We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Bamboo Review

Hedge with Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge with Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

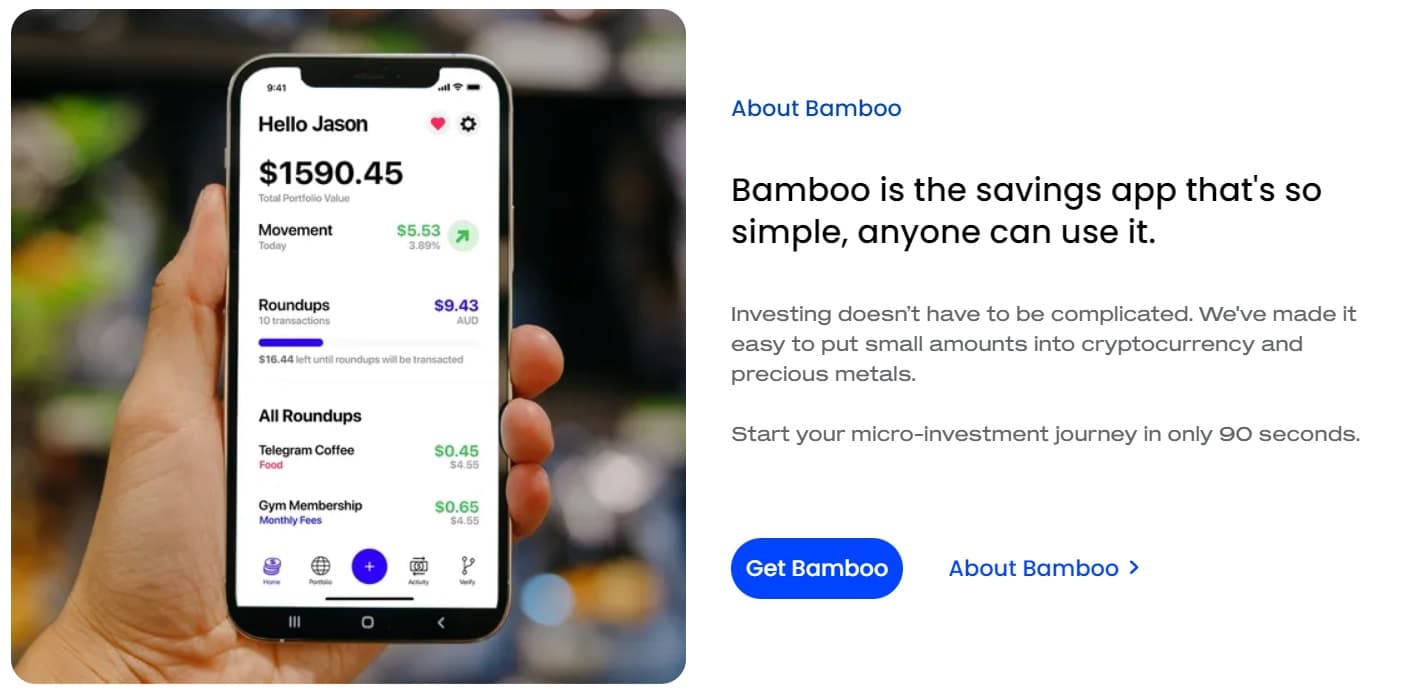

Bamboo is a new player in the niche sector that allows Australians to easily buy cryptocurrencies and precious metals in small amounts. In this review, we will explore the features, fees, and supported digital currencies of the Bamboo App to determine if it’s a good way to build a crypto portfolio.

Bottom line:

Bamboo is an innovative financial platform that enables Australians to gradually build a crypto portfolio using micro-investments. However, Bamboo doesn’t quite stack up against the best Australian crypto exchanges and investment platforms in cost-effectiveness. Depositing small amounts — especially less than $50 — can become expensive. Bamboo makes up for it by providing excellent customer service, an easy-to-navigate user interface, and support for SMSF accounts.

-

Trading Fees:

N/A

-

Currency:

AUD, USD

-

Country:

Australia

-

Promotion:

None available at this time

How We Rated Bamboo

| Review Criteria | Hedge With Crypto Rating |

|---|---|

| Features | 4 / 5 |

| Supported Fiat and Deposit Methods | 3 / 5 |

| Supported Crypto & Trading Pairs | 3.8 / 5 |

| Fees | 3.5 / 5 |

| Ease of Use | 4.8 / 5 |

| Customer support | 4.8 / 5 |

| Security Measures | 4 / 5 |

| Mobile App | 4.9 / 5 |

What is Bamboo?

