We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Mercatox Review

Mercatox boasts a Peer-to-Peer (P2P) crypto exchange, margin trading capabilities, and an in-built crypto wallet. But that doesn’t mean it’s suitable for everyone.

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Bottom line:

Whilst Mercatox is a solid crypto-to-crypto trading exchange, the lack of fiat options will restrict accessibility for new investors who prefer to buy and trade crypto using their local currency. The trading interface is definitely not the most modern one going around, however, it still provides a relatively intuitive service with its TradingView charting and availability of common order types.

Apart from that, its features are fairly standard and not as refined as the top crypto exchanges we have reviewed. One of the strengths of Mercatox is its wide support for over 500+ digital currencies and highly competitive trading fees. Mercatox is a worthy DEX option but its limitations outweigh its benefits and are better crypto platforms to choose from.

-

Trading Fees:

Flat 0.25%

-

Currency:

Fiat not accepted (crypto only)

-

Country:

Global (USA allowed)

-

Promotion:

None available at this time

How We Rated Mercatox

| Category | Hedge With Crypto Rating |

|---|---|

| Features | 3.5 / 5 |

| Supported Fiat Currencies and Deposit Methods | 3 / 5 |

| Supported Cryptocurrencies and Trading Pairs | 4 / 5 |

| Fees | 3.9 / 5 |

| Ease of Use | 4.5 / 5 |

| Customer Support | 3.7 / 5 |

| Security Measures | 3.8 / 5 |

| Mobile App | 4 / 5 |

Mercatox At A Glance

Founded in 2016, Mercatox is a United Kingdom-based Decentralized Exchange (DEX) that serves more than 600,000 users across the globe. The Mercatox crypto exchange boasts many features designed to elevate the trading experience. These include a Peer-to-Peer (P2P) crypto exchange, margin trading capabilities, and an in-built cryptocurrency wallet that stores digital assets.

As an unregulated exchange, Mercatox offers only cryptocurrency-to-cryptocurrency trading services and does not provide a gateway to deposit or withdraw fiat currencies such as USD or EUR. According to CoinMarketCap, Mercatox has a daily trading volume of over $9.5 million which is very small compared to the larger exchanges in the market.

| Exchange Name | Mercatox |

| Fiat Currency | Not supported |

| Cryptocurrency | 510 |

| Payment Type | Crypto only |

| Trading Fee | 0.25% per trade |

| Deposit Fee | None |

| Withdrawal Fee | None |

| Mobile App | Not available |

Mercatox Compared

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

|

|

385 |

0.1% (spot) and 0.02% / 0.04% (Futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

Up to $100 welcome bonus |

Visit Binance | Binance Review |

ByBit ByBit

|

331 (608 trading pairs) |

0% (spot), 0.06% / 0.01% (futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

0% trading fees for 30 days (spot only) |

Visit ByBit | ByBit Review |

|

|

222 |

0.16% (maker) and 0.26% (taker) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

None available at this time |

Visit Kraken | Kraken Review |

Review of the Top Features on Mercatox

Supported Crypto Coins

Mercatox supports an impressive list of 510 different crypto assets and thousands of coin-to-coin trading pairs. Mercatox boasts support for the majority of well-established projects (Bitcoin, Ethereum, XRP) as well as lesser-known assets like Golem, Curium, and Zenon.

Mercatox is well-equipped for people who want to trade exotic cryptocurrencies or are looking to diversify into multiple crypto coins. Its array of supported digital currencies is slightly below that of UniSwap, a highly popular crypto trading DEX.

