We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Coincheck Review

Hedge with Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform, please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge with Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own inquiries.

TABLE OF CONTENTS

Bottom line:

Coincheck offers a small selection of crypto but is the top Bitcoin exchange in Japan with deep liquidity. It also offers an intuitive mobile app, an advanced trading terminal, and crypto lending to earn interest on crypto. The downside of Coincheck is its limited list of supported crypto, high spread fees, and lack of supported fiat currencies other than JPY. You also cannot purchase crypto with a debit or credit card. Moreover, Coincheck does not offer margin or derivatives, which is a disadvantage for those looking for a good exchange in which to trade crypto with margin.

-

Trading Fees:

0.1 – 5.0%

-

Currency:

JPY

-

Country:

Japan

-

Promotion:

None available at this time

How We Rated CoinCheck

| Category | Hedge With Crypto Rating |

|---|---|

| Features | 4.3 / 5 |

| Supported Fiat and Deposit Methods | 3 / 5 |

| Supported Crypto & Trading Pairs | 3.9 / 5 |

| Fees | 3.5 / 5 |

| Ease of Use | 4.5 / 5 |

| Customer support | 4.5 / 5 |

| Security Measures | 4 / 5 |

| Mobile App | 3.5 / 5 |

Coincheck Overview

Coincheck is a top crypto exchange that offers popular cryptos with zero trading fees. Founded in 2014 and headquartered in Japan, Coincheck allows users to buy, trade, and sell 17 cryptocurrencies at live prices, such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP). In addition, Coincheck also offers OTC trading for larger purchases, as well as a new NFT marketplace for buying, selling, and minting NFTs.

Coincheck is designed for both beginners and active traders, with a simple order form for basic trading, and TradingView charts for more advanced trading strategies. Coincheck only accepts Japanese Yen (JPY) fiat currency, but crypto can be deposited to the platform for trading as well. It is available in most countries around the world but is not available to residents of the United States due to regulatory reasons.

Coincheck offers several notable features, including:

- Japan’s largest Bitcoin exchange (by trading volume).

- No trading fees (only spreads apply).

- Adheres to strict regulatory requirements set out by Japan's Financial Services Agency (FSA) and audited by the Japan Blockchain Association.

- A low minimum purchase amount of 500 JPY.

- A crypto lending service where users can earn a maximum of 5% Annual Percentage Yield (APY).

- Cold wallet storage of digital assets.

- An NFT marketplace.

- An OTC trading desk for larger crypto trades.

| Exchange Name | Coincheck |

| Fiat Currency | JPY |

| Cryptocurrency | 17 |

| Payment Type | Cryptocurrency, bank transfer (JPY only) |

| Trading Fee | 0.1% – 5.0% (depending on market) |

| Deposit Fee | None for crypto and JPY deposits via bank transfer Free crypto deposits. Fees may apply to different deposit methods |

| Withdrawal Fee | Varies by withdrawal method and currency |

| Mobile App | Yes |

Coincheck Compared

These exchanges offer a viable alternative to Coincheck, offering similar features and ease of use. These platforms are available worldwide and are examples of top-rated exchanges based on Hedge With Crypto's reviews.

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

|

|

385 |

0.1% (spot) and 0.02% / 0.04% (Futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

Up to $100 welcome bonus |

Visit Binance | Binance Review |

ByBit ByBit

|

331 (608 trading pairs) |

0% (spot), 0.06% / 0.01% (futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

0% trading fees for 30 days (spot only) |

Visit ByBit | ByBit Review |

|

|

222 |

0.16% (maker) and 0.26% (taker) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

None available at this time |

Visit Kraken | Kraken Review |

What Is Coincheck?

Founded in 2014 by Keisuke Wada and Yusuke Otsuka, Coincheck is a Japanese cryptocurrency exchange that provides Japanese residents access to Bitcoin trading. It has since added more cryptocurrencies and crypto products and services and is available in most countries worldwide (except the United States of America). Coincheck aims to be the top exchange in Japan.

Coincheck is regulated by Japan’s Financial Services Agency (FSA) and part of the Japan Virtual Currency Business Operator Association. The platform is unregulated and receives regular audits from the Japan Blockchain Association. Coincheck currently supports 15 different cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and XRP. Coincheck also offers crypto lending that pays up to 5% APY on deposited crypto and an OTC trading desk to support larger clients.

Coincheck recently announced a merger with Thunder Bridge Capital Partners IV Inc to become a publicly-traded company on the Nasdaq exchange in the USA. The deal is expected to close in late 2022.

Coincheck Licencing & Security

Coincheck is a highly regulated and audited exchange by Japan’s government and cryptocurrency-related organizations, including the Financial Services Agency, Japan Virtual Currency Business Operator Association, and the Japan Blockchain Association. Investors and traders in the USA cannot use the Coincheck platform.

