How Many Cryptos Have Failed? List of Dead Coins That Went Bust

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own inquiries.

Key takeaways:

- It is estimated that 1,700 to 2,500 cryptocurrencies have disappeared from the market and no longer are in circulation, have intrinsic value, or utility.

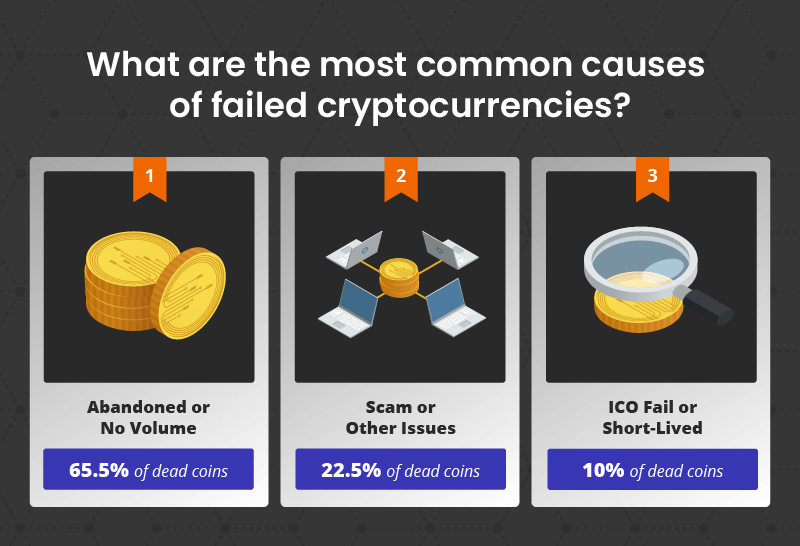

- Various reasons can cause failed cryptos including abandonment (65.5%), scams or other issues (22.5%), ICO fail, or short-lived (10%).

- Leading indicators of potentially failed cryptocurrencies are low volume (99.% of dead coins), not listed on exchanges (99.2% of dead coins), and inactive development (98.1% of dead coins).

TABLE OF CONTENTS

Dead Coins In A Nutshell

Most platforms define failed cryptocurrencies as ‘dead coins'. Dead coins are typically cryptos associated with either an abandoned project, a scam, a lack of liquidity, or a combination of all three. It is important to be aware of dead coins as these digital assets can continue to exist within the blockchain ecosystem. Although all value has been stripped, dead coins can still be listed on exchanges and coin aggregators, which creates a hazard for investors.

Thousands of Cryptocurrencies Have Failed

While it is difficult to confirm an exact number, between 1,700 and 2,500 cryptocurrencies are likely to have failed and disappeared from the market. Popular examples of coin failures include LUNA, UST, BCC, and SQUID tokens. Some of the reasons for these cryptos to fail include developers abandoning them, lack of investment and trading volume, rug pulls, and hacks.

These Are The Most Popular Dead Coins

The table below outlines the most high-profile failures the cryptocurrency industry has ever witnessed.

| Failed Cryptocurrency | Reason for failure | Date of failure |

|---|---|---|

| TerraUSD (UST) | Reported as an external attack to devalue the coin | May 2022 |

| Luna (LUNA) | Connected to failed algorithmic stablecoin, TerraUSD (UST) | May 2022 |

