We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Best Crypto Exchanges In The UK

Hedge With Crypto has done extensive research and analysis to find and compare the best cryptocurrency exchanges in the UK. Find out the final selections below.

The information provided on this page is for educational purposes only and is not intended as investment advice, an endorsement of a cryptocurrency, or a recommendation to trade or use any services. Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

TABLE OF CONTENTS

Here's our short list of the top crypto exchanges for the UK that we will break down in this guide:

- Kraken (best overall crypto exchange)

- eToro (best for copy-trading)

- Crypto.com (best for credit cards)

- Uphold (best for its streamlined interface)

- CoinJar (best alternative exchange)

- Gemini (best for safety)

Featured Partner

Kraken

Crypto platform for smarter investing.

4.8 out of 5.0

Kraken is a US-based crypto trading platform that is best suited for users who need crypto-to-fiat and crypto-to-crypto trading facilities. One of the most regulated and security-focused exchanges, Kraken is a great choice.

200+

USD, GBP, EUR, CAD, CHF, JPY & AUD

Bank transfer, SWIFT, SEPA, debit and credit card

0.16% (maker) and 0.26% (taker)

Best UK Crypto Exchanges Reviewed

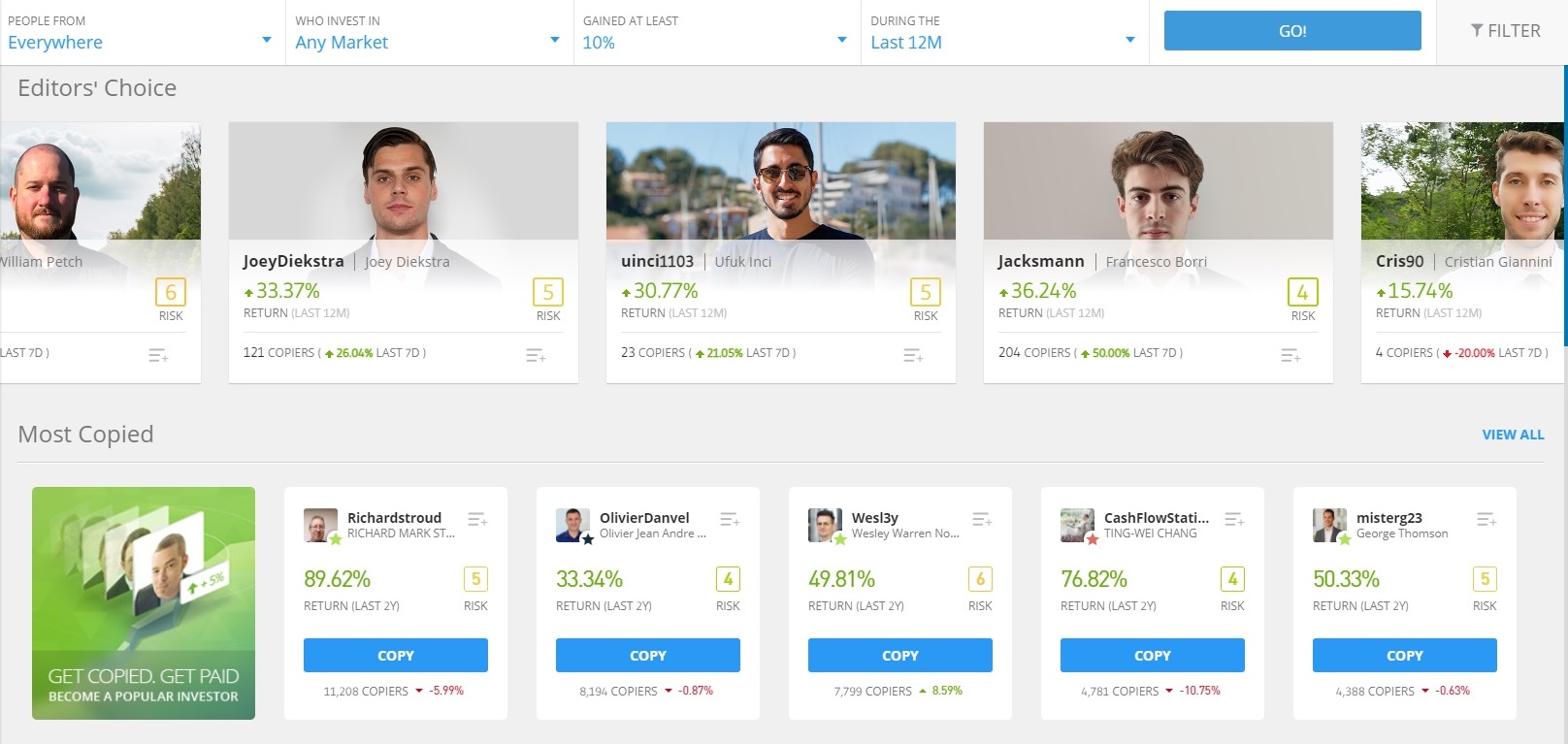

1. Kraken

Kraken is considered a top trading platform in the UK due to its focus on security. With the platform storing its customers' crypto holdings in cold storage and keeping its servers under constant surveillance, Kraken is perhaps the most secure exchange in the UK.

