The Basics of Ethereum (ETH) & How It Works

Key takeaways:

- Founded in 2013 by Vitalik Buterin, Ethereum is an open-source blockchain designed for the construction and distribution of decentralized applications (dApps).

- The Ethereum whitepaper outlines that the native programming language can be used to create dApps to perform smart contracts.

- The decentralized Ethereum blockchain has massive real-world applications in many industries and sectors including finance, real estate, gaming, and supply chain management.

- ETH, the native token of the Ethereum blockchain, is used to pay for transactions made on the network and is often referred to as the ‘gas fee'.

TABLE OF CONTENTS

The Ethereum blockchain and its native cryptocurrency, Ether or ETH, have been among the best-performing assets of the decade. The current price of Ethereum is with a dominance rate of 7.21% increase .

Ethereum differs from Bitcoin in almost every way. Yes, it is a blockchain and accompanying cryptocurrency, but the purpose of Ethereum is vastly different. This article will explain what Ethereum is, how it works, its pros and cons, and what lies ahead for the digital currency.

Ethereum Explained For Beginners

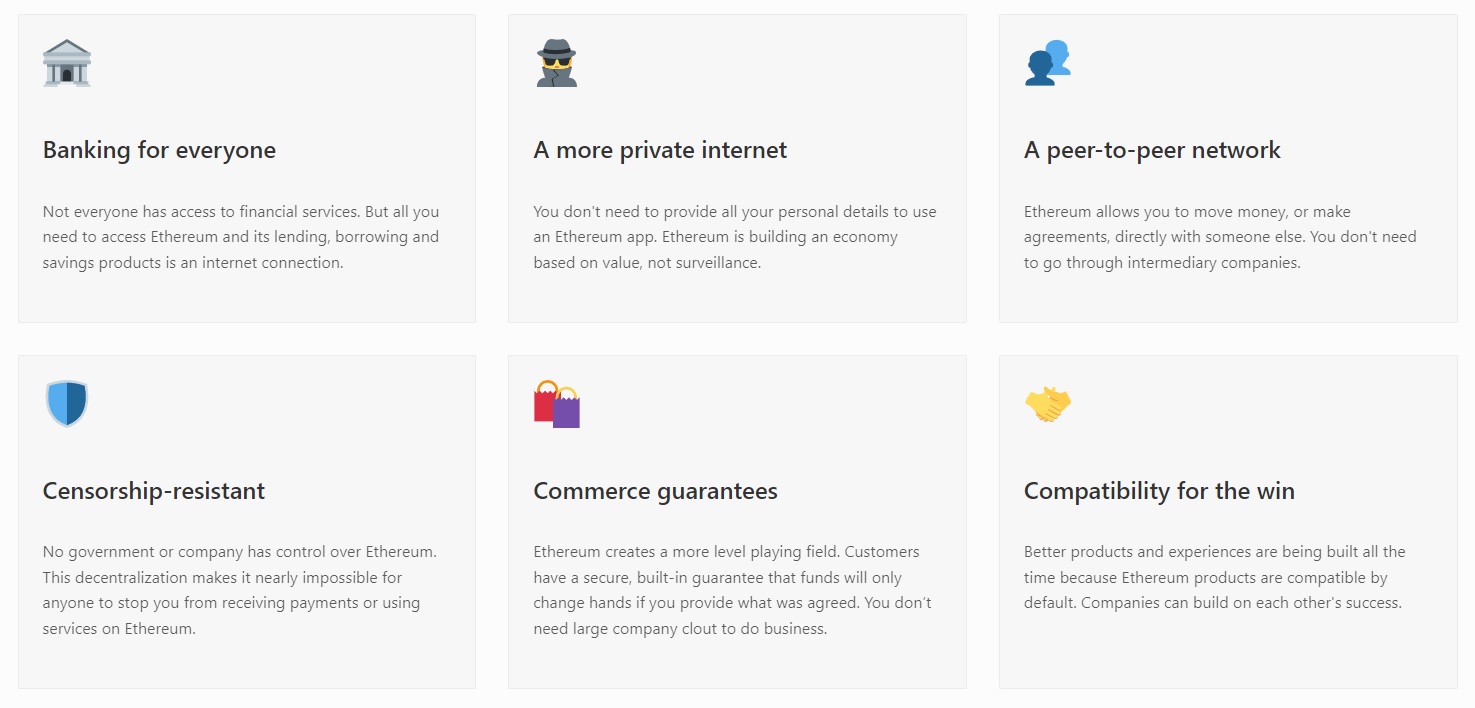

Ethereum is an open-source blockchain designed for the construction and distribution of decentralized applications (dApps). The native cryptocurrency for the Ethereum network is called Ether or ETH is used for secure transactions on the blockchain. Founded in 2013 by Vitalik Buterin and a group of developers, the intent behind Ethereum was to create an ecosystem to improve the real-world use case of Bitcoin beyond performing peer-to-peer transactions.

As outlined in the Ethereum whitepaper, developers can design dApps using the native Ethereum programming language called Solidity, which can be used to run smart contracts on a decentralized network. The Ethereum blockchain has become the go-to ecosystem for the development of thousands of decentralized applications. After launch, most dApps go on to create their native cryptocurrency tokens, which means a large proportion of the cryptocurrency market that exists today can be attributed to the Ethereum ecosystem.

Smart contracts on the Ethereum network have led to innovative real-world applications that have touched several industries such as finance, real estate, medical, gaming, advertising, retail, logistics and supply chain management, sporting and transportation. A popular example is Decentralized Finance, or DeFi, which was first established on the Ethereum network to access financial products and services without an intermediary. More recently, the Ethereum blockchain has been used as the platform for NFT marketplaces, which are decentralized, secure, Non-Fungible Tokens or NFTs that are attached to unique items such as artwork and collectibles.

The Pros & Cons of Ethereum