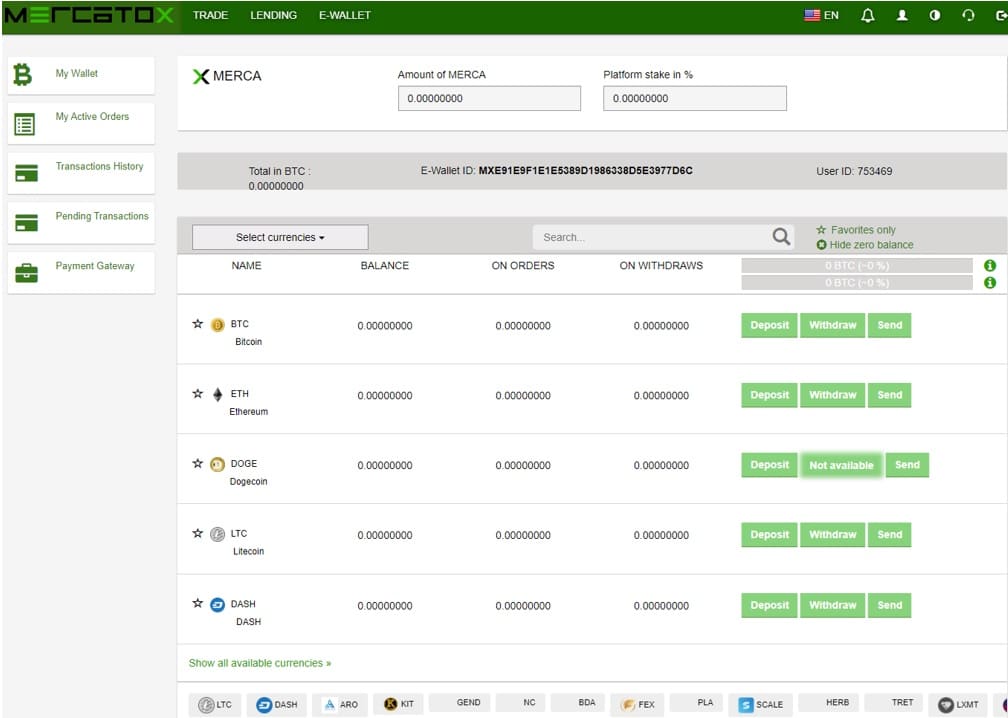

Multi-Currency Wallet

Mercatox comes with an integrated multi-crypto wallet, however, fiat currencies are not able to be stored (or deposited). Users can store every coin that is available to trade on the Mercatox platform. However, as Mercatox offers only an exchange wallet, users cannot access their private keys.

As a result, users could permanently lose access to their assets if the exchange becomes insolvent or gets banned in a particular region, as opposed to using one of the best crypto storage wallets for long-term holds.

Affiliate Program

For anyone wishing to earn money from crypto without investing or trading, Mercatox offers an affiliate program allowing people to promote Mercatox to earn crypto. Anyone with a Mercatox account can share a unique affiliate link with others to earn fee-based rewards. If a user signs up using one of these links, the affiliate will receive 15% of the newly referred user's trading fees. As well as a further 5% of the fees generated by any users the referee invites to Mercatox.

