This Is How Bitcoin Can Be Hacked

Main takeaways:

- Since its launch in 2008, the Bitcoin network has never been hacked or compromised.

- It is extremely difficult to breach the Bitcoin peer-to-peer (P2P) network due to its inherent security design.

- The application of unique private keys and digitally encoded transactions that are protected by Elliptic curve cryptography are near-impossible to successfully penetrate.

TABLE OF CONTENTS

With a $471 Billion dollar market cap, there is a high financial incentive for hackers to steal Bitcoins. But for Bitcoin to be hacked, a mathematical shortcut would need to be developed to compromise an owner's Bitcoin private key or an event that would disrupt the public ledger to rewrite transactions. To date, no one has exploited any vulnerabilities in Bitcoin, however, the asset should never be taken for granted as being 100% safe and un-hackable. Security is still one of the biggest Bitcoin risks and how to keep your Bitcoin safe, particularly when buying or selling Bitcoin using cryptocurrency exchanges.

Featured Partner

Kraken

Best Exchange To Buy Bitcoin

4.8 out of 5.0

Kraken is a top-rated and regulated exchange best known for its safety and multiple methods to buy Bitcoin and crypto worldwide.

222

USD, GBP, EUR, CAD, CHF, JPY & AUD

Bank transfer, SWIFT, SEPA, debit and credit card

0.16% (maker) and 0.26% (taker)

Explaining What Makes Bitcoin Secure

Blockchain technology is the underlying security infrastructure of Bitcoin and other digital currencies that prevents value being sent across the network from being stolen, duplicated, or destroyed. The strength of the Bitcoin network lies in the high degree of trust, confidence, and transparency of all transactions. The Bitcoin network is protected by SHA-256 encryption for both its Proof-of-Work (PoW) system and verification of transactions that removes the possibility of duplicate transactions.

Each transaction is digitally encoded with specific transaction details, including the previous owner of the Bitcoin being sent, the specific amount, and the recipient's BTC address. As a result, it is not possible to duplicate transactions or spend money twice on the network. Each transaction is encoded with a hash identifier, which comprises a unique string of characters that are verified and added to the blockchain.

The information is broadcast across a vast network of computers known as nodes. The computer networks continuously check and verify that the records are accurate. Therefore, to hack the Bitcoin network, a large number of nodes around the world would need to be compromised.

This Is How Bitcoin Could Be Breached

The decentralized nature of the blockchain makes it extremely difficult for unauthorized third parties to access Bitcoin transactions. A low-likelihood but possible scenario to breach Bitcoin is using a 51% network attack. Hackers would need to compromise miners that control more than 50% of the Bitcoin network's mining hashrate. This would allow the hackers with majority control of the network to interrupt the validation of new blocks and prevent other miners from completing blocks.

Smaller networks that use PoW and have a smaller hash rate can be vulnerable to a 51% attack. For example, Ethereum Classic was compromised 3 times by a 51% attack in September 2020. The attack compromised over 14,000 blocks on the network which resulted in a double-spending of 807,260 ETC, which was valued at $5.6 million. The hackers spent 17.5 BTC ($192K) to acquire the hash power for the attack. Other cryptocurrency projects that have been compromised by similar attacks include Monacoin, Bitcoin Gold, and ZenCash.

How 51% Network Attacks Work

A 51% Bitcoin attack involves a group of miners that take control of more than 50% of the network’s mining power, computing power, or hash rate. A successful 51% attack would allow the attacker to prevent new transactions from occurring or being verified on the blockchain for their financial benefit, including earning all the block rewards.

In the event of a 51% attack on Bitcoin, the attacker can't reverse existing transactions that have already been verified by other miners and broadcast to the network. Therefore, it is very difficult to change the block's reward, create new coins, and steal coins that are not owned by the attacker. This also means lost and stolen Bitcoins can be very difficult to recover, but not impossible.

The Likelihood of a 51% Bitcoin Attack

Bitcoin uses a Proof-of-work system that involves a large group of individuals collaborating to verify transactions on the network. The security of the Bitcoin network is correlated to its size, which results in higher mining hash rates and provides greater protection against corruption of the public ledger using a 51% Bitcoin attack.