However, Coincheck was hacked in 2018 and lost over $500 million in user NEM crypto tokens. This was due to storing all of the NEM tokens in a publicly accessible hot wallet, which they no longer do for any crypto on the platform.

Best Features on CoinCheck Reviewed

Buy Bitcoin & Other Major Cryptocurrencies

Coincheck supports 17 cryptocurrencies that can be bought on the exchange including Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. There is a limited number of available trading pairs as supported crypto can only be purchased using JPY or BTC.

| Supported Crypto | Trading Pairs |

|---|---|

| BTC, ETH, ETC, LSK, XRP, XEM, LTC, BCH, MONA, XLM, QTUM, BAT, IOST, ENJ, OMG, PLT, XYM | JPY and BTC only |

Coincheck's limited list of supported digital assets to buy does not include popular coins such as Solana (SOL) or Avalanche (AVAX). Stablecoins such Tether (USDT), USD Coin (USDC), and TerraUSD (UST) are also absent.

As such, Coincheck is not suitable as an altcoin trading option. Global crypto exchanges with large numbers of supported digital assets as well as allowing JPY to be deposited such as Binance, Huobi or KuCoin will serve as better alternatives.

Recurring Purchases (Reserving)

Coincheck provides investors with the ability to use Dollar Cost Averaging (DCA) for their crypto purchasing. Referred to as “Reserving”, the strategy allows users to incrementally use fiat currencies to purchase crypto in smaller volumes over a period of time rather than trying to ‘time' the market. This approach helps to mitigate against fluctuating prices.

Coincheck users simply need to link their bank account, select a preset amount of crypto to purchase, and choose a schedule (monthly or daily) to enable automating their crypto buying.

There is a minimum monthly purchase requirement of 10,000 JPY and a maximum available of 1,000,000 JPY per month. Daily purchases will be made in 1,000 JPY increments at a minimum. There are also no deposit fees on these recurring plans, making them a low-cost way to purchase crypto regularly.

Crypto Lending

Coincheck has a crypto lending platform that pays out interest to users who lend out their crypto to borrowers. Coincheck pays up to 5.0% APY on these crypto loans, but the interest is not payable until the loan term ends. Loan terms are available from 14 days to 365 days in length, and interest rates vary by term length.

Users can deposit any of the 17 supported crypto for lending, choose a term length, and apply to become a lender. Once the application is approved, the coins are locked into the loan term, and unavailable for withdrawal until the loan term ends, or Coincheck chooses to re-deposit for crypto into a user’s account.

While lending with Coincheck can earn a modest interest rate capped at 5% APY, there are much better places to earn interest on crypto with higher rates and more crypto to choose from.

OTC Trading

Coincheck offers an OTC trade desk to allow larger purchases of a few select cryptocurrencies. Users can make high-volume purchases of any of Coincheck's supported 17 cryptocurrencies. This can result in lower spread fees, as well as less slippage, saving users money on larger orders.

There are minimum purchase amounts for OTC trading as listed below:

| Crypto | Minimum Order |

|---|---|

| BTC | 2.5 BTC |

| ETH | 30 ETH |

| LTC | 790 LTC |

| BCH | 300 BCH |

Note: XRP OTC trading has been suspended, though the asset is still listed in the OTC interface on Coincheck.