-

Trading Fees:

0.16% (maker) and 0.26% (taker)

-

Currency:

USD, GBP, EUR, CAD, CHF, JPY & AUD

-

Country:

Global (USA Allowed)

-

Promotion:

None available at this time

Don’t invest unless you’re prepared to lose all the money you invest. Take 2 mins to learn more.

One of the biggest crypto exchanges in the US, Kraken prides itself on regulatory compliance and is registered with the FCA, FinCEN, and FinTRAC. Kraken customers can buy/sell NFTs and stake cryptocurrencies to earn passive rewards of up to 19% APR (at the time of writing), in addition to being able to access the spot and derivatives markets.

While fewer than Binance, Kraken offers an impressive selection of crypto assets. The platform supports spot purchases on 222 cryptocurrencies and provides access to 698 tradable markets. Furthermore, Kraken enables its users to access 91 derivatives markets.

Although Kraken has been operating for over a decade, the exchange hasn't changed its interface much since its inception. The platform does offer a simplified trading interface for users with advanced trading features available via the Kraken Pro platform.

Unfortunately, Kraken is one of this list's more expensive crypto trading platforms. The exchange charges maker/taker fees of 0.16% and 0.26% on spot trades, with futures transactions costing 0.02% and 0.05%. However, the company does offer support for a variety of deposit methods, including credit/debit cards, bank transfers, and crypto.

Read our full Kraken review.

