How To Short on Binance

TABLE OF CONTENTS

Although it is common practice to take profits when an asset price rises, advanced investors also earn profits when prices slump. This is called shorting. Binance is a leading exchange for shorting crypto with several options at hand to enter a short-sell position. The benefit is to hedge an overall portfolio against market volatility and downturns. However, shorting is an advanced skill and not for beginners.

Here's a break down the exact steps on how to short on Binance:

- Open an account. Create a new Binance account or log in using an existing account.

- Deposits funds. Fund a Binance wallet using fiat currency or transfer existing crypto assets to the exchange.

- Transfer funds to the Margin wallet. Move the available funds from the spot wallet to the margin wallet.

- Navigate to the Binance margin platform. Go to the trading platform, select a crypto pair to short and switch to margin mode.

- Borrow funds. Choose the coin to use as collateral for the pair and borrow funds to increase the account trading balance.

- Enter a short trade. Return to the trading platform, set the price to enter a short and the number of funds to use.

- Repay the debt. Once the trade has been completed, repay the debt and accrued interest.

What Is Short Selling?

Short selling Bitcoin involves borrowing BTC to sell when the price is high and then buying them back in the future at a much lower price. It's the exact opposite of a long position, where investors buy low to sell at a higher price in the future. Crypto traders who use the short selling technique believe that the asset price will decrease over time, so they enter a short to profit from the price decline.

Short selling in crypto is an extremely delicate practice as the volatile market is largely unpredictable. Although they can provide massive profits if the price movements move in favor of the investors, traders can also lose their funds in an unexpected price reversal. Short-selling Bitcoin is available on most reputable crypto margin exchanges and futures platforms, including Binance Futures.

Can You Short Crypto on Binance?

Yes, individuals can short on Binance in a number of ways. The most common is borrowing funds and shorting with up to 3x margin. More advanced traders can short-sell on the Binance Futures platform with perpetual contracts up to 100x, leveraged tokens, or options.

How Does Short Selling Work on Binance?

Binance offers two primary methods for traders to short the market which are its margin and Futures platforms.

- Binance margin trading. Margin trading on Binance involves investing in the spot market with borrowed or third-party funds. This is common in the stock market and on futures trading platforms. Binance users can enable a margin trading account in which they can ‘borrow' funds from other parties to increase their trading capital up to 3x.

- Binance Futures. This method is best suited for advanced traders due to the high amount of leverage that can be applied to short positions. It enables traders to speculate on digital asset price movements in the future. and gain exposure without investing huge capital to own the underlying asset. The benefit is they can take risks and profit on the future value of a crypto pair regardless of the market price movements of the underlying asset. The Futures products offered include perpetual contracts, leveraged tokens, and options.

How to Short on Binance with Margin

1. Create a Binance account

The first step traders must action is to create an account to short-sell on the platform. The best way to do this is to use a referral code for Binance that offers up to $300 in bonuses for new users. Registering on Binance is very simple and easy. The first step is to click the ‘Sign Up’ button and enter basic details such as email address, mobile number, and a strong password. Existing crypto owners who already have an account can simply just log into Binance.

