We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

xdYdX Review

dYdX is a no-KYC perpetual exchange based in the US. Although the platform is well-designed and offers up 2ox leverage, its limited feature set could deter those looking for an all-in-one portal to the crypto world.

Hedge with Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge with Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Bottom line:

dYdX is a well-designed perpetual trading platform that allows users to access derivatives contracts without completing Know-Your-Customer verification. The platform offers a highly competitive fee structure in line with market leaders like Binance.

However, its small range of tradable assets, lack of support for fiat deposits, and in-development mobile app mean that dYdX is only suitable for a specific group of traders. Those seeking a more comprehensive leverage trading platform should check out alternatives like ByBit.

-

Trading Fees:

0.02% (Maker) / 0.05% (Taker)

-

Currency:

USD, EUR, GBP, AUD, CAD, +26 Others

-

Country:

Worldwide (USA allowed with restrictions)

-

Promotion:

None available at this time

How We Rated dYdX

| Review Criteria | Hedge With Crypto Rating |

|---|---|

| Features | 4.4 / 5 |

| Supported Fiat and Deposit Methods | 3.5 / 5 |

| Supported Crypto & Trading Pairs | 3.5 / 5 |

| Fees | 4.2 / 5 |

| Ease of Use | 4.3 / 5 |

| Customer support | 3.5 / 5 |

| Security Measures | 4.5 / 5 |

| Mobile App | 2.5 / 5 |

Pros Explained

- Decentralized. Because dYdX is decentralized, it does not take custody of user funds to store information regarding customer identity. As such, the platform is considered more secure than most centralized exchanges and is a top KYC crypto platform for privacy-focused traders.

- No KYC Requirements. Users can link a wallet to dYdX and begin trading without creating an account or completing Know-Your-Customer (KYC) verification. Not many no-KYC exchanges that support leverage are available, providing an edge to dYdX.

- Competitive Fees. With fee-free trading on the first $100,000 worth of transactions each month and highly competitive fees afterward, dYdX is one of the most cost-effective trading platforms on the market.

Cons Explained

- Limited Number of Assets Unfortunately, dYdX only offers under 40 tradable cryptocurrencies. While the exchange supports the most popular cryptos, its limited range will cause issues for those wishing to trade a diverse range of assets.

- Limited Fiat-to-Crypto Support. dYdX does not offer a native fiat-to-crypto gateway, instead opting to partner with Banxa. Users can only purchase USDC with a credit/debit card, significantly limiting the options available to customers.

- Spot Trading Unsupported. Although dYdX previously offered users the ability to spot trade, it disabled this service in late 2021, citing low demand. While perpetual trading has always made up most of the volume on dYdX, it's essential to be aware of this fact before using the platform.

dYdX Compared and Alternatives

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

|

|

385 |

0.1% (spot) and 0.02% / 0.04% (Futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

Up to $100 welcome bonus |

Visit Binance | Binance Review |

Uniswap Uniswap

|

600+ |

0.3% & network fee |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.4 / 5 |

None available at this time |

Visit Uniswap | Uniswap Review |

SushiSwap SushiSwap

|

463+ |

0.3% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.0 / 5 |

None available at this time |

Visit SushiSwap | SushiSwap Review |

dYdX At A Glance

Founded in 2017, dYdX is a decentralized exchange (DEX) headquartered in San Francisco, United States. While the trading platform is focused primarily on perpetual trading, it also offers margin trading. Since dYdX is a decentralized exchange, it is not regulated and does not require KYC verification.