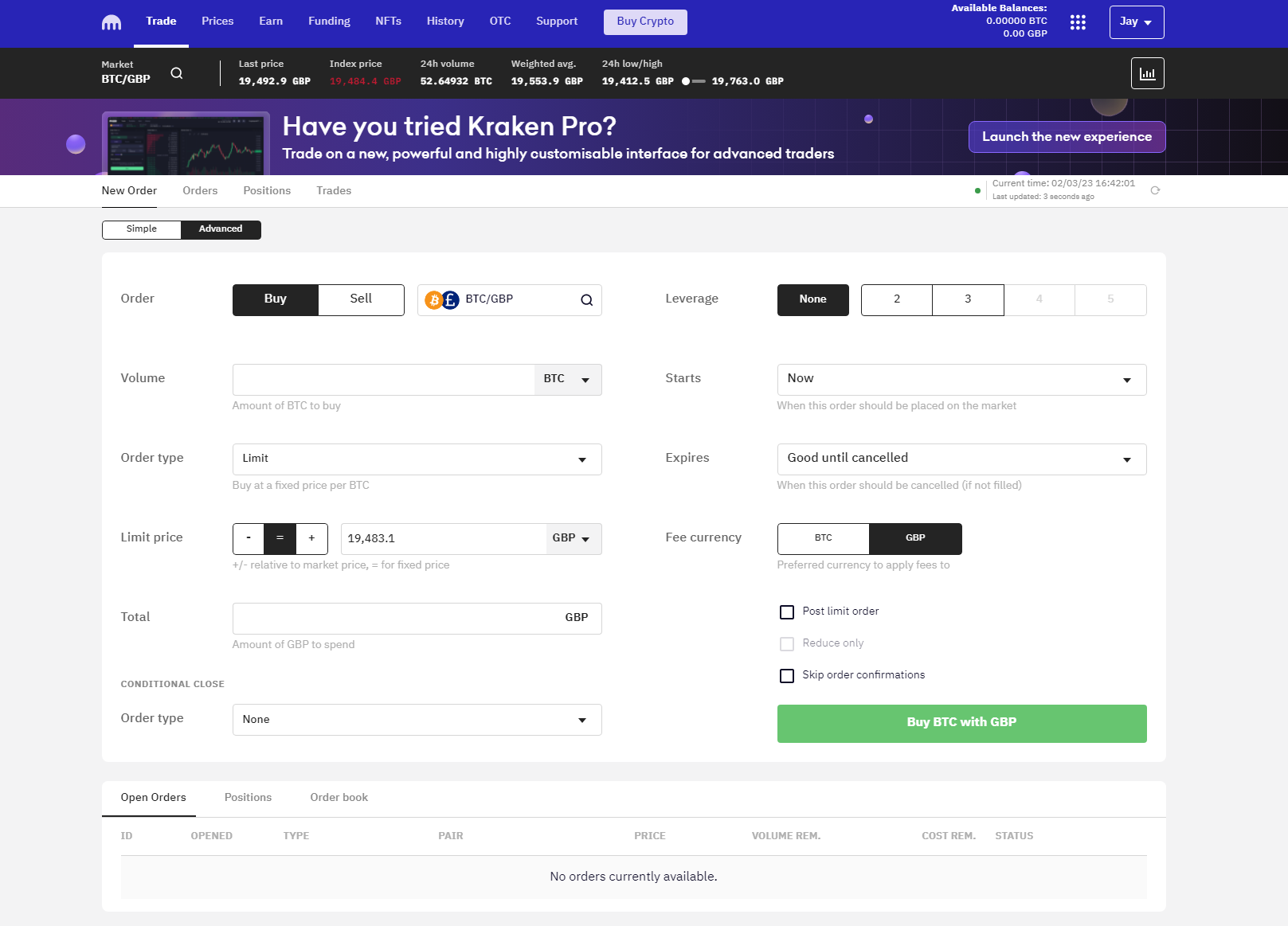

2. eToro

eToro provides access to cryptocurrency and traditional financial products, along with offering some of the best copy trading features on the market, the exchange is worthy of consideration for UK-based investors looking for a platform with social elements.

-

Trading Fees:

1%

-

Currency:

USD

-

Country:

Global (USA allowed)

-

Promotion:

None available at this time

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

Launched in 2007, eToro is a global financial brokerage that provides access to several markets, including crypto, ETFs, stocks, indices, commodities, and forex. Millions of investors and traders use the broker across multiple regions, including customers in the United Kingdom.

eToro is equipped for those who want to automatically engage in crypto trades through copy trading or practice trading using virtual funds. Unfortunately, while the platform does have a staking platform, it's inaccessible to UK or US residents. eToro supports 79 cryptocurrency pairs that can be traded against altcoins or fiat currencies. However, thousands of additional CFD-based trading pairs are available on traditional financial markets.

eToro is well-known for its social trading community, where traders can join and connect with other traders to share ideas and strategies or mirror the trading performance of profitable traders. As such, new investors can get involved with crypto and begin trading without much prior knowledge.

