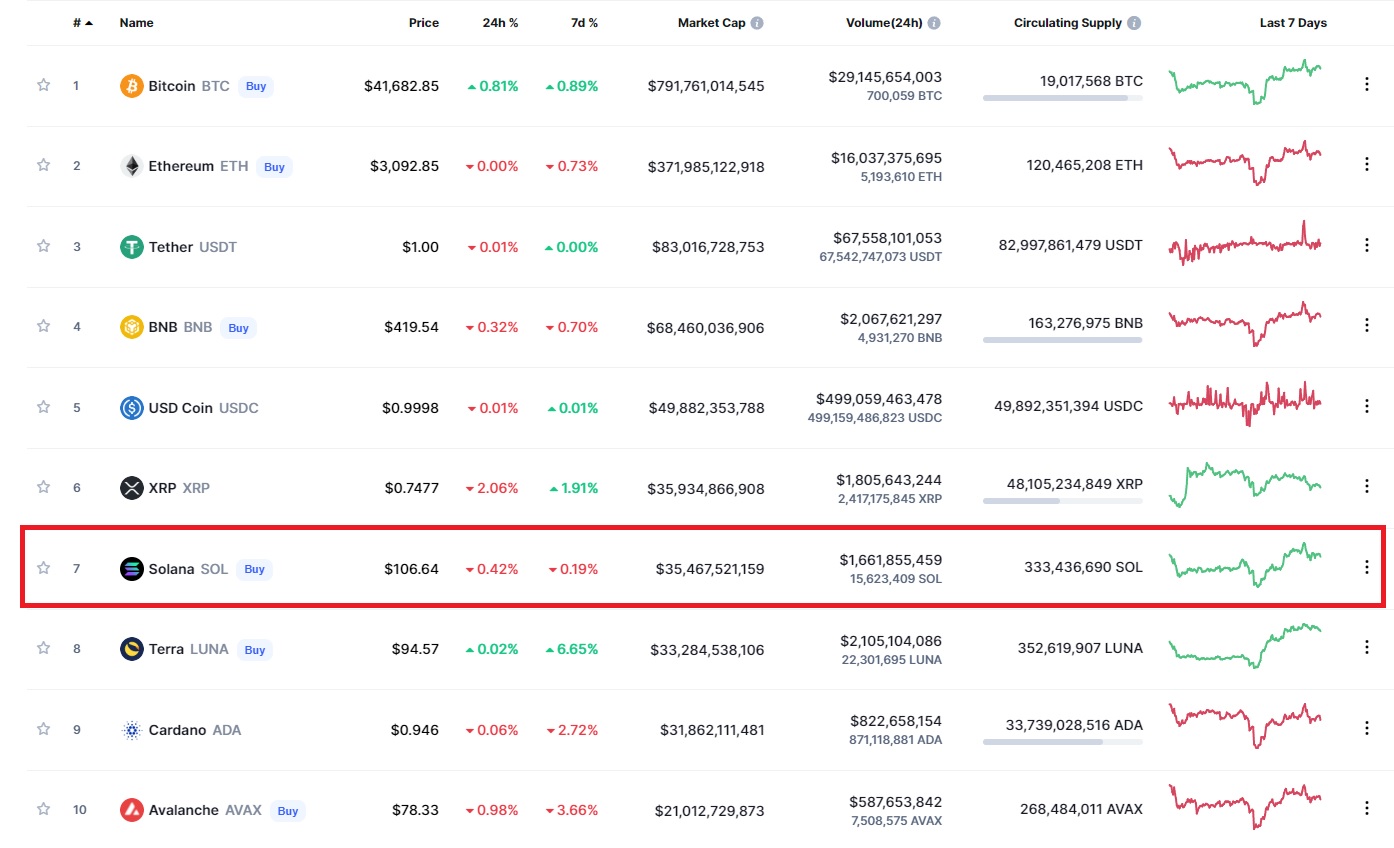

Specifically, Solana has a lot of merit as an investment opportunity compared to other coins. Its large-scale growth over the past two years demonstrates a growing demand for the blockchain and the evolution of NFTs and DeFi will play a major role in Solana’s eventual success (or failure). Solana’s prolific past two years have placed it firmly inside the top ten cryptocurrencies by market capitalization, and it's unlikely to drop far from there for the foreseeable future.

Best Ways To Buy In Solana

There are quite a few ways to buy Solana – these include a brokerage, an exchange (centralized or decentralized), P2P marketplaces or even directly from supported crypto wallets such as the Phantom wallet. The easiest method for beginners to purchase Solana is using a popular centralized exchange. These platforms are often widely available and provide a straightforward process with a secure wallet to store the SOL tokens. Some exchanges will also provide insurance against theft or a hack.