| Exchange Name | dYdX |

| Features | Trading Fee Cashback, Perpetual Trading, Governance Token, Trading Leagues, dYdX Academy |

| Accepted Fiat Currencies | USD, EUR, GBP, AUD, CAD, +26 Others |

| Deposit Methods | Crypto, Credit/Debit Card |

| Supported Cryptocurrencies | 31 |

| Number of Trading Pairs | 31 |

| Trading Fee | 0.02% (Maker) / 0.05% (Taker) |

| Customer Support | Help Center, Live Chat |

| Security Measures | Non-Custodial, Decentralized, Smart Contract Audits |

| Mobile App | Yes (IOS-Only) |

Top dYdX Features Reviewed

Trading Fee Cashback

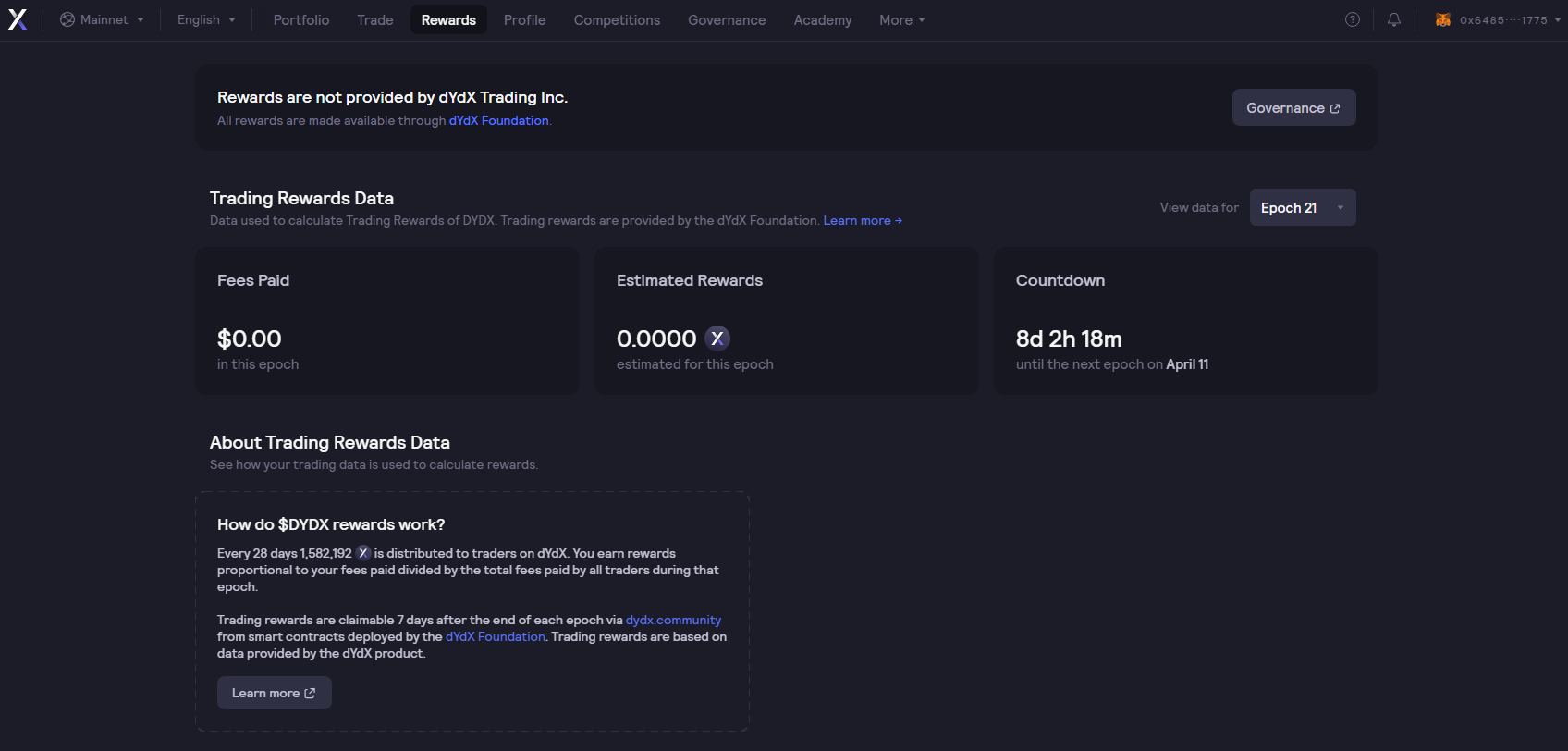

While researching as part of this dYdX review, we found that the exchange offers a rebate equal to 20% of the trading fees a user generates. The program runs based on epochs (a unit of time equivalent to 28 days), with rewards distributed to traders via the DYDX token issuer, the dYdX Foundation.