| Squid Game (SQUID) | Rug pull (scam) | October 2021 |

| BitConnect (BCC) | Associated exchange closed down | January 2018 |

| SafeMoon (SAFE) | Pump and dump (Scam) | Still operational |

| Ethereum’s DAO (DAO) | Hacked | April 2016 |

| SpaceBIT | Shelved after the team changed to another project | March 2015 |

| GetGems | Lack of funding | Still operational (barely) |

Exploring The Biggest Cryptocurrencies To Have Failed

1. Luna (LUNA)

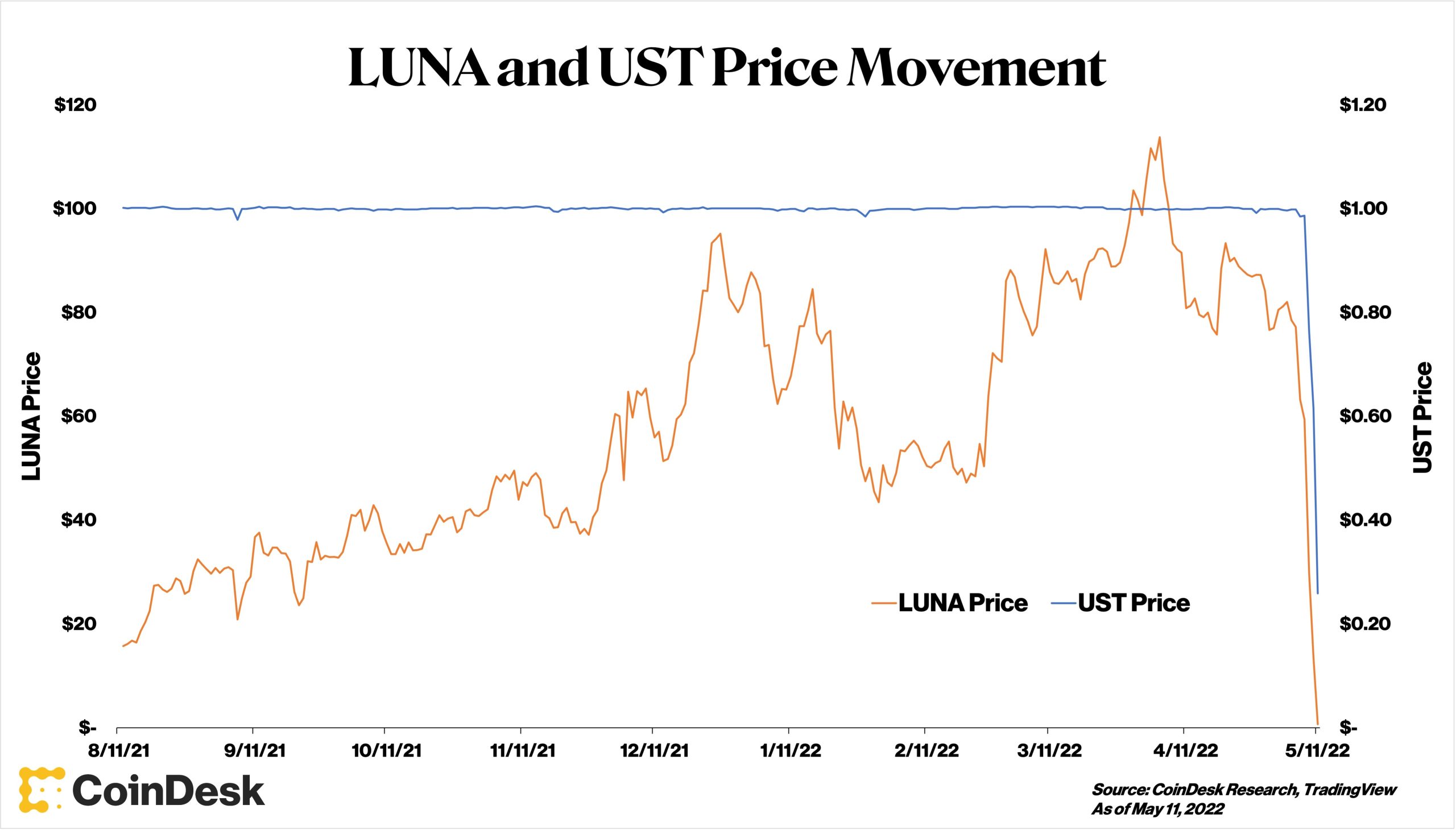

LUNA was the native cryptocurrency of the Terra blockchain, a network designed for the creation and utilization of stablecoins. In November 2021, LUNA reached an all-time high market cap of $44.8 billion and a price of $116. However, in May 2022, Terra’s entire ecosystem collapsed. As a result of extreme selling pressure, Terra’s largest stablecoin, TerraUSD (UST), began to de-peg from $1.

