5 Biggest Crypto Staking Risks

TABLE OF CONTENTS

- Staking crypto can promise high returns but profits are not guaranteed

- Certain staking arrangements involve locking up tokens for a period of time

- Staking protocols can fail, be hacked, or have funds stolen by validators

- Market crashes and volatility risks can lead to losses without the ability to liquidate

- Staking returns can vary and may not take into account the fees

How Crypto Staking Works

Staking cryptocurrency is a process where owners of the tokens can participate in validating transactions on the blockchain to earn a staking reward. This involves locking up Proof-of-Stake tokens in a supported wallet to receive daily, weekly or monthly pay-outs. The staking reward varies and depends on how users stake their tokens, the amount staked and whether it's for transaction validation or for providing liquidity. To learn more about how staking crypto works, read this article.

Are There Risks To Staking Crypto?

The annualized returns for staking the most popular coins are an attractive way to earn passive income like share dividends. However, no investment is ever 100% risk-free. Cryptocurrency is unregulated in most countries by their Governments and therefore involves higher risks than traditional markets. One of the biggest factors that can result in investors losing money by staking is market swings and crashes. For example, an individual can be staking a coin to earn 5% APY, however, incurs a capital loss if the market declines 10% over the same period.

Most Common Crypto Staking Risks

1. Blockchain Project Can Fail

Crypto holders that are considering staking their coins should not run to the tokens that offer the highest staking rewards. While the founders and developers behind the PoS token can have good intentions, the project can fail due to several reasons. These can include a lack of development, no real-world adoption, token value deterioration leading to a loss of confidence in new crypto investors.

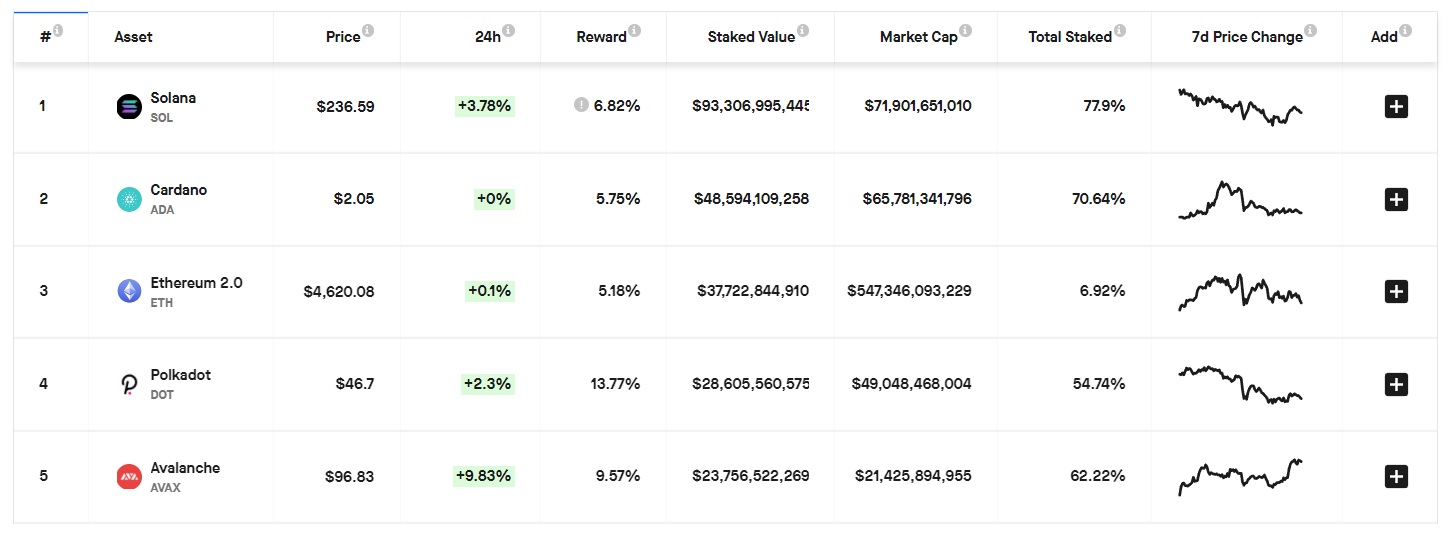

To mitigate the risk of a failing project, it is important to select a blockchain project that has leading-edge technology, a solid roadmap for the next 5 to 10 years and an engaging and active community with a genuine belief the project will succeed. That is, staking the most popular coins by market capitalization is less likely to fail. Metrics such as total amount staked and percentage of token holders staking are a reliable signal of a good PoS project.

2. Tokens are lost, frozen or stolen

Staking cryptocurrency involves delegating tokens to the network in return for rewards. But when it comes to investing, there is always a risk of financial losses. Individuals who stake crypto must be aware of the risks that can result in their funds being hacked, stolen, lost, frozen or the staked token value suddenly going to near-zero. Potential reasons can include:

- Network security is compromised by a 51% attack

- A centralized crypto exchange or wallet is hacked

- Error or mistake transferring funds to staking wallet

- Credentials to exchange or private keys to the wallet are stolen

- The coin is suddenly delisted by an exchange

- Wallet removes support for the particular token

- Exchange or broker goes out of business

According to Bloomberg, more than $200 million worth of cryptocurrencies were lost due to fraudulent activity in 2021. To reduce the risk, a safer option to stake crypto is to consider using a hardware wallet as opposed to using custodial third-party staking platforms.