During its launch, the dYdX Foundation allocated 250 million DYDX tokens for trading rewards, with approximately 1.6 million tokens distributed among users each epoch. Customers can see their accrued earnings via the rewards section, and the dYdX exchange highlights the fees paid to a user, their estimated earnings, and a countdown to the next epoch.

Perpetual Trading

The dYdX platform provides a simple way for users to access perpetual futures contracts. In total, dYdX users can trade 37 assets with 20x leverage on BTC or ETH perpetual contracts and 10x leverage on smaller assets like DOGE.

Unfortunately, dYdX has discontinued its operations as a spot or decentralized margin trading platform, meaning that users can no longer access these markets or withdraw cryptocurrency other than USD Coin (USDC).

DYDX Token

Aiming to compete with products from other crypto exchanges, like BNB or CRO, dYdX has created its governance token aptly called DYDX. The asset boasts a fixed supply of 1 billion tokens, around 15.6% of which is currently circulating, and grants holders the ability to create or vote on proposals regarding changes to the entire dYdX protocol.

The dYdX team aims for the token to become one of the best staking coins available to traders and investors. To achieve this, dYdX holders are rewarded with trading fee discounts for staking their assets. Furthermore, staking pools run semi-frequently, enabling users to earn passive rewards by holding the token.

| DYDX Staked | Trading Fee Discount |

|---|---|

| ≥ 100 | 3% |

| ≥ 1,000 | 5% |

| ≥ 5,000 | 10% |

| ≥ 10,000 | 15% |

| ≥ 50,000 | 20% |

| ≥ 100,000 | 25% |

| ≥ 200,000 | 30% |

| ≥ 500,000 | 35% |

| ≥ 1,000,000 | 40% |

Trading Leagues

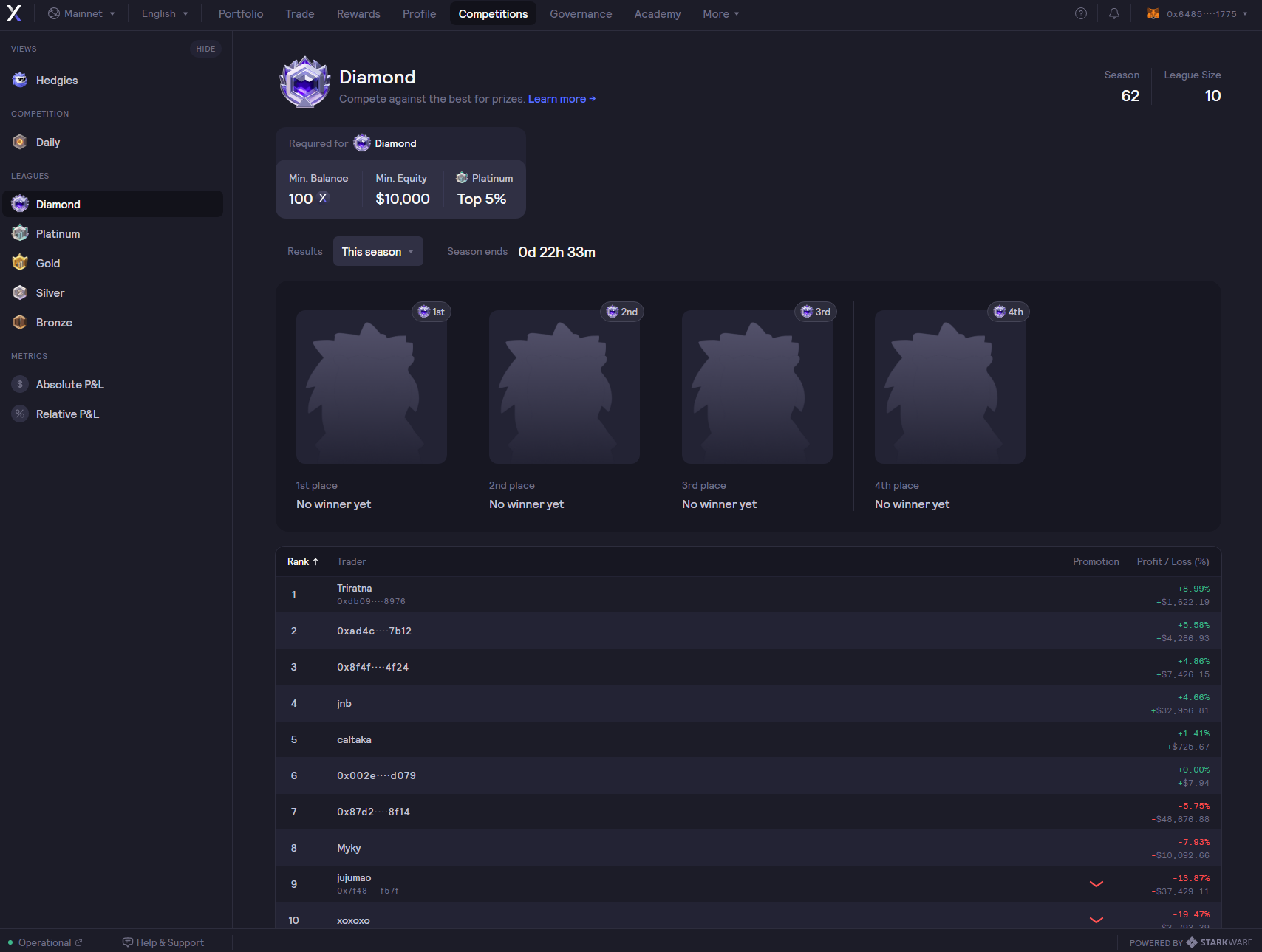