Unfortunately, investors from the UK are not allowed to short cryptocurrencies on eToro due to regulations by the Financial Conduct Authority (FCA). As such, eToro UK does not have a margin trading platform for crypto assets. However, users can trade CFDs with leverage.

The con of eToro is the trading fee of 1% on crypto-assets in addition to a small spread fee which is far above the industry standard for crypto trading platforms. However, the broker does two payment methods, credit/debit card, and bank transfer.

eToro makes this list of the best UK crypto platforms due to its ease of use, wide range of payment methods, and copy-trading platform

Read our full crypto review on eToro.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

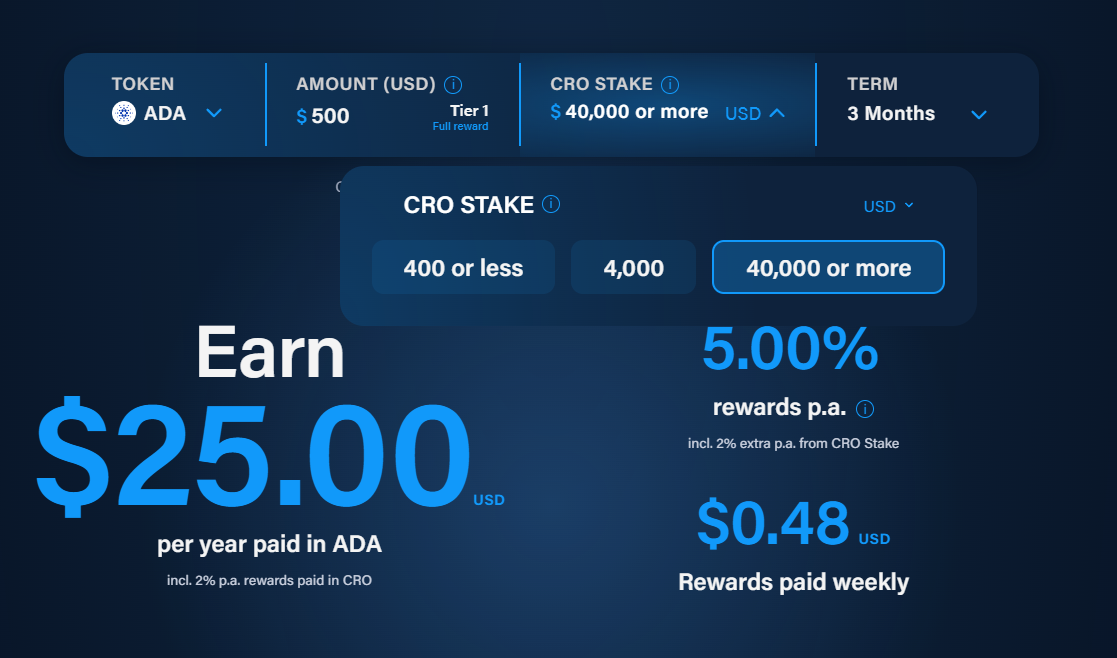

3. Crypto.com

Crypto.com is a versatile trading platform perfect for UK-based investors who want to want to buy crypto with a credit/debit card, bank transfers, and crypto deposits, the platform is highly accessible. Furthermore, with some of the lowest fees in the industry, Crypto.com is one of the best UK cryptocurrency exchanges for spot traders looking to build a portfolio in the crypto market.

-

Trading Fees:

0.075%

-

Currency:

AUD, CAD, EUR, GBP, USD, BRL, and TRY

-

Country:

Global (USA Allowed)

-

Promotion:

None available at this time

Don’t invest unless you’re prepared to lose all the money you invest. Take 2 mins to learn more.

Crypto.com is split into two platforms, making it one of the more accessible exchanges on our list. While the Crypto.com app can be used to buy crypto with fiat and manage the company's Visa debit card, the Crypto.com exchange provides access to trading pairs and additional trading-centric functionality.