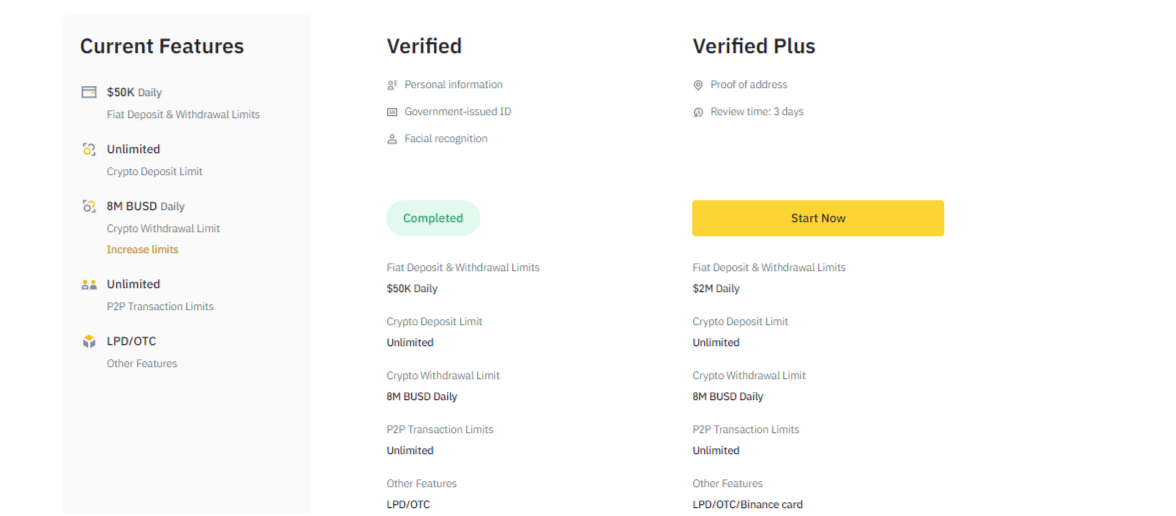

Before depositing funds, a Know-Your-Customer (KYC) process must be completed. Binance offers verification for both corporate organizations and individual investors. To verify a customer's ID on Binance, select the ‘User/Identification’ option to verify a personal trading account. A driver's license or a government-issued ID card should be uploaded to complete the facial recognition. Once this is completed, the account will be verified, and the margin trading platform will be unrestricted with higher withdrawal limits.

Related: How long does it take to verify on Binance?