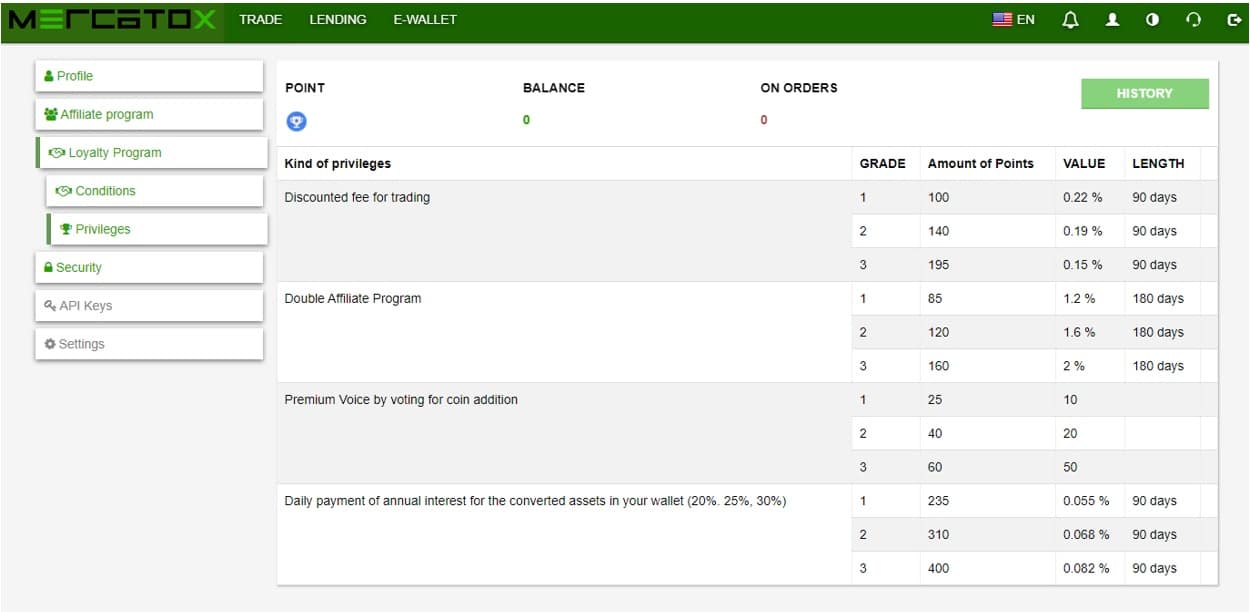

Loyalty Program

In addition to its affiliate program, Mercatox users can participate in a loyalty program. Currently, in beta, users can earn points for interacting with the company on social media and creating topics related to Mercatox on popular forums. Users can earn points to reduced trading fees, earn extra affiliate payments, and even higher annual interest yields on assets held on Mercatox.

Lending Program

While Mercatox does advertise a lending program, the service was inaccessible at the time of writing. Furthermore, while we checked the company's social accounts and checked for any related information on the site, there was none available.

Account Creation & KYC Verification

Being an unregulated exchange, Mercatox boasts a straightforward registration process. Users need to provide an email address and a password to gain access to create an account on the exchange platform. After doing so, users will receive a confirmation email enabling them to gain access to Mercatox.

While not a strict requirement, users are also free to complete the Know-Your-Customer (KYC) process by providing proof of address (bank statement, utility bill) and a form of photo ID (passport, driving license). After completing KYC, the withdrawal limit will increase to 5 BTC. It should be noted that ID verification is not compulsory and users can use the platform to trade crypto-to-crypto without KYC.

Funding & Limits

Unfortunately, Mercatox lacks when it comes to the range of deposit methods as only digital currencies such as Bitcoin and Ethereum can be deposited. While the DEX supports deposits with a massive variety of different cryptocurrencies, there is no option to deposit using fiat currencies.

Lacking the ability is buy crypto using fiat is a significant disadvantage to any exchange. With no option for GBP, AUS, USD, or any fiat currencies, crypto investors will find it challenging to use Mercatox for progressive purchasing strategies like Dollar Cost Averaging.

Withdrawals are mostly the same. The only real difference is that instead of sending funds to Mercatox, they would rather be sent to the user's crypto wallet. Unverified accounts will have a daily 1 BTC withdrawal limit, while verified accounts can withdraw up to 5 BTC.

While there are no reported daily or weekly funding limits, as Mercatox is an unregulated exchange, and therefore limiting the amount of money stored on the platform is advisable. Furthermore, despite the exchange offering strong security, it would be difficult or impossible for users to get their funds back if something goes wrong.