LUNA was used to stabilize and defend the peg as an algorithmic stablecoin. However, the Terra Foundation was unable to regain the peg, and eventually, the price of both UST and LUNA collapsed. LUNA was quickly removed from most exchanges. The fall of LUNA remains one of the biggest, if not the biggest, cryptocurrency failures in the history of the crypto market. It was so large that members of the crypto community dubbed it ‘Mt. Gox 2.0’.

2. TerraUSD (UST)

UST was the leading stablecoin of the Terra blockchain. Thanks to consistent stability, the coin was integrated into several CeFi platforms and DeFi cryptos. However, the 1:1 USD dollar peg of the coin was attacked in May 2022, which led to one of the greatest crypto failures ever witnessed.

UST’s de-peg was caused by a large UST sale on a decentralized stablecoin exchange known as Curve. Many believe that the sale was an intentional attempt to destabilize the entire Terra ecosystem, which eventually happened.

The failure of UST resulted in the abandonment of the entire Terra network, including the native coin, LUNA. TerraUSD was removed from all major cryptocurrency exchanges.

3. Squid Game (SQUID)

Due to the hype associated with the newly released TV series Squid Game, a set of unknown developers released an accompanying Squid Game token. After launching in October 2021, SQUID climbed 23,000,000% in a single week before quickly collapsing back to 0.

Marketed as a utility token for a play-to-earn game, the developers of SQUID used a backdoor within its code to access funds held within a decentralized exchange liquidity pool. After the malicious creators exited with liquidity, the price of the coin collapsed, a move more commonly referred to as a ‘rug pull. According to reports, the developers of SQUID stole approximately $3.4 million worth of assets from investors.

4. BitConnect (BCC)

BCC was the native token of BitConnect, a platform that allowed investors to earn interest on Bitcoin. Investors could swap BTC for the BCC token and earn interest while holding it. It was claimed that high returns were the result of a proprietary trading bot that could spot opportunities in the market. At its peak, the BCC token reached $400 per token.

However, in January 2018, authorities quickly closed the platform due to concerns that it was a Bitcoin Ponzi scheme. The extent of the Ponzi scheme was revealed in early 2022 when the founder, Satish Kumbhani, was formally indicted by the SEC and charged with a range of fraud charges. After the closure of the exchange, the BCC token plunged 90% and was quickly delisted from all crypto platforms, leaving thousands of investors holding the dead coin.

5. SafeMoon (SAFE)

In 2021 a cryptocurrency called SafeMoon, also known as SAFE, was released and quickly garnered attention on social media. Thanks to a well-implemented marketing scheme, that involved getting the backing of several celebrity figures, the SAFE token became widely known within the crypto industry.

The cryptocurrency offered an unusual mechanic whereby 5% of every transaction went back to the holders of SAFE, thereby encouraging investors to hold it. 5% of every transaction was also destroyed.

However, in 2022, several crypto lawsuits were filed against both the founders and promoters of SafeMoon for artificially uplifting prices. Although the coin is still tradable and continues to hold a small community of followers, the coin has been removed from the majority of platforms. To avoid these schemes, here's an article on how to spot a crypto pump and dump before they happen.

6. Ethereum’s DAO

In 2016, Ethereum network members launched one of the first-ever decentralized autonomous organizations (DAOs). Known as ‘The DAO’ or Genesis DAO, the group utilized a native token to generate funds that could then be used to support new ideas or protocols.

The plan was to allow token holders to vote for the most promising projects and then receive a proportion of any profits generated. Unfortunately, after only 3 months of operation, The DAO was one of the biggest DeFi hacks with 3.6 million ETH drained worth $70 million at the time.

To reverse the transaction and, therefore, refund the lost ETH, it was agreed that the Ethereum blockchain would undergo a hard fork. However, this did not sit well with a large percentage of Ethereum users, as it was seen as going against what blockchain technology stands for.

Alongside disagreements, The DAO token was delisted from Poloniex and Kraken exchanges and then served a lawsuit from the SEC stating that The DAO had violated securities laws. The token was eventually abandoned altogether in 2017.

7. SpaceBIT

SpaceBIT was one of the crypto industry’s earliest failures. The project initially garnered huge publicity in 2014 on the back of broad ambitions to make digital currency transactions accessible anywhere globally. Marketed as a decentralized space company, satellites were even launched into space to facilitate the network's infrastructure.