One way that dYdX motivates crypto traders to keep active is through a series of competitions. In contrast to events run by popular centralized exchanges like Binance, dYdX operates as a weekly trading league with users receiving promotions and demotions based on their overall performance.

Each competition lasts for one week, ending Tuesday, with the winners determined by the percentage of total profits and losses over the event period. The best-performing traders are awarded a Hedgie from dYdX's own NFT collection.

Depending on the league, a few requirements exist to be eligible for competitions. The user must have at least $10,000 in equity and hold at least 100 DYDX during the snapshot (which takes place every Tuesday at around 3 pm UTC).

dYdX Academy

For new users and experienced traders wishing to improve their knowledge, dYdX has created an educational platform named the dYdX Academy. Users can browse content, complete brief tests, and even earn rewards in the form of limited edition NFTs, helping to make learning about crypto fun.

The Academy contains a wide range of content on topics, including the difference between a DEX and a centralized exchange, understanding gas fees, and the basics of trading on the dYdX platform. Furthermore, with the Academy containing a mixture of videos and written articles, it's a great tool for anyone, regardless of learning style.

dYdX Account Creation and Verification Requirements

dYdX has arguably the easiest setup process out of any crypto exchange. Rather than creating an account using an email address and password, dYdX directly connects to a crypto wallet and requires the user to sign two transactions to enable API access and prove wallet ownership. Thankfully, dYdX can connect to every mainstream wallet. Some available connections include MetaMask, Trust Wallet, Wallet Connect, and Coinbase Wallet.