Other Ways of Buying Solana

Using a centralized exchange is probably the easiest and most reliable way to purchase SOL, but this doesn’t mean it’s the only option. There are alternate ways to obtain Solana which include:

- Buying directly from a wallet. Certain wallets allow you to purchase, swap and sell cryptocurrencies within the actual application. It’s worth noting that this practice isn’t typically advised, as the wallets will often charge exorbitant fees to compensate for the convenience.

- Peer-to-peer exchange. You can always purchase Solana from someone that already owns SOL – be it family, or friends, by arranging to send them cash and receiving SOL in your wallet. You can also utilize top P2P crypto platforms such as Craigslist, HODL and Paxful for P2P transactions. Be careful when doing this though, as there are no guarantees you won’t get ripped off.

- ETFs. Cryptocurrency exchange-traded funds (ETFs) are still a relatively new concept. Government regulators are only just beginning to allow their listing and sale on traditional stock markets. These ETFs represent a way to invest in an underlying asset, or industry as a whole, without exposing yourself to the risks of purchasing crypto directly. Solana doesn’t yet have a focused ETF, but if you’re skeptical about buying off an exchange keep an eye out for any future announcements in this space.

- Decentralized exchange (DEX). Using a decentralized exchange for their suite of financial services has exploded in the past few years. Popular decentralized crypto exchanges such as Uniswap, Sushiswap and Serum regularly see 24h volume in excess of $100 million. You can use a DEX to swap a portion of your existing crypto portfolio for Solana using an algorithm known as an automated market maker (AMM). This process can be a little complicated, and its recommended that beginners avoid this buying method until they’re a bit more comfortable.

What Are The Risks of Buying Solana?

Solana is one of the most popular and secure cryptocurrency assets out there today. Its huge community and impressive functionality mean that it is better placed to hold its value than some lesser-known alternatives. However, this does not mean that buying Solana is risk-free.

Solana is still a cryptocurrency, where even the most stable of assets are notoriously volatile. The market often moves in tandem based on speculation, so Solana has the potential to rapidly plummet in value for no real reason other than investor and public sentiment.

Some fintech experts have argued that Solana’s hybrid model of proof-of-stake/proof-of-hybrid makes it more susceptible to security breaches. The network and its associated applications have been the subject of hacks in the past. However, purchasing SOL on an exchange is usually a pretty safe and straightforward process, but these platforms can be attacked and result in lost assets.

What Can You Do With Solana After Purchase?

Solana is one of the busiest and most popular blockchain ecosystems out there. For those that have purchased SOL and wish to make use of it (as opposed to leaving it idle in a wallet), there are several options to maximize the purchase:

- Staking to earn SOL rewards. Quite a large number of popular exchanges now support on-platform staking. Staking is the process of locking up your tokens in a network in exchange for additional tokens as a reward. It is a lot like earning interest on a long-term savings account, with rates usually around 6% APY (does not include network inflation metrics). While staking on an exchange is relatively low-risk, it is a good idea to read our guide on the best ways to stake Solana to get a full understanding.

- Medium of exchange. While most will likely hold onto SOL longer-term, some marketplaces and platforms accept SOL, and other cryptocurrencies, as a transaction method.

- Participate in the Solana ecosystem. SOL has an impressive range of decentralized apps (dApps) running on its network. Many of these platforms require users to hold SOL in their wallets before they can access the services. Potential apps include games, financial management and NFT marketplaces.

- Earn passive interest in Solana. More experienced crypto users can leverage DeFi earning opportunities to earn passive income on their investments. These processes can be very confusing and have a lot of risk factors. That said, experienced investors can find Solana savings accounts to earn interest or provide liquidity which can be more lucrative than staking SOL.

What is Solana? A Quick Overview

The idea for Solana came about in 2017 when Anatoly Yakovenko published a whitepaper flaunting new blockchain technology that was 10,000 times faster than current networks like Ethereum. Essentially, Solana is an open-source blockchain network with some of the fastest processing speeds in the industry. Its ability to deploy smart contracts, known as “programs”, has made it a hub for decentralized applications and NFT collections.

The network operates on a hybrid Proof-of-stake/Proof-of-hybrid consensus mechanism that allows Solana’s superior scalability. The growing community of dApps, combined with greater demand for decentralized financial services, has made Solana one of the most popular blockchains for pundits to use and invest in.

