We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Best Crypto Screeners

Hedge With Crypto aims to publish factual and accurate information as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own inquiries.

TABLE OF CONTENTS

To help keep track of each cryptocurrency's metrics, dedicated applications called crypto screeners collate all projects’ data, token percentage change, and market capitalization. Based on our testing, this article will compare and rank the best crypto screeners in the market and outline the considerations crypto traders should take into account when selecting a paid or free cryptocurrency screener.

Here is our hand-picked list of the best cryptocurrency screeners to choose from:

- TradingView – Best screening tool for trading charts

- Coinmarketcap – Best crypto screener for coin metrics

- CoinGecko – Best free screener for exchange listings

- Messari – Top crypto screener for detailed data and project analysis

- AltFins – Reliable screener performance summary, signals and filters

- LunarCrush – Best social intelligence crypto screener

Featured Partner

Kraken

Crypto platform for smarter investing.

4.8 out of 5.0

Kraken is a US-based crypto trading platform that is best suited for users who need crypto-to-fiat and crypto-to-crypto trading facilities. One of the most regulated and security-focused exchanges, Kraken is a great choice.

200+

USD, GBP, EUR, CAD, CHF, JPY & AUD

Bank transfer, SWIFT, SEPA, debit and credit card

0.16% (maker) and 0.26% (taker)

| Screener | Supported coins | Number of filters | Pricing (monthly) |

|---|---|---|---|

| CoinMarketCap | 20,000+ | 12+ | Free |

| TradingView | 700+ | 50+ | $14.95 (Pro plan), $29.95 (Pro+) and $59.95 (Premium) |

| CoinGecko | 13,000+ | 10+ | Free |

| Messari | 2,540+ | 100+ | $24.99 |

| AltFins | 2,700+ | 2,843 | $20 to $60 |

| LunarCrush | 3,973+ | 8 | Free to 2,000 LUNR |

Top Crypto Screeners Reviewed

1. Tradingview

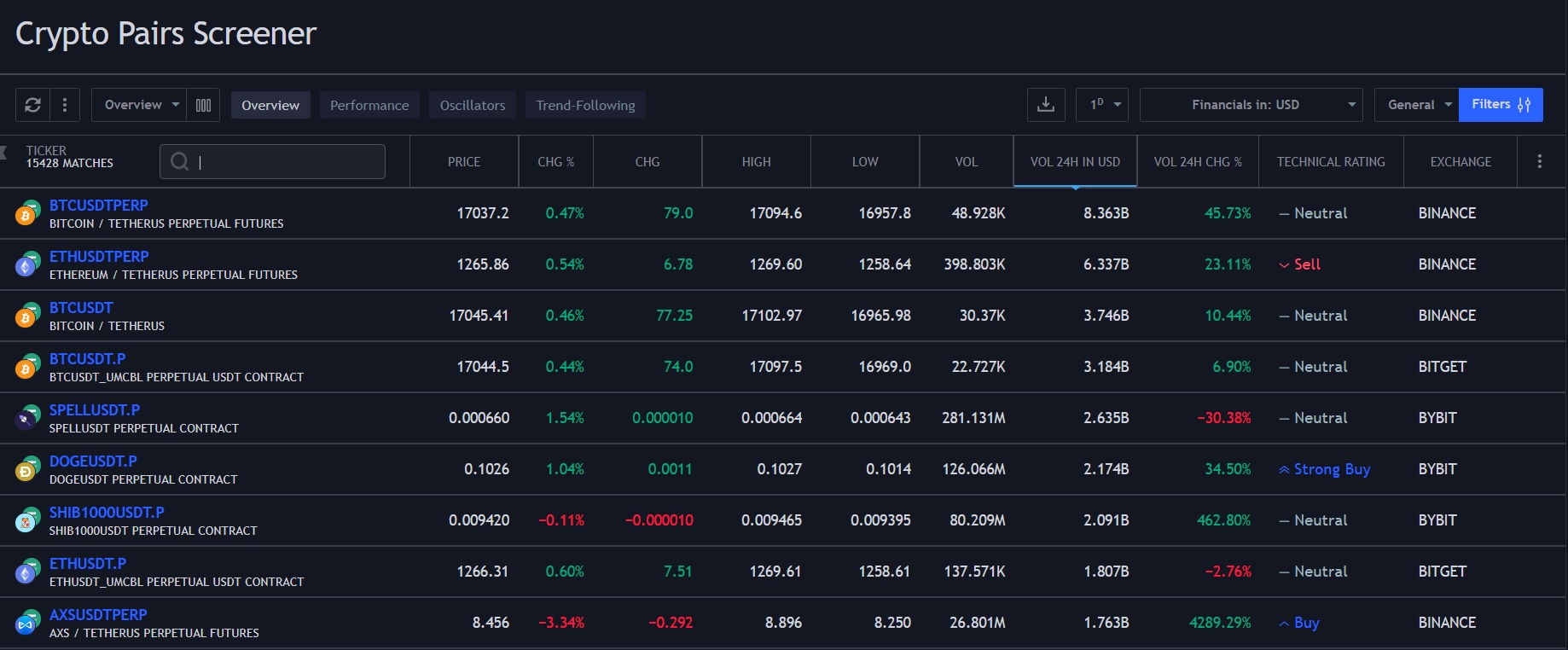

Our number one pick for the overall best cryptocurrency screener is TradingView. It offers screening services for all financial investment vehicles, including stocks, bonds, commodities, and cryptocurrencies. The major advantage of TradingView lies in its superior crypto charting platform that accompanies the market data and analysis tools. The crypto screener graphically represents the price performance of crypto-to-crypto trading pairs, enabling users to ascertain their long-term profitability quickly.

A clear benefit of TradingView is the vast range of tools and features to help users analyze the cryptocurrency market and make informed decisions about a certain coin. Moreover, those who are familiar with technical price charting will have an ample selection of indicators, charting tools, trading signals, and access to real-time data. Given its popularity, the highest-rated crypto trading platforms are integrated with TradingView, which means users can trade pair pricing from multiple exchanges in one location.

Like all the best crypto screeners, TradingView allows users to streamline their search using parameters like market capitalization, volatility, average volume, and 50 others. Also, users can see the price changes for each listed coin percentage measurement of the asset’s performance across a week, month, and the past 12 months — all in real-time.

