Does KuCoin Report to the IRS?

TABLE OF CONTENTS

Cryptocurrency profits come under the capital gains tax. And since crypto gains have become so common, people have started to wonder if the cryptocurrency exchanges enabling them, such as KuCoin, report the findings to the Internal Revenue Service (IRS). Given that KuCoin is not a regulated cryptocurrency exchange in the USA, the question that arises is whether KuCoin reports to the IRS? This guide will answer whether KuCoin reports to the IRS and, if that is the case, whether it is direct or automatic.

Does KuCoin Report Your Transactions To The IRS?

KuCoin is not a licensed cryptocurrency exchange in the United States. This means it's not allowed in the US to provide any services and, therefore, has no regulatory obligation to disclose any of your personal or crypto transaction details to government entities such as the Internal Revenue Service (IRS) and Securities Exchange Commission (SEC).

Individuals that choose to bypass this using a VPN, do so at their own risk and will need to file their crypto taxes on their own. That said, KuCoin's user agreement states that if a regulatory body requests details of users' cryptocurrency transactions, it will consider this request.

How KuCoin Treats Your Crypto Transactions

According to the KuCoin privacy policy, the exchange collects basic personal details as part of the Know-Your-Customer (KYC) process, and records details of crypto transactions placed (e.g. name of recipient, amount, and timestamps). KuCoin uses these details for a variety of purposes, including providing access to KuCoin's services, confirming their identities, sending emails, and improving its features. The disclosure of details about the crypto transactions that are executed using KuCoin's services is not provided to third parties that are outside of the ‘KuCoin Family'.

The Importance of Reporting Crypto Earnings to the IRS

Under US law, financial gains that are realized from the trading of digital currencies during a financial year will be subject to Capital Gains Tax (CGT) and must be reported to the IRS. While KuCoin doesn't divulge transaction details (unless ordered to by the government), investors must take the necessary steps to provide sufficient information to the IRS for taxation purposes. Failure to report to the IRS can incur heavy penalties such as high-interest rates or even criminal charges.

The importance of summarizing and reporting all crypto transactions made on the KuCoin platform goes beyond the capital gains that have been obtained. Although CGT may only be triggered in these situations, losses must also be reported.

Is There A Limit on KuCoin Earnings that must be reported to the IRS?

Although KuCoin keeps a record of crypto transactions made using its services, it does not provide any of the data to the IRS. If KuCoin is ordered to release such information, there would be no limit in terms of the transaction amounts or timestamps. In comparison, cryptocurrency exchanges like Coinbase and Kraken automatically report to the IRS if the income of a user exceeds $600.

How to Report KuCoin Taxes?

Exporting a summary of the cryptocurrency transactions undertaken on KuCoin during the financial year can be easily done with a crypto tax reporting tool such as CoinLedger. These software platforms have a variety of tools to educate on how to calculate crypto gains and losses to file taxes. For example, CoinLedger offers Short and Long-term gains reports, IRS Form 8949, tax loss harvesting reports, Cryptocurrency Income reports, Audit Trail Reports, and TaxAct Direct reports.

To pay taxes on KuCoin cryptocurrency trades, follow these steps to extract a tax report that can be submitted to the IRS.

Step 1 – Login to KuCoin and create a new API

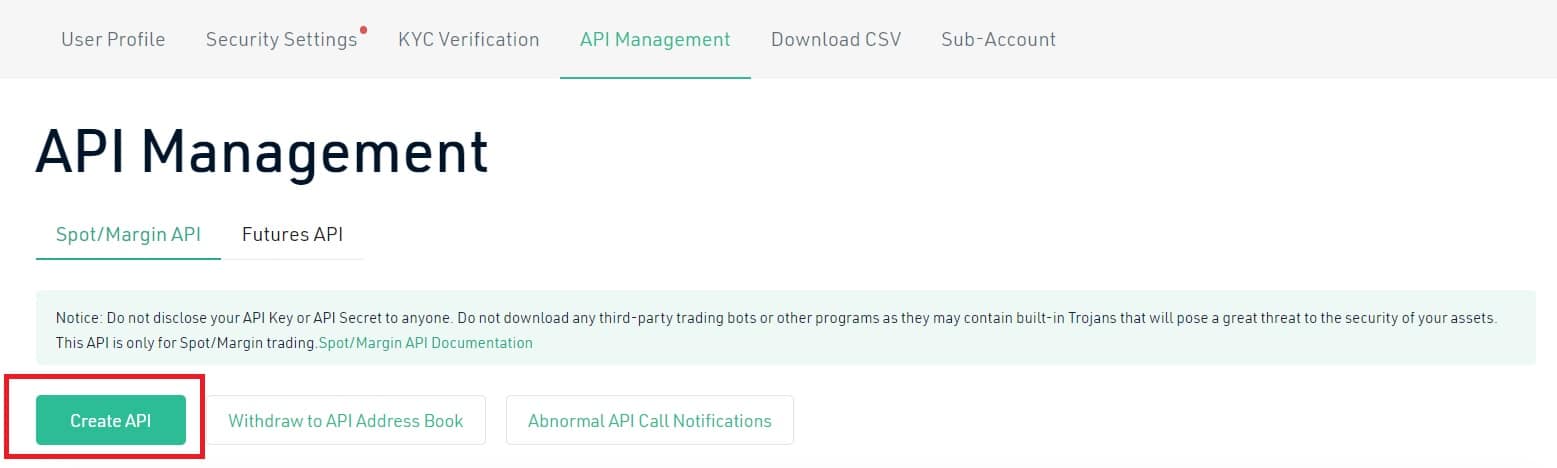

Navigate to ‘API Management' from the drop-down list in the upper-right corner of the interface. Click on ‘Create API' and enter a name and passphrase. Set the API restrictions to ‘General' and ‘No' for IP restrictions.