The launch of Ethereum and smart contract functionality marked a turning point in the history of cryptocurrencies. Like Bitcoin, Ethereum is censorship-resistance meaning that no single entity can alter the network and the data stored within it. Every transaction that is ever completed on the blockchain can be retrieved and reviewed. The programmability of the blockchain has also facilitated many of the DeFi, NFT and crypto-based protocols that currently exist.

Although the supply of the native cryptocurrency ETH is inflationary, the new deflationary mechanism should keep the coin’s value stable. In addition to the increased efficiency of the Ethereum 2.0 upgrade, ETH is widely available in the market and is accessible from hundreds of cryptocurrency trading platforms worldwide.

| Ethereum Pros | Ethereum Cons |

|---|---|

| The network is decentralized with no single entity holding control | Smart contracts within decentralized applications can sometimes malfunction |

| All transactions can be checked via the public ledger | Network congestion on the blockchain can result in high transaction fees |

| Widely accessible cryptocurrency with a high liquidity | ETH is not widely accepted as a form of payment due to high volatility |

| Blockchain will be moving from an inefficient Proof-of-Work blockchain to an efficient Proof-of-Stake blockchain | No finite supply with new ETH coins are released during each new block of the blockchain |

| EIP-1559 has implemented a deflationary token burning mechanism | Upgrade to Ethereum 2.0 has taken far longer than initially anticipated |

However, with a greater level of functionality comes a greater chance of malfunction. Ethereum’s backbone is smart contracts that are programmed by humans which means there is always a risk of human error. As smart contracts are designed to be immutable and irreversible, if errors occur, funds could be lost.

Until Ethereum 2.0, the blockchain’s underlying Proof-of-Work mechanism means that, at periods of high usage, gas fees can rise exponentially. It is also not yet known when Ethereum 2.0 will complete. The upgrade has taken much longer than anyone anticipated.

Finally, the landscape of layer-1 blockchains that are built for the deployment of decentralized applications is constantly changing. Ethereum now sits within a saturated market and faces competition with quicker and more efficient blockchains such as Solana, Cardano, and Binance Smart Chain. If smaller networks capture too much market share, Ethereum may get left behind.

Ethereum Works With 4 Main Components

In comparison to the Bitcoin blockchain, which carries transactional data only, Ethereum’s blockchain network can perform computations, often referred to as smart contracts. These are essentially an agreement between two people using a programmed set of instructions that are executed on the blockchain without a central entity. The four (4) major components involved with how Ethereum works are the blockchain network, staking nodes, Ethereum virtual machine, and wallets. Each component plays a vital role in providing a platform to create DApps and process transactions.