However, a prototype for the network was never launched, and eventually, news from the project dried up. All marketing from the project disappeared in early 2015.

8. GetGems

Finally, we have GetGems, another high-profile project focused on disrupting the social media industry. Built using blockchain technology, GetGem planned to develop a social media platform that allowed users to generate revenue from watching advertisements.

Although the project was highly hyped, a crowd sale in late 2014 fell flat, raising only $111,000. Shortly after the crowd sale, the momentum for the project started to dwindle, and updates from the project eventually stopped altogether in 2017.

Why Do Cryptocurrencies Fail?

Cryptocurrencies and crypto projects fail for a host of different reasons. By understanding those reasons, crypto investors can place themselves in a much stronger position when building a crypto portfolio. The most common reasons that have caused crypto projects to fail are:

- Saturated market. Although cryptocurrencies have only existed for a little over a decade, there are well over 3000 cryptocurrencies in existence, leading to severe oversaturation. While many crypto projects are created with the best of intentions, the high level of competition can make it incredibly difficult for cryptos to become widely adopted. Unless a crypto coin is classed as a ‘first mover’ or manages to stand out from the crowd due to novel utility, it can be almost impossible for a cryptocurrency to become recognized.

- Lack of liquidity. A side effect of oversaturation is low liquidity. If interest in a project is low, liquidity often falls. When liquidity is low, it can be more difficult for investors to buy and sell. Many platforms consider crypto to be ‘dead’ if the trading volume of the coin is less than $1,000 during the previous 3 months.

- It must solve a problem. The majority of successful cryptocurrencies are designed with utility in mind. However, there are also thousands of cryptocurrencies that are created with no particular purpose. While there are examples of joke or meme coin cryptocurrencies doing well, such as Dogecoin, these are exceptions to the rule.

- Inexperienced teams. A lack of true utility can often stem from an inexperienced leadership team. The most successful cryptocurrency projects are run like a business. While people can be excellent at coding and generating ideas, it is the implementation of ideas that leads to success. If the development team behind a cryptocurrency project is inexperienced in the world of business, the chances are higher that the project will fail.

- Scams. Unfortunately, creating a cryptocurrency is almost too easy, making the crypto market advantageous to malicious parties and scams. There are numerous examples of crypto scams that involve rug pull and investment schemes that are abandoned once enough money has been taken from investors. Once liquidity has been drained from a scam ecosystem, malicious actors abandon the crypto coins, leaving them ‘dead’ in the market.

- Lack of monetization. Every cryptocurrency project requires funding to remain operational. Early funds are often used to pay for developers and marketing so that a project can get off the ground. Thanks to Initial Coin Offerings (ICOs) and incubator platforms it has never been easier to generate funding for a project from both private and public investors. However, private and public investors need to eventually see returns from an initial investment. If a project fails to generate lucrative profits, investment funds can quickly be pulled and a crypto project can easily fall by the wayside.

The Most Common Causes Of Failed Cryptocurrencies

Now that we have examined why some cryptocurrencies fail, we can examine the data, looking at lists of failed cryptocurrencies to find the most common reasons cryptocurrencies fail to flourish.

- Abandoned or No Volume (65.5% of dead coins). Legitimate cryptocurrency projects always begin with high hopes as developers believe investors will leap into their currency. However, if investors show little interest in the coin it can quickly be abandoned due to a lack of trading volume. More than 65% of dead cryptocurrency projects have failed thanks to low or no trading volumes, often as a result of not being listed on the biggest exchanges.

- Scam or Other Issues (22.5% of dead coins). Crypto scams involve developers luring in investors with promises of huge returns only to disappear with the funds, leaving those who bought into the currency with a worthless asset. Rug pulls are the most high-profile cryptocurrency scam. The development team ‘pumps up’ a token’s value with excessive marketing before making off with the coin’s liquidity. More than 20% of dead coins have been scammed.