Other beneficial tools for crypto traders and investors are a news section and chat option. These products allow users to go through newsreels and comments left by other users on the specified assets to obtain unique market insights. Users can even share their market ideas and charts which is very popular and a valuable commodity for other traders. The trading view, however, currently supports 700+ digital assets, which is far less compared to CoinMarketCap.

For those on a budget, TradingView does have a free plan available, which makes it a suitable crypto screen for crypto investors. There are paid subscriptions that include additional perks: Pro, Pro+, and Premium. These plans are priced at $14.95, $29.95, and $59.95 per month. This is one of the cons of TradingView, as some of the better features are behind a paywall.

TradingView is a great option for those looking for a crypto market screener. It has successfully integrated research and data on crypto projects and exchanges with a powerful and robust charting platform, with multiple exchanges providing live data.

TradingView Pros:

- Excellent for traders who are focused on screening crypto-to-crypto pairs

- Has a good selection of indicators for technical analysis in evaluating crypto assets' potential

- One of the best charting and visualization screens with live data

TradingView Cons:

- Nothing we can think of so far

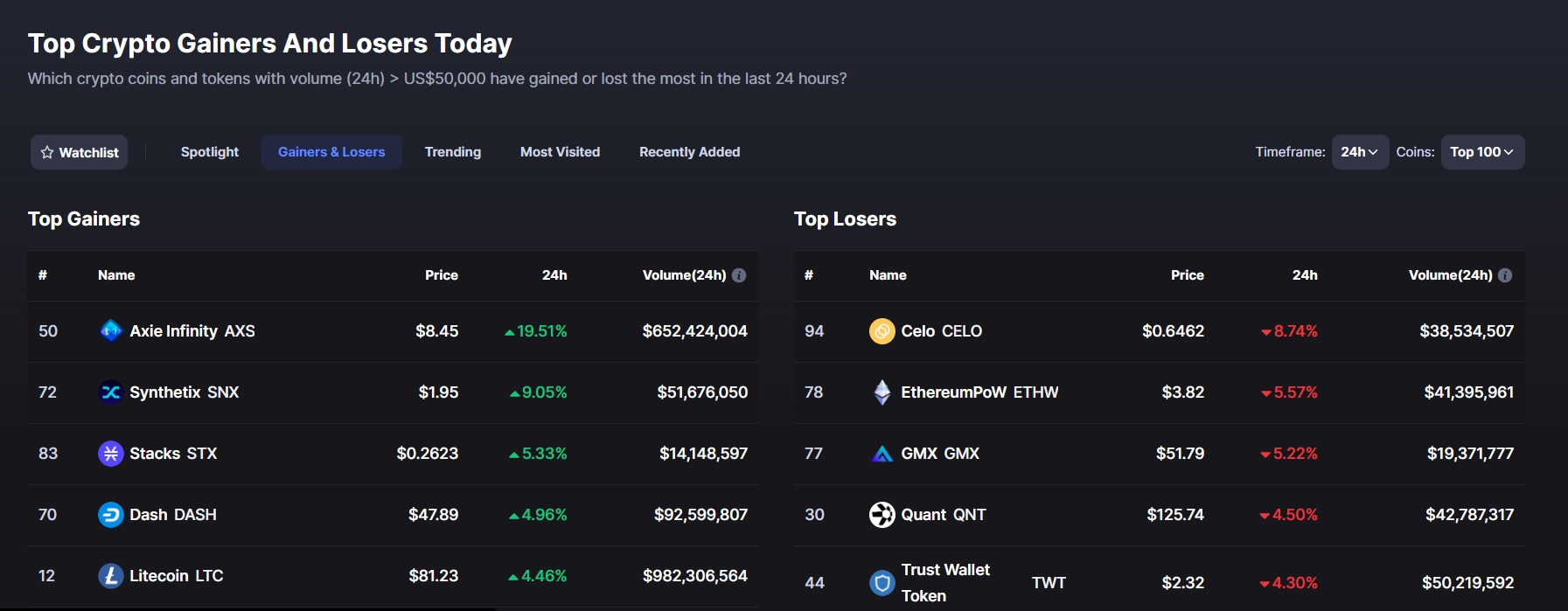

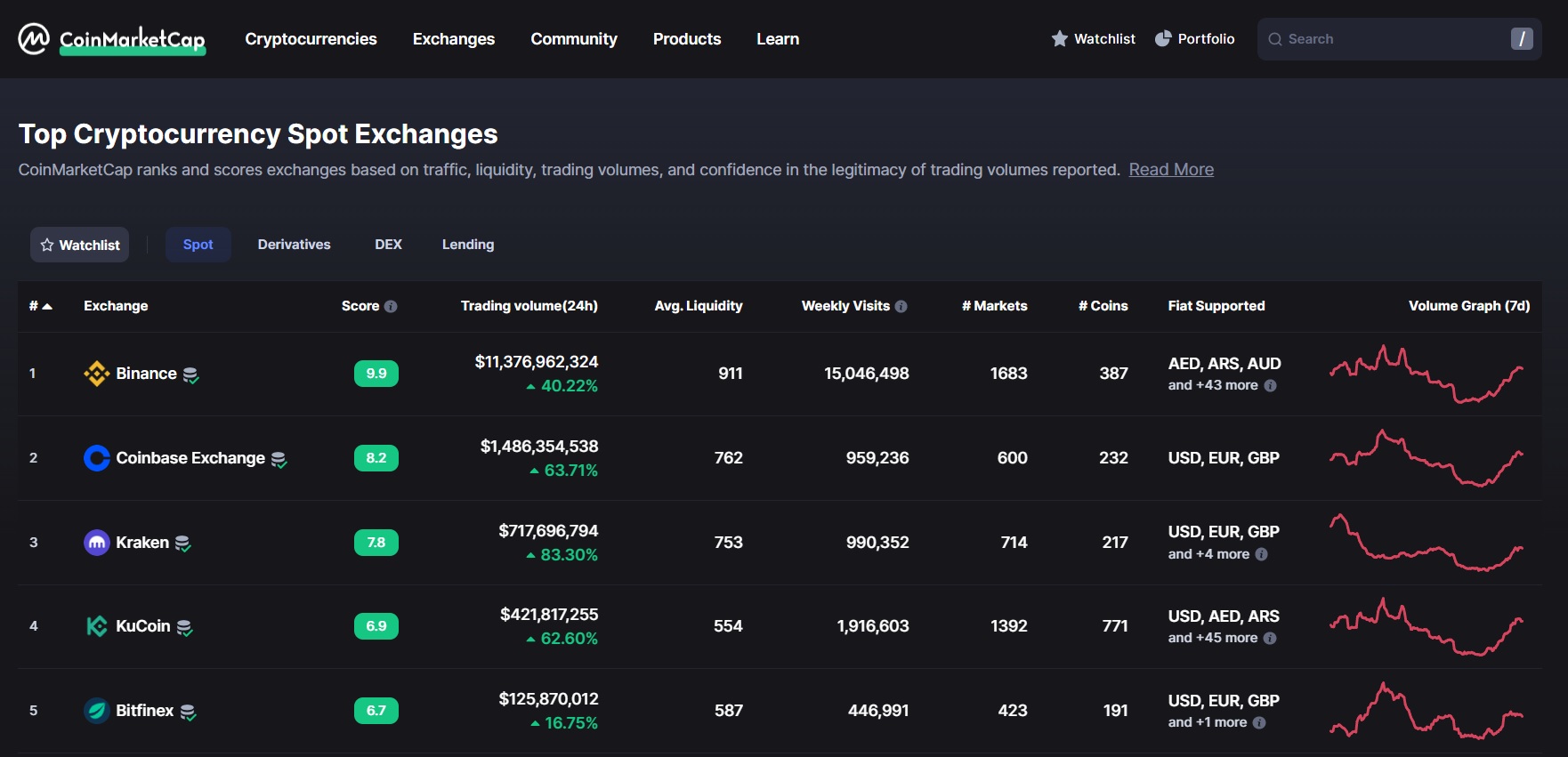

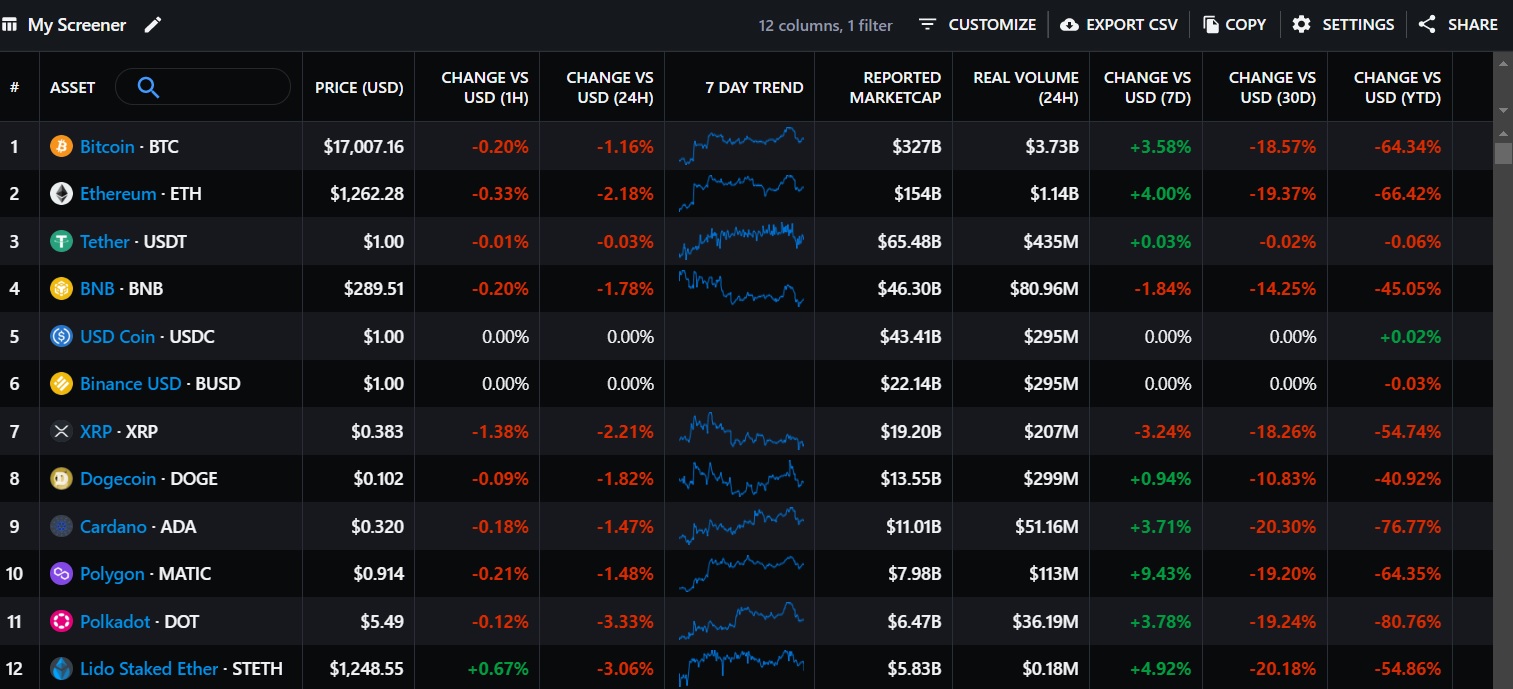

2. CoinMarketCap

CoinMarketCap, commonly called CMC, is one of the most well-known and established crypto aggregators or price-tracking websites. The platform provides thorough coverage of the 20,000 plus digital assets like Bitcoin, Ethereum, Binance Coin, and thousands of others. CoinMarketCap is one of the best free crypto screeners as it provides highly accurate information on digital currencies for many users across a variety of coins and exchanges in particular.

What we liked about CoinMarketCap is the navigation and excellent ease of use to quickly find information on specific crypto circulating supply, or to find which exchanges have recently listed a new coin. In addition, CoinMarketCap can filter through the data to find a specific piece of information using more than 12 filters.

For instance, data about a cryptocurrency project can be sorted by pricing, trading volume, industry, and crypto exchange. This enables users to easily browse through each coin to see fundamental and technical aspects of a project, including recent news, available trading pairs, supported platforms, historical prices, and 24-hour gains, and losses.

The cryptocurrency monitoring platform provides crypto investors with real-time updates on the prices of coins and their performances over time. CoinMarketCap ranks 500+ crypto exchanges based on their trading volume, liquidity score, and market pairs at the time of writing. This way, users can directly search for and trade coins they want on trustworthy exchanges instead of manually scanning through the 20,000 plus crypto projects the website indexes.