Between the two Crypto.com platforms, users can buy crypto with fiat, manage the Crypto.com Visa card, create basic trading bots, and access various staking products. Unfortunately, however, residents of the UK and US are unable to trade with margin on Crypto.com.

The Crypto.com Exchange offers a sleek and intuitive interface for traders to speculate on digital currency markets. With Tradingview integration, Crypto.com provides advanced trading features, tools, and indicators for analysis.

Crypto.com customers can access 229 unique cryptocurrencies and 518 trading pairs denominated in USD, USDT, BTC, and the company's native CRO token. Its spot trading fee is 0.075% and derivatives fees of 0.0170% / 0.0340% (maker/taker).

Read our full Crypto.com review for more details.

4. Uphold

Uphold is likely the easiest-to-use platform to buy and sell crypto. The exchange boasts a simplistic interface, making it perfect for beginners wishing to get started with minimal effort. In addition to offering users the ability to trade fiat and digital currencies, international investors can use Uphold to buy and sell commodities like platinum. However, this feature is currently not available for residents of the UK.

-

Trading Fees:

1.5% (spread)

-

Currency:

27

-

Country:

Global (USA allowed)

-

Promotion:

None available at this time

Don’t invest unless you’re prepared to lose all the money you invest. Take 2 mins to learn more.

On top of offering staking on a variety of assets and the ability to automate reoccurring buys, the digital platform also has a cryptocurrency debit card that allows its users can pay for purchases using the asset of their choice (crypto, fiat, or commodities).

Traders with an Uphold crypto exchange account can buy and sell 237 cryptocurrencies and 53 additional non-crypto assets. Additionally, while the exchange offers a zero-trading fee platform, the spread on cryptocurrency is typically 1.5%, depending on market conditions and sentiment.

Uphold is a visually appealing, convenient, and easy-to-use platform for investing in crypto. However, the exchange could be overly basic for some, as it lacks any real charting or analysis capabilities, with the platform simply acting as a fiat-to-crypto gateway.

With Uphold supporting deposits using a credit/debit card, crypto, and bank transfer, the exchange is fairly easy to access. However, while suitable for beginners looking for the easiest way to get involved with crypto, the platform should be avoided by traders looking for advanced trading features.

Read our full crypto review of Uphold.

5. CoinJar

CoinJar is an excellent alternative to the more popular UK crypto exchanges, like Binance and KuCoin. Additionally, with a beginner-friendly platform and a more advanced exchange, the platform is suitable for a wide range of investors. CoinJar is an FCA-registered crypto exchange that provides a simple way to buy & sell digital currency. Initially established in 2013 as an Australian crypto exchange, CoinJar has expanded its innovative platform to residents in the UK.

-

Trading Fees:

1% (instant buy and sell)

-

Currency:

GBP

-

Country:

United Kingdom

-

Promotion:

None available at this time

Don’t invest unless you’re prepared to lose all the money you invest. Take 2 mins to learn more.

On CoinJar UK Limited, users can switch to the CoinJar exchange to access better charting software and an extensive range of technical indicators.

There are also no fees to deposit GBP using a bank transfer (Faster Payment Service) or to withdraw GBP to a UK bank account. However, CoinJar charges 2% for instant buys using Visa or Mastercard and a 1% fee on all trades, making it equally as eToro for trading.

In our opinion, CoinJar is a well-designed exchange with features likely to appeal to a wide range of crypto enthusiasts. However, the cons include its fees and a limited range of assets.

Read our full review on CoinJar.