Bamboo is an Australian fintech startup formed out of Perth in 2017. The company, headed by CEO Blake Cassidy and COO Tracey Plowman, created a smartphone application that makes investing small amounts into cryptocurrency a seamless process. By rounding up loose change from everyday expenses like coffee or bus fare, those with minimal experience in the blockchain sector can easily accumulate cryptocurrency and other assets.

Bamboo is not a cryptocurrency exchange, as users cannot buy crypto assets others have put up for sale. It is instead a financial service that allows micro-investments to buy into Bitcoin, Ethereum, Gold and Silver. Bamboo even offers a native token, BAM, which can be purchased and held for various earning opportunities and cost-saving benefits. Users can download the Bamboo mobile app for Android and iOS devices via the Google Play and Apple App Store, respectively.

| Product Name | Bamboo |

| Supported Countries | Australia, (United States coming soon) |

| Accepted Fiat Currency | AUD, USD |

| Supported Cryptocurrency | Bitcoin (BTC), Ethereum (ETH) |

| Deposit Methods | Bank transfer |

| Transfer Fees | Deposit and withdrawal fees vary based on amount being transferred |

| Account Maintenance Fees | $3.50 per month for accounts under $15,000 |

| Minimum Transaction | $50 (for manual top-ups) |

| Mobile App | Yes |

Bamboo App Compared

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

Swyftx Swyftx

|

422 |

0.6% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.9 / 5 |

$20 Bitcoin for creating a verified account |

Visit Swyftx | Swyftx Review |

|

|

385 |

0.1% (spot) and 0.02% / 0.04% (Futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

Up to $100 welcome bonus |

Visit Binance | Binance Review |

|

|

380 |

1% (instant), 0.1% (spot) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

$20 Bitcoin for creating a verified account and depositing |

Visit CoinSpot | CoinSpot Review |

How Does Bamboo Work?

Bamboo leverages a prominent investment strategy referred to as dollar-cost averaging (DCA). Various Australian and international cryptocurrency exchanges have introduced features supporting this, often known as a “recurring buy” order.

The DCA process involves buying a set amount of an asset at pre-determined intervals. For example, someone might set up an order to buy $50 of Ethereum (ETH) every fortnight. Therefore, the investor can avoid the trap of trying to time the market and grow their portfolio over time. By buying in regular timeframes, Bamboo customers don’t have to worry as much about short-term price swings and volatility that the crypto market is notorious for.

The DCA strategy, provided by the Bamboo app, is popular among long-term and novice investors. It requires minimal trading knowledge and only requires incremental deposits, rather than large lump sums that other trading strategies might need. It takes the emotion out of trading (in particular, FOMO and FUD), which is one of the biggest and most common mistakes beginners make.

Bamboo customers can create their own DCA portfolios depending on how they wish to weigh their investments. Someone that wanted to put all their money into Bitcoin would choose a 100% Bitcoin portfolio, and so on.

Is Bamboo Legit?

Bamboo is a licensed Australian business, and all associated exchanges used to provide crypto are AUSTRAC-registered. It is important to note that, as Bamboo is not technically an exchange, they have slightly different legal obligations than other platforms like Coinspot. Bamboo is an Australian micro-investment platform that’s been around for a few years and built up a trustworthy reputation. The team has since developed a decent reputation among the Australian community. Bamboo has received a 4.3/5-star rating from customer reviews on ProductHunt.

Review of the Top Features on Bamboo

Automated Micro-Investing

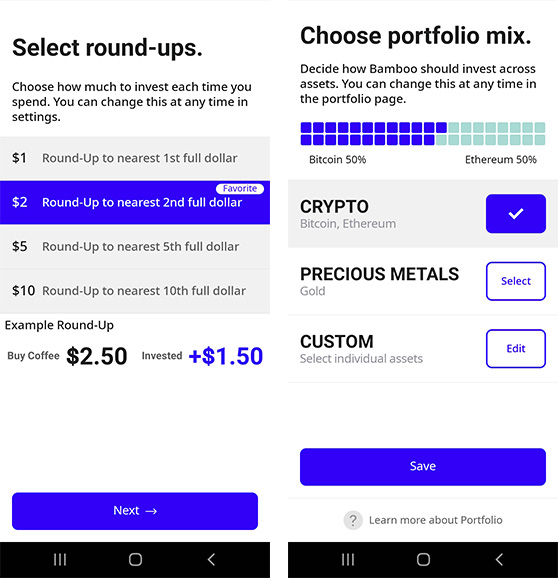

The Bamboo investment process involves something they call “round-ups”. Customers can link their bank account to the mobile app, and every time they make a purchase Bamboo will round it up to the nearest dollar. Say someone buys a restaurant meal for $8.43 — the app would round that up to $9 and take 57 cents. Once the round-ups reach a certain point (typically $50), they are automatically invested into a pre-determined Bamboo portfolio.