SOL is the native token of Solana’s burgeoning ecosystem and has a myriad of utilities – paying transaction fees, participating in-network dApps, staking, governance and as a medium of exchange. For more information, read our full guide on Solana which explains the blockchain’s underlying technology and how it works.

Where To Store SOL Tokens?

Once Solana has been purchased, the exchange will often provide a native wallet to store the SOL tokens on the user's behalf. This may seem like the easiest way to hold Solana, however, it is not usually recommended long-term.

Although exchanges will typically have advanced security measures in place, leaving Solana in a custodial wallet can be risky. If the exchange is hacked, funds are lost, or it goes bankrupt, the Solana tokens on the exchange could be lost.

There are three options to choose from for storing Solana:

- Leave SOL on the exchange wallet. The majority of centralized exchanges are reliable and will replace lost funds in the event of a major attack. However, insurance funds are not compulsory, and there isn’t always legislation protecting the assets if they are stolen or lost. Furthermore, users will not be able to leverage the Solana funds for use in DeFi earning opportunities like staking or yield farming (although some exchanges do support this).

- Transfer SOL to a ‘hot wallet’. A hot wallet is an application or software, either on your PC or mobile device, that is used to store cryptocurrency. Unlike on an exchange, the owner is in control of any SOL that is held in a hot wallet. Wallets like Solflare, Phantom and Metamask are easy to set up, use and connect with various platforms if you wish to participate in DeFi or send some of your SOL balance elsewhere. However, hot wallets are connected to the internet and can therefore be hacked. Additionally, as these wallets are non-custodial, if the owner loses the password or seed phrase, the Solana tokens may be lost forever.

- Transfer SOL to a hardware wallet. This is the recommended method of storing SOL, as well as any other cryptocurrencies. They are usually small USB devices that connect to a computer and store assets offline. In this sense, they are far more secure than alternative wallets. However, if the hardware wallet is lost or stolen, there’s not much chance of getting the assets back. For more information, read our guide on the best hardware wallets.

Step-By-Step Guide For Buying Solana

1. Compare and select a crypto exchange

The first step to buying Solana is to decide on what type of cryptocurrency services to use. There are several options which include fiat-to-crypto exchanges, trading platforms, decentralized exchanges and brokerages to choose from. Centralized crypto exchanges are the most commonly used and convenient for beginners which allow individuals to buy, store, trade and sell Solana.

Important aspects to keep in mind when selecting an exchange are:

- Supported countries and accepted fiat currencies. Governments with tight regulatory rules – such as certain US states and China – may be barred from using certain exchanges. For example, residents of Hawaii and New York are unable to use Binance. Furthermore, you will need to investigate the exchange’s supported fiat currencies. While you can typically deposit AUD/GBP/SGD etc. to USD-based exchanges, you will likely incur additional Forex fees that can cut into your profit margins.

- User experience. Certain platforms are designed for experienced traders and will be difficult for newcomers to navigate.

- Volume and liquidity. Using a popular exchange, as well as likely being more reliable, may also help in settling transactions faster with less slippage and tighter spreads.

- Fees. Low fees are one of the most important factors for investors when deciding on a platform. It’s important to consider more than just transaction fees. Exchanges may come with withdrawal and deposit fees, as well as ‘hidden’ fees such as spreads (the difference between an asset’s purchase price and its actual price).

- Security. Analyzing an exchange’s security history and protocol (have they suffered any hacks? Do they have insurance for such an event?) is a significant factor in choosing a platform. Some exchanges are more transparent than others with their security measures, and you should never use a platform that doesn’t offer 2FA.

- Customer service. Some exchanges are renowned for their customer support, offering 24/7 live chat and active phone lines. Others are lacking in this regard, and it may take multiple days to receive help for any issues. It’s worth checking websites like Trustpilot or reading Hedge With Crypto’s reviews to get an idea of customer support reliability.

For this article, we will demonstrate buying SOL using the Binance exchange. This is not a specific endorsement of Binance, and user's decision-making process may end up on a completely different platform. However, Binance in particular has the highest trading volume for Solana which means less slippage in placing orders. Moreover, the trading fees start at 0.1% and can be decreased with higher trading volumes or staking BNB coins.