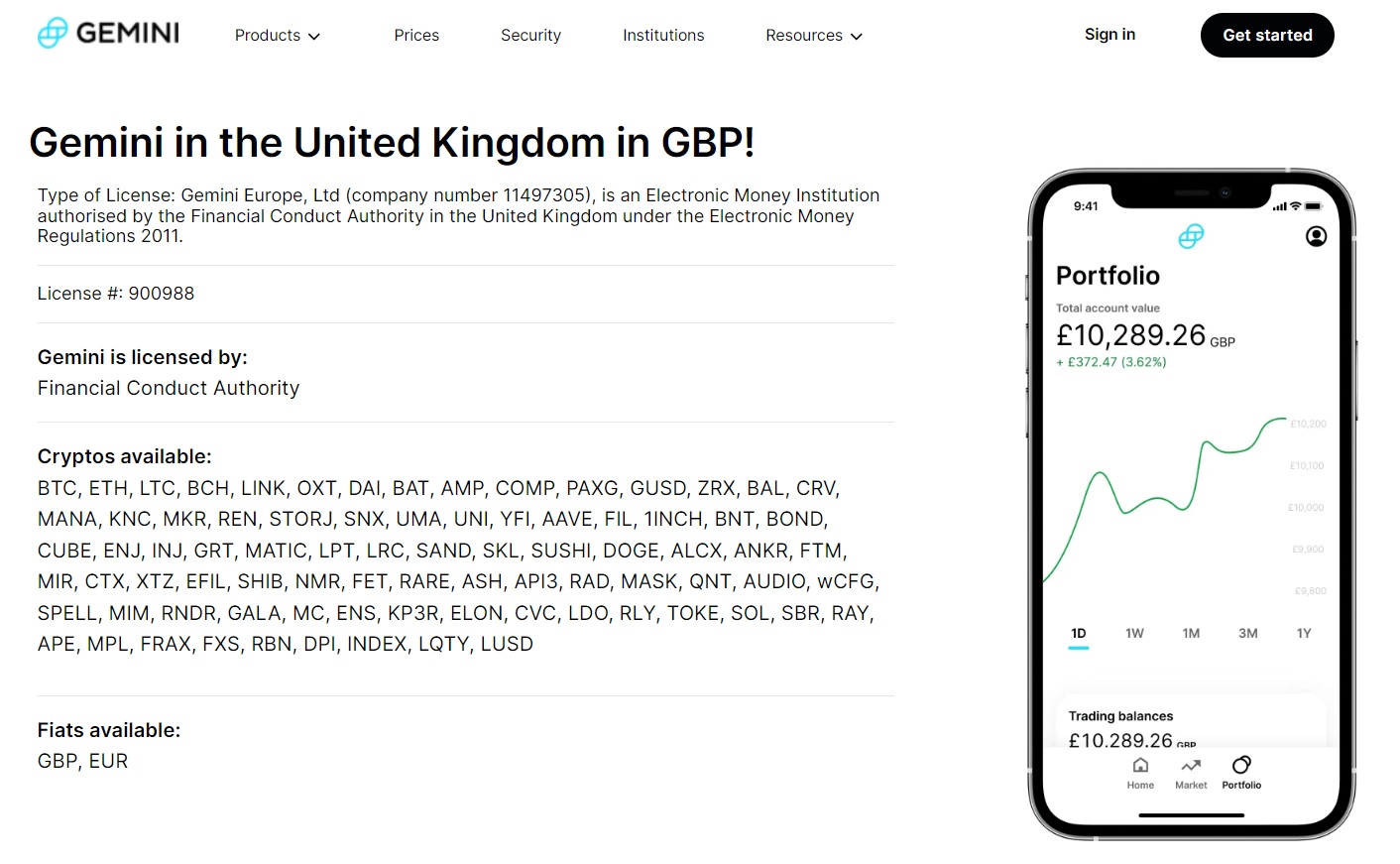

6. Gemini

Gemini is a reasonable choice for individuals looking for a regulated and safe exchange to invest in crypto. However, with its Earn program running into a few issues, it's advisable to be wary when storing funds on the platform.

-

Trading Fees:

1.49%

-

Currency:

USD, GBP, EUR, CAD, SGD, HKD & AUD

-

Country:

Global (USA allowed)

-

Promotion:

None available at this time

Don’t invest unless you’re prepared to lose all the money you invest. Take 2 mins to learn more.