Overall, CoinMarketCap is a valuable and free resource for the crypto community. There are a few cons, such as the insights provided for each coin being essentially a summary and lacking the same depth of information as other crypto screeners. Moreover, there is no option to perform technical analysis like its main competitor, TradingView.

CoinMarketCap Pros:

- The website is user-friendly for a range of investors to quickly find a summary of the overall crypto market, or drill down to a specific coin or exchange with relevant data

- Is one of the largest open-sources of market data for more than 20,000 cryptocurrencies that are ranked and categorized in a simple and logical manner for easy reference

- CoinMarketCap is free to use and also includes a comprehensive “Learn” section for beginners via its Alexandria portal

- Offers a price estimate features where users can cast their votes on the predicted price of a coin. This is helpful to gather insight in the market sentiment towards a particular crypto

Cons

- CMC does not include advanced charting for crypto traders to overlay analysis. Therefore, CoinMarketCap needs to be used in conjunction with a charting website that saves the overlays for future sessions within the browser

3. CoinGecko

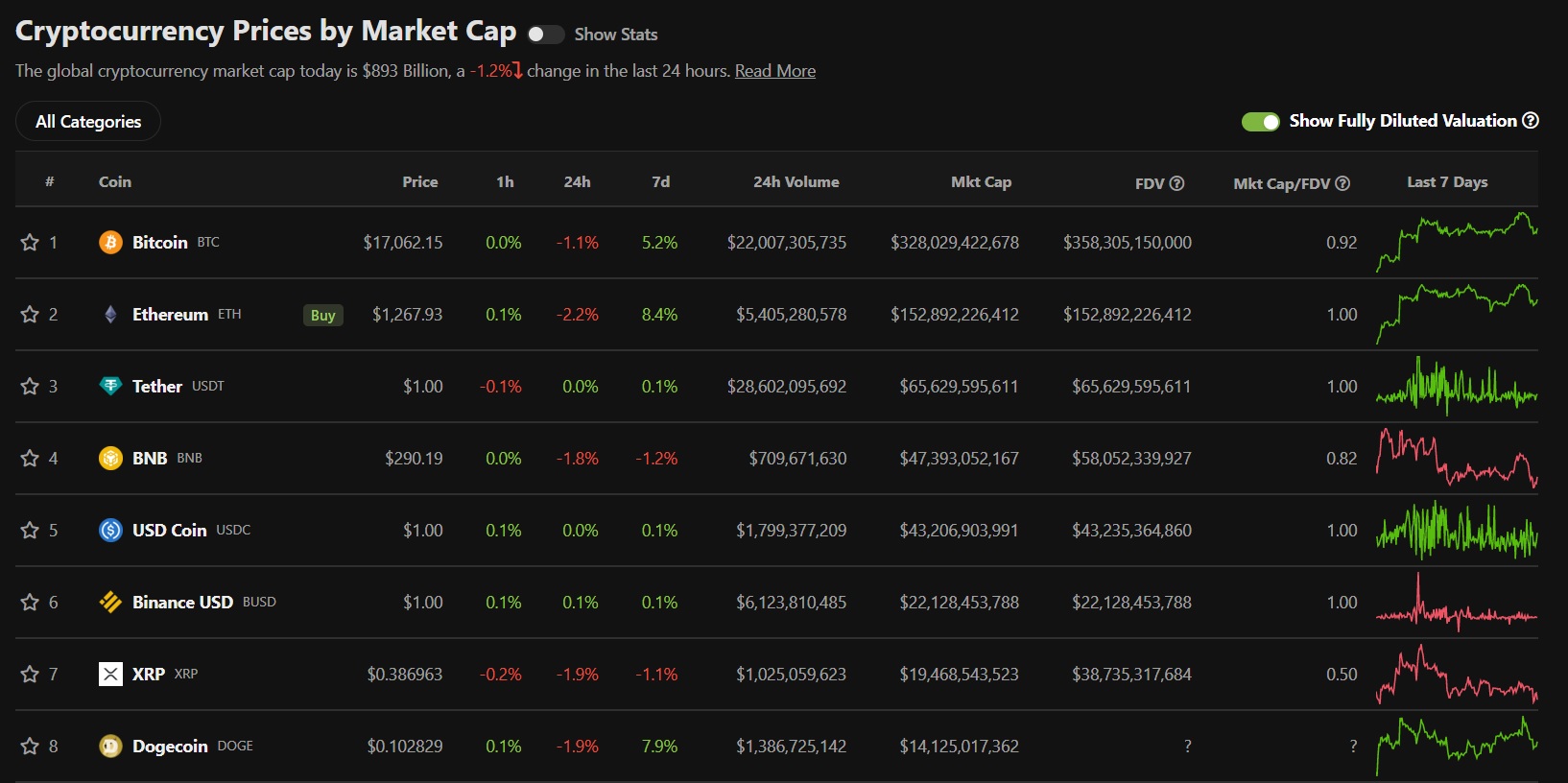

CoinGecko is our third pick which is one of the best alternatives to CoinMarketCap. The website operates as a crypto aggregation platform that lists over 13,000 coins, covering recent asset price changes and performance within 24 hours. Additionally, the platform supports 606 exchanges at the time of writing, which makes CoinGecko one of the most comprehensive crypto screeners for exchanges on the market.