Supported Fiat Currencies and Deposit Methods

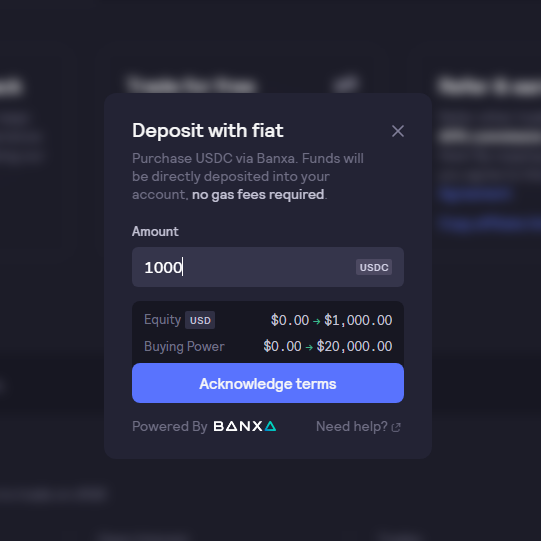

While creating our dYdX review, we were disappointed by the lack of fiat options. dYdX has recently partnered with Banxa, turning the platform into a fiat-to-crypto exchange with support for 31 currencies, including USD, GBP, and EUR. However, users can only buy USDC with a card, hindering accessibility. Furthermore, US residents are prohibited from using the service.

Although it's not uncommon for decentralized exchanges to be strictly crypto-to-crypto, it would be nice for the company to implement a way for users to top up their wallets with fiat natively rather than having to purchase a specific asset via a third party.

Supported Cryptocurrencies and Trading Pairs

Despite being a DEX platform, dYdX offers a comparatively limited number of crypto assets compared to other platforms. Users can buy and sell 37 unique assets, including Bitcoin, Ethereum, XRP, and Dogecoin, denominated in USD with up to 20x leverage.

Unfortunately, the small range of cryptocurrencies offered by the dYdX exchange will likely turn away frequent traders and users wishing to invest in a diverse range of projects.

dYdX Fees

Trading Fees

dYdX focuses on perpetual and leveraged trading rather than spot transactions, meaning the average user's trading volume is higher than on spot platforms. As such, dYdX offers fee-free crypto trading for a user's first $100,000 in trades each month.

However, high-volume traders could still find themselves paying fees. The exchange uses a variable funding rate and a maker/taker fee structure which charges 0.02% (maker) and 0.05% (taker) for each trade a user makes between $100,000 and $1 million in volume. Further discounts are available for larger volumes or staking certain amounts of the DYDX token.

| 30-Day Trading Volume | Trading Fee (Maker/Taker) |

|---|---|

| $0 to $100,000 | 0.00% / 0.00% |

| $100,000 to $1 Million | 0.020% / 0.050% |

| $1 Million to $5 Million | 0.015% / 0.040% |

| $5 Million to $10 Million | 0.010% / 0.035% |

| $10 Million to $50 Million | 0.005% / 0.030% |

| $50 Million to $200 Million | 0% / 0.025% |

| $200 Million+ | 0% / 0.020% |

dYdX Trading Fees Compared

dYdX boasts a competitive fee structure that rewards high-volume traders. Below, we've highlighted how the exchange compares against other popular trading platforms.

| Exchange Name | Perpetual Trading Fees (Maker / Taker) |

|---|---|

| KuCoin | 0.02% / 0.06% |

| dYdX | 0.02% / 0.05% |

| Bybit | 0.01% / 0.06% |

| Binance | 0.02% / 0.04% |

Deposit and Withdrawal Fees

For the most part, dYdX does not charge additional fees to withdraw assets or deposit funds to the platform. However, layer-2 fast withdrawals incur an additional charge equal to 0.1% of the transaction. Additionally, the user must pay the network fee for each transaction.