2. Register an account with the exchange

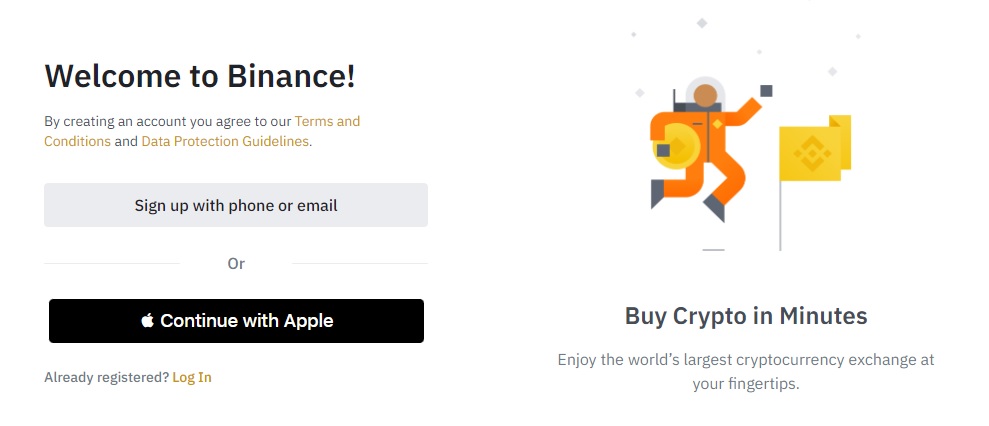

Create an account with a cryptocurrency exchange such as Binance. Select a country of residence and enter a valid email address or phone number. Binance, like some other exchanges, lets users connect with an Apple account to speed up the registration process. For most exchanges, a code will be sent to the provided email address or phone. Enter it, and the account will be activated.

To buy Solana with a fiat currency such as USD, GBP, EUR or AUD, an identity verification process will need to be completed. Passing the verification process will differ among exchanges, but typically basic information (date of birth, residential address), as well as images of government-issued documentation will need to be submitted. This may be a proof of residency, driver’s license, passport, bank statement or a combination of the above. This information is collected by the exchange to comply with the international Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

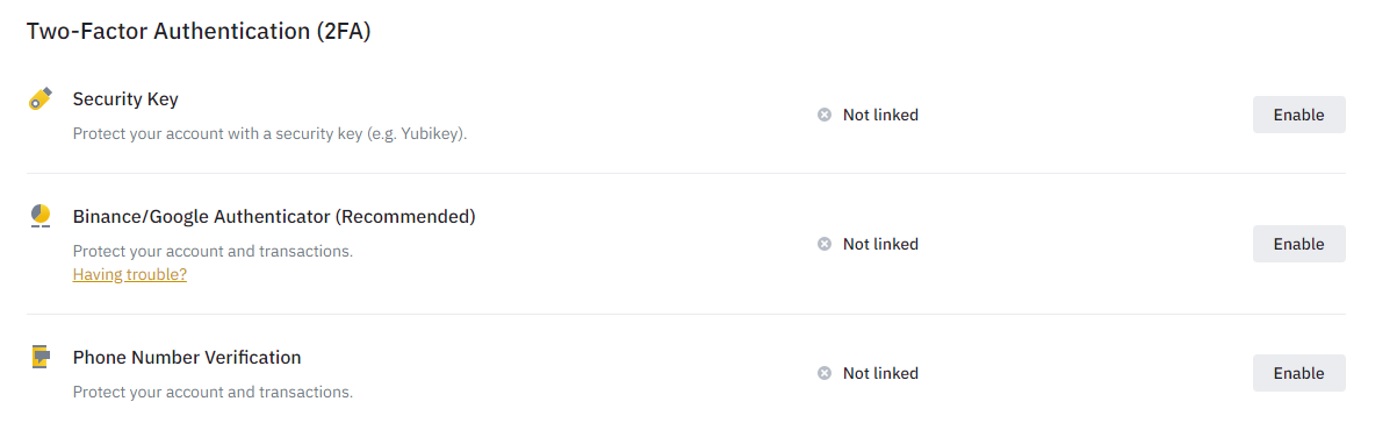

For additional account security, it is also recommended to activate 2 Factor Authentication which adds another security layer for account login and withdrawal requests. To do so on Binance, go to the profile menu (the grey icon in the top right of the screen) and select ‘Security’. The different options for 2FA can be selected which include email, mobile, Google App or key verifications.

3. Deposit funds

The next step is to deposit funds to the account or transfer cryptocurrency from another trading platform or wallet. For those that are buying crypto for the first time using fiat currency, exchanges provide several on-ramp options to deposit money including wire transfer, bank transfer, credit/debit cards and Faster Payments. There are usually minimum limits and payment fees for each supported payment method which can vary on the investor's place of origin.