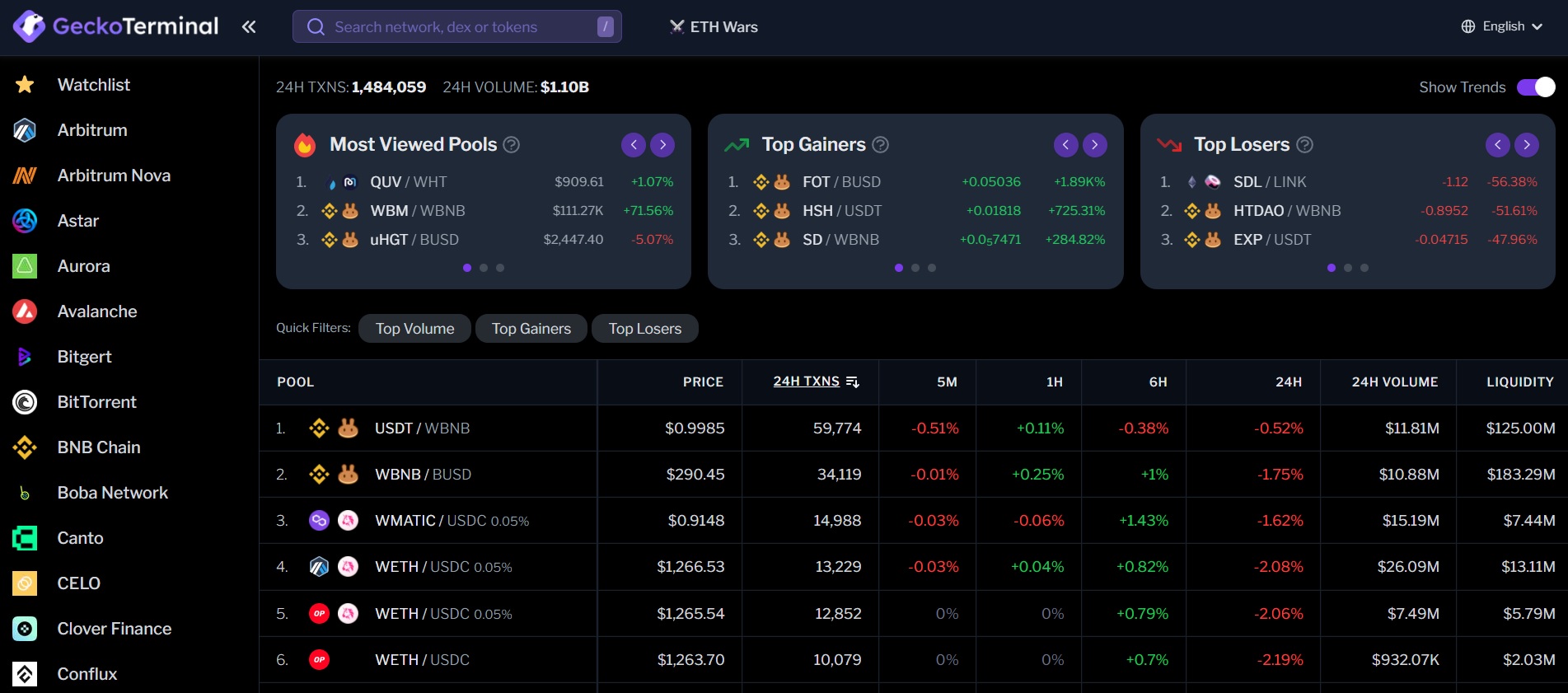

For those who want a broad-brushed view of the crypto market, CoinGecko is a great choice. There is even a toggle to show each project's fully diluted market cap. In addition, users can dive deep into specific projects to inform a trading or investment decision. The screening service also offers a DeFi-facing screening platform through GeckoTerminal. This captures all the top-performing decentralized finance (DeFi) coins, and investors can filter projects based on the underlying network, top gainers, and losers in a day.

One of the pros of using CoinGecko is that it's free to use, making it a suitable option for almost everyone. It provides detailed graphics and charts to depict market trends that are easy on the eyes. The website is intuitive, and users can filter their crypto search based on ecosystem functionality, industry, platform, and crypto sub-sectors by selecting the ‘All Categories' tab. However, it lacks the sophistication for traders that require multi-exchange pricing data for cryptos.

In short, CoinGecko is a leading crypto screener for gathering overall sentiment and data points on the market. However, compared to the screening services above, CoinGecko is not as detail-oriented, doesn't support traditional financial assets, and has a user interface that can be a little confusing.

CoinGecko Pros:

- CoinGecko homepage can be fully customized to suit the individual in addition to a watchlist to see the performance of favorite coins quickly

- Solid selection of supported crypto assets with more than 13,000 available. There is also a category for newly listed projects within the last 30 days

- Solid list of DeFi project research and data on its GeckoTerminal platform, in addition to tracking price, volume and market capitalization data for gaming tokens, meme projects, and metaverse coins like The Sandbox, Decentraland, and Apecoin.

CoinGecko Cons:

- CoinGecko is a market aggregator for the crypto market only. Does not provide information for traditional assets, which may be a limiting factor for multi-asset class investors