Hardware wallets maintain ownership of the staked coin private keys and remain in full possession of the owner. Examples of premium hardware wallets that allow PoS staking are the Ledger Nano S and CoolWallet Pro. The only downside is the selection of coins available for staking is quite limited.

3. Market Crashes & Volatility

Market risk is a real threat as cryptocurrencies are known for extreme price volatility swings as more capital flows into the emerging market. The sudden shift in the valuation of crypto-assets can have a high impact on investors that have pledged coins in locked staking arrangements. An individual that is staking crypto for a 3% APY can incur short to mid-term losses without the ability to liquidate during a sudden market crash.

For example, Solana had a price decline of approximately 40% over 12 days in September 2021, which is significant compared to an average staking return of 6.92% APY. The amount earned from staking at the end of the term would not cover the price devaluation in most cases. Therefore, it is important to consider the price volatility risk before staking crypto as capital losses can exceed estimated rewards for staking.

4. Lock Up Periods

Crypto owners that stake coins should be aware that certain tokens have fixed lockup periods. This means any tokens that are delegated cannot be sold or used in transactions when pledged to the blockchain network. There are instances where early redemption has a delay period of up to 7 days for certain tokens. For example, individuals that stake Cosmos must delegate the coins for 21 days.

The main risk associated with staked coins is that the funds cannot be transferred, exchanged or sold during this period. If there is a sudden price drop, the tokens cannot be redeemed quickly and sold on an exchange. Furthermore, at the end of the fixed staking term, potential losses in the market value could negate the rewards earned and reduce the overall performance of a crypto portfolio.

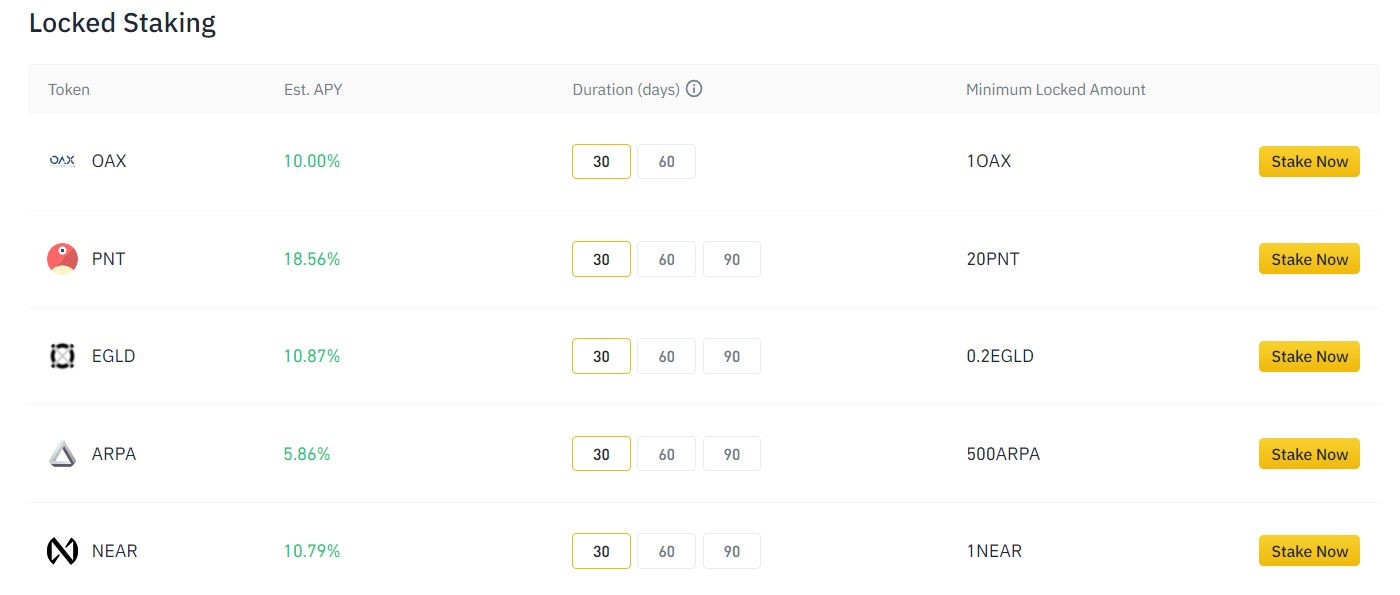

In addition, crypto exchanges such as Binance offer fixed staking arrangements. PoS coins can be delegated for 30, 60 or 90 days to earn slightly higher returns. Un-staking coins before expiry are difficult and can incur early redemption fees of up to 2% on Pancakeswap based on our review. To avoid being locked in, flexible staking is suitable risk mitigation but offers lower APY's.

5. Staking Rewards Can Fluctuate

Crypto investors that stake their assets are subject to staking protocols enforced by the network or supported wallet that determine the staking reward and pay-out frequency. Staking rewards are not guaranteed in many cases as it depends on the number of participants in the staking pool and the number of tokens staked. This presents a risk to investors as the estimated rewards can fluctuate from the moment the funds are committed to the network.

Moreover, new staking coins are susceptible to decreases in rewards. Over time as the network gains popularity, the rewards may reduce as more participants delegate tokens. An example is staking Ethereum 2.0 which had rewards of around 20% APY. At the time of writing, staking ETH.20 rewards averages between 5% and 6%.

A good way to mitigate this risk is to stake reputable and well-established projects with stable estimated returns. This is often the case with the larger PoS coins such as Cardano and Solana. This will help to flatten the volatility of staking rewards in a crypto portfolio in the long run.