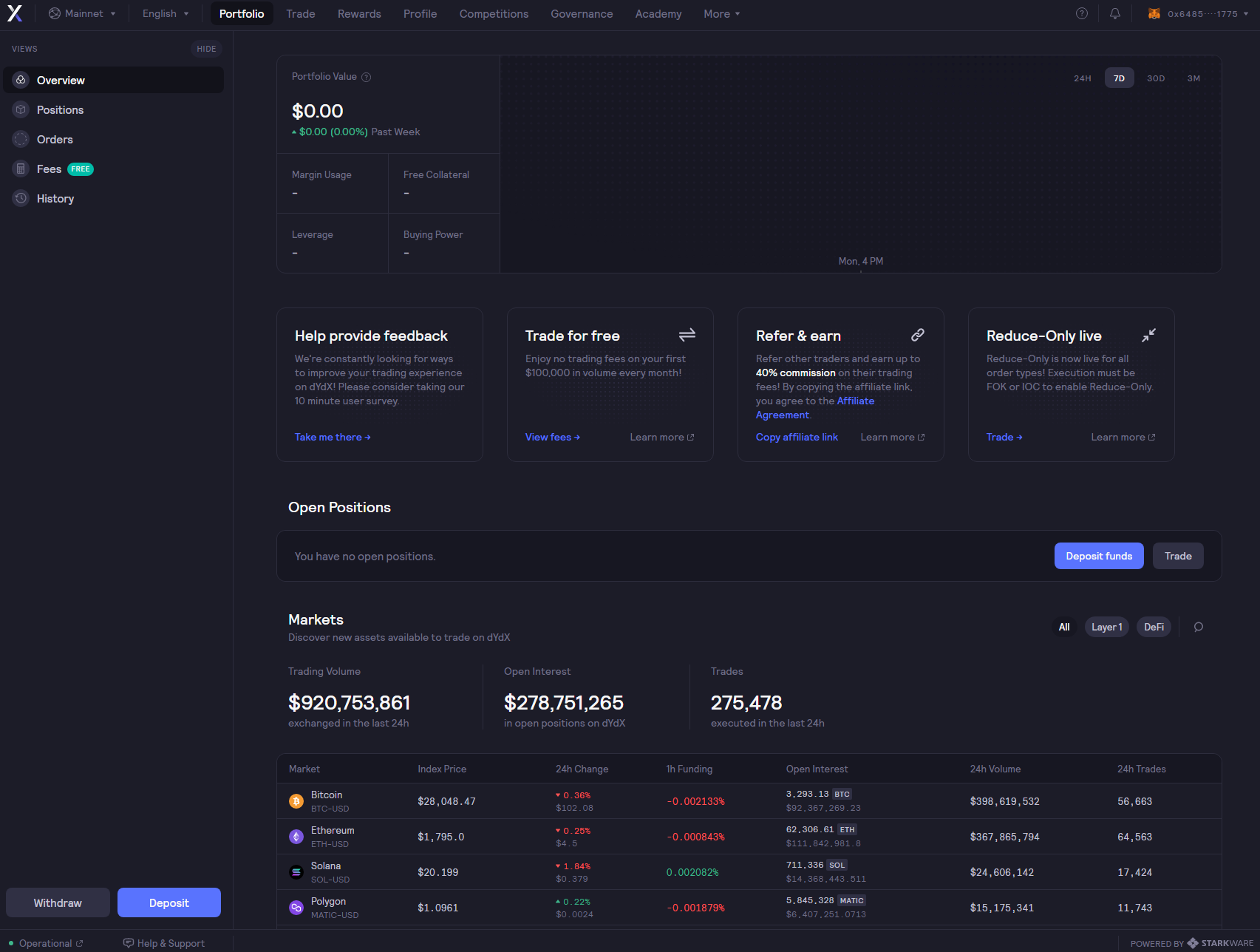

dYdX Ease of Use

Ease of use is among the most important considerations when selecting which platform to conduct trading activities on. If an exchange is needlessly complex and difficult to use, simple processes can take far longer to complete than they should.

To ensure its users have no difficulty using the platform, dYdX has taken a no-frill approach, primarily offering essential trading features. Moreover, the exchange is easily navigated via the top menu, making it simple for customers to find precisely what they want.

The TradingView-powered charting offers many technical indicators and comprehensive drawing tools, making it possible to plot detailed strategies without switching to another crypto charting website. Furthermore, the order-book-based interface means anyone with previous trading experience will have no trouble opening and closing positions on dYdX.