2. Deposits funds

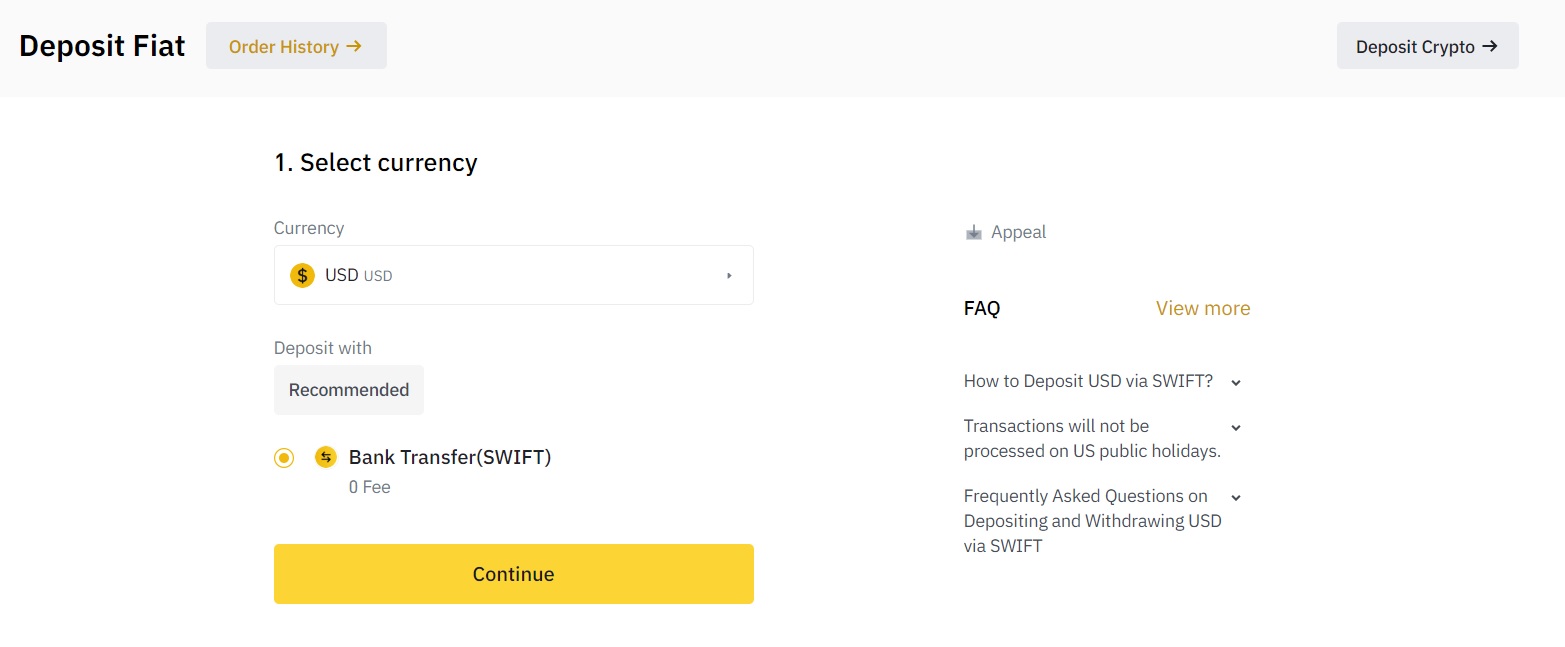

Before an investor can short-sell on Binance, their account needs to be funded. This can be in the form of fiat currency (e.g. USD, GBP, AUD) or crypto. Binance supports deposits from bank wire transfers, credit/debit cards, e-wallet solutions, and crypto deposits. Select any of the supported deposit methods and fund the new account with a minimum of $10. The funds would be credited to the investor’s ‘Spot’ wallet section.

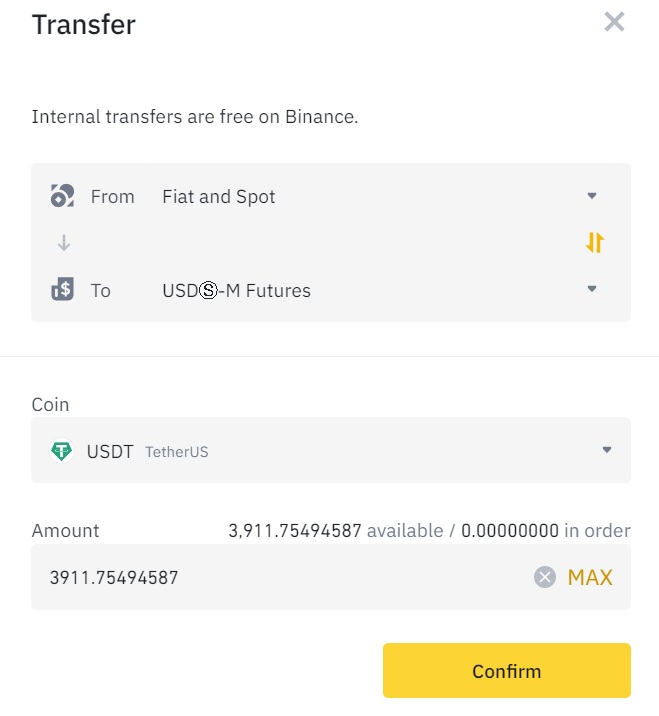

3. Transfer funds to the Margin wallet

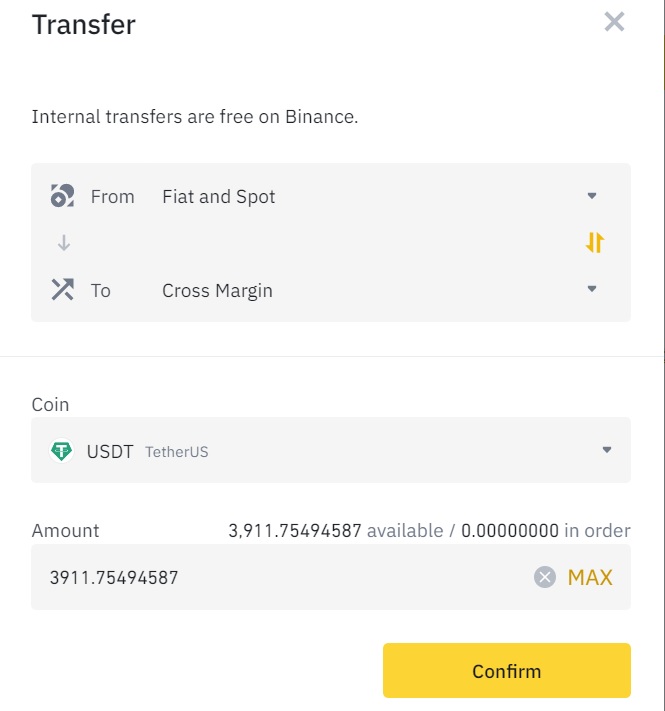

The next step is to move the funds from ‘Spot’ to the ‘Margin Wallet’. By default, funds deposited into Binance are stored in the ‘Fiat and Spot’ wallet. But to short-sell, funds must be transferred to the Margin account. This is done by tapping on the ‘Wallet’ button to select the ‘Fiat and Spot’ wallet.