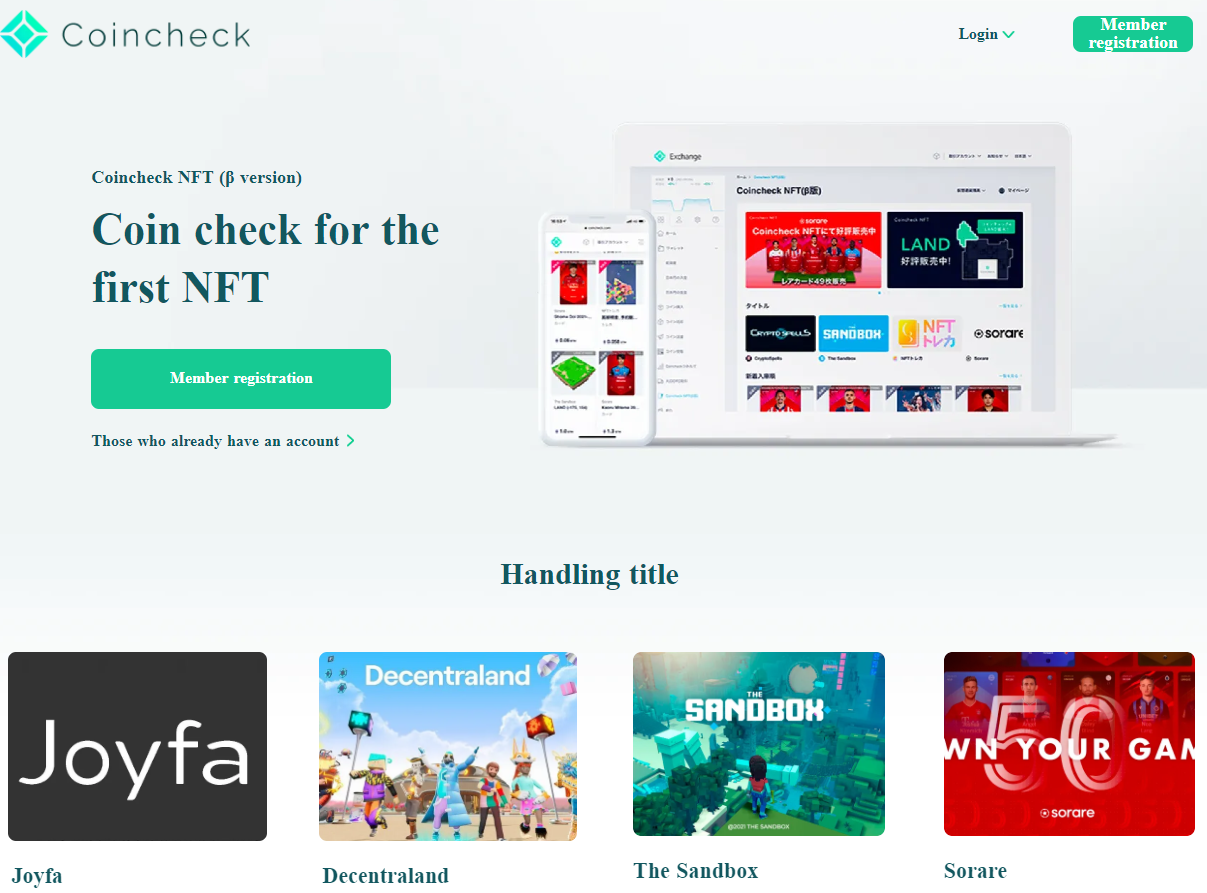

Coincheck NFT Marketplace (Beta)

Coincheck recently launched an NFT marketplace based on the Ethereum blockchain (ERC-721 standard) to allow users to buy and sell NFTs. Popular NFT projects such as Decentraland and The Sandbox are supported, and individual NFTs are listed on the exchange. There are no fees to buy or list an NFT, but Coincheck charges a 10% seller’s fee for NFT trades.

Coincheck also charges withdrawal fees to transfer your NFT off the platform. The fees are tiered based on the current network charges and are as follows:

| Withdrawal fee | Network charges tiers |

|---|---|

| 0.01 ETH | Less than 0.01 ETH |

| 0.02 ETH | Equal or more than 0.01 ETH and less than 0.02 ETH |

| 0.04 ETH | Equal or more than 0.02 ETH and less than 0.04 ETH |

| 0.08 ETH | Equal or more than 0.04 ETH and less than 0.08 ETH |

| 0.16 ETH | 0.08 ETH or higher |

Note: The NFT marketplace is currently in Beta as Coincheck continues to improve the service and add features.

Coincheck Verification

Coincheck requires Know Your Customer (KYC) verification to be completed on all newly created accounts. Accounts that do not complete KYC cannot make deposits, place trades, or withdraw funds. Verification is required to comply with regulatory authorities and prevent money laundering on the platform.

To verify an account, users must provide a legal name, address, and personal identification number on the Coincheck “Identity” account page. They must also submit a picture of a government-issued ID, including a photo of themselves holding the ID, and a second ID.

Finally, users will need to submit proof of residency documents, such as a copy of a utility bill showing a residential address with a date stamp within the past six months. All documents will be submitted to Coincheck, reviewed for accuracy, and then the account will be manually approved for use.

Funding & Limits

The Japanese Yen (JPY) is the only supported fiat currency to be deposited for account funding. JPY deposits can be made via bank transfer, convenience store, or the PayEasy network. Coincheck does not accept deposits via debit or credit card. Accounts can also be financed by transferring any of the 17 supported cryptocurrencies into the wallet.

There are no deposit limits for fiat or crypto deposits. Withdrawal minimums must cover the withdrawal fee for each asset, which varies by currency. A full list of deposits and withdrawal fees and minimums can be found on the Coincheck fees page.

Coincheck Trading & Ease of Use

Coincheck offers a basic crypto order form, as well as an advanced trading platform aimed at experienced traders. Here’s how trading works with Coincheck.