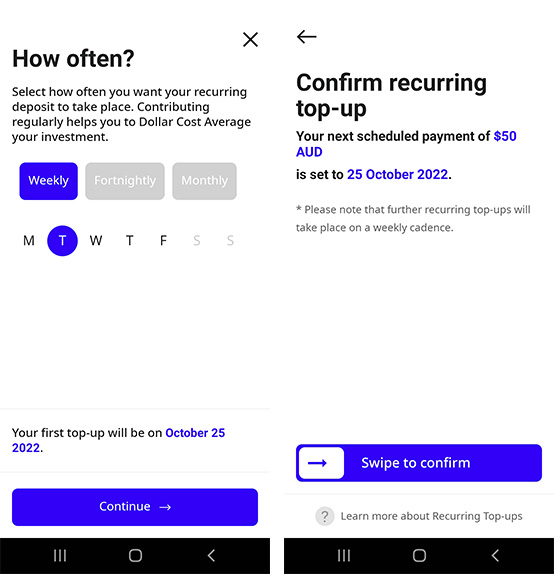

The Bamboo application also supports the manual accumulation of assets through something they call “top-ups”. Top-ups have a minimum deposit of $50. They can be executed at any time in conjunction with the automatic round-up investments. Those who desire to deposit a little more than loose change can set up recurring orders daily, weekly, or monthly. Alternatively, top-ups may also be made as a one-off payment, which can be very useful when receiving a lump sum like a pay cheque.

Manual top-ups also give more advanced investors flexibility with their trading. Round-ups make deposits in regular intervals without much user input. Conversely, manual top-ups can be manipulated to reflect the current market state. For example, say Bitcoin and Ethereum are in a bear run, and an investor identified this as a good time to buy in cheap. They could set up a recurring top-up for a couple of months and then re-assess the market once the order is completed. It’s a decent way to gain exposure to trading strategies while mitigating risk through DCA and using small amounts of capital.

Customizable Portfolio

Investors can build their own portfolios depending on their risk appetite, trading experience, and preferred assets. The four commodities on offer — ETH, BTC, gold and silver — can be split proportionally. For example, a crypto-centric strategy might look like 60% BTC and 40% ETH.

Someone who wants to hedge against inflation and a bear market might prioritize gold, with a portfolio of 75% gold and 25% BTC. Having a customizable portfolio is a decent way for beginners to learn some fundamentals of the financial world (e.g., precious metals are typically popular during harsh economic climates, while crypto is quite high-risk and volatile). Those without the desire to customize their portfolio can choose one of Bamboo’s pre-made investment plans. Ultimately, the choice is with the investor which is a useful feature.

Portfolio Rebalancing

Accompanying the portfolio customization feature is something Bamboo refers to as a “portfolio rebalance”. This is an upcoming feature on the mobile application that helps investors adjust their portfolios in real-time, depending on market movements and their risk appetite. Similar to the best crypto portfolio tracker apps, this will allow the users to quickly manage their portfolio during sudden volatility events.

The downside is using this feature may incur some fees, as assets are moved around each time the portfolio rebalances. It is also unclear if rebalancing will be automatic depending on a pre-determined risk appetite or if it will have to be adjusted manually.

BAM Token

The BAM token is one of Bamboo’s more unique features. It is very uncommon for smaller Australian cryptocurrency exchanges to offer a native rewards token, let alone a micro-investing application.

The complete package that comes with owning BAM tokens hasn’t been fully unwrapped yet, but there are already plenty of use cases for holding the asset. BAM can be earned just by using the Bamboo app as an incentive for customers to keep coming back.