Once there, the user must select the ‘Transfer' icon. There is the option to move fiat currency or crypto assets from the spot wallet to the margin wallet. Choose the asset to transfer and enter the amount from the available funds. Set ‘Cross Margin Wallet’ as the destination and transfer the funds. The transaction will be completed instantly.

4. Navigate to the Binance margin platform

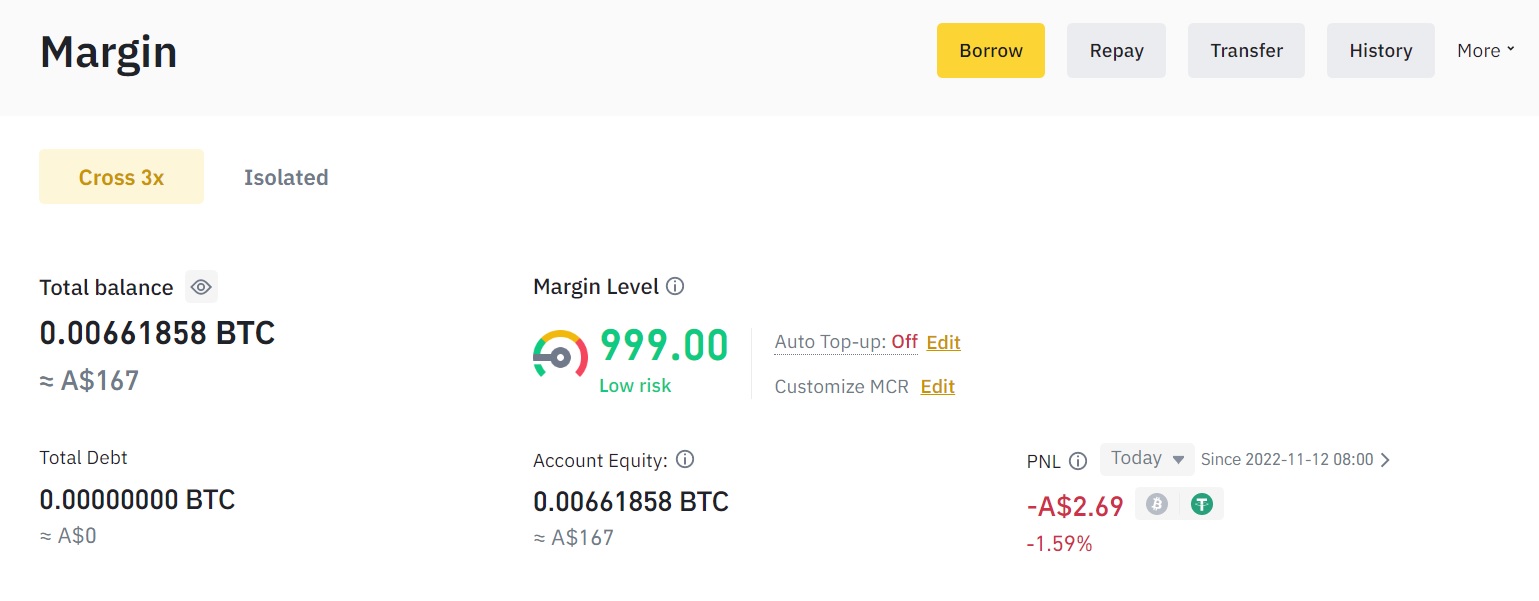

Tap on ‘Wallet’ and select ‘Margin’ to switch to the Margin Trading interface. To short crypto on Binance, find and select the desired trading pair (e.g. BTC/USD). Once selected, hit the ‘Trade’ button which will redirect to the relevant assets page automatically. For this tutorial, we will use the Cross Margin account, but investors can also use the isolated margin mode.