User Interface

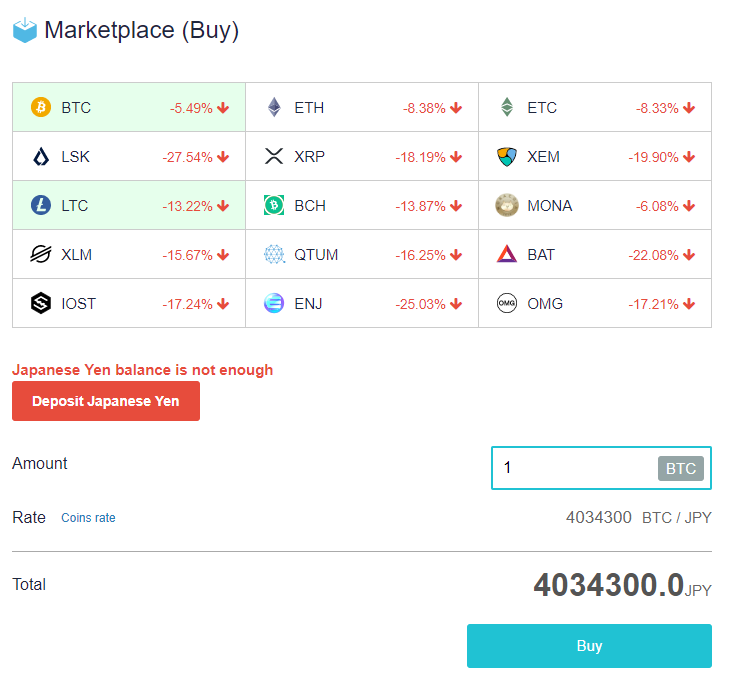

The standard Coincheck interface provides a basic “buy” or “sell” order form that allows users to purchase crypto with JPY or BTC (except Bitcoin, which can only be purchased with JPY). Basic line charts are also available for each cryptocurrency to view its price history.

Users can easily choose one of 17 cryptos to purchase or sell, select the amount of crypto they wish to trade, and execute the transaction. The price quoted for the crypto is set by the exchange and includes up to a 5% spread fee, which the exchange collects. This spread is not obvious and may result in paying much more for crypto than it is currently worth. Learn how crypto spreads are calculated in this guide.

Coincheck also offers a more advanced trading interface referred to as “Tradeview”. The premium TradingView charts are integrated into the interface along with order books, and an active transaction history per asset. The buying and selling panel includes the option to apply stop-loss and market orders.

The TradingView chart integration allows advanced traders to customize their charts with different views, as well as add indicators to overlay on the chart. There is a wide range of time frames and tools to draw trend lines, add indicators, and chart patterns to perfectly time a crypto trade. Some of the indicators that can be applied include:

- Volume

- Relative Strength Index (RSI)

- MACD

- Simple Moving Averages

- Bollinger Bands

- Average True Range, and others.

Despite the inclusion of TradingView charting and its suite of advanced analytical tools and indicators, the interface is fairly basic and stripped back. While this may be suitable for beginner or novice traders, serious traders will likely look elsewhere to platforms such as Binance or ByBit.

Placing Orders

To place an order on Coincheck, users can select their desired trading pair, select a limit or market order, and choose the amount to “Buy” or “Sell” in the order window on the trading interface.

Users can also set stop-loss orders to execute a trade in the case of a falling price, protecting gains or cutting losses in a market downturn. Overall, the order forms are fairly basic but offer just enough control to allow traders to create a trading strategy on the platform.

Coincheck Fees

Coincheck charges zero trading fees for buying, trading, or selling crypto. purchases, trades, and sells. Instead, a spread between 0.1% and 5% applies to trades where the spread is the difference between the buying and selling price of the asset. While this can be as low as 0.1% in normal markets, it can also rise as high as 5% during a turbulent market or where the trading volume is low.

During initial testing, comparing the Coincheck price of Bitcoin on the “Marketplace (Buy)” form vs. the price of Bitcoin on the “Marketplace (Sell)” form, there was over a 5% spread between the prices (4,058,800 JPY purchase vs. 3,814,200 sell), which is a very high fee. This fee may be lower in less volatile markets, but it is very important to understand how much is being charged by exchanges for transactions.

Here’s how Coincheck compares to a few other crypto exchange fees.

| EXCHANGE | TRADING FEE | TOKEN DISCOUNTS |

|---|---|---|

| Coincheck | 0.1% – 5.0% | No |

| Binance | 0.1% | Yes |

| Huobi | 0.2% | Yes |

| Gemini | 0.5% | No |

| Coinbase | 0.5% | No |

Coincheck App

Coincheck offers a mobile app compatible with Android and iOS devices and downloaded by over 1 million users. Based on over 11,000 reviews, the app has an overall 3.7/5 star rating on the Android marketplace, which is not a bad rating but not great. The app can be used to make trades, deposit and withdraw JPY and cryptocurrency, and submit ticket requests to customer support.

The majority of negative feedback related to the platform's high spread fees, ID verification problems, and the app's responsiveness. Coincheck seems to respond to some of the complaints directly, but overall the crypto app seems a bit lackluster compared to others.