The current rewards rates are:

- 1.5 BAM for every $50 invested

- 4 BAM per month that has a recurring payment schedule

- 5 BAM for every new Bamboo account referred

To meet the above criteria and activate rewards earning, 2% of the investor’s portfolio must be BAM. The value of BAM tokens fluctuates — but at the time of writing this article, 1 BAM is equivalent to $1.15 AUD. The primary use-case of BAM tokens is to pay for fees. Participating in the rewards program can be a simple way for investors to essentially get free trades. Alternatively, BAM can be cashed out to a linked bank account anytime.

The tokenomics of BAM requires every user participating in the rewards program to have 12 tokens burnt at the beginning of every month. This is to avoid inflation and prevent BAM from becoming debased. While losing 12 BAM monthly may seem like a major negative, reducing the supply increases the value of BAM, so the loss is somewhat offset.

Self-managed Super Fund (SMSF) Support

Bamboo allows eligible Australians to open SMSF accounts on their platform. Pairing a risk-averse, long-term DCA strategy with superannuation is a logical match, making Bamboo an excellent option for residents looking to diversify into cryptocurrency.

The requirements for a crypto SMSF can be overwhelming. It is generally only recommended for high-net-worth individuals (HNWI) or those with a relatively high salary. However, the Bamboo application only requires your super fund name, trustee name and BSB to open an SMSF account. The Bamboo team has partnered with several super companies to ensure they provide the best services to their clients. This includes tax agency Cryptocate, Blockchain Australia and Sequoia Superannuation.

Supported Cryptocurrencies

Bamboo app is a very simple process that intends to make micro-investing possible for those who view investing as “too difficult”. To keep true to its business philosophy, Bamboo supports very few cryptocurrencies. While the list of cryptos to buy may underwhelm advanced blockchain users, Bamboo is not targeted toward the demographic that wants to buy altcoins and meme coins.

There may be scope for adding a few high-profile cryptocurrencies down the line. However, this is unlikely to occur until more coins have a similar stature and market cap to Bitcoin and Ethereum. The two coins on offer are Bitcoin (BTC) and Ethereum (ETH). While Bamboo allows investors to divert some, or all, of their funds into precious metals (gold and silver), it will not suit serious crypto investors.

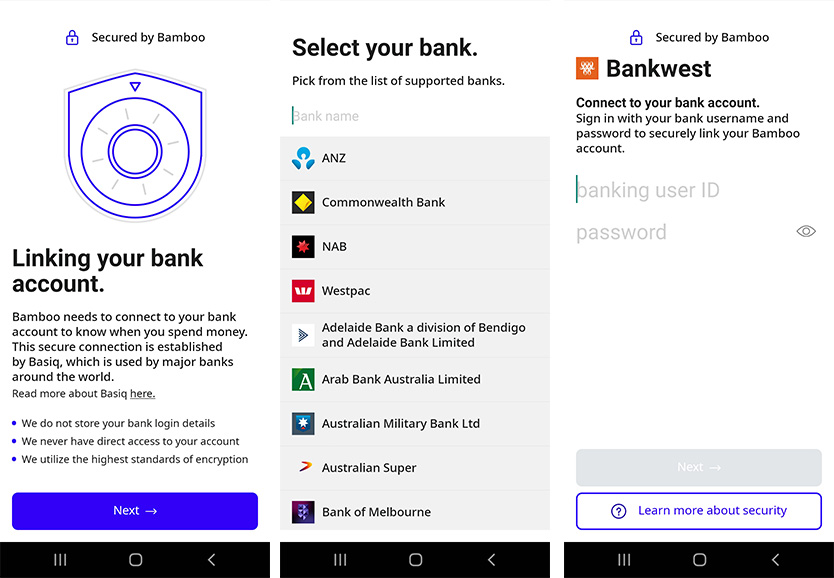

Deposits, Withdrawals & Limits

Bamboo has only one accepted deposit method — bank transfers. New accounts must sync up their bank details to Bamboo upon signing up. Then, Bamboo will automatically take “round-ups” from the linked bank account when they total $50. In addition, any recurring payments will also be taken from a connected bank account. Users can link multiple accounts, although they must be from the same banking institution.

Bamboo is partnered with over 50 banks, so most Australians should have no problem syncing their accounts. We did not notice any glaring absentees from the list of accepted financial institutions. In addition, there isn't much flexibility for crypto investors that have ample choice to deposit AUD on a traditional exchange.

Withdrawals are similarly made to the linked bank account as a direct deposit, taking 1-3 business days. As the order is not executed instantly, withdrawals can be prone to slippage. Slippage is an asset’s price difference between when a trade is placed and when it is finalized. Bamboo discloses that customers should expect slippage of +-5% per withdrawal.