5. Borrow funds

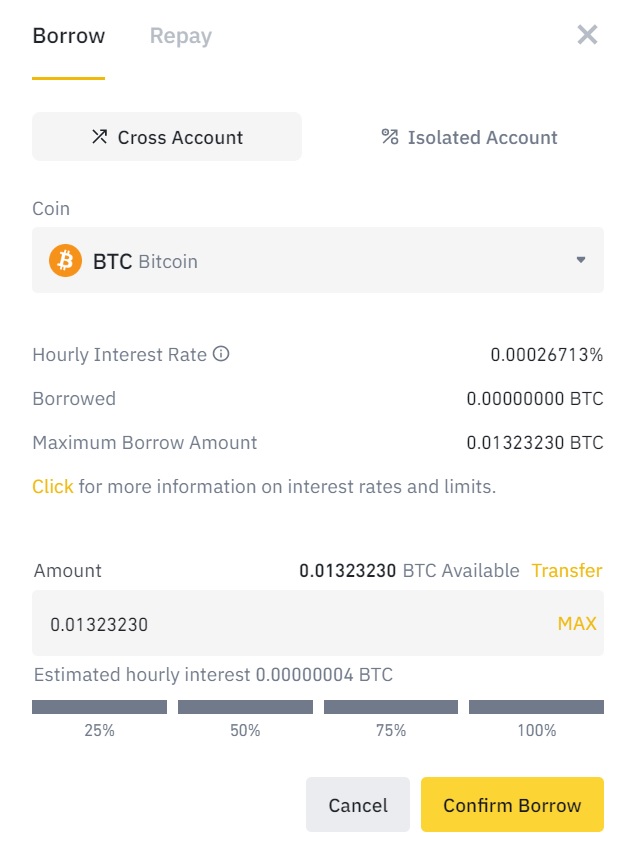

To trade with margin, the user must borrow funds from Binance (for example, traders can borrow Bitcoin). Select the coin to be borrowed, enter the amount, and click ‘Confirm Borrow.' The Binance exchange indicates the amount that can be borrowed. It is also important to note that borrowed funds accrue hourly interests that must be repaid.

Moreover, the margin wallet balance determines the amount that can be borrowed, following a fixed rate of 3X. With 0.01 BTC, a trader can borrow up to 0.04 BTC from Binance.

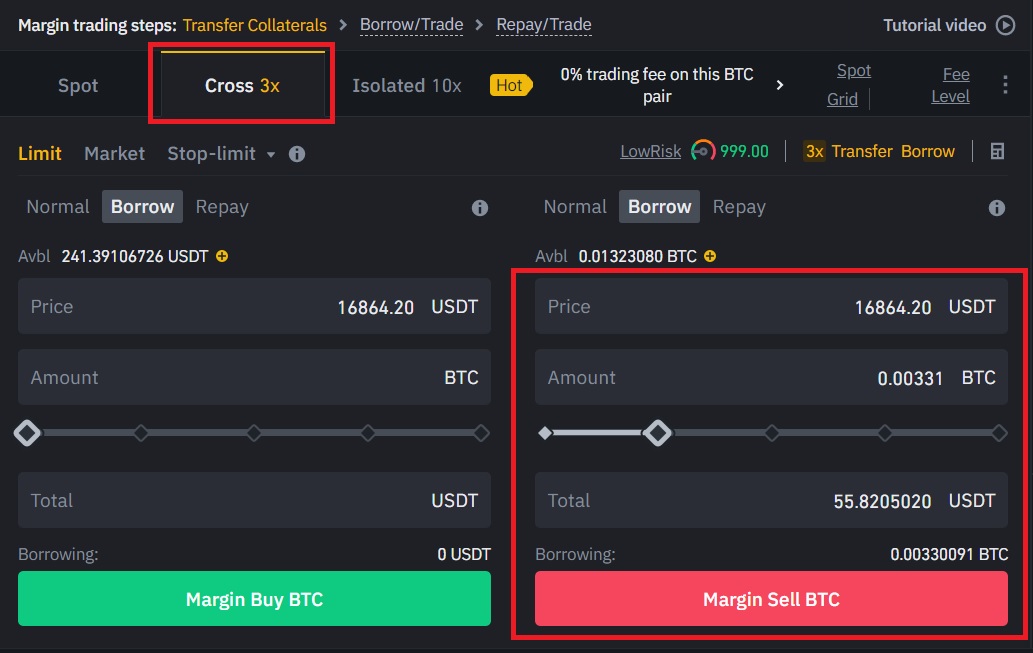

6. Enter a short trade

Go to the Binance margin trading page to start trading. Select the BTC/USDT trading pair to start short-selling Bitcoin or other crypto assets. This stage involves entering the price to sell the asset and the number of funds to use (including the borrowed amount). The short position can be executed at the market rate or at a future price using a limit order. Review the short position details and confirm the trade by clicking on the ‘Sell' button.