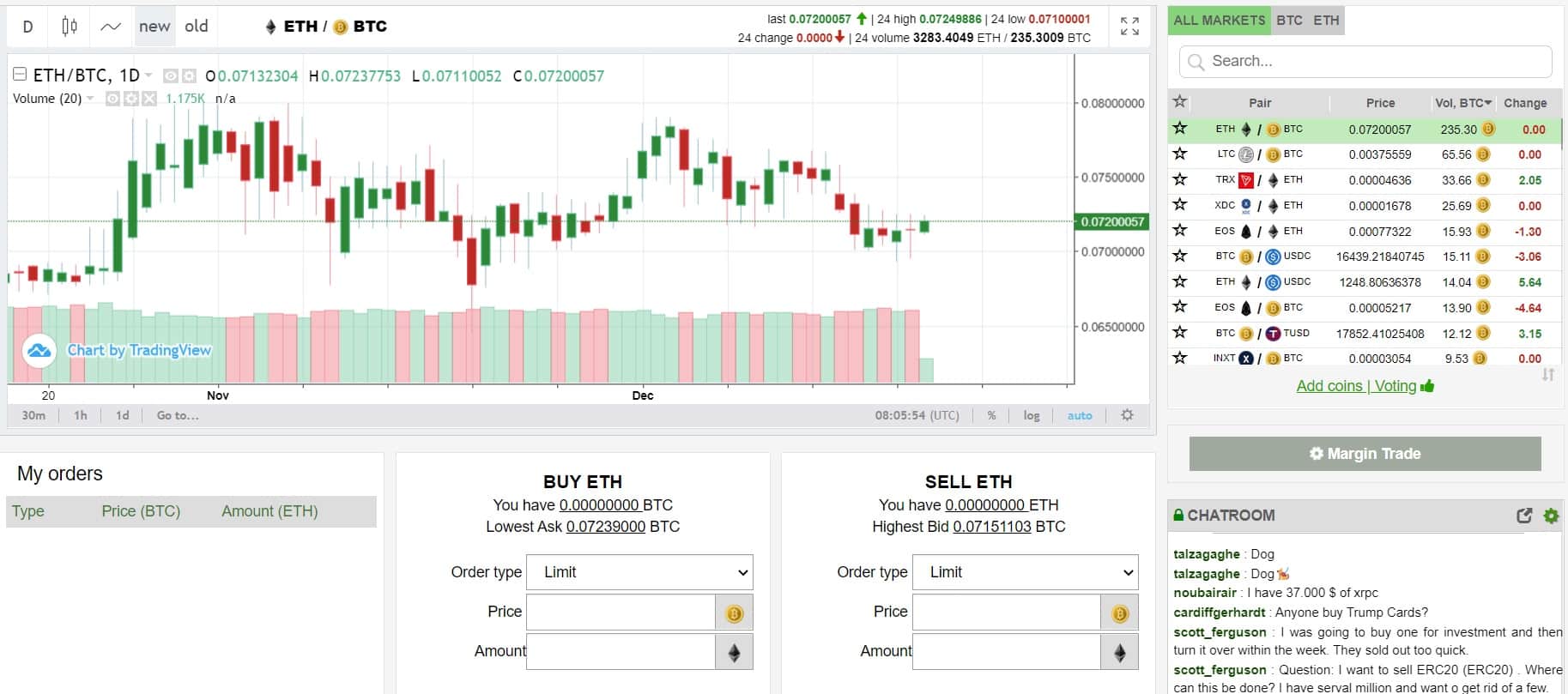

Ease of Use & Trading Experience

Naturally, its trading platform is the primary focus of the Mercatox cryptocurrency exchange. With support for over 500 different cryptocurrencies, users have more than enough assets for trading and diversification.

While most modern trading platforms have opted to keep with the times and boast a sleek design, Mercatox has instead gone for a bare-bones approach. As a result, the exchange lacks modern styling, detracting from its appearance but adding to its ease of use.

Ensuring that users can dial in their purchases effortlessly, Mercatox boasts three different order types.

- Limit Order: The user sets a specific price that needs to be reached for the transaction to complete.

- Market Order: Automatically completes transactions at the current market prices.

- Stop Order: Once the target asset hits a specific price, the transaction converts into a market order.

Similar to most crypto exchanges, Mercatox offers an order book-style exchange. Users can see sell and buy orders for any pair and the total volume for each side, providing valuable information helpful in determining buyer sentiment.

The Mercatox platform has TradingView charting but it suffers from latency issues and lacks a robust selection of drawing tools. A chatroom (troll box) is presented and is indicative of an older-style platform but it doesn't exude the level of professionalism that the major exchanges provide.