A miner or group of miners would need to invest a significant amount of network mining power given the size of the network. With the increase in the adoption of Bitcoin, the probability of an attacker obtaining the resources to overtake the other miners decreases rapidly each day to near-impossible. As Bitcoin miners are compensated for validating transactions on the network by earning block rewards which are currently 12.5 BTC per block, there is a minimal financial incentive to disrupt their own mining business or invest in large computing power to alter a few blocks. This incentive is further reduced after each Bitcoin halving where the reward per block is cut in half.

Bitcoin Is Not Hack-Proof, It Is Technically Possible

To date, Bitcoin has never been hacked or compromised since Satoshi Nakamoto mined the first Bitcoin in 2008. The SHA-256 encryption used by Bitcoin for the Proof-of-Work (PoW) system and transaction verification has so far stood the test of time and remains hack-proof. However, this does not rule out that Bitcoin will never be breached in the future with advancements in quantum computing to crack the mathematical code used in cryptography.

The biggest vulnerability is associated with buying, short selling Bitcoin and storing the asset by owners, and using centralized cryptocurrency exchanges. Exchanges use hot wallets that are connected to the internet to facilitate the deposit and withdrawal of Bitcoin to and from the trading exchange, or to a personal hardware wallet.

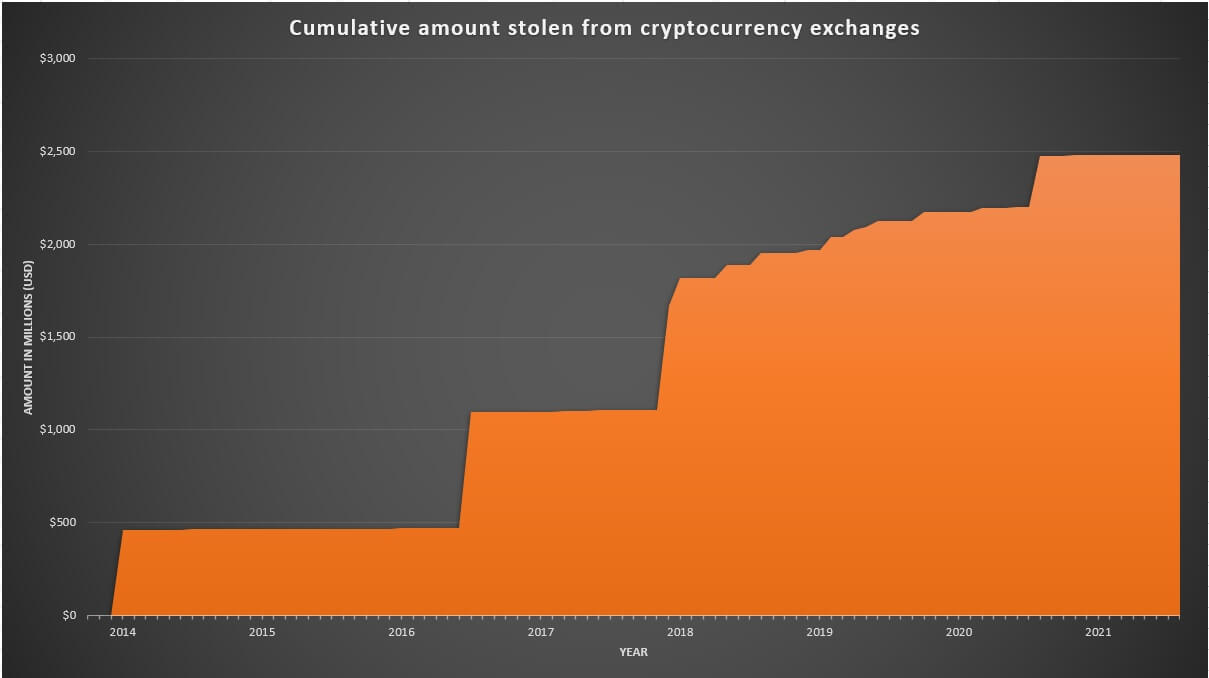

While the number of successful crypto exchanges that have been hacked is decreasing due to bank-like security features, several currency exchanges are still hacked each year. According to our research on hacked exchanges, almost $2.72 billion worth of various cryptocurrencies has been lost since 2014 due to hackers, individuals, and cybercrime organizations alike. The most famous incident is the Tokyo-based Bitcoin exchange Mt. Gox which filed for bankruptcy after losing a reported $460M worth of Bitcoin. More recently, in September 2020, more than $270 million in assorted cryptocurrencies was stolen from the crypto exchange Kucoin.