- ICO Fail or Short-Lived (10.0% of dead coins). Since the ICO boom in 2017, initial coin offerings have been the most popular way for developers to raise funding for their projects, issuing their coins or tokens to investors in return for other, more established cryptocurrencies. However, if the project fails to reach its funding target, the money is returned to investors and deemed dead. 10% of cryptocurrencies are considered dead thanks to a failed initial coin offering or the project being short-lived.

The Biggest Indicators Of Failed Cryptocurrencies

Now that we have looked at the best ways to spot a failed cryptocurrency, we have examined thousands of failed coins and the reasons they are considered dead to discover the biggest indicators that a cryptocurrency will fail.

- Not listed on exchanges (99.2% of dead coins). By far the most common indicator of a failed cryptocurrency is the lack of listing on exchanges. If coins are not listed on reputable exchanges this shows that the developers failed to drum up support and investors saw little value in the cryptocurrency in terms of utility and as an asset, causing it to fail. Over 99% of dead coins were not listed on reputable exchanges.

- Low Volume (99.0% of dead coins). Low trading volumes are the second biggest indicator that a cryptocurrency is considered a failure, with 99% of dead coins sharing this characteristic. Suppose only a limited number of people use this cryptocurrency as an asset. In that case, it suggests that the coin either has no real utility or traders simply are not interested, causing the developers to abandon the project.

- Inactive development (98.1% of dead coins). Many cryptocurrencies are open source by nature, so it is easy to check on their progress, as their files are often hosted on publicly accessible cloud storage sites like GitHub. However, if the developers have not updated their code repository within six months, the project will likely be abandoned. 98.1% of failed cryptocurrencies are judged to be inactive, making it the third biggest indicator.

Which Cryptocurrencies Are The Next To Fail?

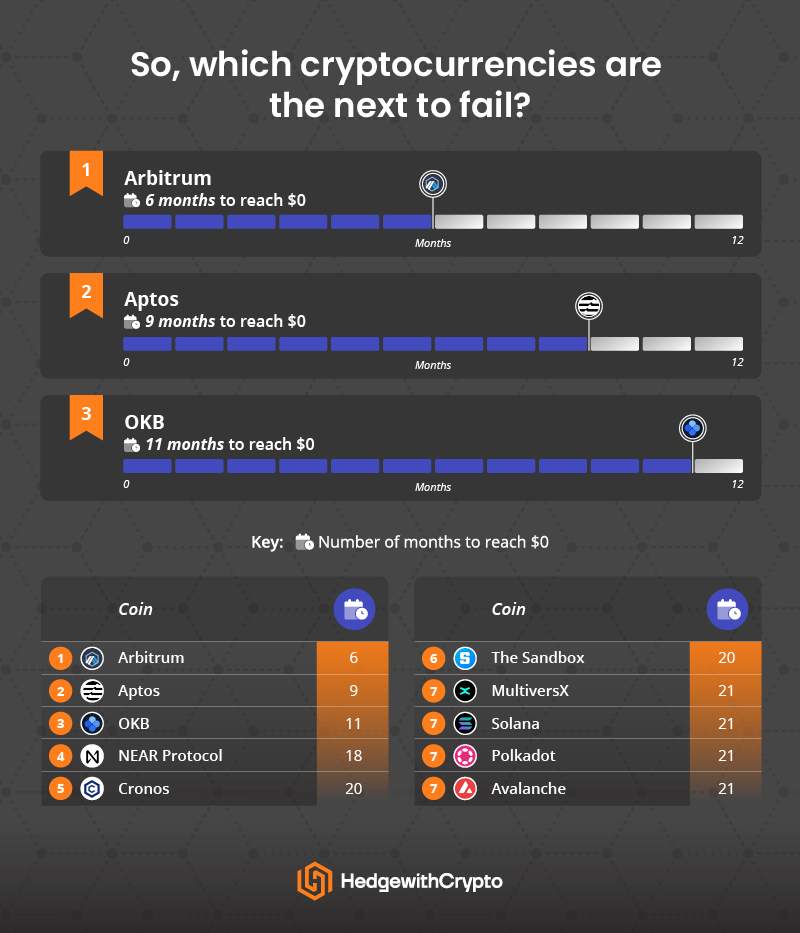

The cryptocurrency market can often be unpredictable, so it is important to know that even the biggest coins can drop in value. Looking at current market trends, we can estimate how long it will take for some of the most popular cryptocurrencies by market cap to reach a value of $0 if current trends continue.