Overall, the Mercatox trading interface is outdated and clunky, and it doesn't appear that it is an area of investment for the company. Simply put, active traders have a lot better trading interfaces to choose from that provide much more streamlined and modern user experiences.

Mercatox Fees & Charges

The fee structure of Mercatox is simple as a 0.25% transaction fee applies for all trades. Whilst it is not as cheap as UniSwap (0.05% – 1% fees) or Binance (0.1% fees), Mercatox's trading fees still beat a lot of popular crypto exchanges and it provides some value for money.

Deposits and withdrawals of cryptocurrencies to and from the Mercatox multi-token wallet will not incur any fees. For crypto withdrawals to an external wallet, a standard network fee will apply. The fee will be minor but will be dependent on the asset transferred, network congestion, and the complexity of the transaction.

Customer Support

When it comes to customer support, Mercatox misses the trick. The company has a dedicated support email and a forum-style Mercatox website that covers common issues and allows users to create a ticket to get assistance.

On the surface, this may seem adequate, but users of the exchange have repeatedly stated that they received heavily delayed assistance or, worse yet, have yet to receive a response. Lack of support is unacceptable for such a prominent exchange and is worth considering before registering.

Mobile App

Unlike the majority of popular cryptocurrency exchanges, Mercatox does not provide an Android or iOS-compatible mobile app for its users. Instead, its services are only accessible via an internet browser and the lack of a mobile app is a major downside. We found the Mercatox website to be mobile-friendly, however, the experience was a bit cumbersome and tricky. Users who prefer cryptocurrency trading on a mobile device will be better served by an alternative exchange that provides a top-rated crypto app.

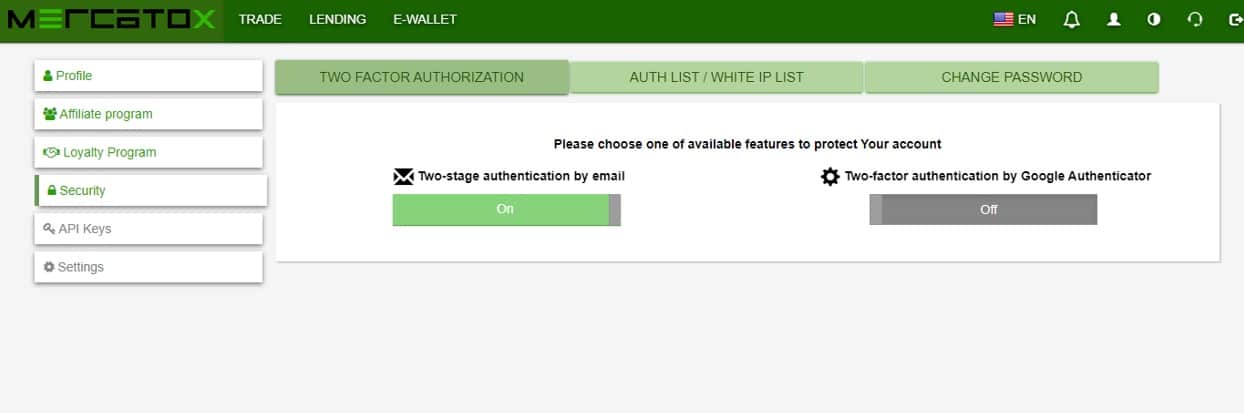

Security of Assets

Details about Mercatox's security measures are rather lacking on its website and this might hinder consumer confidence. This is particularly important since coins and tokens traded on the platform will be stored in its multi-asset wallet unless they are withdrawn. 2-Factor Authentication (2FA), a standard security measure to protect against unauthorized account access, can be set up via email and Google Authenticator

Akin to most other DEX's, Mercatox does not offer insurance coverage in the event that digital funds and assets are lost. This is one of the downsides of decentralization, as there is no legal entity to assist if a trader runs into issues of lost currency, theft, or fraud.