Gemini is a world-famous exchange that rapidly gained attention from investors due to its commitment to honoring regulatory requirements. Gemini is an FCA-regulated company founded by the Winklevoss twins in 2015. Since its inception, the Gemini exchange has become a popular choice for individuals, traders, and institutions.

You can buy, sell, and store Bitcoin and other cryptocurrencies thanks to the 117 unique cryptocurrencies and access to 144 trading pairs, slightly fewer than most popular crypto exchanges. Additionally, Gemini doesn't offer margin trading, which can be a con for some traders.

The available ways to pay for crypto include debit cards or transfers from a bank account via Faster Payments, CHAPS, or SWIFT wire. For UK investors, bank transfers are the most popular as they do not incur any fees. Linking a debit card to a Gemini account is convenient and fast but will incur a 3.49% fee on the total purchase amount.

As for the trading fees, a 1.49% surcharge will apply to orders above £150 using the website or mobile application. Cheaper fees can be obtained on Gemini ActiveTrader, starting from 0.2% and 0.4% for maker and taker orders, plus an auction fee.

Although Gemini's trading fees are relatively high, the platform excels in user experience. While the standard Gemini platform offers an easy way to purchase crypto with fiat currencies, the Gemini ActiveTrader exchange provides advanced analytical tools for technical traders.

Read the full Gemini exchange review for more information.

How To Choose A Crypto Exchange In The UK

Finding a suitable UK cryptocurrency exchange can be tricky for beginners in the crypto-sphere. Here is our complete list of what to consider when buying cryptocurrencies to help get you started:

- Regulated in the UK. It is important to use a trusted platform that is regulated in the UK and complies with the strict laws and regulations that govern the digital currency industry. Cryptocurrency exchanges that are certified by the Financial Conduct Authority (FCA) are regarded as trustworthy and safe to buy digital currencies.

- Beginner-friendly. Look for an exchange supported in the UK that allows quick and easy GBP deposits and a mobile app to buy or sell Bitcoin at any time or place.

- Supported deposit methods for GBP. Find a UK cryptocurrency exchange that offers preferred deposit options such as bank transfers or credit/debit card purchases to buy Bitcoin. These are the most common payment methods to look for which have low GBP conversion fees and fast processing times. Each platform has a minimum and maximum daily limit per 24 hours.

- Supported cryptocurrencies. There are thousands of different cryptocurrency projects and coins to buy and sell. Not all exchanges will offer each coin for trading. If there is a particular digital currency that you want to buy, check the exchange website to confirm the coin is listed and a GBP trading pair is available (e.g. BTC/GBP).

- Wallet security. Pick a crypto platform that offers security features such as cold wallet storage, a multi-signature withdrawal process, and two-factor authentication. These measures will help to prevent the theft of funds and fraudulent activity. To help you decide, here is our list of the best crypto wallets to safely store digital assets.

- Fees. There are several different fees to be aware of when using a crypto exchange such as depositing GBP, withdrawing cash or crypto, and trading between assets. There is also a spread fee and forex conversion fee which is often a ‘hidden cost' and not fully disclosed. ‘It is recommended to check the difference between the buy and sell price on the exchange to determine the spread.

- Customer support. Explore the website to find out what communication methods are available to support users that need troubleshooting advice or assistance on the exchange. Most UK crypto exchanges will provide a Frequently Asked Questions (FAQ's) section and How-To-Guides which is useful for beginners. Otherwise, make sure the website has a ticket system to contact the customer support team directly or through a live chatbot.

- Online reviews and social media. Searching for online exchange reviews, forum comments, and posts on social media is a great way to see what experience other investors and traders have had with the platform. Review websites generally aim to provide a quick, easy-to-read summary of the exchange before creating an account.

Frequently Asked Questions

Which crypto exchange is best in the UK?