1. Arbitrum (6 months to reach $0)

Arbitrum Bridge is a layer two solution on the Ethereum blockchain created to improve the transaction speed, scalability, and privacy of Ethereum. Its native token ARB is used for the governance of its DAO structure. Despite a slight value increase of 2.80% over the last six months, If current trends continue Arbitrum will be the first of the current top 40 cryptocurrencies by market cap to fail, taking only six months to reach a value of $0.

2. Aptos (9 months to reach $0)

Built with a new smart contract programming language called Move, Aptos is a layer-one proof-of-stake blockchain that can process more than 150,000 transactions per second thanks to its parallel execution engine, which drastically reduces user transaction costs. Having fallen in value by just under 60% over the last six months, if its token price continues to fall at the current rate, it is predicted to reach $0 in nine months.

3. OKB (11 months to reach $0)

The utility token for the OKX crypto exchange, OKB, is used on the platform to pay trading fees and gives users the opportunity to vote on the platform’s governance, too. It also grants users special features including up to 40% off transaction fees, depending on the amount of OKB the user is holding. With its value already dropping by just under 40% since the start of the year, if OKB keeps dropping in value, it will take 11 months to reach $0, if current trends continue.

Best Tips To Avoid Buying Failed Coins

With hundreds of failed cryptocurrencies littering the market, it is useful to know how to avoid projects that may fail in the future. Although not all dead coins are predictable, there are several red flags to look out for.

- Check for a whitepaper. One of the most significant red flags in the cryptocurrency industry, and one that can help to identify potentially dangerous cryptos, is the lack of a whitepaper. Poorly written whitepapers should also cause some concern. A whitepaper is a technical document that details the exact aim of a crypto project and should include all details regarding the associated coin or token. If a whitepaper is not visible on a crypto project website, it is likely best to steer clear.

- Look for utility. When assessing a whitepaper, it is crucial to uncover the exact utility of a cryptocurrency. As previously mentioned, cryptos without utility often don’t survive for long. The use case of a cryptocurrency should be stated within the associated whitepaper and accompanying project website. If the utility of a cryptocurrency coin is ambiguous or there is no utility at all, it might be best to avoid the coin.

- Check liquidity. Another useful metric to look at when evaluating cryptos is liquidity. Low liquidity suggests that there is very little market interest, whereas high liquidity indicates that crypto is being traded frequently between market participants. Crypto screeners and aggregators, such as CoinMarketCap and CoinGecko, are useful websites that allow investors to check the trading volume of specific cryptocurrencies across multiple crypto exchanges.

- Is it too good to be true? While the world comes to grips with crypto regulation, it is still common to find projects with overinflated promises. If a coin or token is associated with a project that is offering returns that are too good to be true, they likely are.

- Check social media. Social media platforms are now a huge marketing avenue that cryptocurrency projects focus on to engage with members of the community. The majority of projects will have a presence on social platforms such as Twitter, Instagram, and Discord. While created to promote a crypto project, social media profiles can also help to uncover cryptocurrency coins that are no longer active. If there has been little to no interaction from social channels for several months, a project may have been abandoned.

- Is the project a ‘first mover?' While there are no guarantees when it comes to crypto, one of the best tips to help avoid cryptos that fail in the future is to look for projects that are the first movers in a particular field. There is still high risk, but being a first mover allows a project to capture market share and avoid the dreaded oversaturation that can befall many.

Methodology

The most common causes of failed cryptocurrencies were taken from Coinopsy’s List Of Dead Crypto Coins.

The biggest indicators of failed cryptocurrencies were taken from 99Bitcoins.

Using Coin Market Cap to find the current value of the top 40 cryptocurrencies by market cap, we were able to predict the length of time it would take for each currency to reach a value of $0 by charting the length of time between its peak value and current value, finding the average percentage change per month and diving this by 100.

Data was collected on 06/01/2023.