Step 2 – Copy the API key to the clipboard

Copy the API passphrase to the clipboard since it needs to be used later. Click on ‘Next' to complete 2FA and activate the API.

Step 3 – Open the tax software and select KuCoin

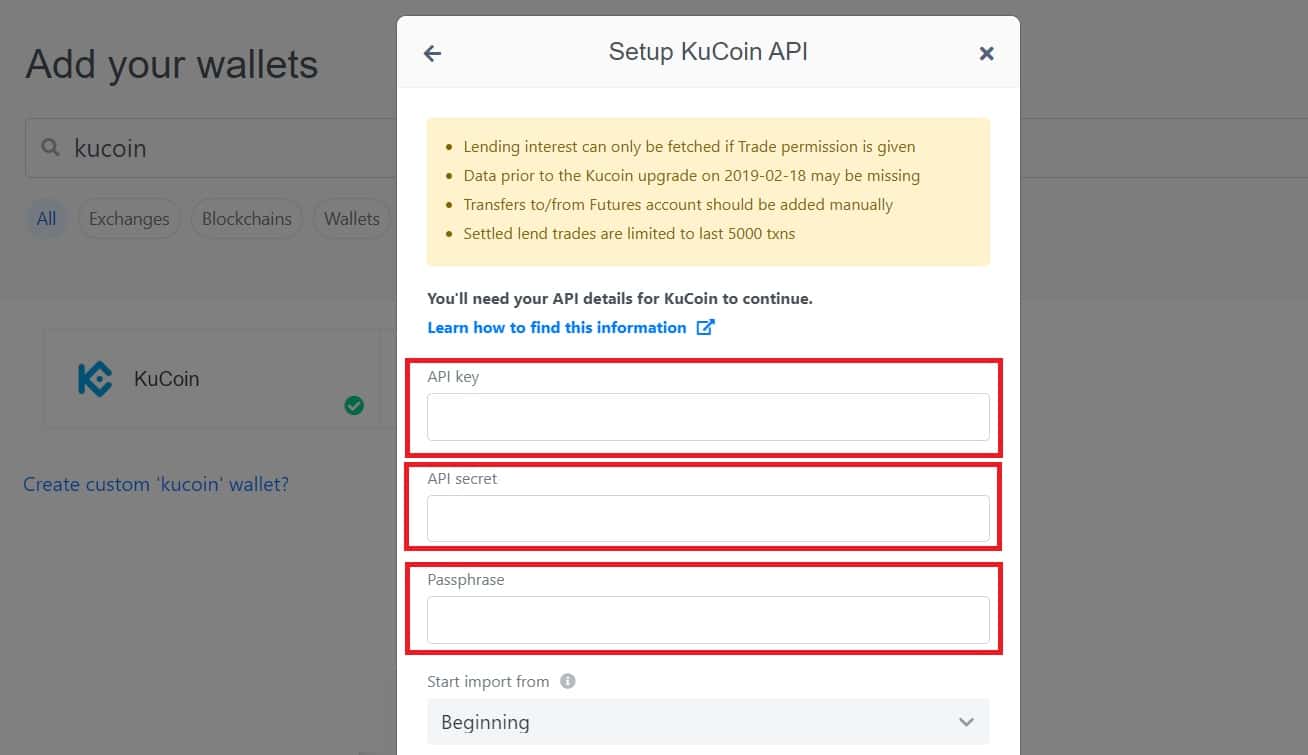

Log into a tax software program and select KuCoin. Select ‘Auto Import' and enter the APY key, API secret, and API passphrase. For this example, we will use Koinly which is a reputable tax program that is compatible with KuCoin.

Step 4 – Generate tax report

Once the API has been connected, click on the ‘Generate Tax Report' button. A full report of the trading activity on KuCoin will be generated.

Frequently Asked Questions

Does KuCoin report transaction details to the IRS?

Although KuCoin retains details about cryptocurrency transactions that investors and traders execute, the exchange does not automatically report the information to the IRS or SEC. This is outlined in KuCoin's privacy policy where data and information about its customers are not released in any way to third parties. Whilst KuCoin does not report to the IRS, it will comply if ordered to do so and does not remove the individual's responsibility to report their crypto taxes.

How do taxes work with KuCoin?

Crypto taxes work with KuCoin in the same way they would work with another cryptocurrency exchange. Trading, staking, or earning interest from lending products or mining pools on KuCoin are considered taxable events and investors must report to the IRS.

Is KuCoin licenced in the USA?

KuCoin is currently not licensed to provide digital currency services in the United States. Investors and traders residing in the USA will not be able to create an account.