1. Blockchain Network

The blockchain is a decentralized and digital public ledger that transmits and records smart contracts that are executed on the network which are cryptographically secured. This means that Ethereum transactions on the blockchain network can be viewed and inspected by anyone. There is no reliance on one central entity or intermediary, such as the centralized servers found at Google or Facebook.

2. Ethereum Staking

Like Bitcoin, the Ethereum network runs on a Proof-of-Stake (PoS) consensus mechanism. A process called staking is used to validate and verify each of the transactions on the Ethereum network. This entails validators and delegators to process and validate transactions on the Ethereum blockchain. Once validated, the contributors will receive a staking reward paid in ETH, based on their contributions to the staking pool.

3. Ethereum Wallets

Ethereum transactions between persons are carried out using a wallet which can take the form of a physical device, software, or mobile phone application. Each type of Ethereum wallet generates two components: a public key and a private key.

- Public key. A public key is a string of unique numbers and letters that can be shared when a user needs to send and receive transactions. It is akin to an account number for a bank account in traditional financing.

- Private key. A private key is used to sign transactions processed by the cryptocurrency wallet. Like a public key, the private key is another random string of numbers and letters, however, most wallets use a simpler root seed phrase such as a password.

By signing a transaction with a password, the user permits the movement of funds from an Ethereum wallet. While a public key can be shared with anyone, a private key must always be kept extremely secure. This is how a user stays in control of cryptocurrency assets. Check to make sure a cryptocurrency wallet is compatible with ETH before using it. To assist, we have compiled a list of the top Ethereum wallets based on our research.

4. The Ethereum Virtual Machine

Smart contracts on the Ethereum ecosystem are written in a programming language called “Solidity” which is quite similar to JavaScript which is commonly used for web applications. To make it easier for developers, Ethereum uses a software platform called the Ethereum Virtual Machine (EVM) that can be used for developers to create DApps on the network.

Ether (ETH) Is Used For Many Applications

Ether is the native cryptocurrency of the Ethereum blockchain that is used to create and run DApps, incentivize stakes, and as currency to pay transaction fees. Ether is often used as a platform for other cryptocurrency ecosystems and is represented on exchanges with the ticker ETH.

- Support DApps. Ether is used to create, operate, store data, and execute smart contracts. With the explosive development of Ethereum-based dApps, the demand for ETH has increased significantly which is why it currently holds the second-largest market cap of any cryptocurrency.

- Staking rewards. In the current PoS model, Ethereum stakers that validate a transaction on the network are rewarded with ETH rewards each time a new block is added to the blockchain. Ethereum staking rewards mean that ETH is an inflationary coin. That is, new coins are constantly being added to the circulating supply. Unlike Bitcoin which has a maximum supply of 21 million coins, there is no maximum cap on the number of ETH that can be created. This means the number of Ethereum left to be minted is technically infinite.

- Transaction fees. ETH is used to pay for transactions that are completed on the network which is often referred to as a “gas fee”. After the recent Ethereum upgrade (EIP-1559), all gas fees are now burnt, which has added a deflationary mechanism to the coin. The new gas fee burn is intended to offset the ETH minted during the staking process. For more information on the costs to transfer Ethereum, read this article next.

Ethereum Security & Safety

Ethereum is a mature and well-established cryptocurrency that is the second largest in terms of market capitalization and dominance. Based on a decentralized framework, Ethereum is one of the most secure blockchain networks today that is very difficult to hack or breach. This is due to its vast array of validator nodes worldwide and computing power that verifies and secures each transaction which significantly reduces the likelihood of a 51% attack.

Ethereum Is Bought From Exchanges

As the second-largest cryptocurrency by market capitalization, ETH is widely available across a variety of different platforms. The most popular ways to buy Ethereum include centralized cryptocurrency exchanges, decentralized exchanges, brokerages, and wallets. These platforms can also be used to sell Ethereum to cash when the price is right.

- Centralized exchanges. Centralized exchanges are extremely useful platforms that match cryptocurrency buyers with sellers. Most provide several fiat payment methods and offer a wide selection of cryptocurrencies. As centralized exchanges are governed by one central entity, many are now regulated and require KYC documentation before exchanges can be completed. Examples of centralized exchanges include Kraken, Crypto.com, Gemini, and Binance.