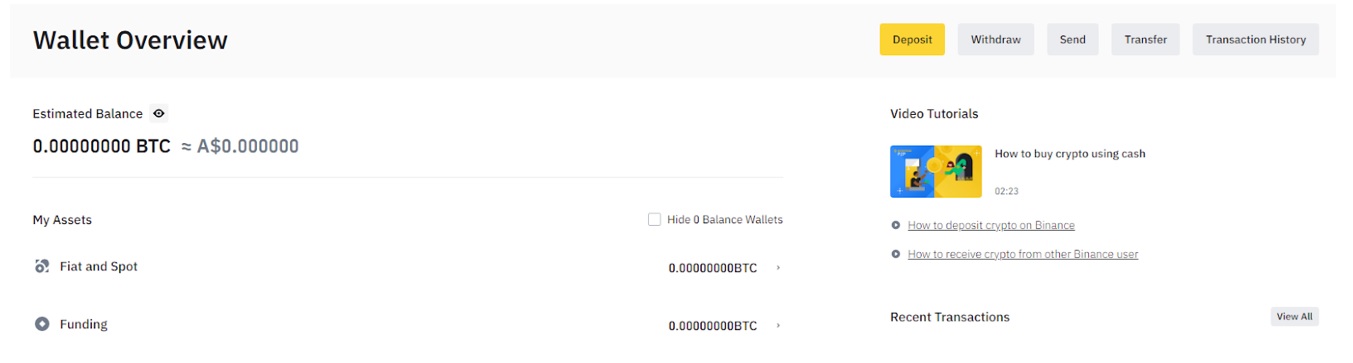

For example, using Binance – navigate to the wallet and click ‘Deposit’ from the top bar. Binance offers four different ways to fund your account – fiat, crypto, instant buy with a debit/credit card, and P2P. Select the preferred method. Next, choose a supported currency and desired deposit method. Take note of any deposit fees that may come with the transaction.

Finally, input the amount of fiat (or crypto) to deposit and confirm the transaction. Depending on the deposit method selected, the funds should be transferred to the Binance account anywhere between 10 seconds to a few days after the order is processed.

4. Buy Solana

Once an account is funded with money, the last step is to find and choose Solana in the asset list and click buy. Depending on the exchange, the way to purchase Solana will be a simple order form or using an advanced trading platform with different order types.

For Binance users, select ‘Cash Balance’ from the dropdown and then the ‘Buy Crypto’ menu. Take note of the minimum purchase value and input the amount to spend on SOL. Using the deposited funds, choose the amount to spend on Solana. More advanced traders may wish to utilize their exchange’s markets, which can include order options like Stop, Limit and Market, as well as other trading pairs.

Once purchased, the amount of Solana that will be received will usually be shown at the time of the transaction. Review and complete the trade and the purchased amount of Solana will arrive near-instantly in the user's wallet, although it can take longer depending on the specific platform or wallet.

Related: How long to send Solana from Binance?

How To Sell Solana

The process for selling SOL is almost identical to buying it. The easiest method is to use the same exchange that Solana was purchased on initially.

- Head to a centralized exchange like Binance, FTX, Kraken or Coinbase. If SOL is not stored in the exchange wallet already, send it using the supplied wallet addresses. To receive SOL on Binance, navigate to the Solana wallet and select ‘Deposit’. This will show the unique SOL address to transfer the funds.

- Now that SOL is all in one place, most platforms will allow selling it directly from the wallet. Click on the ‘Sell’ button next to the asset (in this case, Solana) to transact.

- If the exchange wallet doesn’t let users sell directly from there, it is likely the platform will have a ‘Buy/Sell’ hub or a ‘Markets page.’ This allows users to choose Solana to sell.

- Next, choose a Solana trading pair. This can include converting Solana back to a supported fiat currency, or swapping it for different cryptos.

- Input the amount of SOL to sell. Confirm the transaction and the funds should arrive in the exchange account within a few minutes, depending on the platform being used.

- Once sold, the funds can be withdrawn to a bank account, or kept on the platform to buy other cryptocurrencies in the future.

Frequently Asked Questions

Can US citizens buy Solana?

Yes, as long as they are using an exchange that can be used in the United States. It’s worth noting that the number of exchanges that are legal in the USA are limited from being used in certain states, particularly New York and Hawaii.

Can I buy a portion of SOL?

Yes, SOL can be purchased fractionally. While Solana isn’t as expensive as Bitcoin or Ethereum, it isn’t exactly cheap, either. Small and first-time investors may only want to deposit $100 or less to their exchange accounts. If this describes you, it is important to take note of various exchange minimum deposits and trade orders when signing up.

Is Solana better than ETH?

Solana is a much faster and far more efficient cryptocurrency than Ethereum. Although Solana’s ecosystem is rapidly growing, it is still much smaller than Ethereum’s and, at the time of writing, has significantly fewer applications hosted on the network.