Both manual top-ups and automatic round-up payments have a minimum $50 requirement. This means the Bamboo app must identify $50 worth of “loose change” before making a transaction. The deposit limit for top-ups is $500 daily and $15,000 monthly. These figures are very low compared to most other platforms.

However, considering Bamboo’s target audience this isn’t necessarily a negative. In addition, customers can request their limits to be increased under certain circumstances. There is technically no minimum withdrawal, however as withdrawals incur a fee, the minimum is actually $1.49. Moreover, it is important to note that cryptocurrencies cannot be withdrawn or deposited. Users can’t send Bitcoin or Ethereum to a cryptocurrency wallet for safe storage. The only disposal method is via sale for Australian dollars.

Related: What is the best crypto wallet to use in Australia?

Bamboo Fees

As a micro-investing platform, fees will typically be unfavorable compared to trading-centric cryptocurrency exchanges. Bamboo holds up decently, however those with more investment experience — even if only early in their journey — might want to look elsewhere for efficient trading. No cryptocurrency deposits or withdrawals are available for Bamboo users, so there are no related fees.

Bamboo charges a monthly $3.50 maintenance fee for accounts with a portfolio under $15,000. This rate is comparable to other Australian micro-investing platforms like Raiz ($3.50 monthly) and Spaceship ($2.50). There are no transaction fees charged by Bamboo, as users cannot directly make trades. However, this may change depending on the Rebalancing update.

Bamboo charges AUD and USD deposit and withdrawal fees. These fees vary depending on how much fiat currency is being transferred.

| Transfer amount | Bamboo Fee |

|---|---|

| $100 or less | $1.49 |

| $100 to 250 | $1.49 |

| $250 to 500 | $3.99 |

| $500+ | 0.8% |

A fee of $1.49 on the minimum deposit/top-up amount ($50) is quite uncompetitive, working out to around a 3% surcharge. By comparison, Swyftx charges a flat 0.6% fee and Digital Surge 0.5%. Other micro-investment platforms like Raiz and Spaceship don’t charge any brokerage fees at all. However, deposits of over $500 are relatively cost-effective and comparable to most other Australian cryptocurrency exchanges.

Bamboo Customer Support

Bamboo is an Australian-based company that provides prudent customer support during relevant business hours. Users can contact the team via email for customer inquiries. Bugs can also be reported via a short form. Bamboo has also introduced a live chat feature thanks to an integration with Intercom. The team was very fast to reply to us (within 3 minutes) and were very helpful and friendly.

The application also hosts a comprehensive Help Centre and FAQ section with 50+ articles covering the most relevant questions. The same FAQ page is bugged on the desktop website, as nearly 50% of the articles are missing.

What’s It Like To Use Bamboo App?

True to the team’s business philosophy and target audience, using the Bamboo App is an incredibly seamless experience. There are only four tabs for customers to browse through:

- Home (includes settings and an overview of the investment schedule)

- Portfolio (allows adjustment of portfolio weighting and shows performance)

- Activity (shows manual top-ups and “loose change” rounded-up)

- Rewards (shows how much BAM the customer has earned)

Finally, manual investments and withdrawals can be accessed via the middle button. Customers can choose between Top-ups (one-off payments), Recurring Top-ups (a DCA strategy), and withdrawals. With just a few taps of the phone, these payments can be set up. It's one of the best crypto apps for beginners however, they will need to enter their personal information and bank details from the outset without seeing the features of the app which is a negative.

How To Sign Up For Bamboo App

Signing up for the Bamboo app is a simple process, although it can take 5-10 minutes to get everything ready. First, customers must download the application via Google Play or Apple App store. From there, they must submit basic personal data, such as their full legal name and email address.

Next, new accounts must verify their phone number by entering a text code. Then, a list of all supported bank accounts will come up. Customers must select their banking institution and input their customer ID and password. Bamboo will then sync the bank account with the Bamboo application. This can take a couple of minutes.

Finally, users can adjust investment settings, including how much they wish to round up by. To the nearest second dollar is the automatic round-up option, meaning a $2.50 coffee would invest $1.50 (for a total of $4). Customers can also set up a recurring payment in the signup stage, which is not required.

Because Bamboo is not a cryptocurrency exchange, the platform does not have the same KYC requirements as other Australian platforms. New accounts do not need to provide government-issued documentation, like a passport, as they would for some other crypto services.