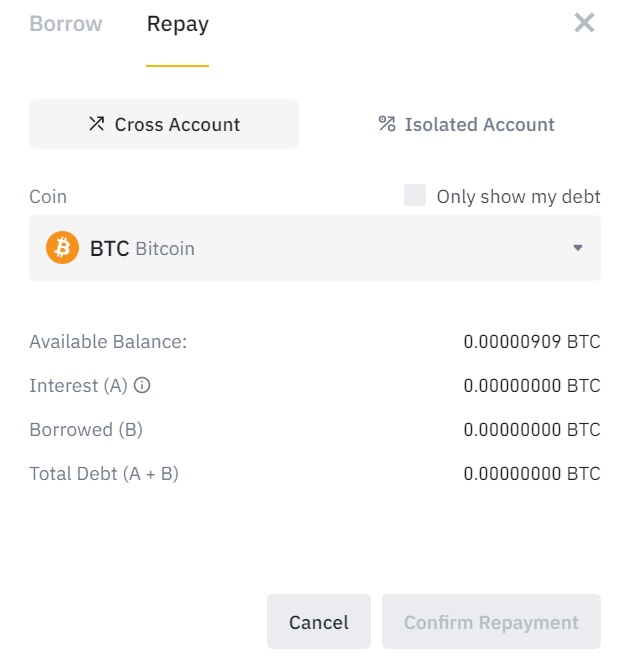

7. Repay the debt

Once the trade is finalized and all orders closed, the investor has to repay the loan including the interest accrued on the amount. To repay the debt, navigate to the account page and select ‘Repay'. Select the borrowed asset and amount to be repaid and click ‘Confirm Repayment' to complete the refund. The wallet must have sufficient funds to be able to pay the loan.

The repaid value is the addition of the borrowed fund plus interest. But it’s important to note that this trading method comes with price risk, so we recommend investors have a trading strategy and do their research before margin trading on Binance.

How To Short on Binance with Futures

1. Open Binance

To create a Binance account for futures trading, visit the Binance Futures and derivatives trading section on the Binance mobile app or Binance Futures website and log in. Click on the ‘Open Account' button in the middle of the screen.

2. Transfer funds to Binance Futures

Before shorting Futures, investors must have enough funds in their futures wallet. Assuming the spot wallet has funds, the user can simply transfer USDT from the Fiat and Spot trading wallet to the USDT-M account futures wallet, where USDT contracts are traded. Once the transfer is initiated, the funds will become visible in the Futures account under the USDT-M section. This means the investor can now take up a short position against a wide selection of perpetual contract trading pairs using crypto as collateral.

3. Navigate to Binance Futures

Once the wallet has been funded with USDT, navigate to the Futures trading platform. Binance offers two major futures contracts investors can choose from.

- USD-M Futures: denominated and settled in stablecoins like USDT or BUSD.

- COIN-M Futures: denominated and settled in the underlying cryptocurrency like BTC, ETH, or LINK.

For this tutorial, we'll focus on USDT-margined futures contracts.

To begin futures trading with low trading fees on Binance, the investor must click on the ‘Derivatives' menu along the top, the fourth option from the left. Click on the ‘USD-M Futures' from the dropdown menu to access the trading portal for USDT-settled contracts. The default page is the BTCUSDT Perpetuals — which denotes Bitcoin contracts.

There are other options available for investors on Binance. This page details other contracts such as ETHUSDT, ETCUSDT, and LTCUSDT. The benefit of the Binance Futures exchange is the support for multiple trading pairs which can be shorted. There are over 100 coins, including APE and LUNA, on Binance. Moreover, Binance has live market data on open interest, so you can check the open interest, long/short, and funding information for each crypto.