While the best crypto exchange in the UK will vary from person to person, based on their individual requirements, we found Binance to be the all-around best exchange in the UK thanks to its mixture of low fees, excellent analysis tools, a substantial range of assets, and additional features.

What is the best Bitcoin trading platform in the UK?

Bitcoin trading requires access to excellent charting tools, a good variety of technical indicators, and low trading fees. Binance offers all of the above in spades and provides a lite mode, making the cryptocurrency trading platform accessible for beginners and advanced traders.

Which crypto exchange in the UK has the lowest fees?

For spot trading, Crypto.com is a cost-effective exchange, with crypto trading fees of just 0.075% per transaction considering the industry average is 0.1% per trade. However, the cheapest exchange is Binance which has zero trading fees on Bitcoin spot pairs.

What is the safest crypto exchange in the UK?

Although all of the exchanges on our list offer good customer protection, Kraken takes things to a new level by encrypting all user data, strictly monitoring transactions for suspicious activities, and keeping its servers under watch 24/7 by armed guards.

Are all crypto exchanges in the UK regulated?

Cryptocurrency is technically unregulated within the UK. But, to operate in the country legally, any exchange providing custodian services must comply with anti-money laundering legislation. In addition, all exchanges headquartered in the UK or operating crypto ATMs in the region must register with the Financial Conduct Authority (FCA).

Is it legal to buy Bitcoin in the UK?

There are currently no restrictions or cryptocurrency laws that prohibits individuals from buying digital currencies such as Bitcoin. Cryptocurrencies are not considered legal tender in the UK and investors must abide by local tax laws.

Conclusion

To conclude our comparison of the best crypto exchanges in the UK, although all of the above platforms are worth considering based on their ease of use, security, deposit methods, support for GBP, trading fees, and customer support, one platform stood out from the rest. Binance offers the most well-rounded trading platform available in the UK. With its competitive fees, constant innovation, range of assets, and additional features, the platform is ideal for beginners and experienced UK-based investors/traders.

We recognize there are many other UK crypto exchanges available. However, beginners should be careful only to use well-established and reputable cryptocurrency exchanges used by millions of customers worldwide.

Risk Summary

Estimated reading time: 2 min

Due to the potential for losses, the Financial Conduct Authority (FCA) considers this investment to be high risk.

What are the key risks?

1. You could lose all the money you invest

• The performance of most cryptoassets can be highly volatile, with their value dropping as quickly as it can rise. You should be prepared to lose all the money you invest in cryptoassets.

• The cryptoasset market is largely unregulated. There is a risk of losing money or any cryptoassets you purchase due to risks such as cyber-attacks, financial crime and firm failure.

2. You should not expect to be protected if something goes wrong

• The Financial Services Compensation Scheme (FSCS) doesn’t protect this type of investment because it’s not a ‘specified investment’ under the UK regulatory regime – in other words, this type of investment isn’t recognized as the sort of investment that the FSCS can protect. Learn more by using the FSCS investment protection checker here.

• The Financial Ombudsman Service (FOS) will not be able to consider complaints related to this firm. Learn more about FOS protection here.

3. You may not be able to sell your investment when you want to

• There is no guarantee that investments in cryptoassets can be easily sold at any given time. The ability to sell a cryptoasset depends on various factors, including the supply and demand in the market at that time.

• Operational failings such as technology outages, cyber-attacks and comingling of funds could cause unwanted delay and you may be unable to sell your cryptoassets at the time you want.

4. Cryptoasset investments can be complex

• Investments in cryptoassets can be complex, making it difficult to understand the risks associated with the investment.

• You should do your own research before investing. If something sounds too good to be true, it probably is.

5. Don’t put all your eggs in one basket

• Putting all your money into a single type of investment is risky. Spreading your money across different investments makes you less dependent on anyone to do well.

• A good rule of thumb is not to invest more than 10% of your money in high-risk investments.

If you are interested in learning more about how to protect yourself, visit the FCA’s website here.

For further information about cryptoassets, visit the FCA’s website here.