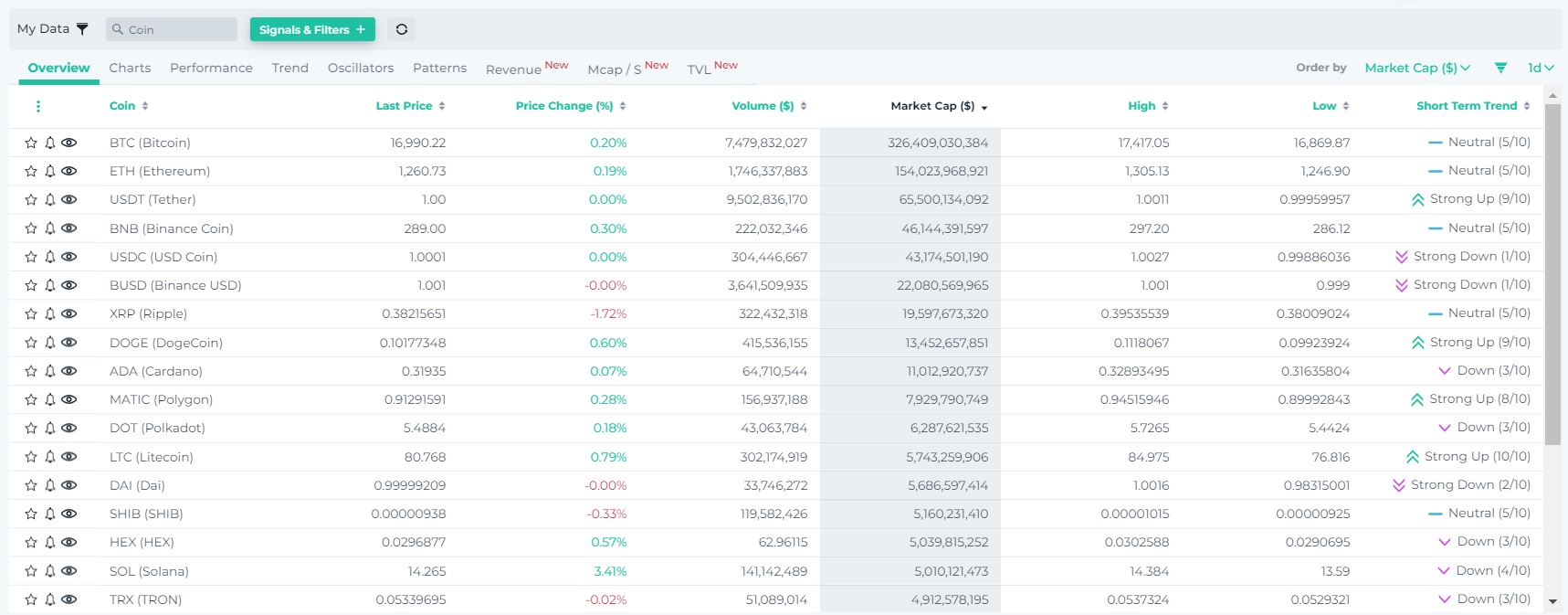

4. Messari

Messari is another top cryptocurrency screener. Messari is a native crypto platform that provides detailed background information and history on 2,540 listed cryptocurrencies. A trading volume average, market capitalization, and highs and lows of the previous year accompany each asset. There is also a section for users to view the exchanges that support each cryptocurrency and the accepted trading pairs.

Messari's crypto screener is quite bold in design, but this doesn't undermine its utility. Users can easily search for their selection of coins using over one hundred filters which are significant compared to TradingView, CoinGecko and CoinMarketCap. Messari lets crypto enthusiasts customize their screening experience from the app by clicking on the ‘Customize' button. This will open up several filters like the ‘Standard Metrics,’ ‘ROI,’ ‘All-Time High & Cycle Low, ’ and several others.

Users can also set custom alerts to receive notifications once a coin reaches a price or trading volume threshold. With this comprehensive lineup of filters, users can get access to custom data to make informed decisions about which crypto assets to add or remove from a portfolio. Unlike TradingView, there is no option to browse non-crypto assets, which may be a con for broader investors. Moreover, the charting is quite simplistic in features.

Regarding pricing, Messari has a free version and a paid service. While the free plan offers useful analytical insights to unlock the full selection of screeners, the subscription fee is $24.99 per month or $29.99 per month for its annual package, comparable to TradingView's packages.

Like most exchange aggregators, the information on Messari can be outdated and inaccurate. This is due to the reliance on third-party sources. However, this should not be seen as a major negative, as the screener provides a fairly thorough overview of the crypto market and can create a watchlist. Despite not having a comprehensive listing of cryptocurrencies (especially newer coins) as its competitors, Messari is a great option for market research.

Messari Pros:

- Supports the major cryptocurrencies with over 2,540 listed

- Elegant and modern user experience that is well-arranged

- Free version available to get basic crypto market data and price feeds

Messari Cons:

- Does not have an extensive list of cryptos such as gaming tokens, metaverse coins and meme coins

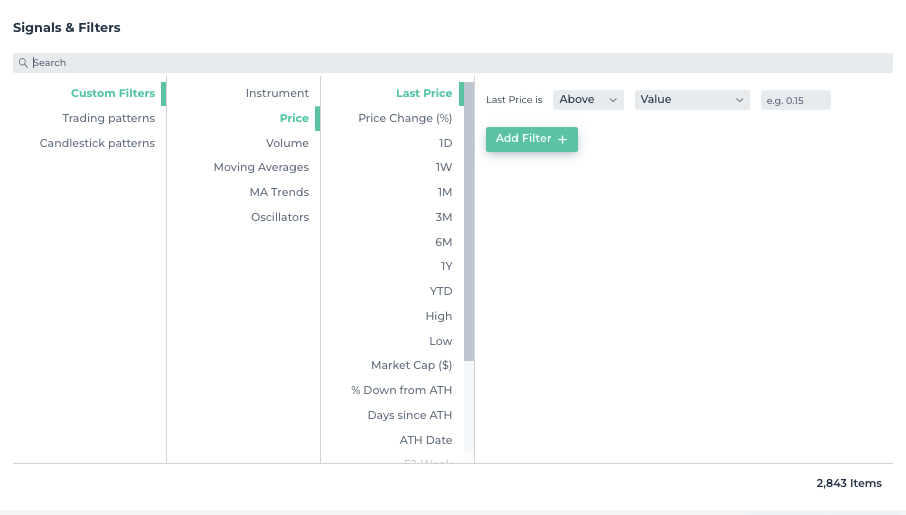

5. altFINS

Another top option in this list of best screeners is altFINS. The platform essentially combines the best of both worlds in CoinMarketCap and TradingView. It allows users to screen over 2,700 coins directly using various signals and filters. Several other tools can be used for further research, including revenue, oscillators, trends, total volume locked (TVL), performance, and many others. There is also useful access to on-chain data.

AltFins boasts 2,843 items in its Signals & Filters section, making it the most elaborate crypto screening software out there. The platform is packed with features such as price updates, chart patterns, on-chain data, and short-term trend metrics of their favorite coins. However, the presentation of all the information could be improved and will be quite difficult for some to understand.

Regarding fees, AltFins charges users to unlock all its screeners. Its subscription starts from $20 to $60 per month or $180 to $600 annually. In addition, the more useful features are available only on the higher plans.

In short, we found the user interface on AltFins a little too complicated to navigate due to its outdated design. Plus, the pricing plans are above market and will not be affordable to newer crypto traders. While AltFins makes this list with some useful features such as price alerts, on-chain data, and Android/iOS compatible apps, it isn't the most user-friendly crypto screener and has limited coin support in this list.

altFINS Pros:

- One of the biggest selections of filters to extract custom data on cryptocurrencies and exchanges

- Access to on-chain data, news and event information

- Good range of supported cryptos at 2,700+

altFINS Cons:

- Isn't the most user-friendly crypto screener in the market

6. LunarCrush

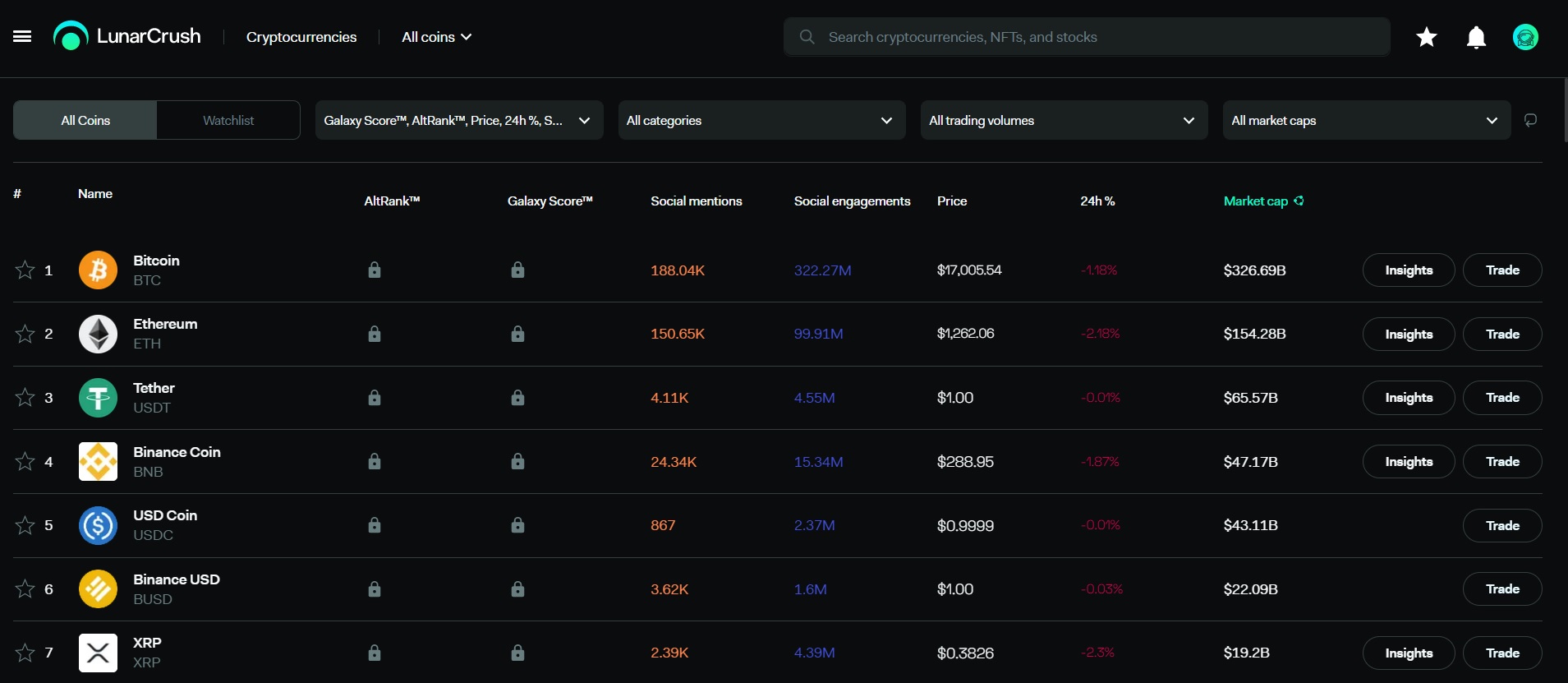

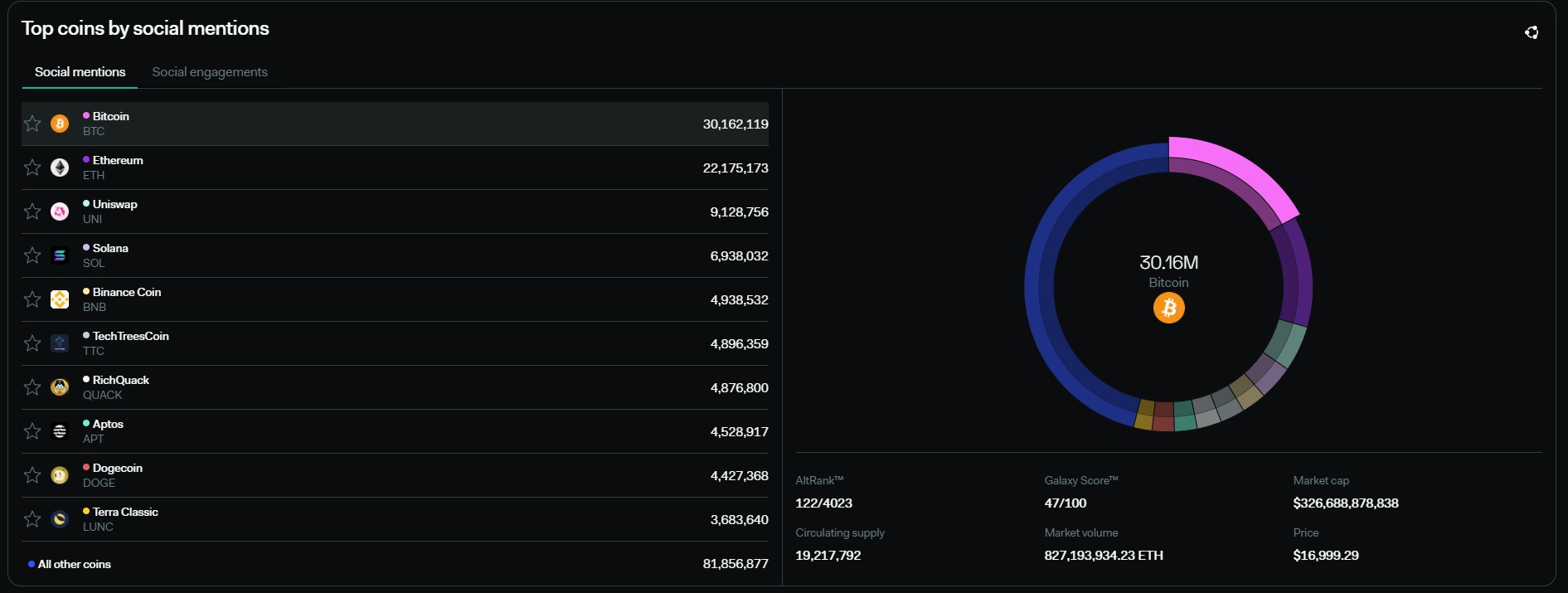

LunarCrush, a social network for crypto investors, is rounding up our crypto screener's list. Where LunarCrush stands out is in its social intelligence capability. Using AI, LunarCrush gives users insights into top-performing coins and NFTs in the format of social media platforms. This way, users can easily identify profitable opportunities based on the amount of social engagement and mentions the underlying asset has.

While others have an extended lineup of metrics users can access, LunarCrush affords only eight parameters. Users can gain insight into the price change, the ranking of each coin, 24-hour performance, and five other filters. While it does not offer the same number of technical indicators as its counterparts, LunarCrush still offers a reasonable amount of technical analysis investors can access.