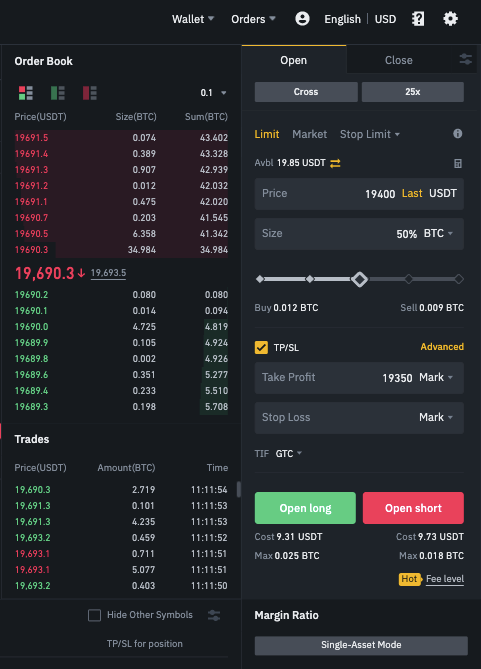

4. Enter a short trade

The final step is to short Bitcoin or another crypto on Binance Futures. For this tutorial, we will short Bitcoin using cross-margin mode with 25X leverage. Low leverage is recommended for inexperienced traders to reduce the risk of liquidation. We will demonstrate the process of shorting on Binance using Bitcoin/USDT as an example when the price falls below the $19,400 limit price.

As shown in the price chart, Bitcoin’s price is above $19,600 at the time of writing. Since the collateral for this order is low (20 USDT), we’ll place an order for 40% of the amount available. That comes out to 0.025BTC as the order size. We can also set a ‘Take Profit' and ‘Stop Loss' level. This is very important, as it puts the trade on autopilot and can help users take profits once a certain level has been achieved or stop the bleeding if the market turns against the trader.

Once all these are set, the next step is to click on ‘Open Short.' The position won’t open until the Bitcoin price drops to $19,400. Once it does, the futures contract will be initiated. However, price volatility is a major constant. If the Bitcoin price continues to slide, the investor will profit, and if the prices rise, the investor will lose money.

Is It Profitable To Short on Binance?

Yes, it is possible to generate profits from the crypto market by entering a short position. Although, shorting is a high-risk trading strategy that can result in significant profits and losses. While it's possible for short sellers to make huge gains in a market decline using leverage, the opposite is also true if the market trends higher, or the account is overleveraged and forced to liquidate its short position. Investors who want to short Bitcoin price or any other crypto assets should be experienced with using leverage to avoid making significant losses.

What Are The Fees to Short on Binance?

There are trading fees for shorting Bitcoin on Binance. Short sellers on Binance Futures are required to pay from 0.02% (makers) and 0.04% (takers) when using a limit or market order respectively. Paying with the platform's native token BNB can reduce trading fees by 10% to 0.018% and 0.036%. In addition, Binance's short-selling fees are largely based on trading volumes. The more short sales an investor makes, the lower fees they pay.

There are additional fees when trading with the Binance margin platform for repaying the interest. The rate charged on the borrowed funds is based on an hourly basis. This means if an investor borrows funds for an hour, the interest incurred would be charged based on the timeframe. For more information on the fees on Binance, read our full Binance review.

Frequently Asked Questions

Can you short altcoins on Binance?

Yes, there are over 100 altcoins that can be shorted with leverage up to 3x on Binance. The altcoins are paired against other fiat currencies, stablecoins (e.g. BUSD, USDT), Bitcoin, Ethereum, and others as collateral. Moreover, there are more than 50 altcoins that can be shorted on the Futures platform with leverage up to 100x.

Does Binance have an options market to short crypto?

Binance has an options market that gives users the right, but not the obligation, to sell an underlining cryptocurrency at a certain price and predetermined date. Binance has a BTC/USDT and ETH/USDT spot index with daily, weekly, monthly, and quarterly options. This form of short-selling involves a lower capital requirement compared to margin and futures products with capped losses. The transaction fee rate is 0.02% for opening and closing an options position.

Can you short crypto on Binance.US?

No, users on Binance.US cannot margin or leverage trading cryptocurrencies. This is due to strict regulations in the United States that prohibit citizens of the U.S. from using crypto margin trading products.