While dYdX is mostly user-friendly and intuitive, we found linking a wallet to the platform cumbersome and had to reaffirm the connection several times, even after clicking the ‘Remember Me' button. Nevertheless, dYdX is a well-made trading platform that is intuitive and an attractive option for experienced and novice traders alike.

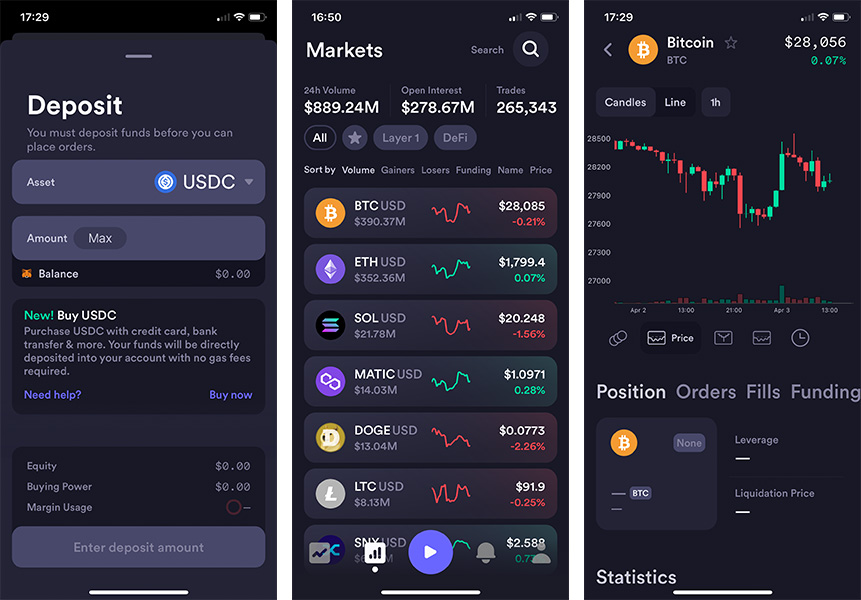

dYdX Mobile App

For users who want to trade crypto without a desktop PC or dedicated trading setup, dYdX has built a mobile app for IOS devices, with support for Android-based operating systems in the works. The app has an average rating of 5 / 5 on the App Store based on six reviews.

Firstly, it's worth noting that the dYdX app boasts an excellent interface that is well-designed, easy to use, and intuitive. Furthermore, the app is responsive, with charts and menus loading quickly. However, while the interface is excellent, the app's features could be better.

Although the app is available to download, it's still in development, with some core functionality unavailable. As such, while users can link a wallet, monitor positions, and browse through tradable assets, there is currently no way to place a trade using the dYdX app.

Analysis tools are equally limited. Users can view each asset's basic candlestick or line chart with time frames ranging from 1 minute to 1 day. However, no drawing tools or technical indicators are present, meaning it's impossible to perform detailed analysis using the app.

While the dYdX app is expected to improve progressively with the team working on adding trading functionality and new features, it's currently almost unusable except for portfolio/position monitoring. As such, those looking for an on-the-go trading solution will have to look elsewhere.

dYdX Customer Support

Customer support is crucial for any platform that deals with sensitive issues or customer funds. To ensure its clients can always get a fast response to a question, dYdX has built a comprehensive help center containing 70 articles on general topics and perpetual trading. Additionally, dYdX offers a live chat for users that require specially tailored assistance.

Unfortunately, the dYdX support team is not available over the weekend. As such, customers with a query on late Friday or Saturday would have to wait till Monday at the earliest for a response which could be problematic for time-sensitive issues.

dYdX Security Measures

The primary way that dYdX ensures its users' safety is through its decentralized nature. Centralized exchanges take custody of users' funds and store sensitive information, including identity documentation and home address. However, dYdX does not own customer data or funds, effectively preventing the risk of account hacking.

To protect the benefits of decentralization, dYdX frequently audits its smart contracts using third-party companies. In doing so, any malicious code can be identified before deploying the contract. This is crucial for a decentralized exchange as they typically connect directly to a user's crypto wallet.