Investors have unique access to social signals and engagements, and unique metrics called Galaxy Score and Altrank for a different perspective on the market. Perhaps one of the most unique features is the ability to browse and find the top coins by social mentions and media engagements. This can be extremely helpful when keeping an eye on potential coins (e.g. meme tokens) that are starting to gain a lot of market attention.

Like crypto copy-trading platforms like eToro, LunarCrush has a newsreel section covering the entire crypto space that enables cross-platform communication to share personal insights on market sentiment and stats. Furthermore, there are 3,973 coins, which is a good selection compared to other crypto screeners listed herein. It also provides a comprehensive cryptocurrency portfolio tracker that allows users to easily keep track of investments by holdings, allocation, and specific metrics (e.g. price, gains/losses). However, these features are locked behind fees based on levels that involve holding LUNR tokens.

In short, LunarCrush is a useful social intelligence platform but doesn't have the depth of data on individual coins compared to CoinGecko or CoinMarketCap. This means those who want to benefit from the social network may need to use another scanner in conjunction with LunarCrush, which is not ideal.

LunarCrush Pros:

- AI-based market data on top-performing coins

- Integration with social media platforms to obtain unique insights into the industry based on social signals

- Highly visual platform

LunarCrush Cons:

- Has a limited selection of filters to categorize crypto asset information

- Social network is a great feature, although are not as popular as competitors such as eToro and TradingView

The Basics of a Crypto Screener

Crypto screeners are specialized cryptocurrency tools that investors and traders use to search for cryptocurrencies based on certain criteria to extract coin metrics, fundamental news, and historical pricing data. They let investors set specific parameters to streamline and sort through crypto projects in the fast-paced crypto market. Some parameters include price, market cap, daily trading volume, and a brief trading chart of the underlying asset.

More sophisticated screeners cover different blockchain projects and their percentage change within an hour, 24 hours, and in the past week, respectively. Crypto screeners make investing easier because they filter trades and help traders identify profitable trading opportunities and make informed decisions.

Some crypto screeners are optimized for arbitrage crypto trading because of their more specific offerings. However, day traders can also utilize most crypto screeners we covered in this article. By combining the following parameters, crypto screeners allow users to streamline their research. Among them are;

- Price.

- Volatility

- Average trading volume.

- Market cap.

- Charting patterns and formations.

- Percentage price change within a timeframe.

Once these parameters are inputted, the crypto screener filters through thousands of crypto projects and provides results that fit the stipulated description. With these results, an investor can easily adjust their trading strategy to profit from the current market trends.

Don't know how to trade? Here's our step-by-step guide on how to trade cryptos.

How Do Crypto Screeners Work Just Like Stock Screeners

Crypto screeners gather publicly available information on all cryptocurrencies and their respective networks. This information is usually derived from each network’s blockchain explorers, liquidity pools, and websites, among other sources. Crypto screeners use AI-powered technology to present the stipulated result in milliseconds, making them necessary tools for crypto investors to gain a holistic view of the market.

A user generally sets their parameters and values, and then the crypto screener explores the market and presents the coins that meet the user's unique parameters. Since investor needs differ, so will the results. For instance, long-term investors would naturally be drawn to projects that have doubled or tripled their market cap over several months or the past year. This might not interest a short-term or arbitrage trader who may filter projects with massive uptrend potential in the last few hours or days.

These Are The Benefits of Using a Crypto Screener

There are other benefits investors can derive if they tap into a crypto screener aside from providing market-leading insights. Below, we highlight some of the core benefits of using one:

1. Obtain data-driven market insights

The crypto market is a highly charged emotional landscape, and several investors jump into positions based on fear of missing out (FOMO). Without adequate trading data, many traders have recorded more losses than gains. Crypto screeners generate the needed data to make unbiased decisions that could significantly boost a trade's return on investment (ROI). With this, investors can do due diligence on an entire ecosystem of crypto assets and individual projects, thereby boosting their trading confidence.

2. Saves time

This benefit is self-explanatory. The crypto market comprises over 20,000 cryptocurrencies, leaving investors flustered about where to start. Instead of spending countless hours toiling through an endless list manually, investors can easily use a crypto screener and filter their search. This would be a better use of time and provide all the details based on the values supplied to the screener. Time is money for an investor, and wasting it on scrolling through an endless list would significantly affect long-term profitability.

3. Find trending coins & new investment opportunities

Aside from streamlining the research process, crypto screeners can be used to find and buy new crypto before listing (e.g. ICO/IDOs). These recent debutants are usually on the trending coins list, and investors can easily hop on these projects. They tend to have higher daily performance, and short-term investors can profit from it. Meanwhile, crypto screeners also feature crypto projects that perform quite well in 24 hours on its charting platform. For instance, a bullish session is usually depicted in a green chart. Investors can easily use this as a cue to engage in more targeted research and invest in these opportunities once their profitability is ascertained.

What You Need To Look For In a Crypto Screener

The uses of crypto screeners are multi-fold, but the most important utility is to help investors identify profitable trading opportunities. Screeners usually come with the most popular crypto indicators, which are highly useful in making informed trading decisions. Here are the basic features to look out for when finding the best crypto screener:

- Ease of use. The paramount metric in choosing a crypto screener should be intuitiveness. Filtering coins should be simple and only require a few clicks or a maximum of three clicks. Additionally, it should have a clean interface. Platforms that offer crypto are notorious for overloading their dashboards with information. To save time, the filters should be easily selectable.

- Mobile-friendly. Another crucial factor to consider is mobile friendliness. Many investors turn to mobile phones to buy and sell digital currencies. Ideally, crypto screeners offer the same information and metrics on desktop and mobile. While most crypto screeners are web-based tools only, there are exceptions like CoinMarketCap, TradingView, and CoinGecko, which have a mobile app for 24/7 access to live crypto data.

- Real-time data. For fundamental-based investors, having access to accurate and live data is essential. This includes real-time price data from multiple sources, top weekly performances, and historical data. This is particularly important for day traders who require quick access to information and news to make informed trading decisions quickly.

- Graphical charting. Screeners with a highly visual graphical user interface with price charts are advantageous in complementing the data from a different perspective. TradingView is a great example that displays coin metrics, performance indicators, sentiment ratings, and key stats adjacent to the crypto trading pair. It can also overlay key news events along the bottom of the price chart.