- Decentralized exchanges. Built on top of a blockchain, such as Ethereum, decentralized exchanges (DEXs) are developed using smart contracts and, therefore, remove the need for an intermediary. DEXs also do not require custody of funds to complete an exchange. After connecting a Web3 crypto wallet, a DEX will utilize funds held within user-supplied liquidity pools to swap cryptocurrencies. All transactions are recorded on the blockchain. Examples of the top crypto DEXs include Uniswap, SushiSwap, and Bancor.

- Brokerages. Most brokerages provide a platform that allows users to convert fiat into crypto. However, unlike centralized exchanges that match buyers with sellers, brokerages form the other side of all trades. The level of capital required to trade with a brokerage may be slightly higher although this is not always the case, and like centralized exchanges, KYC documentation will be required before an exchange can take place. Examples of brokerages include PayPal, Robinhood, and eToro.

- Wallets. Many software-based cryptocurrency wallets now offer users the ability to purchase cryptocurrencies directly. Payment methods to buy crypto can range from debit/credit card, bank transfer, and Apple Pay, with digital assets deposited straight into a user’s cryptocurrency wallet after the purchase is complete.

Related: Solana vs. Ethereum: Which is better?

Storing Ethereum In A Wallet

All cryptocurrencies, including Ethereum, must be stored within a cryptocurrency wallet. Wallets can be grouped into two distinct categories: (1) hot wallets (e.g. software or mobile app) and (2) cold wallets (hardware devices).

- Hot wallets. A hot wallet is defined as any cryptocurrency wallet that is frequently connected to the internet. Hot wallets provide excellent convenience when transferring funds between different cryptocurrency platforms, however, frequent connection with the internet does mean that these wallets are more vulnerable to online attacks. Hot wallets typically include mobile, desktop and web browser-based applications.

- Cold wallets. A cold wallet is defined as a cryptocurrency wallet that is not connected to the internet. Due to a disconnection from the internet, these wallets are infinitely more secure than hot wallets, however, users lose the convenience of having cryptocurrencies ready and waiting. Cold wallets usually take the form of a USB drive and, therefore, must be connected each time cryptocurrency assets need to be moved. A popular example of a hardware wallet that supports ETH is the Ledger Wallet X.

Ethereum 2.0 (ETH2) Explained

At times of high usage, the Ethereum network can be limited by the Proof-of-Work protocol that limits the amount of data it can process. During peak usage in 2017, it became clear Ethereum was not infinitely scalable. To combat this problem, Ethereum founder Vitalik Buterin announced that the Ethereum blockchain would receive an upgrade called Ethereum 2.0. This upgrade, which has already entered the implementation phase, is scheduled for completion between 2022 and 2023.

In short, Ethereum 2.0 is the next iteration of Ethereum that has made the network more scalable, secure and sustainable for the environment. The protocol shifted from Proof-of-Work (PoW) to Proof-of-Stake (PoS) in 2022 and introduced cryptocurrency staking to the network that has superseded mining to validate transactions.

The new Proof-of-Stake consensus mechanism called the Beacon Chain, requires users to stake ETH and become network validators. Validators update and manage transactions, ensuring all of the different blockchain nodes on the network remain in sync. This results in higher throughput, increased energy efficiency, fewer hardware requirements, and an increased number of nodes.

Frequently Asked Questions

Is Ethereum Better Than Bitcoin?

Ethereum and Bitcoin both operate on the blockchain network, however, have vastly different objectives to compare them like-for-like in terms of their network value. Bitcoin was initially designed as a peer-to-peer network but has evolved into a store of value in recent years due to its limited supply. On the other hand, Ethereum is used as a platform to develop applications (DApps) and broader services such as Decentralized Finance (DeFi) and spawned the NFT market.

Can Ethereum Make You Rich?

Cryptocurrencies including Ethereum are highly speculative assets that can be extremely volatile in price. Investors and traders that are experienced to handle market conditions can potentially profit from investing in Ether (ETH) or holding for the long-term using a buy and hold or DCA strategy.

How Long Does It Take To Send Ethereum?

The Ethereum network can process between 13 and 15 transactions per second. However, due to various factors such as traffic, block times and sizes, and gas prices, the time can vary from 1 minute up to 30 minutes. For more information, read our guide that explains how long it takes to send Ethereum and the impact of the upcoming ETH2.0 upgrade on its speed.